23andMe Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

23andMe Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, helping users easily analyze and share 23andMe data.

What You’re Viewing Is Included

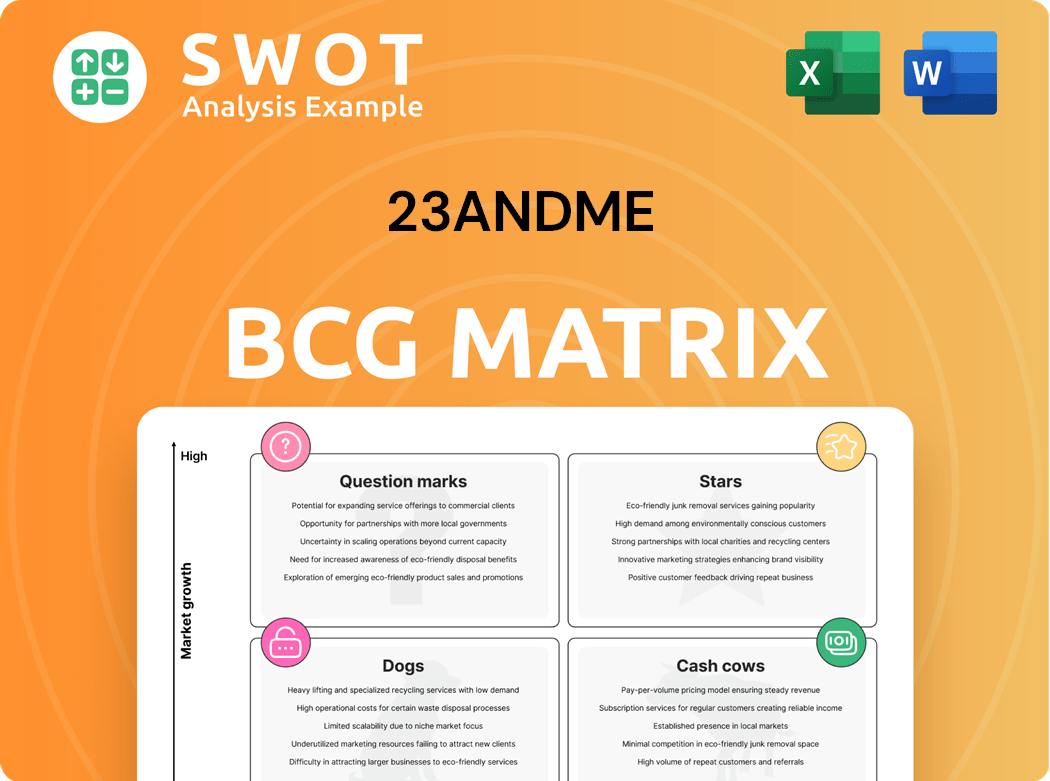

23andMe BCG Matrix

This is the 23andMe BCG Matrix you'll get after buying. It's the same report you'll receive, fully formatted. Designed for strategic decisions, it’s immediately downloadable.

BCG Matrix Template

23andMe's product lineup varies significantly in market share and growth potential. Their DNA testing kits could be considered "Stars," with high growth. Conversely, ancestry reports might be "Cash Cows," generating steady revenue. Other services, like health reports, might be "Question Marks," needing investment to grow. A deep dive using the BCG Matrix reveals product positions. Get the full report for detailed quadrant placements.

Stars

The Ancestry Service is a key part of 23andMe, boasting a large user base. It gives users detailed ancestry details and family connections. As of 2024, this service has over 14 million users. To stay competitive, 23andMe could use marketing and feature updates.

The premium Health + Ancestry Service from 23andMe, combining health and ancestry data, positions itself as a "Star" in their BCG Matrix. This subscription model fosters recurring revenue and boosts customer engagement. To maintain its "Star" status, 23andMe must continuously deliver value, such as updating health reports. The company's 2024 revenue was $270 million.

23andMe's research partnerships, a "Star" in its BCG Matrix, focus on collaborations to boost revenue and drug discovery. These partnerships utilize its extensive genetic database, potentially leading to breakthroughs and financial gains. However, the 2024 discontinuation of in-house therapeutics development raises concerns about future growth. In 2023, research collaborations generated $10.2 million in revenue.

Data Licensing

Licensing anonymized, aggregated genetic data is a high-potential area. AI firms, especially in healthcare, find this data invaluable for research and model training. In 2024, the global AI in healthcare market was valued at approximately $28.6 billion. 23andMe must prioritize privacy and ethical use to sustain customer trust.

- Data licensing generates significant revenue streams.

- AI companies heavily rely on genetic data for advancements.

- Privacy breaches can severely impact customer relationships.

- Ethical guidelines are crucial for data usage.

Personalized Reports

23andMe's personalized reports offer detailed ancestry insights, including geographical origins and historical timelines. Users can connect with relatives through the DNA relative finder, expanding their family network. Moreover, the reports feature over 30 trait reports, revealing unique genetic characteristics. In 2024, 23andMe had over 14 million customers.

- Ancestry Breakdown: Detailed geographical and historical context.

- DNA Relative Finder: Connect with individuals sharing DNA.

- Trait Reports: Uncover unique genetic traits.

- Customer Base: Over 14 million in 2024.

Stars in 23andMe's BCG matrix include Health + Ancestry and research partnerships, both key to growth. These segments drive revenue and customer engagement through recurring subscriptions and collaborations. Data licensing, especially to AI firms, is another promising avenue. The global AI in healthcare market was valued at $28.6 billion in 2024.

| Star Segment | Description | 2024 Status |

|---|---|---|

| Health + Ancestry | Subscription service combining health and ancestry data. | Drives recurring revenue and customer engagement; $270M revenue |

| Research Partnerships | Collaborations for revenue and drug discovery using genetic data. | Generated $10.2M in 2023; in-house therapeutics discontinued |

| Data Licensing | Licensing anonymized data to AI and healthcare firms. | Significant revenue potential; market valued at $28.6B in 2024 |

Cash Cows

Legacy DNA testing kits, 23andMe's original offering, are in a mature market. These kits, benefiting from brand recognition, generate revenue. In Q3 2023, 23andMe reported $54.4M in revenue. Focus on efficient distribution and minimal marketing to maximize profits.

23andMe's existing customer base, with its vast genetic data, forms a cash cow. This low-effort asset supports research, product development, and licensing. In 2024, 23andMe's database contained over 14 million genotyped customers. Data security and privacy are paramount for this revenue source.

23andMe's FDA authorizations for health reports are a strong asset. These approvals show they meet strict standards, building trust with customers. For example, in 2024, they have several FDA-cleared reports. Marketing should highlight these to attract more users. They should also seek more approvals to grow their offerings.

Brand Recognition

23andMe's strong brand recognition, established since its 2006 launch, is a significant asset. This recognition has cultivated a loyal customer base, with over 14 million customers as of 2023. The company can capitalize on this trust and awareness to launch new offerings. For instance, in 2024, 23andMe expanded its health services.

- Customer Base: Over 14 million customers by 2023.

- Launch Year: 2006

- Health Services Expansion: 2024

Innovative Technology

23andMe's innovative technology is a cash cow, providing steady revenue through its genetic analysis services. The company uses advanced technology for accurate and reliable genetic reports. Maintaining its technological edge is crucial for 23andMe's long-term success. The company generated $71 million in revenue in Q3 2023 from its subscription services.

- Revenue from subscription services grew by 11% year-over-year in Q3 2023.

- 23andMe's total revenue for 2023 was $260 million.

- The company's gross profit margin was 42% in Q3 2023.

- 23andMe has over 6.9 million genotyped customers.

23andMe's cash cows are stable revenue generators. These include legacy DNA kits and a vast customer database. The FDA-cleared health reports and innovative tech also contribute. In 2023, the company had $260M in revenue.

| Cash Cow | Description | Financial Data (2023) |

|---|---|---|

| Legacy DNA Kits | Mature market, brand recognition. | Q3 Revenue: $54.4M |

| Customer Database | 14M+ genotyped customers. | Subscription Revenue: $71M |

| FDA-cleared Reports | Builds customer trust. | Gross Profit Margin: 42% |

Dogs

The Therapeutics division of 23andMe, within a BCG matrix, represents a "Dog." This division was discontinued due to financial struggles and the absence of groundbreaking therapies. Turnaround strategies are costly and often ineffective. From 2021 to 2023, the company's R&D expenses grew, yet this division failed to yield significant returns, making it a strategic liability. 23andMe's stock price fell over 90% from its 2021 peak.

Given 23andMe's financial constraints, telehealth services might be struggling. With a focus shift, underperformance is possible. Without investment, it risks draining resources. Consider divesting or restructuring telehealth. In 2024, 23andMe faced challenges.

Following the 2023 data breach, 23andMe discontinued features like match file downloads, diminishing user value. These features boosted engagement, but now represent lost assets. In 2024, restoring them with improved security is crucial. Consider that 23andMe's stock dropped over 70% after the breach, showing the impact of lost features.

Public Trust (Compromised)

The 23andMe data breach and related issues have severely hurt public trust. Turnaround strategies are often costly and uncertain in the long run. To regain consumer confidence, significant investment in data security and transparency is essential. This includes bolstering cybersecurity measures and clearly communicating data handling practices. The company's stock price has fallen by over 80% since its peak in 2021, reflecting these challenges.

- Data Breach: Impacted millions of users.

- Stock Performance: Significant decline since 2021.

- Turnaround Costs: High expenses for recovery.

- Consumer Trust: Requires substantial rebuilding efforts.

Stock Value

23andMe's stock performance paints a grim picture, especially for investors. The company's value has plummeted, reflecting significant challenges in the market. The stock's dramatic fall underscores the urgency for 23andMe to address its financial strategies. They are exploring revenue growth avenues to stabilize their position.

- Stock down about 98% since 2021.

- Market cap around $80 million.

- Needs to manage cash burn effectively.

- Focusing on strategies to boost revenue.

In the 23andMe BCG matrix, Dogs are underperforming ventures. The Therapeutics division, a Dog, was shut down, highlighting strategic failures. Telehealth and features like match file downloads also underperformed. 23andMe's stock dropped sharply.

| Category | Metric | Data |

|---|---|---|

| Stock Performance | Decline Since 2021 | ~98% |

| Market Cap (as of 2024) | Value | ~$80M |

| Data Breach Impact | Users Affected | Millions |

Question Marks

Expanding 23andMe's subscription model with added features can boost recurring revenue. Subscribers gain deeper health insights. To thrive, they must continually show value through research and findings. In 2024, 23andMe's revenue reached $276 million.

23andMe should forge partnerships with AI firms. Such collaborations could unlock personalized medicine and accelerate drug discovery using genetic data. However, data privacy is paramount; maintaining customer trust is essential. In 2024, the global AI in healthcare market was valued at $11.6 billion.

International market expansion is a question mark for 23andMe. Entering new geographic markets could boost growth, but it demands substantial investment and thorough market research. These markets bring in new demographics. 23andMe must evaluate demand and regulations, with the global DNA testing market projected to reach $2.2 billion by 2024.

New Diagnostic Tools

Investing in new diagnostic tools is a strategic move for 23andMe to broaden its customer base. The launch of tools for conditions like epilepsy and syphilis, alongside the MRD panel, expands service offerings. However, data privacy and ethical usage remain paramount concerns for consumer trust.

- 23andMe's revenue in 2023 was approximately $300 million.

- The company invested $100 million in R&D in 2023.

- Over 14 million people have used 23andMe's services.

- Data breaches can lead to a decline in stock value.

AI-Powered Health Solutions

AI-powered health solutions are transforming the market, offering personalized insights. 23andMe faces the challenge of investing wisely in these AI platforms to stay competitive. This strategic move is crucial for maintaining its market position. Failure to adapt could lead to a decline in market share, highlighting the urgency of this investment.

- Personalized health solutions are growing.

- 23andMe needs to invest in AI.

- Competition is increasing.

- Adaptation is essential.

International expansion represents a "Question Mark" for 23andMe, requiring careful consideration. New markets could drive growth, but they also demand significant investment. Demand and regulations must be thoroughly evaluated.

| Metric | Value | Year |

|---|---|---|

| Global DNA Testing Market Size (Projected) | $2.2 billion | 2024 |

| 23andMe Revenue | $276 million | 2024 |

| 23andMe R&D Investment | $100 million | 2023 |

BCG Matrix Data Sources

The 23andMe BCG Matrix relies on data from public financial reports, market research, and competitive analysis, providing a strategic market overview.