A2A Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

A2A Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Quickly identify winners and losers with an intuitive, visual representation.

Full Transparency, Always

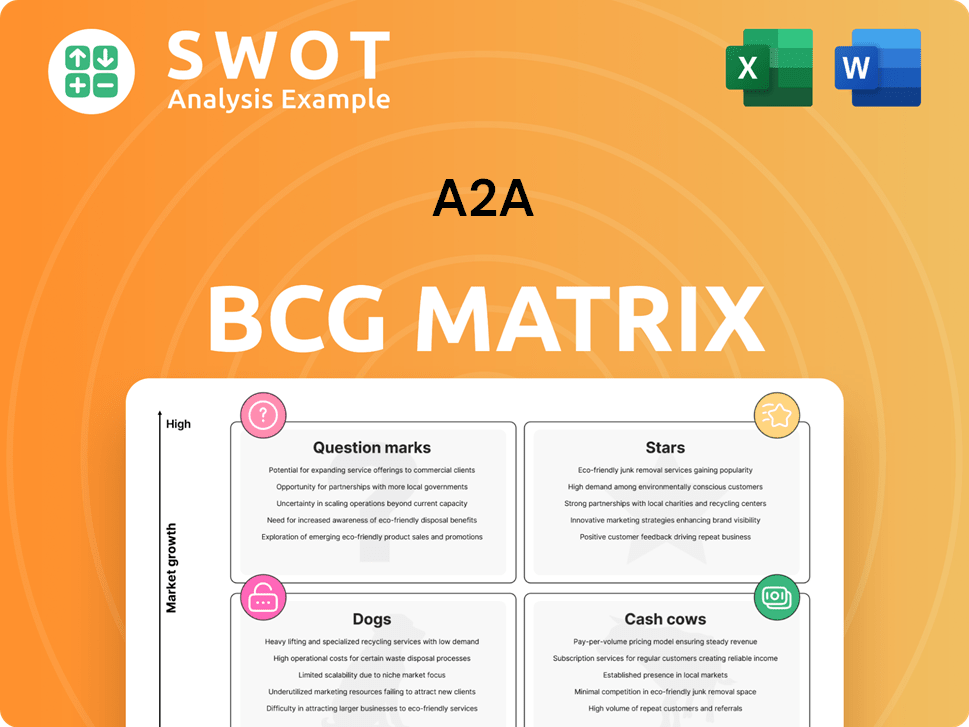

A2A BCG Matrix

The BCG Matrix displayed here is the complete document you'll receive after purchase. It's a ready-to-use file, offering a comprehensive strategic analysis tool for your business planning. This is the final, fully functional report.

BCG Matrix Template

This is a glimpse into the A2A BCG Matrix, a tool used to analyze product portfolios. See how A2A's offerings are classified as Stars, Cash Cows, Dogs, or Question Marks. This basic understanding reveals potential opportunities and risks. Discover the full BCG Matrix for detailed quadrant breakdowns and strategic recommendations.

Stars

A2A is significantly expanding its renewable energy portfolio, leading the energy transition. In 2024, renewable energy generation exceeded 6 TWh, marking a 33% increase from 2023. This growth reflects investments in new plants and strategic acquisitions. A2A's commitment strengthens its position in the evolving energy market.

A2A's smart city projects, like its work with INWIT in Milan to boost 5G, highlight its tech focus. These projects enhance infrastructure, offering services like traffic management and EV charging. In 2024, smart city spending is projected to reach $250 billion worldwide. A2A's investments position it well in a growing market.

A2A strategically positions itself in the waste sector, aiming for leadership. They plan to handle over 7 million tons of waste by 2035. Their investments in waste treatment focus on resource recovery. This includes electricity, heat, and secondary raw materials.

Strategic Acquisitions

A2A's strategic moves, like acquiring Duereti S.r.l. from e-distribuzione, boost its electricity network and operational efficiency. These acquisitions fuel its industrial expansion, solidifying its standing in the market. In 2024, A2A continued to invest in strategic acquisitions to enhance its infrastructure. These acquisitions are key to A2A's growth strategy.

- Acquisition of Duereti S.r.l. increased A2A's managed electricity network.

- These acquisitions enable operational synergies and improve efficiency.

- They contribute to A2A's industrial growth and market strength.

- A2A's focus remains on strategic acquisitions for infrastructure.

Sustainable Finance

A2A's focus on sustainable finance is clear, with 78% of its total debt tied to sustainable financial instruments. This showcases its commitment to environmental responsibility. The company's green bond issuances and green loan subscriptions further highlight its dedication to eco-friendly projects. These actions support ecological transition.

- Sustainable financial instruments make up 78% of A2A's total debt.

- A2A issued its first subordinated perpetual hybrid green bond.

- A2A is actively subscribing to green loans.

Stars in the BCG matrix represent high-growth market opportunities with a large market share. A2A's renewable energy and smart city projects align with this category. Investments in strategic areas propel A2A's growth and market leadership. A2A's 2024 revenue reached €14.8 billion, reflecting strong performance.

| Key Metrics | 2023 | 2024 (Projected) |

|---|---|---|

| Revenue (€ billions) | 14.2 | 14.8 |

| Renewable Energy Generation (TWh) | 4.5 | 6.0 |

| Smart City Spending (Global, $ billions) | 210 | 250 |

Cash Cows

A2A's energy distribution networks, especially for electricity and gas, are consistent revenue generators. The company's investments, including acquisitions in Milan and Brescia, support network efficiency. In 2024, A2A's regulated activities saw a rise in revenues, indicating stable cash flow.

A2A's waste treatment facilities are solid cash cows, providing steady revenue from waste disposal and resource recovery. In 2023, A2A treated approximately 3.8 million tons of waste. This contributes significantly to environmental sustainability while ensuring financial stability. The waste-to-energy plants generated 1.2 TWh of electricity in 2023.

A2A's district heating systems in Milan and Brescia are cash cows. They generate steady revenue with high market share, yet low growth. In 2023, A2A's district heating served over 500,000 equivalent apartments. These systems leverage waste heat from industries and data centers.

Hydroelectric Power Generation

A2A's hydroelectric power plants, with a capacity of 1.6 GW, are a reliable source of renewable energy. This contributes significantly to the company's financial stability. Hydroelectric production saw a 39% increase in 2024, reaching 5.2 TWh, showcasing strong operational performance. This sector is a cash cow for A2A.

- 1.6 GW Capacity: A2A's hydroelectric power plants.

- 2024 Hydroelectric Production: 5.2 TWh.

- Production Growth in 2024: 39%.

Retail Energy Sales

A2A's retail energy sales represent a cash cow, thanks to its established customer base. The company's consistent revenue stream is supported by its strong market position. In 2024, A2A added over 150,000 new customers, highlighting ongoing success. This growth strengthens their ability to generate reliable profits.

- Steady income from an established customer base.

- Over 150,000 new customers in 2024.

- Strong market position.

A2A's hydroelectric plants are strong cash cows, providing steady revenue. Their 1.6 GW capacity and 2024 production of 5.2 TWh demonstrate strong performance. The 39% production growth in 2024 highlights their financial stability and operational efficiency.

| Key Metric | Details |

|---|---|

| Hydroelectric Capacity | 1.6 GW |

| 2024 Production | 5.2 TWh |

| 2024 Production Growth | 39% |

Dogs

A2A might sell gas assets in slow-growing areas like Brescia, Bergamo, and others. Demand for gas is falling, pushing the company toward electricity. In 2024, natural gas consumption decreased by 10% in Italy. This shift reflects broader trends in energy markets.

A2A's thermoelectric plants, representing 6.7 GW of capacity, currently serve as Dogs within its portfolio. These plants face challenges as the company shifts towards renewables. The 2024 data indicates a strategic shift, with decreasing reliance on fossil fuels. This aligns with the broader industry trend of retiring older plants.

Non-strategic waste disposal activities, not fitting A2A's circular economy aims, are assessed. These activities, with low returns, could be divested. In 2024, waste management saw a 5% profit decline. Divestiture decisions are data-driven. A2A's focus: high-return, circular practices.

Legacy Public Lighting Infrastructure

Legacy public lighting, like older streetlights, falls into the Dogs category. A2A is actively replacing outdated systems with LED technology. This shift reduces energy consumption and maintenance costs. In 2024, A2A aimed to upgrade a significant portion of its lighting infrastructure.

- Upgrading to LED reduces energy use by up to 60%.

- Maintenance costs for LEDs are lower due to longer lifespans.

- A2A's investment in LED upgrades boosts its sustainability profile.

- Outdated lighting represents an opportunity for A2A to improve efficiency.

Water Cycle Infrastructure in High Leakage Areas

Water cycle infrastructure in high-leakage areas can be a problem child. A2A's focus on reducing network leakages is a strategic move. This boosts efficiency and cuts down on water losses. In 2024, the company aimed to reduce water losses, improving its financial performance.

- A2A's investments in leak reduction are crucial for operational efficiency.

- Reducing leaks helps to minimize water waste.

- Improved efficiency can lead to better financial results.

- Focus on infrastructure improvements is key.

A2A's thermoelectric plants, with 6.7 GW capacity, are classified as Dogs. These face challenges amid the shift to renewables. In 2024, fossil fuel reliance decreased. The industry is retiring older plants.

| Category | Description | 2024 Impact |

|---|---|---|

| Assets | Thermoelectric plants | 6.7 GW Capacity |

| Challenge | Transition to renewables | Decreased fossil fuel reliance |

| Trend | Plant Retirement | Industry-wide shift |

Question Marks

A2A's venture into lithium-ion battery recycling is a Question Mark in the BCG matrix, due to its high growth potential and low market share. This initiative requires substantial capital for development, with the global lithium-ion battery recycling market projected to reach $25.8 billion by 2032, growing at a CAGR of 22.6% from 2023. The company faces the challenge of gaining market share in a competitive landscape, as the recycling of lithium-ion batteries is projected to increase the demand for lithium by 140% by 2030.

A2A is exploring innovative waste treatment technologies. These include solutions for refinery waste and soil/water remediation. Such technologies promise high growth but require significant investment. A2A's 2024 report shows a 15% R&D increase in these areas. This aligns with market forecasts predicting a 10% annual growth in environmental tech through 2028.

Expanding smart city services outside Milan positions A2A as a Question Mark. This involves high growth potential but uncertain outcomes. In 2024, the smart city market grew, yet competition is fierce. A2A's strategy requires significant investment and alliances to succeed in new locations. Success hinges on capturing market share in these new urban areas.

Variable Recurring Payments (VRPs)

Variable Recurring Payments (VRPs) in the energy sector fall into the Question Mark category of the BCG Matrix. Their adoption is uncertain, requiring infrastructure investment and consumer buy-in for success. The potential benefits include enhanced payment flexibility and transparency for energy consumers. However, the current market penetration of VRPs remains low, indicating significant challenges to overcome. For example, in 2024, only about 5% of energy providers have fully integrated VRP systems.

- Low Adoption Rate: Around 5% of energy providers use VRPs.

- Infrastructure Needs: Requires substantial investment in new payment systems.

- Customer Adoption: Depends on consumer willingness to embrace new payment methods.

- Potential Benefits: Offers greater payment flexibility and transparency.

AI-Driven Energy Management Solutions

AI-driven energy management solutions present a "Question Mark" for A2A, indicating high growth potential but uncertain market share. These solutions demand substantial investment in AI technology, data analytics, and infrastructure. The success hinges on effective optimization of energy demand and significant efficiency improvements. However, the return on investment (ROI) remains unproven.

- Investment in smart grid technology is projected to reach $61.3 billion by 2024.

- The global energy management systems market is expected to reach $74.6 billion by 2029.

- AI can reduce energy consumption by up to 20% in buildings.

- A2A's revenue in 2023 was around €14.7 billion.

Question Marks in the BCG matrix represent high-growth potential yet low market share ventures. These projects demand considerable capital investment to compete effectively. Success depends on capturing market share and navigating uncertain outcomes.

| Category | Example | Key Challenge |

|---|---|---|

| High Growth | Smart city expansion | Securing Market Share |

| Investment | AI-driven energy | ROI Uncertainty |

| Market Share | Battery recycling | Competitive Landscape |

BCG Matrix Data Sources

This BCG Matrix leverages market data from financial reports, industry research, and competitive analysis for strategic accuracy.