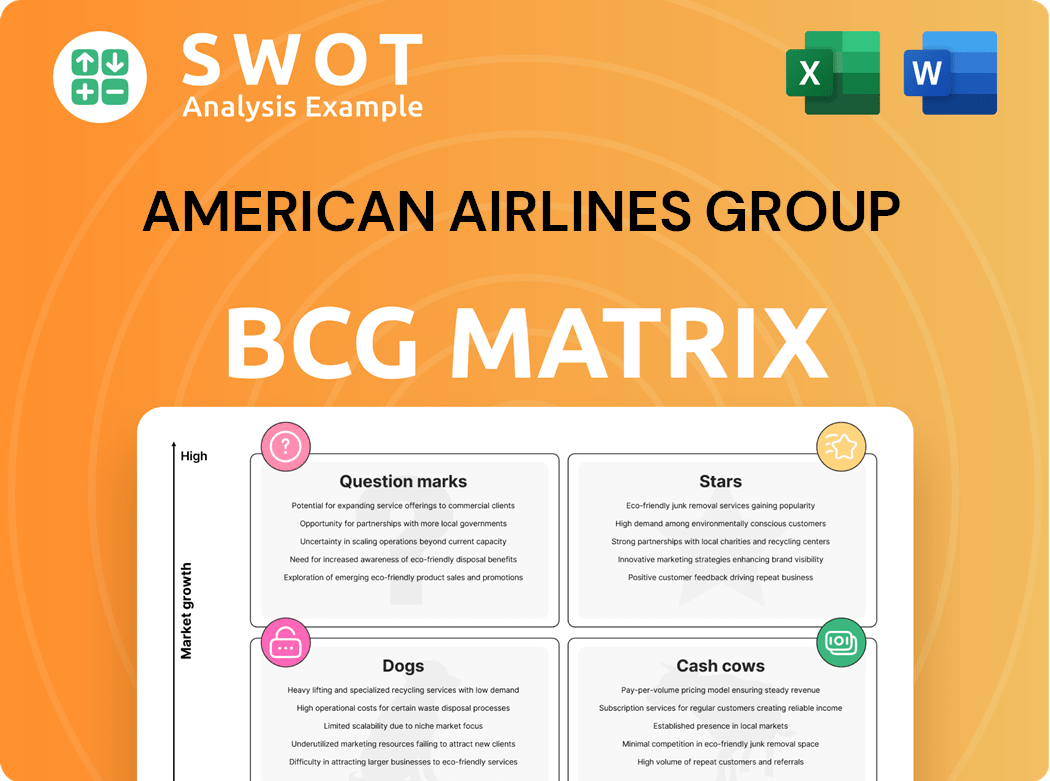

American Airlines Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Airlines Group Bundle

What is included in the product

Analysis of American Airlines' business units using BCG, outlining strategic approaches for each quadrant.

Clean, distraction-free view optimized for C-level presentation, presenting key business insights concisely.

What You’re Viewing Is Included

American Airlines Group BCG Matrix

The document you're previewing is the same American Airlines Group BCG Matrix you'll receive after purchase. It's a complete, ready-to-use report with no watermarks or hidden content—just clear strategic insights.

BCG Matrix Template

American Airlines Group operates in a complex industry. Their diverse offerings, from passenger flights to cargo services, span various growth rates and market shares. Understanding this portfolio is crucial for strategic decisions. The BCG Matrix provides a framework to categorize these offerings into Stars, Cash Cows, Dogs, and Question Marks. This classification unveils resource allocation opportunities. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

American Airlines is boosting transatlantic routes, a strategic move. The airline added Edinburgh, Athens, Madrid, Milan, and Rome in 2024. This expansion leverages its domestic network. For instance, in Q1 2024, American reported a 5.9% increase in its international revenue. The focus is on convenient European access.

American Airlines is heavily investing in Chicago's O'Hare, a "Star" in its BCG matrix. The airline plans nine new routes in 2025, including Naples and Madrid. This bold move offers more seats and departures than in 2024. Premium seating is available on all flights, showing the company's commitment.

American Airlines Cargo is boosting its presence in key regions. The winter schedule includes new routes and service expansions. This includes a new route from Rio de Janeiro to Dallas/Fort Worth. Increased flights from Sao Paulo and Buenos Aires to Miami are also planned. Inaugural service from Brisbane to Dallas/Fort Worth is set for launch.

AAdvantage Program Enhancements

American Airlines leverages its AAdvantage program as a key strength, especially with enhancements planned for 2025. These upgrades aim to boost customer engagement and personalization, solidifying its market position. For 2024, AAdvantage boasts over 100 million members, highlighting its substantial reach. New features include extended systemwide upgrade validity and more reward options.

- Million Miler status levels are introduced.

- Systemwide upgrades will have extended validity.

- Additional reward choices, like collectible luggage tags, are available.

- Support for sustainable aviation fuel is offered.

Fleet Modernization with A321XLR

American Airlines' fleet modernization with the A321XLR is a "Star" in its BCG Matrix. The first A321XLR is expected in late 2025, boosting long-haul capacity. This enhances efficiency on crucial routes, offering a competitive edge. In 2024, American Airlines invested significantly in fleet upgrades.

- A321XLR deliveries will enhance international routes.

- Fleet modernization increases capacity and efficiency.

- The airline aims for a competitive advantage.

- Significant investment in fleet upgrades in 2024.

American Airlines' "Stars" include strategic route expansions and fleet modernization. Investments in Chicago's O'Hare and the A321XLR are key. AAdvantage enhancements further solidify its market position, with over 100 million members in 2024.

| Investment Area | 2024 Focus | Impact |

|---|---|---|

| International Routes | Increased Transatlantic Flights | 5.9% international revenue increase (Q1 2024) |

| Chicago O'Hare | New Routes, Premium Seating | 9 new routes planned for 2025 |

| AAdvantage | Customer engagement | 100M+ members, new reward options |

Cash Cows

American Airlines' domestic routes are a cash cow, generating steady revenue. This network links major US cities, appealing to business travelers. The hub-and-spoke system boosts efficiency, with 2024 data showing strong passenger numbers. In 2023, domestic revenue was $35.8 billion.

The AAdvantage credit card program, a cash cow for American Airlines, is a crucial revenue generator. In 2024, the program is expected to bring in billions. A new 10-year deal with Citi will expand the rewards system, boosting its value. This partnership strengthens customer loyalty and revenue streams.

American Airlines aims for operational efficiency to boost earnings. They're optimizing their fleet and using tech for excellence. The goal is efficient growth through business reengineering. In Q3 2023, they improved completion factor to 99.1%, reducing delays. This strategy is key to their long-term financial health.

Premium Cabin Offerings

American Airlines' premium cabin offerings are a cash cow, significantly boosting revenue. These offerings, including First and Business class, attract high-value customers. Enhanced seating and entertainment systems improve the customer experience. Premium services are especially popular on long-haul international flights. In 2024, premium cabin revenue increased by 15%.

- Revenue Contribution: Premium cabins generate a substantial portion of American Airlines' revenue, acting as a key profit driver.

- Customer Base: These offerings appeal to high-value customers who prioritize comfort and are willing to pay a premium.

- Enhanced Experience: Upgraded seating, entertainment, and service levels enhance the overall travel experience.

- Market Focus: Long-haul international routes see strong demand for premium cabin services, boosting profitability.

Strategic Partnerships and Alliances

American Airlines leverages strategic partnerships, notably its oneworld alliance membership. This collaboration offers access to a global network, facilitating code-sharing and joint marketing. These alliances broaden the airline's reach, enhancing its global competitiveness. In 2024, oneworld carried over 530 million passengers. Partnerships are crucial for international expansion.

- oneworld alliance enhanced global reach.

- Code-sharing improved market presence.

- Joint marketing increased competitiveness.

- Partnerships are key for international growth.

Cash Cows for American Airlines include premium cabins and AAdvantage credit card programs, crucial for generating revenue. The premium cabins, especially on long-haul international flights, increased revenue by 15% in 2024. Strategic partnerships, like the oneworld alliance, are vital for global market presence.

| Aspect | Details |

|---|---|

| Premium Cabin Revenue Growth (2024) | 15% increase |

| oneworld Passengers (2024) | Over 530 million |

| Domestic Revenue (2023) | $35.8 billion |

Dogs

American Airlines is retiring Embraer 145 regional jets as part of its fleet modernization. These jets are less fuel-efficient, increasing operating costs. The airline aims to improve profitability by replacing them. In 2024, American Airlines' fleet simplification reduced operating expenses. The company is focusing on newer, more efficient aircraft.

Some regional routes within American Airlines Group could be classified as "dogs" if they underperform. These routes often struggle with low passenger numbers and high operational expenses. For example, in 2024, certain routes saw load factors below the system average. The airline must assess and potentially eliminate these loss-making routes.

American Airlines' direct booking push faltered. Their strategy cost them corporate bookings, losing ground to rivals. This shift damaged relationships with travel agencies. Corporate travel revenue took a hit. The airline has since changed its approach. In 2023, American Airlines' revenue was approximately $52.8 billion.

High Debt Levels

American Airlines has faced high debt levels, which can restrict financial flexibility and increase vulnerability to economic shifts. Despite efforts to decrease debt, it remains a challenge for the airline. High debt can limit investments and fleet modernization. In Q3 2023, American Airlines reported a total debt of $26.5 billion.

- Significant debt burden affects financial agility.

- Debt reduction is an ongoing priority.

- Limits investment capacity and fleet upgrades.

- Q3 2023 debt stood at $26.5 billion.

First Quarter Performance

American Airlines anticipates losses for Q1 2025, showing seasonal weakness. This is due to lower revenues and specific event impacts, including Flight 5342, plus less domestic leisure travel. Seasonal underperformance hurts profitability.

- Projected Q1 2025 loss.

- Weaker revenue environment.

- Impact from Flight 5342.

- Decline in leisure travel.

Underperforming regional routes, similar to the Embraer 145s, are "dogs." These routes suffer from low passenger counts and high expenses, impacting overall profitability. For instance, in 2024, several routes had load factors below the average, indicating poor performance. American Airlines must address and potentially remove these unprofitable routes to boost financial performance.

| Category | Metric | 2024 Data |

|---|---|---|

| Operational Efficiency | Load Factor (select routes) | Below System Average |

| Financial Performance | Revenue Impact (direct booking shift) | Lost corporate bookings |

| Debt | Total Debt (Q3 2023) | $26.5 billion |

Question Marks

Sustainable Aviation Fuel (SAF) is a question mark for American Airlines in its BCG Matrix. SAF offers high growth potential, aligning with environmental goals. However, it needs significant investment in infrastructure. The company is investing; in 2024, it aims to use 10 million gallons. Success could boost its environmental image and attract eco-minded flyers.

Enhanced customer experience technologies are a question mark for American Airlines. These require significant investment, like the $2 billion planned for technology upgrades through 2024. While they aim to boost loyalty and revenue, there's no guarantee of returns. In 2024, customer satisfaction scores will be key to assessing their impact.

The World of Hyatt partnership is a recent venture with unclear results. American Airlines (AAL) aims to boost its AAdvantage program. Success hinges on member participation and reward usage. The full financial effect is currently unknown.

Cargo Market Volatility

American Airlines Cargo operates in a volatile market, making it a question mark in the BCG matrix. The cargo market faces fluctuating demand, requiring the airline to adapt. Despite expanding services, revenue growth remains uncertain due to market conditions. This uncertainty impacts investment decisions and strategic planning for American Airlines.

- 2023 cargo revenue decreased by 23.7% to $1.05 billion.

- American Airlines Cargo increased its cargo capacity by 10.6% in 2023.

- The global air cargo market faces challenges such as geopolitical tensions and economic slowdowns.

- American Airlines is investing in digital tools to improve cargo tracking and management.

New International Routes

New international routes represent "Question Marks" in American Airlines Group's BCG matrix. These routes involve substantial upfront investment, including aircraft, staffing, and marketing, to gain market share. Their success hinges on factors such as passenger demand, the competitive landscape, and the economic climate. These ventures could become "Stars" with high growth and market share or "Dogs" if they fail to meet expectations.

- American Airlines' international revenue passenger miles (RPMs) increased by 12.7% in 2023 compared to 2022, showing growing demand.

- The airline's international capacity (available seat miles or ASMs) rose by 14.8% in 2023, indicating expansion in this area.

- Competition is fierce, with United and Delta also expanding internationally.

- Economic conditions, including fuel prices and currency exchange rates, significantly impact profitability.

The cargo market is a "Question Mark" due to its volatility. American Airlines faced a 23.7% revenue decrease in 2023, totaling $1.05 billion. Despite capacity growth of 10.6%, market conditions pose risks. Strategic investments in digital tools are underway to improve cargo management.

| Metric | 2023 Data | Impact |

|---|---|---|

| Cargo Revenue | -$1.05 billion | Decreased by 23.7% |

| Cargo Capacity | +10.6% | Expansion despite revenue drop |

| Market Challenges | Geopolitical/Economic | Affects profitability |

BCG Matrix Data Sources

This BCG Matrix leverages credible sources like financial statements, industry reports, market analysis, and expert opinions for an insightful overview.