AAR PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAR Bundle

What is included in the product

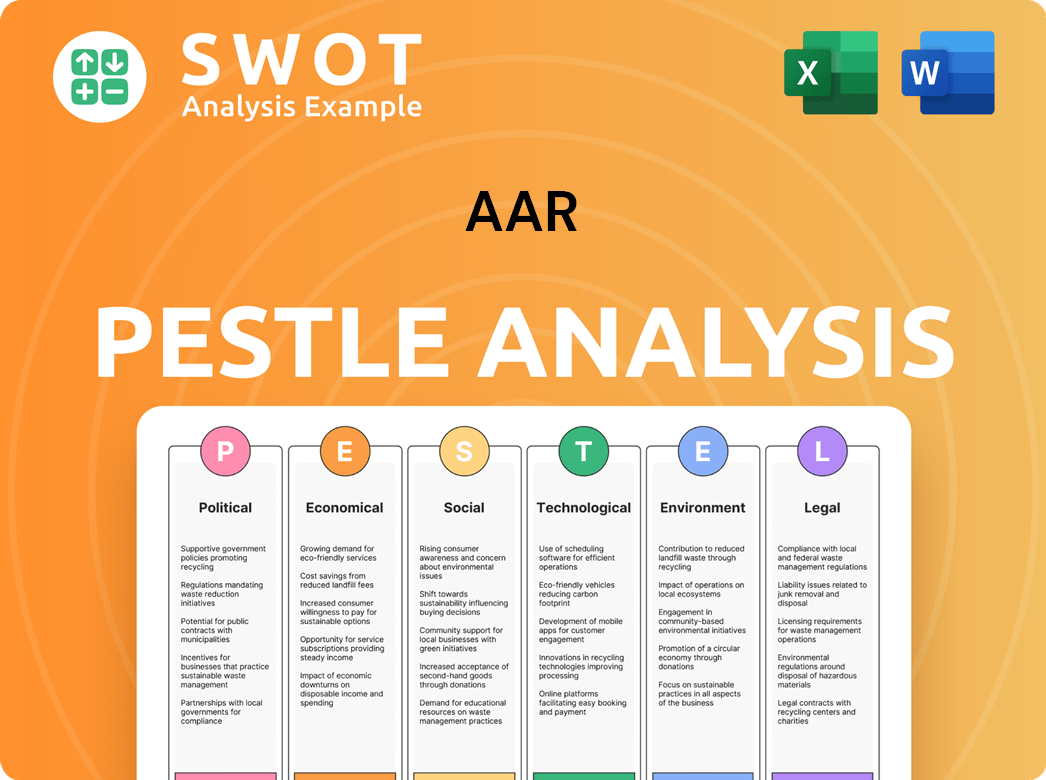

Analyzes external influences shaping the AAR via Political, Economic, Social, Tech, Environmental, and Legal lenses.

The AAR PESTLE Analysis streamlines complex external factors, delivering insights at a glance.

Preview the Actual Deliverable

AAR PESTLE Analysis

We’re showing you the real product. This preview reveals the AAR PESTLE Analysis format. Upon purchase, you'll download this fully structured document.

PESTLE Analysis Template

See how AAR is shaped by external forces in our concise PESTLE Analysis. We break down the political, economic, social, technological, legal, and environmental factors impacting the company.

Gain a clear view of AAR’s challenges and opportunities. This analysis is perfect for strategy, investment, and research. Buy the full report for detailed insights and actionable recommendations now.

Political factors

AAR Corp heavily relies on government and defense contracts. In fiscal year 2024, approximately 60% of AAR's revenue came from government-related business. Fluctuations in defense spending or shifts in government priorities directly affect AAR's financial performance. For example, the U.S. defense budget for 2024 was around $886 billion.

Geopolitical instability and trade policies are critical for AAR. Changes in tariffs or trade agreements, like those impacting aerospace components, directly influence AAR's supply chain and operational expenses. For example, the imposition of a 25% tariff on certain imported aircraft parts could significantly raise AAR's costs, impacting its profitability. In 2024, global trade volume is projected to grow by only 3.3%, according to the WTO, indicating potential headwinds for AAR's international operations.

Aviation and defense are heavily regulated. In 2024, regulatory changes impacted AAR. New airworthiness directives and safety rules increased compliance costs. Export control adjustments also affected market access. These factors can impact AAR's operations.

Political Stability in Operating Regions

Political stability is crucial for AAR's operations. Instability, conflicts, or government changes in operating regions can disrupt services. This can affect demand and create security risks. For example, political unrest in areas where AAR has significant contracts could lead to delays or cancellations. In 2024, political risks in certain regions increased operational costs by an estimated 7%.

- Increased operational costs due to political instability.

- Potential for service disruptions.

- Impact on demand for AAR's services.

- Heightened security risks in volatile areas.

Government Support and Initiatives for Aerospace

Government backing significantly impacts AAR. Initiatives like infrastructure projects, R&D funding, and MRO incentives directly affect operations. In 2024, the U.S. government allocated over $2.5 billion for aerospace R&D. Such support can boost AAR's competitiveness. Conversely, policy changes or budget cuts pose risks.

- U.S. aerospace manufacturing output reached $155 billion in 2024.

- European Union invested €10 billion in aerospace research by 2025.

- Tax incentives for MRO are expected to increase MRO activity by 15% by 2026.

Political factors significantly influence AAR's operations, primarily due to government contracts and defense spending. The U.S. defense budget for 2024 was approximately $886 billion, representing a critical revenue source. Trade policies and geopolitical stability also play key roles, potentially impacting supply chains and operational expenses.

Regulatory changes, such as airworthiness directives, increase compliance costs and affect market access. Political instability in operating regions poses service disruption risks. The impact includes increased operational costs, estimated at 7% in some areas during 2024. Government support, like R&D funding, influences AAR’s competitiveness.

| Political Factor | Impact on AAR | 2024 Data/Examples |

|---|---|---|

| Defense Spending | Revenue, Contract Reliance | US defense budget ≈ $886B |

| Trade Policies | Supply Chain Costs | Tariffs on aircraft parts ↑ costs |

| Regulatory Changes | Compliance Costs | Airworthiness directives increase costs |

| Political Instability | Operational Disruptions | 7% cost increase in some regions |

| Government Support | Competitiveness | US aerospace R&D ≈ $2.5B |

Economic factors

Global economic growth significantly impacts AAR's services, with stronger economies boosting airline profits and demand for maintenance, repair, and overhaul (MRO) services. In 2024, global GDP growth is projected at 3.2%, influencing the airline industry's performance. Conversely, economic slowdowns or airline financial struggles, such as the 2020 pandemic downturn, reduce demand for AAR's offerings. For example, airline revenues fell by 60% in 2020, directly impacting MRO spending.

AAR's government and defense segment is sensitive to shifts in defense budgets. In 2024, the U.S. defense budget is approximately $886 billion, a slight increase from 2023. Increased government spending often translates into more contracts for AAR. Conversely, budget cuts can decrease available opportunities, impacting revenue.

AAR's aerospace operations depend heavily on a global supply chain. Inflation in 2024 and early 2025, coupled with supply chain issues, increases costs. For example, materials prices rose 3-5% in 2024. These increases can squeeze profit margins. AAR's financial reports for 2024 show these impacts.

Currency Exchange Rates

AAR faces currency exchange rate risks as a global entity. Fluctuating rates impact international operational expenses, the worth of foreign income, and earnings. For instance, a stronger USD can make international sales less competitive. Conversely, a weaker USD can boost the value of foreign revenue.

- In 2024, the EUR/USD exchange rate varied significantly, impacting AAR's European operations.

- Currency hedging strategies are crucial to mitigate these risks.

- Monitoring key exchange rates (USD, EUR, GBP) is essential for financial planning.

Interest Rates and Access to Capital

Interest rates are pivotal for AAR, impacting borrowing costs for investments and operations. Access to capital is crucial for acquisitions and expansion, influenced by economic conditions. For instance, the Federal Reserve's rate hikes in 2023, with the federal funds rate reaching a target range of 5.25%-5.50%, increased financing expenses. This affects AAR's ability to fund growth initiatives.

- Rising interest rates can increase AAR's debt servicing costs.

- Economic downturns may reduce access to credit, hindering expansion plans.

- AAR's financial strategy needs to adapt to changing interest rate environments.

- Access to capital affects AAR's ability to pursue strategic acquisitions.

Economic expansion fuels demand for AAR's services; global GDP growth of 3.2% in 2024 is projected, boosting the airline industry's performance. Shifts in defense budgets, like the $886 billion U.S. defense budget in 2024, affect AAR's government contracts. Inflation and supply chain issues increase costs; material prices rose 3-5% in 2024, impacting margins, as seen in AAR's 2024 reports.

| Economic Factor | Impact on AAR | 2024 Data/Trends |

|---|---|---|

| GDP Growth | Affects airline demand and MRO services | Global GDP projected at 3.2% |

| Defense Spending | Influences government contract revenue | U.S. defense budget approx. $886B |

| Inflation | Increases operational costs and squeezes profit | Materials prices increased by 3-5% |

Sociological factors

Societal shifts significantly affect air travel demand, influencing aircraft usage and MRO requirements. Leisure travel, driven by rising incomes and a desire for experiences, fuels demand. Business travel, though evolving with remote work, remains crucial, especially for international operations. Cargo transport, vital for e-commerce and global supply chains, further boosts aircraft utilization. In 2024, global passenger traffic reached 94.1% of pre-pandemic levels, highlighting the ongoing recovery and its impact on the aviation sector.

AAR's success hinges on a skilled workforce. The availability of aviation maintenance engineers is crucial. Labor costs and capacity depend on demographics and education. The U.S. Bureau of Labor Statistics projects a 6% growth for aircraft mechanics and service technicians from 2022 to 2032. Competition for talent impacts AAR's operations.

Public perception of aviation safety significantly impacts AAR's reputation. Strong safety culture and addressing concerns are key. According to the FAA, in 2023, the US airline industry's accident rate was approximately 0.0019 per 100,000 flight hours. AAR must maintain this standard.

Employee Relations and Labor Unions

Employee relations and labor unions significantly influence AAR's operations. Strikes and wage negotiations can disrupt services and increase costs. A positive work environment boosts productivity and enhances service quality, critical for customer satisfaction. In 2024, labor disputes in the aviation sector caused delays, impacting airline performance.

- AAR's employee satisfaction scores directly correlate with operational efficiency.

- Negotiated labor contracts affect cost structures.

- Strong labor relations reduce the risk of disruptions.

- Positive employee morale enhances customer service.

Community Engagement and Corporate Social Responsibility

AAR's community engagement and corporate social responsibility (CSR) efforts significantly shape its public perception. Investing in sustainability and ethical practices is vital, as stakeholders increasingly prioritize these aspects. Strong CSR can attract and retain top talent, boosting AAR's competitive edge. In 2024, CSR spending by aerospace companies saw a 15% increase, reflecting this trend.

- AAR's CSR initiatives influence public image and attract talent.

- Sustainability and ethical practices are key for stakeholders.

- Aerospace companies increased CSR spending by 15% in 2024.

AAR navigates societal shifts in travel, like increased leisure demand driving aircraft usage and MRO needs. Workforce dynamics are crucial; projected 6% growth for aircraft mechanics influences labor costs and talent acquisition. Maintaining public trust hinges on a robust safety culture and positive employee relations to prevent disruptions and boost productivity, impacting service quality.

| Factor | Impact | 2024 Data |

|---|---|---|

| Travel Trends | Shapes aircraft and MRO demand. | Global passenger traffic at 94.1% of pre-pandemic levels. |

| Workforce | Affects labor costs, skills, and availability. | 6% growth projected for mechanics (2022-2032). |

| Public Perception/Labor | Affects Reputation & Operational efficiency | CSR spending rose 15% in 2024. |

Technological factors

Technological advancements are revolutionizing MRO processes. Predictive maintenance, leveraging data analytics, is expected to grow significantly. The global predictive maintenance market is projected to reach $17.9 billion by 2028. Automation and 3D printing are also enhancing efficiency and reducing costs. AAR can leverage these technologies to improve service offerings.

AAR's PESTLE analysis reveals that digital transformation significantly impacts its MRO operations. The adoption of advanced software solutions, such as Trax, is crucial. These tools enhance planning, execution, and record-keeping. AAR's strategic use of technology directly influences operational efficiency and competitive advantage. In 2024, the global aviation MRO market was valued at $85.9 billion.

New aircraft and engine tech necessitates specialized MRO. AAR must evolve its services. The global MRO market is projected to reach $116.1 billion by 2025. This includes advanced composite materials and complex avionics, requiring specialized skills. AAR's adaptation is crucial.

Impact of Electrification and Sustainable Aviation Fuels

The aviation industry is undergoing a transformation towards sustainability, significantly impacting maintenance and support needs. Electric aircraft and sustainable aviation fuels (SAF) are gaining traction, reshaping operational demands. This shift requires adapting to new technologies and maintenance protocols.

In 2024, SAF production increased, with the U.S. government aiming for 3 billion gallons annually by 2030. Electric aircraft, though still emerging, are projected to grow, potentially altering fleet composition. This evolution demands skilled technicians and updated infrastructure.

- SAF usage could reduce lifecycle emissions by up to 80%.

- Electric aircraft maintenance will require specialized skills in battery technology.

- Investment in charging infrastructure and SAF production facilities is crucial.

Cybersecurity Risks

Cybersecurity risks are escalating as technology integrates further into aviation and MRO operations. AAR must prioritize protecting sensitive data and operational systems from cyber threats. The aviation industry saw a 28% increase in cyberattacks in 2024, costing airlines an average of $1.2 million per incident. These attacks can disrupt operations and compromise passenger safety.

- Data breaches impacting passenger information and financial records.

- Operational disruptions causing flight delays and cancellations.

- Attacks on aircraft systems potentially affecting flight safety.

Technological innovation fundamentally alters MRO. Automation, predictive maintenance (est. $17.9B by 2028) and software solutions like Trax are key. Specialized skills for new aircraft and cybersecurity (28% rise in attacks in 2024) are critical. Sustainability through SAF is also transforming demands.

| Factor | Impact | Data |

|---|---|---|

| Predictive Maintenance | Enhances efficiency, reduces costs | Market: $17.9B (2028) |

| Digitalization | Improves planning & execution | Aviation MRO Market: $85.9B (2024) |

| Sustainability | Requires new maintenance protocols | U.S. goal: 3B gal SAF by 2030 |

Legal factors

AAR Corp. navigates intricate aviation regulations from bodies like the FAA and EASA. These rules dictate maintenance, parts tracking, and airworthiness, crucial for safety. In 2024, the FAA issued over $5.5 million in civil penalties for violations. Compliance is vital as non-compliance leads to penalties and reputational harm, impacting financial performance.

AAR's operations in defense and international markets necessitate strict adherence to export controls and trade sanctions. Compliance with these regulations is crucial for avoiding legal penalties and ensuring continued market access. The U.S. government, for example, has significantly increased enforcement of export controls, with penalties reaching millions of dollars in recent years. Maintaining a robust compliance program is therefore paramount. This includes continuous monitoring of changing regulations and comprehensive employee training.

AAR operates under contract law, crucial for agreements with commercial and government clients. Government procurement regulations significantly impact AAR's defense sector. In 2024, government contracts comprised a substantial portion of AAR's revenue, approximately $1.8 billion. Non-compliance risks penalties and contract loss; thus, adherence is vital.

Product Liability and Intellectual Property

AAR's provision of parts and services exposes it to product liability risks, potentially leading to lawsuits and financial repercussions. The company must navigate complex legal landscapes to protect its intellectual property, including patents and trademarks, and respect the intellectual property rights of others. In 2024, the global product liability insurance market was valued at approximately $20 billion. AAR's success hinges on its ability to mitigate these legal challenges.

- Product liability lawsuits can cost companies millions in settlements and legal fees.

- Intellectual property infringement can result in significant penalties and reputational damage.

- Compliance with international laws is crucial for AAR's global operations.

Labor Laws and Employment Regulations

AAR Corp. must adhere to labor laws and employment regulations across its global operations. This includes adhering to minimum wage standards, working hours, and providing employee benefits. Non-compliance can lead to costly legal battles and reputational damage. AAR's workforce, as of 2024, is approximately 6,000 employees.

- Compliance costs can fluctuate, with legal and administrative expenses potentially reaching millions.

- Recent legislation, like the EU's Pay Transparency Directive, requires companies to be more transparent about employee compensation.

- Companies must comply with local regulations, which can vary significantly by country.

- Failure to comply may result in significant penalties, including fines and lawsuits.

Legal factors significantly affect AAR Corp.'s operations.

Adherence to aviation regulations is crucial; the FAA issued over $5.5M in penalties in 2024.

Compliance with export controls and contract law, especially in defense, is also critical for sustained market access, with government contracts totaling around $1.8B in revenue in 2024.

| Risk Area | Impact | 2024/2025 Data |

|---|---|---|

| Non-compliance with FAA regulations | Penalties, reputational damage | FAA civil penalties exceeded $5.5 million in 2024. |

| Breach of Export Controls | Penalties, sanctions | Increased enforcement by U.S. government; penalties in millions. |

| Government contract non-compliance | Contract loss, financial penalties | ~$1.8B revenue from government contracts in 2024. |

Environmental factors

AAR's MRO and manufacturing face environmental rules. These concern waste, emissions, and hazardous materials. In 2024, companies faced an average of $100,000 in EPA fines. Compliance is essential to avoid penalties and maintain a good reputation. AAR's sustainability report for 2024 showed a 5% increase in recycling efforts.

AAR faces impacts from the aviation industry's sustainability push. The industry aims to cut emissions, affecting AAR's services. For example, sustainable aviation fuel (SAF) use is growing; in 2024, SAF production reached approximately 130 million gallons. This shift influences AAR's maintenance and supply chain strategies. Regulatory pressures and consumer preferences further drive the adoption of eco-friendly practices.

Climate change poses significant risks, including extreme weather events that can disrupt aviation. This could lead to more frequent maintenance, repair, and overhaul (MRO) needs. For instance, in 2024, weather-related flight delays cost airlines globally billions. The aviation industry faces challenges in adapting to these environmental shifts, impacting operational strategies.

Waste Management and Recycling

AAR must manage waste and recycle properly at its facilities. This includes handling hazardous materials from aircraft maintenance. Effective waste management reduces environmental impact and costs. AAR's sustainability efforts are crucial for its reputation.

- In 2024, the global waste management market was valued at approximately $2.1 trillion.

- Recycling rates vary, with some countries achieving over 50% recycling.

- Proper waste disposal can reduce landfill use by up to 70%.

Resource Consumption (Energy and Water)

Resource consumption, particularly energy and water, is a key environmental consideration for AAR. Efficient management of these resources directly impacts AAR's operational costs and sustainability profile. AAR's commitment to reducing its environmental footprint involves various strategies, including investments in energy-efficient equipment and water conservation practices across its facilities. These efforts are crucial for cost management and regulatory compliance.

- In 2024, AAR reported a focus on reducing energy consumption by 5% across its global operations.

- Water usage reduction targets were set for key facilities, with a goal of a 3% decrease by the end of 2024.

- AAR is actively exploring renewable energy options, aiming for a 10% renewable energy usage by 2025.

AAR faces environmental rules about waste and emissions. The aviation industry’s push for sustainability impacts AAR's services, like Sustainable Aviation Fuel (SAF), with 130 million gallons produced in 2024. Climate change, waste management, and resource consumption significantly affect AAR.

| Environmental Factor | Impact on AAR | 2024/2025 Data |

|---|---|---|

| Regulations & Compliance | Requires adherence to reduce penalties, reputation | Average EPA fines were $100,000 in 2024 |

| Sustainability Trends | Affects maintenance, supply chain; shift to SAF | SAF production: ~130 million gallons in 2024 |

| Climate Change Risks | Extreme weather may increase MRO needs and delays | Weather delays cost billions; waste market: $2.1T in 2024 |

| Waste Management | Handling hazardous materials; crucial for sustainability | Landfill use reduced by up to 70% via proper disposal |

| Resource Consumption | Energy, water impact costs and profile | AAR aimed to reduce energy consumption by 5% in 2024 |

PESTLE Analysis Data Sources

Our PESTLE analysis uses data from governments, market research firms, and policy updates for precise and dependable macro-environmental insights.