Aareal Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aareal Bank Bundle

What is included in the product

Analyzes Aareal Bank's units through BCG matrix, suggesting investment, holding, or divestment strategies.

Printable summary optimized for A4 and mobile PDFs allowing for easy sharing and offline access.

Delivered as Shown

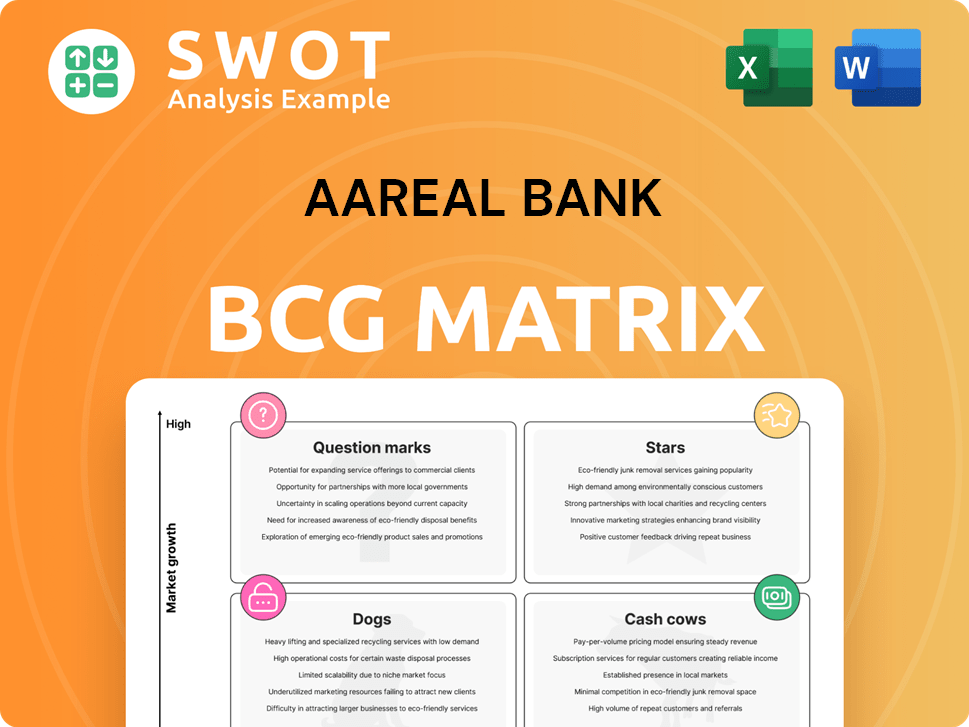

Aareal Bank BCG Matrix

This preview provides the exact Aareal Bank BCG Matrix report you'll receive after purchasing. Download the complete, ready-to-use document with no modifications, just immediate access to the full version.

BCG Matrix Template

Aareal Bank's BCG Matrix reveals its portfolio's strategic landscape. Identify its potential stars, cash cows, question marks, and dogs. Understand how each product contributes to overall profitability. This snapshot is just a glimpse of Aareal Bank's strategic posture. Purchase the full report for in-depth quadrant analysis and action-oriented strategic advice.

Stars

Aareal Bank's 2024 operating profit surged to €294 million, a 33% increase, signaling robust financial health. This performance, the highest since 2018, suggests 'Star' status. Such strength supports market leadership and expansion. These results reflect strategic success.

The 'Aareal Ambition' strategy highlights Aareal Bank's push for growth, investing in tech and efficiency. They aim for at least a 13% adjusted return on equity by 2027. This plan shows Aareal's proactive approach to maintaining its market leadership. In 2024, Aareal Bank's operating profit increased to €117 million.

Aareal Bank's successful AT1 capital placement boosts investor trust, fortifying its capital structure. This supports expansion plans and preserves financial health. The bank's ability to secure AT1 capital highlights its investment appeal. In 2024, Aareal Bank issued €100 million in AT1 bonds, reflecting positive market sentiment.

Green Loan Portfolio Growth

Aareal Bank's green loan portfolio grew to €7.6 billion by the close of 2024. This growth shows their dedication to ESG principles. It also highlights their success in meeting the demand for sustainable financing. This move attracts clients focused on environmental impact.

- Green loan portfolio reached €7.6 billion.

- Focus on ESG principles is a key strategy.

- Attracts environmentally conscious clients.

Strategic Hotel Financing

Aareal Bank maintains a strategic focus on hotel financing, evidenced by its recent €567 million refinancing deal for a pan-European hotel portfolio. This commitment is underscored by the high yield-on-debt the sector offers. The bank's expertise in hospitality and cross-border transactions further solidifies its position.

- Yield-on-Debt: Hotels: 10.4% (highest), Logistics: 9.4%

- Refinancing: €567 million for a pan-European hotel portfolio.

- Sector Focus: High-yield asset class.

Aareal Bank's 2024 performance, like the growth in its green loan portfolio to €7.6B, indicates a 'Star' position. Strong financial health and strategic growth initiatives, like the €567M hotel refinancing, highlight market leadership. The focus on ESG and high-yield sectors drives expansion.

| Metric | Value (2024) | Strategic Implication |

|---|---|---|

| Operating Profit | €294M (33% increase) | Supports Expansion |

| Green Loan Portfolio | €7.6B | ESG Leadership |

| AT1 Bonds Issued | €100M | Investor Confidence |

Cash Cows

Aareal Bank's Structured Property Financing, a 'Cash Cow', focuses on commercial property investments. Active in Europe, North America, and Asia/Pacific, it provides consistent revenue. In 2024, this segment's stable income reflects its established market position. The bank's expertise ensures a competitive advantage, delivering reliable financial returns.

The Banking & Digital Solutions segment is a cash cow for Aareal Bank, providing sector-specific payment processes and digital solutions. This segment is focused on improving efficiency and profitability through digitalization and process optimization. Client deposits from the housing and energy industries averaged €13.7 billion in 2024, ensuring a steady income stream. This financial stability reinforces its cash cow status.

Aareal Bank's robust deposit-taking business, a financial 'Cash Cow,' significantly boosts its net interest income. The bank's resilience, evidenced by its consistent deposit volume even after strategic shifts, highlights strong client relationships. In 2024, this stable funding source supported lending and boosted profitability. Specifically, the bank reported a net interest income of €405 million in H1 2024.

European Market Presence

Aareal Bank's strong European presence makes it a cash cow. This presence ensures a steady income stream due to established relationships. The bank's deep market understanding also boosts consistent performance. In 2024, 72% of new business came from Europe, showing dominance.

- Stable Income: Consistent revenue from European operations.

- Market Expertise: Deep understanding of local markets.

- Geographic Focus: High concentration of business in Europe.

- Financial Performance: Reliable financial results due to the focus.

Conservative Risk Strategy

Aareal Bank's conservative risk strategy is key for stability. It focuses on strong liquidity and capitalization, shielding against losses. This approach supports consistent profits and a solid reputation. The bank's commitment ensures long-term sustainability in the financial sector.

- In 2024, Aareal Bank's CET1 ratio was above 16%, showing strong capitalization.

- The bank maintained a high liquidity coverage ratio (LCR) above 130%, ensuring it can meet short-term obligations.

- Aareal Bank's focus on conservative lending practices has resulted in a low non-performing loan ratio.

Aareal Bank's cash cows, including Structured Property Financing and Banking & Digital Solutions, generate steady income. These segments leverage expertise and digitalization. Stable client deposits support strong financial results.

| Segment | Key Feature | 2024 Performance |

|---|---|---|

| Structured Property Financing | Commercial Property Investments | Stable Income |

| Banking & Digital Solutions | Sector-Specific Solutions | Client deposits €13.7B |

| Deposit-Taking | Boosts Net Interest Income | NII of €405M (H1 2024) |

Dogs

Aareal Bank's US office loan portfolio is categorized as a 'Dog' in its BCG matrix. These loans, totaling approximately €1.12 billion in non-performing assets, offer low returns. They also demand considerable restructuring and management. The bank is actively reducing its exposure to improve profitability.

Legacy IT systems at Aareal Bank are categorized as 'Dogs' due to their inefficiency and high maintenance expenses. The bank is actively modernizing its IT infrastructure, aiming for cost savings and improved operational efficiency. This transition, however, poses challenges and may slow down innovation. For instance, in 2024, IT maintenance costs were approximately 15% of the total IT budget.

High Loan Impairment Charges (LICs) at Aareal Bank, despite improvements, continue to weigh on earnings, classifying them as a 'Dog' in the BCG matrix. These charges, reflecting commercial property market woes, require diligent risk management. In 2024, Aareal Bank's LICs remain a concern, impacting overall profitability. The bank actively manages its non-performing loan (NPL) portfolio, aiming to reduce these charges.

Geopolitical and Economic Uncertainties

Geopolitical and economic uncertainties pose significant risks to Aareal Bank, potentially relegating it to a 'Dog' in the BCG matrix. External factors, such as the ongoing conflict in Ukraine and rising inflation rates, create an environment of volatility. These uncertainties can lead to higher risk provisions and reduced profitability. The bank's conservative approach aims to buffer against these challenges.

- In 2024, Aareal Bank reported a net profit of EUR 59 million, a decrease from EUR 70 million in 2023, influenced by economic uncertainty.

- The bank's risk provisions increased by 15% in 2024 due to the uncertain economic outlook.

- Aareal Bank has a strong focus on commercial real estate financing.

- The bank operates in several European countries.

Potential for Increased Regulatory Scrutiny

Increased regulatory scrutiny poses a significant challenge for Aareal Bank, potentially classifying it as a 'Dog' in the BCG matrix. Compliance costs are rising, impacting resource allocation and growth. Evolving regulations and stricter enforcement divert management's focus and inflate operational expenses. The bank must adapt to maintain its competitive edge, with regulatory fines in the financial sector reaching billions in 2024.

- Rising compliance costs can limit investment in new opportunities.

- Increased scrutiny demands more internal resources.

- Adaptation is crucial for sustained performance.

- Regulatory fines in the financial sector reached billions in 2024.

Aareal Bank's 'Dogs' include struggling areas. These face low returns, demanding restructuring efforts. High costs and regulatory hurdles also define this category.

| Category | Details | Impact |

|---|---|---|

| US Office Loans | €1.12B in non-performing assets | Low returns, high management costs. |

| Legacy IT Systems | High maintenance costs (15% of IT budget in 2024) | Inefficiency and cost drain. |

| High Loan Impairments | Reflects commercial property market woes. | Weighs on earnings and profitability. |

Question Marks

Aareal Bank's new digital solutions target high-growth potential in the property sector, yet face uncertain market share. These solutions require substantial investment, with digital transformation spending at banks rising. Success hinges on meeting evolving customer needs and differentiating offerings. In 2024, digital transformation spending in the banking sector is forecasted to reach $200 billion.

Aareal Bank's expansion into new European markets like Germany and other regions presents question marks, reflecting uncertain outcomes. Entering new client segments offers growth potential, but also carries risks, demanding strategic planning. Success hinges on effective market penetration, potentially transforming these ventures into 'Stars' or relegating them to 'Dogs.' In 2024, Aareal Bank's strategic moves in these markets will be critical.

The First Financial Software joint venture, a 'Question Mark' in Aareal Bank's portfolio, targets growth in payment software. Success hinges on market share capture and revenue generation. The venture positively impacts client acquisition; however, long-term viability is uncertain. In 2024, the payment software market is projected to reach $80 billion.

Strategic Investments in Technology

Aareal Bank's strategic focus includes technology investments, such as process optimization and digitalization, aimed at boosting efficiency and cutting expenses. These initiatives, like modernizing its IT architecture, are "Question Marks" within the BCG matrix. Success hinges on effective implementation, which could significantly impact profitability. These investments are substantial: in 2024, Aareal Bank allocated €45 million towards technology upgrades.

- Process Optimization: Streamlining operations for cost savings.

- Digitalization: Enhancing services and client interactions.

- IT Modernization: Upgrading infrastructure for better performance.

- Investment Amount: €45 million in 2024.

Partnerships and Acquisitions

Future partnerships and acquisitions could represent a growth vector for Aareal Bank. These strategic moves might unlock access to new markets, technologies, or expertise. However, they also introduce integration risks and demand thorough due diligence. Success hinges on strategic fit and effective management.

- 2024: Aareal Bank might focus on partnerships to enhance digital capabilities.

- Acquisitions could be targeted to expand its presence in specific European markets.

- Due diligence will be critical to mitigate integration challenges.

- Strategic fit and management capabilities are essential for success.

Aareal Bank's ventures, like new European market entries, represent "Question Marks" due to uncertain outcomes and require strategic planning. The First Financial Software joint venture is another example, its success depending on market share and revenue. Technology investments, crucial for efficiency, also fall into this category, demanding effective implementation and significant capital.

| Aspect | Details | Financials (2024) |

|---|---|---|

| New Markets | Expansion into Germany & other regions | Strategic moves critical |

| Joint Ventures | First Financial Software (payment software) | Market projected at $80B |

| Technology Investments | Process Optimization, Digitalization | €45M allocated |

BCG Matrix Data Sources

Aareal Bank's BCG Matrix leverages financial statements, market analysis, and industry research for data-driven strategic insights.