Alphabet Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alphabet Bundle

What is included in the product

Highlights competitive advantages and threats per quadrant

Dynamic data updates instantly reflect changes, eliminating manual rework and time waste.

What You See Is What You Get

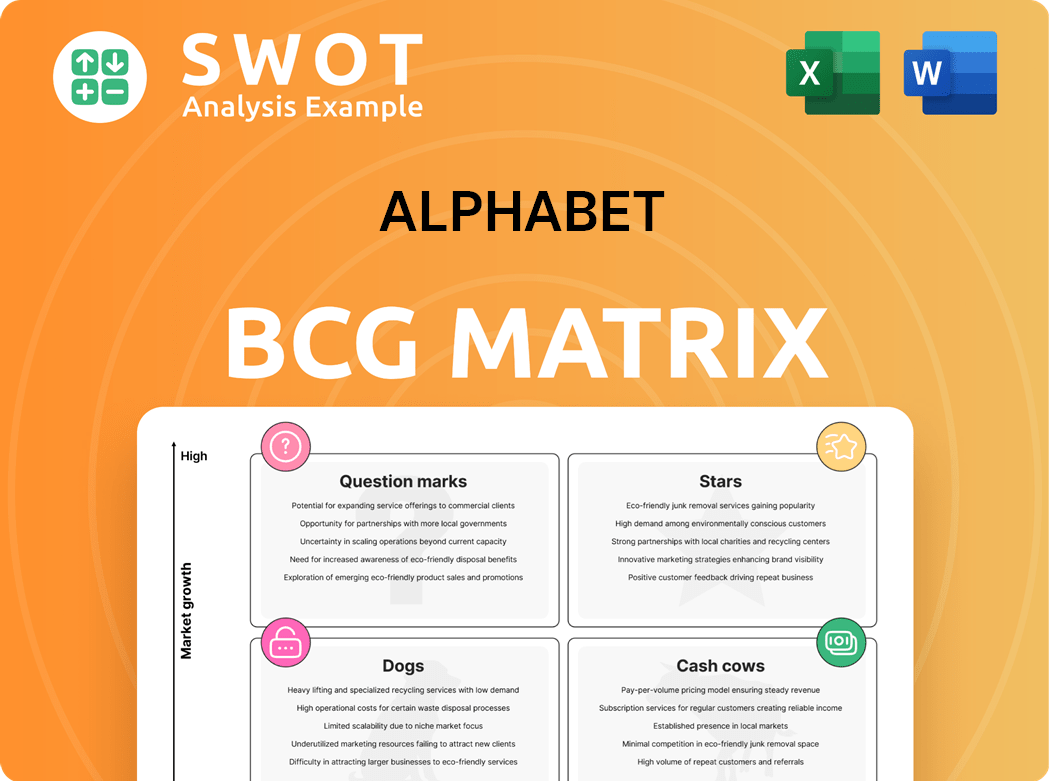

Alphabet BCG Matrix

This preview showcases the complete Alphabet BCG Matrix document you'll receive after buying. It’s a fully functional, editable file with no hidden content or watermarks, ready for immediate application.

BCG Matrix Template

The Alphabet BCG Matrix categorizes Google's diverse offerings: Stars, Cash Cows, Dogs, and Question Marks. This simplified view shows product market share and growth rate. Identify which products drive revenue or need strategic attention. See how Alphabet balances its portfolio across these quadrants. Learn where to allocate resources for optimal returns. Purchase the full BCG Matrix for in-depth analysis and strategic guidance.

Stars

Google Search, enhanced by AI, leads the search market. In 2024, it held over 50% of global share. AI overviews and features like 'Circle to Search' boost engagement. This drives significant advertising revenue for Alphabet. AI innovations are key to maintaining leadership.

YouTube continues to be a dominant force in the video content sphere, attracting billions of users. The platform's strategic investments in creator support and features like YouTube TV fuel its expansion. In Q4 2024, YouTube's ad revenue hit $10.47 billion, underscoring its appeal to advertisers. Its leadership in streaming and podcasts solidifies its role as a major growth engine for Alphabet.

Google Cloud Platform (GCP) is a rising star, fueled by AI and core services. GCP's revenue surged 30% in Q4 2024, hitting $12.0 billion, driven by AI solutions. This growth signifies GCP's increasing importance within Alphabet. Continued investment in AI and data centers supports its expansion.

Waymo

Waymo, Alphabet's self-driving car project, is becoming a player in the transportation world. Its robotaxi service is growing in cities like San Francisco, Los Angeles, and Phoenix. Waymo is increasing its paid rides weekly, showing that people are interested in self-driving rides. This could bring in a lot of money for Alphabet, which may raise its value over time.

- Waymo has completed over 10 million miles of driving in 2024.

- Waymo's revenue is projected to reach $2 billion by 2026.

- In 2024, Waymo's robotaxi service expanded to new areas in Los Angeles.

Android OS

Android, a key component of Alphabet's portfolio, remains the dominant mobile OS. It provides a massive user base for Google's services. Its open-source model and wide adoption boost its market reach. Android's deep integration with Google's ecosystem drives user engagement and revenue.

- Market Share: Android held about 70% of the global mobile OS market share in 2024.

- Device Numbers: Over 3 billion active Android devices were in use worldwide as of early 2024.

- Revenue Generation: The Google Play Store generated over $40 billion in revenue in 2023.

- Strategic Importance: Android is crucial for Google's advertising and cloud services.

Alphabet's Stars, including Google Search, YouTube, GCP, Waymo, and Android, show high growth potential and market share. These businesses drive significant revenue, exemplified by YouTube's $10.47 billion ad revenue in Q4 2024. Investments in AI and expansion strategies fuel their continued growth and leadership in their respective markets.

| Star | Market Share/Revenue (2024) | Key Growth Drivers |

|---|---|---|

| Google Search | Over 50% global search share | AI enhancements, 'Circle to Search' |

| YouTube | $10.47B ad revenue (Q4 2024) | Creator support, YouTube TV |

| Google Cloud (GCP) | $12.0B revenue (Q4 2024) | AI solutions, data centers |

| Waymo | Expanding robotaxi services | Self-driving tech, route expansions |

| Android | ~70% mobile OS share | Open-source model, Google ecosystem |

Cash Cows

Google Ads is a cash cow for Alphabet, fueled by its search dominance. In Q4 2024, Google's advertising revenue hit $72.46B. This platform delivers targeted ads to billions, generating substantial income. While growth slows, it remains a reliable cash flow source.

Gmail, a key part of Alphabet's portfolio, boasts billions of active users, securing a steady revenue stream. In 2024, Gmail's advertising revenue alone contributed significantly to Alphabet's overall financial performance. Its seamless integration with other Google services boosts user engagement. Gmail's established market presence ensures sustained profitability.

Google Maps, a dominant player in navigation, generates substantial revenue through advertising and location-based services. In 2024, Google Maps accounted for a significant portion of Alphabet's ad revenue, estimated at billions. Its vast user base and essential services solidify its cash cow status. Ongoing feature enhancements ensure continued user engagement and revenue growth.

Google Play Store

The Google Play Store is a cash cow within Alphabet's portfolio, generating substantial revenue through app sales, in-app purchases, and subscriptions. It benefits from the massive Android user base, ensuring consistent revenue with relatively low additional investment. In 2024, Google Play's revenue is projected to reach $85 billion. The platform's effective curation and security measures enhance its attractiveness to both developers and users, solidifying its market position.

- Projected revenue for 2024: $85 billion.

- Provides apps and digital content.

- Benefits from the vast Android user base.

- Focuses on curation and security.

Google Workspace

Google Workspace, featuring apps like Docs and Sheets, is a key cash cow for Alphabet. It offers productivity solutions via subscriptions to businesses and individuals. These tools are integrated seamlessly with other Google services, enhancing user engagement. Its strong market presence ensures consistent revenue with minimal extra investment. In 2024, Google Workspace's revenue is projected to reach $35 billion.

- Revenue Stream: Subscription-based model.

- Market Position: Established in productivity software.

- Integration: Seamlessly integrated with other Google services.

- Revenue Projection: $35 billion in 2024.

YouTube, a leading video platform, generates substantial revenue through advertising and subscriptions. In 2024, YouTube's advertising revenue hit over $31.5 billion. Its vast user base and content library drive consistent revenue. YouTube's established presence ensures sustained profitability.

| Feature | Details | 2024 Revenue |

|---|---|---|

| Revenue Streams | Advertising, Subscriptions | $31.5B (advertising) |

| User Base | Billions of users globally | |

| Platform | Video content platform |

Dogs

Google Play Music, sunsetted in December 2020, was a streaming service that failed to gain traction. It lagged behind competitors like Spotify, which had 236 million paid subscribers in Q4 2023. Google Play Music's limited market share made it a 'dog' within Alphabet's portfolio. Its discontinuation consolidated Google's focus on YouTube Music, aiming for better profitability.

Google+ aimed to rival Facebook but flopped, leading to its shutdown. The social network struggled with user engagement, ultimately becoming a 'dog'. Alphabet's investment in Google+ yielded minimal returns. The project's failure prompted resource reallocation. Google+ was closed in 2019, after years of trying.

Google Glass, the original consumer version, was a costly augmented reality device. It struggled with privacy issues and limited features, failing to gain traction. Despite its high launch price of $1,500 in 2013, sales were disappointing. This made it a "dog" in Alphabet's portfolio. The project's failure taught valuable lessons for future AR/VR innovations.

Nest Secure (Discontinued)

Nest Secure, a home security system by Google, was discontinued. It struggled against established competitors, failing to gain substantial market share. Limited profitability and growth classified Nest Secure as a "dog" in the Alphabet BCG Matrix. Its discontinuation in 2020 allowed Google to concentrate on more promising smart home ventures.

- Discontinued in 2020 due to poor performance.

- Competed with ADT and other established brands.

- Failed to capture a significant market share.

- Contributed minimally to Alphabet's overall revenue.

Hangouts (Classic)

Hangouts (Classic), Alphabet's initial messaging service, has been retired. It was superseded by Google Chat and Meet. Its user base dwindled as newer, feature-rich platforms emerged. The shift reflects Alphabet's strategy to consolidate and modernize its communication tools.

- Hangouts was officially shut down in November 2022.

- Google Chat and Meet saw a significant increase in usage after Hangouts' discontinuation.

- The decision streamlined Alphabet's communication offerings.

Google Play Music's low market share made it a Dog in Alphabet's portfolio, discontinued in December 2020. Google+ faced user engagement struggles, leading to its closure in 2019, a definite Dog. Google Glass, priced at $1,500 in 2013, also became a Dog due to privacy and feature limitations.

| Product | Status | Key Issue |

|---|---|---|

| Google Play Music | Discontinued | Low market share |

| Google+ | Closed | Poor user engagement |

| Google Glass | Discontinued (original) | Privacy/feature limitations |

Question Marks

Google Shopping, a part of Alphabet, strives to boost its e-commerce presence, yet it trails behind giants like Amazon. In 2024, Amazon controlled roughly 38% of the U.S. e-commerce market, while Google Shopping's share was much smaller. The platform's new features aim to draw in more users and vendors. Google Shopping's future is uncertain, making it a "question mark" due to its growth potential in a growing market. Its success relies on standing out and gaining more market share.

Google Fiber, Alphabet's high-speed internet service, is a question mark in its portfolio. It aims for high growth in the broadband market. However, it faces infrastructure costs and competition. The project is investing in advanced technologies. Its success depends on efficient scaling and competitive pricing.

Verily, Alphabet's life sciences division, tackles healthcare innovations. It faces a tough, regulated market, making it a 'question mark'. Its high growth potential is offset by uncertainties. In 2024, Alphabet's "Other Bets", including Verily, saw fluctuating financial results, reflecting the challenges of launching new health technologies.

DeepMind

DeepMind, Alphabet's AI research division, is a 'question mark' in the BCG matrix, embodying high potential with uncertain returns. It drives innovation in AI, yet its commercial viability remains unproven. Despite significant investment, including billions in research and development, its direct revenue contribution is still emerging. The company's progress is closely watched, as its success hinges on turning research into marketable products.

- DeepMind's 2023 revenue was estimated at $1.2 billion, a fraction of Alphabet's overall revenue.

- Alphabet's R&D spending in 2023 reached $44.5 billion, with a substantial portion allocated to AI ventures like DeepMind.

- DeepMind's valuation is estimated to be between $30 and $50 billion, reflecting its potential.

- Key projects include advancements in healthcare and drug discovery, which could generate significant future revenue.

Other Bets (e.g., Wing, X)

Alphabet's "Other Bets" are like "question marks" in a BCG matrix, representing high-potential, high-risk ventures. These include projects like Wing, focusing on drone delivery, and innovations from X, formerly Google X. These areas are still developing, and their long-term market success remains uncertain. The key is whether they can scale up and become profitable.

- Wing's drone deliveries have expanded, but profitability is a challenge.

- X's projects, like self-driving cars (Waymo), face regulatory and technological hurdles.

- The "Other Bets" segment reported a revenue of $657 million in Q3 2023, but an operating loss of $1.18 billion.

- These ventures require significant investment, and their success hinges on innovation and market acceptance.

The "question mark" category in Alphabet's BCG matrix consists of high-potential, but uncertain ventures. These include Google Shopping, facing market giants, and Google Fiber with high infrastructure costs. Verily in healthcare and DeepMind in AI also fit this profile.

| Company | Category | Key Challenges |

|---|---|---|

| Google Shopping | Question Mark | Market share, competition |

| Google Fiber | Question Mark | Infrastructure costs, competition |

| Verily | Question Mark | Regulatory, market uncertainties |

| DeepMind | Question Mark | Commercial viability of AI |

BCG Matrix Data Sources

The BCG Matrix employs robust financial statements, industry reports, and competitive intelligence for trustworthy analysis.