ABC Supply SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ABC Supply Bundle

What is included in the product

Maps out ABC Supply’s market strengths, operational gaps, and risks.

Offers a clear SWOT template for quick business unit alignment.

Preview Before You Purchase

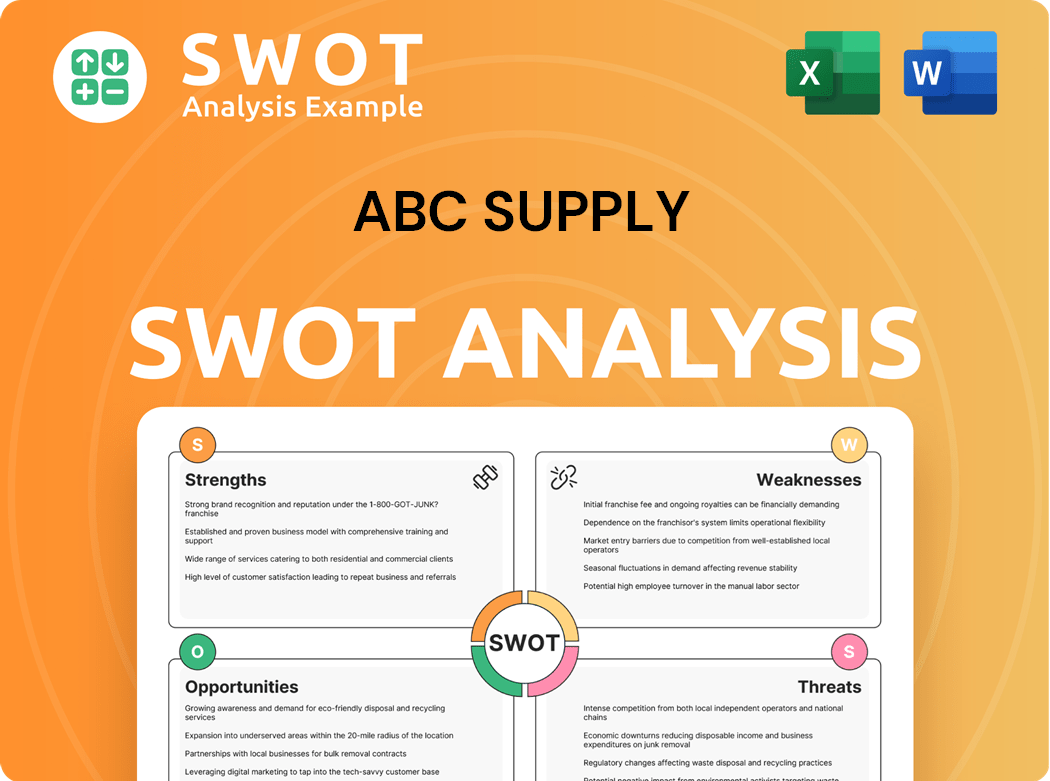

ABC Supply SWOT Analysis

What you see is what you get! This preview shows the exact SWOT analysis document you will receive upon purchase.

There are no differences between this excerpt and the complete, downloadable file.

Access the full, in-depth analysis instantly after your order is processed.

Expect the same quality content you are currently viewing.

Get ready to use your SWOT analysis!

SWOT Analysis Template

Here’s a glimpse of ABC Supply's strategic landscape. Our SWOT analysis touches on its core strengths, such as its expansive network and customer relationships. We've also identified weaknesses like potential regional market limitations. Opportunities, including expansion and e-commerce, are evaluated. Threats, like competition and economic shifts, are carefully considered.

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

ABC Supply's extensive national network, with over 900 locations as of late 2024, offers a key advantage. This broad presence supports efficient distribution and local customer service. Their footprint enables catering to diverse regional needs. The network strengthens relationships with contractors. ABC Supply's 2023 revenue was approximately $18.8 billion, highlighting the network's impact.

ABC Supply's decades of experience, dating back to 1982, have cultivated a strong brand reputation. This reputation underscores reliability and quality in building materials distribution. Their focus on contractors builds trust, leading to customer loyalty. This positive brand image attracts and retains customers, supporting a stable base. In 2024, ABC Supply's revenue reached $18.5 billion, reflecting their strong market position.

ABC Supply's dominance as the largest wholesale distributor of roofing supplies and a major player in siding and windows is a key strength. This market leadership translates to substantial economies of scale, boosting profitability. The company's size grants it considerable bargaining power with suppliers, improving cost management. In 2024, ABC Supply's revenue reached approximately $20 billion, reflecting its market influence.

Comprehensive Product Portfolio

ABC Supply boasts a broad selection of products, supported by a vast network of branches across the U.S. This extensive presence gives ABC Supply a significant logistical advantage, enhancing distribution and customer service. Their wide footprint helps ABC Supply meet various regional demands and build strong relationships with contractors. In 2024, ABC Supply's revenue exceeded $20 billion, reflecting its market dominance.

- Extensive product range to meet diverse needs.

- Efficient distribution through numerous branch locations.

- Strong customer service and localized support.

- Ability to cater to regional demands effectively.

Financial Stability

ABC Supply's financial stability is a cornerstone of its success, built over decades since its 1982 founding. The company has cultivated a strong reputation for reliability in building materials distribution. This reputation supports a stable customer base and fosters trust. ABC Supply's commitment to contractors helps grow and retain customers.

- Established in 1982, ABC Supply has over 40 years of experience.

- A strong brand image helps retain and attract customers.

- Reliability and quality are key to ABC Supply's reputation.

ABC Supply's national presence, with over 900 locations, ensures efficient distribution and strong customer relationships, reinforced by its substantial $20 billion in revenue as of late 2024.

A reputation built since 1982, focuses on contractors and their positive image has helped secure a market-leading position.

Its market dominance as a top roofing and siding supplier and broad product range translate into substantial economies of scale.

| Strength | Details | 2024 Data |

|---|---|---|

| Extensive Network | Over 900 locations for efficient distribution. | $20 Billion Revenue |

| Strong Reputation | Established since 1982; focused on contractors. | Strong Customer Loyalty |

| Market Leadership | Top roofing and siding supplier; economies of scale. | Significant Market Share |

Weaknesses

ABC Supply's performance is tied to the construction industry, which is sensitive to economic cycles. A downturn can severely impact sales and profitability. For example, in 2023, the construction sector experienced fluctuations due to rising interest rates. Decreased demand for building materials affects revenue. Proactive strategies are crucial for mitigating losses.

ABC Supply's revenue heavily relies on the housing market, encompassing new construction and remodeling. Housing starts and sales fluctuations directly impact demand for their products. This dependence on one segment makes the company vulnerable to market volatility. The National Association of Home Builders reported a 5.7% decrease in housing starts in 2024. Diversification is vital to stabilize revenue.

ABC Supply faces volatility in raw material costs like steel and asphalt, which can significantly affect profit margins. The need for hedging and supply chain management is crucial to navigate these fluctuations. Unpredictable material costs can squeeze profit margins, making consistent pricing difficult. In 2024, steel prices saw a 10% increase, impacting construction material suppliers.

Labor Shortages

ABC Supply faces labor shortages, a significant weakness, particularly impacting the construction and building materials sector. The industry's cyclical nature makes it susceptible to economic downturns, potentially decreasing sales and profitability. For instance, the construction sector saw a 5.6% decrease in employment in 2023, indicating a challenge. Economic fluctuations can decrease building material demand, necessitating proactive loss mitigation strategies.

- Labor shortages can increase operational costs.

- Construction slowdowns directly affect ABC Supply's revenue.

- Economic downturns demand strategic inventory management.

- The industry's cyclical nature requires financial resilience.

Competition

ABC Supply's reliance on the housing market, including new construction and remodeling, poses a weakness. Fluctuations in housing starts and sales directly impact demand for their products. This dependence on a single market segment introduces vulnerability to housing market volatility. Diversification is key to stabilizing revenue streams, considering the potential impact of economic downturns on construction. In 2023, the U.S. housing starts decreased by 9%, impacting construction supply businesses.

- Housing market volatility directly impacts the company.

- Diversification is necessary for stable revenue.

- 2023 U.S. housing starts decreased by 9%.

ABC Supply is vulnerable due to reliance on cyclical construction and housing markets. Fluctuations in raw material costs and labor shortages affect profit margins and operational costs. The company faces risks from volatile material prices and housing market shifts.

| Weakness | Impact | Data Point (2024) |

|---|---|---|

| Market Dependence | Revenue volatility | Housing starts down 5.7% |

| Material Costs | Margin pressure | Steel price up 10% |

| Labor Shortages | Cost increase | Construction employment down 5.6% |

Opportunities

Sustainability initiatives represent a significant opportunity for ABC Supply. The demand for eco-friendly building materials is rising, creating a market for green products. ABC Supply can expand offerings like green roofing to attract environmentally conscious customers. This focus could boost the company's brand image. In 2024, the green building market is valued at over $80 billion.

Technological integration presents significant opportunities for ABC Supply. Implementing AI and digital platforms can boost operational efficiency and customer service. This approach optimizes processes, reduces costs, and improves the customer experience. For example, in 2024, companies investing in supply chain AI saw up to a 15% reduction in operational costs.

ABC Supply can grow by targeting underserved markets, increasing its footprint nationally. Strategic expansion boosts market share and diversifies income streams. New geographic entries unlock growth potential, reducing dependence on current markets. In 2024, the building materials market grew, presenting expansion opportunities. Focusing on specific regions can lead to increased profitability and market penetration.

Strategic Acquisitions

ABC Supply has a strategic opportunity to expand by acquiring companies that specialize in sustainable building materials. This move aligns with the increasing demand for eco-friendly products, a market that's expected to grow substantially. By incorporating green roofing and siding, ABC Supply can attract customers focused on sustainability. Such acquisitions can boost the company's brand image and market share in the green building sector.

- The global green building materials market was valued at $334.4 billion in 2023.

- Projections estimate it will reach $685.8 billion by 2032.

- This represents a compound annual growth rate (CAGR) of 8.4% from 2023 to 2032.

- Acquiring sustainable material suppliers will help ABC Supply capture a larger share of this expanding market.

Enhanced Customer Service

ABC Supply can leverage technology to boost customer service. Implementing AI and digital platforms can streamline supply chain management and improve operational efficiency. This investment can cut costs and offer a better customer and employee experience. For example, the global customer service AI market is projected to reach $22.6 billion by 2028, according to Statista.

- AI-powered chatbots can provide instant support.

- Digital platforms can offer self-service options.

- Real-time tracking improves transparency.

- Personalized recommendations can boost sales.

ABC Supply faces substantial opportunities, highlighted by the rising demand for sustainable materials, representing a $334.4 billion market in 2023.

Technological advancements, such as AI, can improve efficiency and customer service, with the global customer service AI market expected to reach $22.6 billion by 2028.

Strategic market expansion, including acquisitions and geographical growth, enables increased market share and revenue diversification, with the green building materials market projected to hit $685.8 billion by 2032.

| Opportunity | Details | Data |

|---|---|---|

| Sustainable Materials | Expand eco-friendly offerings like green roofing | $334.4B market in 2023, growing to $685.8B by 2032 |

| Technological Integration | Implement AI, digital platforms | Customer Service AI market: $22.6B by 2028 |

| Market Expansion | Target underserved regions | Building material market grew in 2024 |

Threats

A recession could severely cut construction activity, hitting ABC Supply's sales and profits. Proactive strategies are key for weathering economic storms. Decreased construction spending, triggered by economic woes, affects the building supply chain. In 2024, the U.S. construction sector saw a slowdown, with a 1% decrease in new construction starts, according to Dodge Data & Analytics.

Supply chain disruptions pose a significant threat to ABC Supply. Global events, natural disasters, and geopolitical instability can disrupt the supply chain, leading to shortages and increased costs. Diversifying suppliers and implementing robust risk management strategies are essential to mitigate these risks. Unforeseen disruptions can severely impact the availability of key materials. For example, in 2024, the global supply chain disruptions increased operational costs by approximately 15% for construction material suppliers.

The surge of online retailers, including Amazon, intensifies competition for ABC Supply. To stay relevant, ABC Supply must boost its online presence and e-commerce features. This digital shift could reduce ABC Supply's market share and squeeze prices. In 2024, Amazon's building supply sales reached $1.2 billion, highlighting this challenge.

Changing Building Codes and Regulations

Changing building codes and regulations pose a threat. A major economic recession, like the one in late 2023 and early 2024, could significantly reduce construction activity. This impacts ABC Supply's revenue and profitability, as seen when construction spending decreased by 5.2% in Q4 2023. Proactive strategies are crucial for preparing for potential economic downturns. Economic instability can decrease construction spending, affecting the entire building materials supply chain.

- Economic downturns reduce construction.

- Decreased spending impacts revenue.

- Building codes evolve, affecting materials.

- Economic instability affects supply chains.

Inflation and Rising Interest Rates

Global events, natural disasters, and geopolitical instability pose significant threats to ABC Supply's supply chain. These disruptions can cause material shortages, impacting project timelines and increasing costs. Rising interest rates and inflation, as seen with the Federal Reserve's actions in 2024, also elevate operational expenses. Diversifying suppliers and employing strong risk management are crucial to mitigate these threats.

- Supply chain disruptions led to a 15% increase in material costs for construction projects in 2024.

- The Federal Reserve increased interest rates multiple times in 2024, raising borrowing costs.

- Geopolitical events caused a 20% reduction in the availability of certain materials.

Economic downturns threaten construction activity and ABC Supply’s revenue. Supply chain disruptions from global events and natural disasters hike costs. Rising competition from online retailers squeezes market share.

| Threat | Impact | 2024 Data |

|---|---|---|

| Recession | Reduced sales, lower profits. | Construction starts decreased by 1%. |

| Supply Chain Issues | Shortages, cost increases. | Supply costs increased by 15%. |

| Online Competition | Market share erosion. | Amazon's building supply sales reached $1.2B. |

SWOT Analysis Data Sources

The ABC Supply SWOT analysis relies on financial reports, market research, and expert analyses, all used to drive reliable, strategic insights.