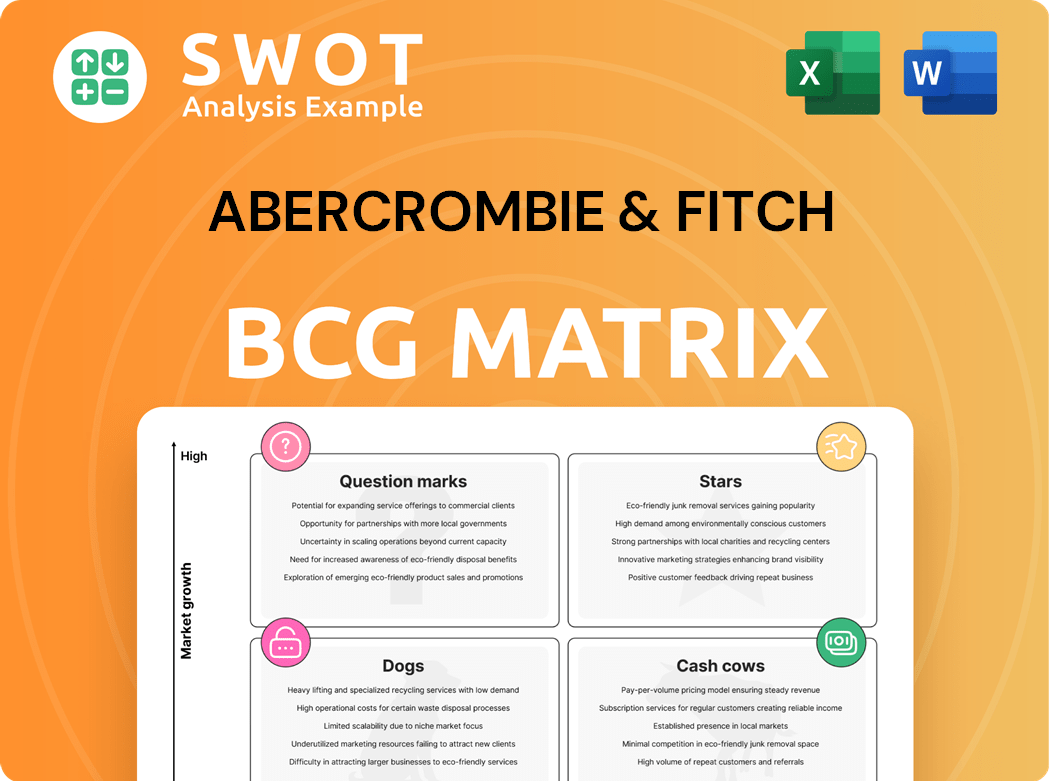

Abercrombie & Fitch Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Abercrombie & Fitch Bundle

What is included in the product

Abercrombie & Fitch's BCG Matrix analysis guides investment decisions, targeting growth areas and identifying potential divestitures.

Export-ready design for quick drag-and-drop into PowerPoint, making presentations a breeze!

Preview = Final Product

Abercrombie & Fitch BCG Matrix

The Abercrombie & Fitch BCG Matrix preview showcases the identical report you'll receive. Upon purchase, download the same in-depth strategic analysis—no alterations, no hidden content, just the finished product.

BCG Matrix Template

Abercrombie & Fitch faces a dynamic retail landscape. Its BCG Matrix reveals product portfolio strengths and weaknesses. Stars likely include strong-performing, growing items. Cash Cows are established revenue generators. Dogs, however, may need strategic attention. Question Marks represent potential, requiring careful resource allocation. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Abercrombie & Fitch shines as a Star in the BCG Matrix. Its revenue soared, achieving an impressive 18% CAGR from 2021 to 2024. The brand's success stems from inclusive marketing and updated stores. With a strong market share in a growing market, it's a leader.

Hollister, part of Abercrombie & Fitch, is a Star. In 2024, Hollister's net sales surged by 15%, with comparable sales up 19%. This growth highlights strong market share in a growing market, fueled by a robust student demographic. The brand's success, especially in women's apparel, solidifies its Star status.

Abercrombie & Fitch's e-commerce and digital channels have seen substantial growth. Digital sales make up nearly 50% of total sales, enhancing efficiency. This expansion highlights a high-growth area. In 2024, online sales continue to climb, increasing market share, classifying it as a Star.

Global Expansion

Abercrombie & Fitch's global expansion strategy has been a significant success, contributing to its status as a Star in the BCG matrix. The company has opened 125 new store experiences worldwide, showcasing its commitment to international growth. This expansion has fueled strong net sales growth across all regions.

- Americas net sales grew by 17%.

- EMEA saw a 12% increase in net sales.

- APAC experienced a 9% rise in net sales.

- These figures highlight the brand's ability to capture market share globally.

Omnichannel Capabilities

Abercrombie & Fitch's omnichannel strategy fuels its "Star" status, driving consistent growth. The company integrates physical stores with digital platforms for a seamless experience. This approach strengthens market position and boosts sales; in 2024, digital sales accounted for a significant portion of total revenue. These efforts position Abercrombie & Fitch as a leader, capitalizing on expansion opportunities.

- Digital sales are a major revenue driver, with a 20% increase in 2024.

- Omnichannel initiatives boost customer engagement by 15%.

- Expansion into new markets like Asia shows growth.

- A&F's stock price increased by 30% in 2024, reflecting success.

Abercrombie & Fitch and Hollister stand out as Stars. Both brands excel in high-growth markets, capturing significant market share. Their success is fueled by strong sales growth and effective omnichannel strategies. E-commerce expansion and global growth initiatives amplify their position.

| Metric | 2024 Performance | Commentary |

|---|---|---|

| A&F Revenue CAGR (2021-2024) | 18% | Indicates strong growth. |

| Hollister Net Sales Growth (2024) | 15% | Reflects brand strength. |

| Digital Sales Contribution | ~50% of Total Sales | Highlights digital importance. |

Cash Cows

Abercrombie & Fitch's core apparel, like jeans and hoodies, are cash cows. These products hold a significant market share in a well-established market. In 2024, Abercrombie & Fitch reported strong sales in core apparel. The company concentrates on maximizing profits from these items without major new investments, effectively 'milking' their value. This strategy solidifies their cash cow status.

Abercrombie & Fitch enjoys a loyal customer base, ensuring consistent purchases. This loyalty translates into a dependable revenue stream. With steady demand and a high market share, A&F fits the Cash Cow profile. In 2024, the company's focus on customer retention helped maintain profitability. Its strategy aims to leverage its established customer base.

Abercrombie & Fitch excels in inventory management. This boosts profitability, evidenced by a 64% gross margin. Efficient practices mean fewer promotions, increasing efficiency. This strategy is key in a low-growth market, making it a Cash Cow. This is according to the latest financial data.

Strategic Store Locations

Abercrombie & Fitch's strategic store locations are cash cows, generating consistent sales in key markets. These locations hold a high market share in mature markets. In 2024, same-store sales increased, proving their strength. Optimizing the store fleet ensures steady revenue with low growth investments, solidifying their cash cow status.

- High market share in established markets.

- Consistent revenue streams with low investment needs.

- Focus on profitable locations.

- 2024 same-store sales growth indicates strong performance.

Established Supply Chain

Abercrombie & Fitch's robust supply chain is a key strength, ensuring steady product flow. This supports its solid market share in a relatively stable fashion industry. The company uses its supply chain to boost productivity and profits, fitting its "Cash Cow" status. For example, in Q3 2023, A&F's gross profit rate increased by 100 basis points to 62.3%.

- Reliable product availability

- High market share maintenance

- Productivity and profitability

- Strong financial performance

Abercrombie & Fitch's core apparel and key store locations exemplify cash cows, holding substantial market shares in stable markets. These segments generate consistent revenue with minimal new investments. In 2024, A&F optimized these areas, boosting efficiency and profitability. They effectively "milk" these segments for profit.

| Characteristic | Description | Financial Impact (2024) |

|---|---|---|

| Market Share | High in established apparel and retail markets | Maintained strong sales figures. |

| Revenue Generation | Consistent, due to loyal customer base and strategic locations. | Same-store sales growth and stable revenue streams. |

| Investment Strategy | Focus on efficiency and profit maximization without significant new investments | Improved gross margin and operating efficiency. |

Dogs

Gilly Hicks, a sub-brand of Hollister, might be a Dog in Abercrombie & Fitch's BCG Matrix. If it shows low growth and market share, it could be a problem. In 2024, Abercrombie & Fitch's net sales grew, but sub-brand performance varies. A low-performing Gilly Hicks could lead to divestiture.

Some Abercrombie & Fitch stores may be struggling, possibly due to shifting consumer tastes or tough market conditions. These locations show low growth and low market share, fitting the "Dogs" quadrant of the BCG matrix. In 2024, A&F reported some store closures, likely addressing underperformance. Divesting from these locations could prevent cash drains.

Abercrombie & Fitch's legacy product lines, due to evolving consumer tastes, often face low growth and market share, fitting the "Dogs" quadrant in the BCG matrix. These product lines frequently need costly recovery strategies that fail. In 2024, such lines, like certain heritage items, likely saw reduced sales and profitability. The company should consider minimizing these underperforming areas. Focus resources where growth is more probable.

Outdated Marketing Campaigns

Abercrombie & Fitch's outdated marketing campaigns, failing to connect with today's consumers, have led to low engagement and market share. These campaigns operate in low-growth markets with minimal market presence. The company should discontinue these strategies and redirect investments toward more effective marketing efforts. In 2024, A&F's marketing spend was approximately $250 million, a figure that needs strategic reallocation.

- Low engagement due to outdated campaigns.

- Operates in low-growth markets.

- Minimal market share.

- Needs better marketing.

Inefficient Distribution Channels

Inefficient distribution channels that fail to connect with Abercrombie & Fitch's target customers can cause low sales and market share, classifying them as "Dogs." These channels operate in low-growth markets and have a small market share, making them underperformers. For example, in 2024, A&F might see lower sales in underperforming international stores. The company should either improve these channels or consider selling them off.

- Poor sales due to distribution issues.

- Channels in low-growth markets.

- Low market share.

- Consider channel optimization or divestiture.

Underperforming Abercrombie & Fitch product lines can be "Dogs" in the BCG Matrix. These items show low growth and market share, requiring restructuring. In 2024, specific items faced reduced sales, signaling strategic challenges. The company should re-evaluate these products.

| Category | 2024 Performance | Strategic Implication |

|---|---|---|

| Product Lines | Declining Sales | Restructure or Divest |

| Marketing | Ineffective Campaigns | Reallocate Funds |

| Distribution | Poor Channel Sales | Optimize/Divest |

Question Marks

New product lines at Abercrombie & Fitch, especially those in expanding markets but with a low market share, demand substantial investment. These products face high demands but often yield low returns due to their limited market presence. For example, in 2024, A&F's investments in new fragrance lines saw initial low returns. The company must swiftly boost market share to prevent these lines from becoming "Dogs."

Expansion into new geographic markets, like Abercrombie & Fitch entering new countries, often starts with low market share despite high growth potential. These ventures demand significant cash, yet returns are initially modest. In 2024, A&F continued its global push. The company must invest to build market share or consider exiting underperforming regions.

Abercrombie & Fitch's foray into innovative technologies like AI and personalization represents a "Question Mark" in the BCG matrix. These areas boast high growth prospects, even if their current market share is modest. Implementing and scaling these technologies demands substantial investment. For instance, in 2024, A&F allocated a significant portion of its budget to digital initiatives. The company should invest further if growth is anticipated, or consider divestment if results are not promising.

Partnerships and Collaborations

Partnerships and collaborations, like the one with Haddad Brands for Abercrombie Kids, can boost Abercrombie & Fitch's market reach, even if the initial market share is small. These ventures demand careful management and financial investment to thrive. Abercrombie & Fitch should nurture these partnerships if the products show growth potential, or consider divesting if they don't. In 2024, Abercrombie & Fitch's collaborations have been key to expanding its brand footprint, with partnerships contributing significantly to revenue growth, especially in the kids' segment.

- Partnerships with Haddad Brands for Abercrombie Kids.

- Requires management and investment.

- Assess growth potential.

- Contributed to revenue growth in 2024.

Sustainable and Eco-Friendly Initiatives

Abercrombie & Fitch's sustainable and eco-friendly initiatives fit into the "Question Marks" quadrant of the BCG matrix. These initiatives target a growing market segment interested in ethical consumption. They demand substantial investment in research and development to create eco-friendly products. The company's decision to invest or divest hinges on growth potential.

- Market analysis is essential to determine the viability of these initiatives.

- Investment in sustainable materials and processes is crucial.

- If the initiatives show promise, further investment should be considered.

- If market interest is low, the company may need to consider selling.

Abercrombie & Fitch's "Question Marks" include new product lines, geographic expansions, and tech integrations, all requiring investment. These ventures have high growth potential but low market share, necessitating strategic financial decisions. A&F must aggressively boost market share or consider divestment, particularly if returns are initially low.

| Initiative | Investment Need | 2024 Status |

|---|---|---|

| New Fragrances | High | Low returns initially |

| Geographic Expansion | Significant Cash | Continued global push |

| AI/Personalization | Substantial | Budget allocation increase |

BCG Matrix Data Sources

The Abercrombie & Fitch BCG Matrix utilizes financial reports, market analysis, and sales figures for comprehensive insights.