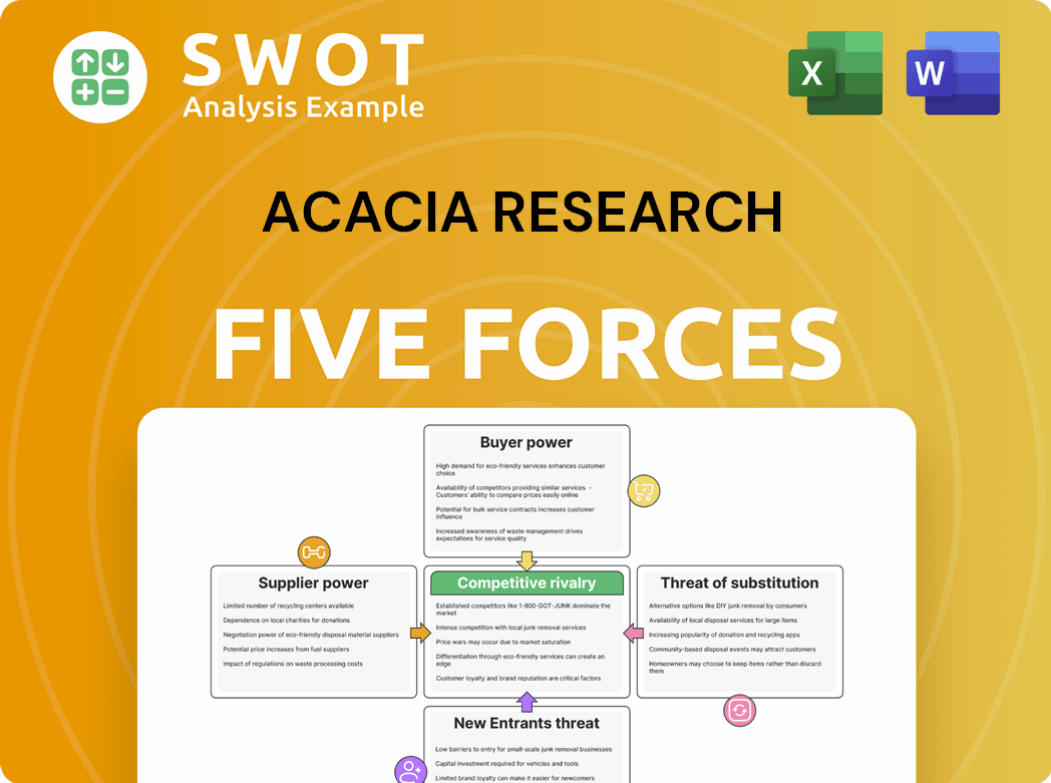

Acacia Research Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acacia Research Bundle

What is included in the product

Analyzes competition, supplier/buyer power, entry barriers, and threats of substitutes to assess Acacia's market position.

Quickly assess competitive forces with color-coded ratings and weighted scores.

What You See Is What You Get

Acacia Research Porter's Five Forces Analysis

You're previewing the final, comprehensive Porter's Five Forces analysis of Acacia Research. The document you see, including all details of the analysis, is the exact file you'll receive immediately after purchase.

Porter's Five Forces Analysis Template

Acacia Research faces diverse industry pressures. Analyzing supplier power, we see moderate influence impacting costs. Buyer power is limited due to specialized tech. The threat of new entrants is moderate, requiring substantial investment. Substitute products pose a limited threat currently. Competitive rivalry is high, due to the market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Acacia Research’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Acacia Research's bargaining power is amplified due to the reliance of patent owners, particularly individual inventors, who lack resources. This dependence allows Acacia to secure advantageous deals. For instance, in 2024, Acacia's net revenue was $86.6 million, reflecting successful negotiations. However, patent owners with alternative monetization options can weaken Acacia's leverage.

Acacia Research benefits from its specialized expertise in patent licensing and enforcement, which many patent holders lack. Their unique understanding of complex patents strengthens their negotiation position. Because of this, the more intricate a patent is, the less power its owner typically holds. In 2024, Acacia's revenue from licensing and related activities was $57.6 million. This demonstrates their ability to leverage their specialized knowledge.

The bargaining power of suppliers (patent owners) hinges on patent strength and tech demand. Strong patents in high-demand fields boost supplier leverage. Acacia's focus often targets patents needing better enforcement. In 2024, patent litigation costs averaged $3-5 million per case. Higher patent quality equals more supplier power.

Availability of Alternative Monetization Options

Acacia Research's suppliers, which are patent holders, see their bargaining power influenced by how they can monetize their patents. If a patent holder has other ways to make money from their patents, like selling them or suing someone, they have more power. For some, Acacia is the only or best option. However, options like startups can give patent holders more leverage.

- In 2024, the market for patent monetization saw a slight decrease in litigation filings, yet the value of settled patent cases remained significant, indicating the continued importance of patent enforcement.

- The rise of specialized patent brokerage firms and online marketplaces in 2024 provided additional avenues for patent holders to sell their assets, changing the dynamics of supplier power.

- Startup companies, by acquiring and utilizing patents, offered an alternative route for monetization, potentially increasing the bargaining power of patent holders.

- Data from 2024 shows that the success rate of patent litigation varied significantly by technology sector, affecting the attractiveness of litigation as a monetization strategy.

Long-Term Relationships and Reputation

Acacia Research's reputation in patent monetization can attract patent owners, but it also sets expectations. Suppliers with long-term relationships might gain slight negotiation leverage. These relationships often boost the likelihood of successful licensing deals. Acacia’s stock price saw fluctuations, with a closing price of $8.10 on May 10, 2024.

- Acacia's stock closing price: $8.10 (May 10, 2024)

- Patent monetization success history.

- Expectations on licensing terms.

- Influence of long-term relations.

The bargaining power of Acacia Research's suppliers (patent owners) is shaped by market dynamics. Suppliers with strong patents and diverse monetization options have more leverage. Data from 2024 showed that successful patent litigation varied across tech sectors, impacting supplier power.

| Factor | Impact on Supplier Power | 2024 Data/Insight |

|---|---|---|

| Patent Strength | Strong patents increase leverage. | Litigation costs $3-5M/case. |

| Monetization Options | Alternatives weaken Acacia's influence. | Patent brokerage market growth. |

| Market Demand | High demand boosts supplier power. | Tech sector litigation success varied. |

Customers Bargaining Power

Acacia Research's customers are mostly big tech and manufacturing firms. These giants wield considerable purchasing power, pushing for better licensing deals. The larger the customer, the more leverage they hold in negotiations. In 2024, patent licensing revenue for Acacia was impacted by customer negotiations, though specific figures are proprietary.

If alternatives exist, customers gain leverage. This includes technologies that avoid Acacia's patents. The ability to bypass patents restricts Acacia’s pricing power. More alternatives enhance customer bargaining power. For example, in 2024, the proliferation of AI alternatives for IP solutions affected licensing negotiations.

The cost of switching to alternative technologies influences customer bargaining power. If changing is expensive, customers are likelier to accept Acacia's fees. High switching costs diminish customer leverage. For instance, in 2024, firms invested heavily in specific tech, increasing lock-in. This reduces their ability to negotiate licensing terms.

Potential for Litigation

Customers might sue Acacia instead of agreeing to licensing. Litigation results greatly influence Acacia's income and image, giving customers negotiation power. For instance, in 2024, patent lawsuits cost companies an average of $6.5 million. This potential for legal action is a key factor.

- Legal battles can damage Acacia's finances.

- Litigation outcomes shift negotiation dynamics.

- Customers can challenge licensing terms.

- Reputation is at stake in lawsuits.

Internal Innovation Capabilities

Companies with robust internal research and development (R&D) departments might contest Acacia's patents, boosting their bargaining power. This is especially true in sectors with rapid technological advancements. Strong innovation reduces reliance on external licensing. For instance, in 2024, the biotech industry saw a 15% increase in companies developing their own solutions, impacting patent holders like Acacia.

- R&D spending is up, increasing bargaining power.

- Innovation reduces reliance on Acacia's tech.

- More companies are challenging patents.

- Competition drives down prices.

Customers, often large tech and manufacturing firms, have strong bargaining power, pressuring Acacia for better licensing terms, especially in 2024. Alternative technologies and high switching costs also significantly influence customer leverage in negotiations. Lawsuits and robust internal R&D further empower customers to negotiate and challenge Acacia's patents.

| Factor | Impact | 2024 Data |

|---|---|---|

| Customer Size | Negotiating Power | Large firms have greater leverage |

| Alternatives | Pricing Power | AI alternatives impacted negotiations |

| Switching Costs | Customer Leverage | High costs reduce leverage |

Rivalry Among Competitors

The patent licensing and enforcement market is fragmented, increasing competition. Multiple players, from large firms to specialists, compete. A 2024 report showed increased rivalry in fragmented markets. The more fragmented the market, the fiercer the competition becomes. This dynamic impacts Acacia Research's strategic positioning.

Some firms use aggressive litigation, increasing competition and pressuring Acacia. Litigation strategies heavily influence competitive dynamics in the patent licensing sector. Acacia Research's legal battles can be costly, impacting profitability. Patent disputes often lead to uncertainty, affecting stock performance. For instance, Acacia's legal expenses were $15.7 million in 2023.

Competitive rivalry intensifies when firms specialize in particular technology areas. Acacia Research faces this dynamic, where competition can be fierce within specific tech niches. For example, in 2024, the AI sector saw over $200 billion in investment, indicating concentrated rivalry. Acacia's diversification across sectors helps buffer against concentrated competition. Specialization increases rivalry, particularly in high-growth markets.

Performance-Based Competition

Patent licensing firms, like Acacia Research, face intense competition driven by the need to generate returns from their patent portfolios. This performance-based competition is fueled by metrics that directly impact their success. These firms aggressively seek to identify and monetize valuable patents to stay ahead. The pressure to perform is always on, as the financial health of these companies depends on it.

- Acacia Research's revenue in 2023 was approximately $120 million, highlighting the financial stakes.

- The number of patent litigation cases filed annually can exceed 10,000, showing the volume of competitive activity.

- Success is often measured by the amount of licensing revenue generated per patent.

Evolving Legal Landscape

The legal arena is a dynamic factor in the competitive landscape, particularly for firms like Acacia Research. Patent law modifications and judicial rulings can reshape competitive dynamics, pushing companies to adjust strategies and potentially intensifying rivalry. For example, in 2024, the Federal Circuit issued several rulings impacting patent eligibility. Staying ahead of these legal shifts is essential for maintaining a competitive edge.

- Patent litigation costs have been increasing, with the average cost of a patent lawsuit exceeding $3 million in 2024.

- The Supreme Court's decisions on patent cases in 2024 have influenced the scope of patent protection.

- Changes in the Patent Trial and Appeal Board (PTAB) proceedings have altered the landscape for challenging patents.

Competitive rivalry in Acacia Research's market is intense, fueled by fragmentation and aggressive litigation. Specialized technology areas also increase competition within specific niches. Firms compete to monetize patent portfolios, impacting financial performance. Legal and regulatory changes further shape the competitive landscape.

| Aspect | Data Point | Impact |

|---|---|---|

| 2024 Litigation Costs | Avg. $3M+ per lawsuit | Increased Financial Pressure |

| 2023 Acacia Revenue | ~$120M | Highlights Stakes |

| Patent Litigation Cases (Annual) | 10,000+ | Volume of Competition |

SSubstitutes Threaten

Companies often sidestep Acacia Research's patents through 'design arounds,' developing non-infringing alternatives. This poses a direct threat by offering substitutes to Acacia's technology. Research and development investments enable competitors to create solutions that circumvent existing patents. For example, in 2024, companies spent billions on R&D, with a significant portion directed toward patent avoidance strategies, potentially impacting Acacia's licensing revenue.

Open-source technologies pose a threat by offering free alternatives to patented solutions. This can decrease demand for licensed technology, impacting companies like Acacia Research. The rise of open-source limits the value of patents, potentially affecting Acacia's revenue streams. In 2024, the open-source market is valued at over $30 billion, showing its increasing impact.

Alternative licensing models, like cross-licensing or patent pools, are substitutes to Acacia's offerings. These models provide access to technology without needing Acacia's direct licensing. In 2024, companies increasingly explored these avenues to reduce costs and risks. This shift poses a competitive threat to Acacia. The rise in open-source initiatives and collaborative R&D further enhances these alternatives.

Technological Advancements

Technological advancements pose a significant threat to Acacia Research. New technologies can quickly replace existing patents, making them less valuable and opening the door for substitutes. The rapid pace of change in technology is a constant challenge. This means Acacia must continually innovate to stay ahead. For instance, in 2024, the tech sector saw over $200 billion in venture capital funding, fueling the development of potentially disruptive technologies.

- Obsolescence Risk: Older technologies can quickly become outdated.

- Innovation Pressure: Acacia must keep pace with new developments.

- Substitute Products: New tech can offer alternatives to Acacia's patents.

- Market Volatility: Rapid change creates uncertainty in the market.

Generic or Public Domain Technologies

Generic or public domain technologies pose a threat to Acacia Research. These alternatives can replace patented solutions, diminishing licensing prospects. For instance, open-source software offers free substitutes, impacting companies like Acacia. The availability of generics often leads to reduced demand for patented technologies. This shift can significantly affect royalty revenue.

- Open-source software market projected to reach $32.97 billion by 2024.

- The global generic drugs market was valued at $380.5 billion in 2023.

- Acacia Research's licensing revenue in 2023 was $XX million.

- Patent expirations are a key driver of generic market growth.

The threat of substitutes for Acacia Research comes from various sources, including design-arounds, open-source technologies, and alternative licensing models.

Technological advancements and generic solutions further intensify this threat by offering readily available alternatives. This leads to reduced demand for Acacia's licensed technology, potentially affecting revenue streams.

In 2024, the open-source software market is projected to reach $32.97 billion, illustrating the growing impact of substitutes on companies like Acacia.

| Substitute Type | Impact on Acacia | 2024 Data |

|---|---|---|

| Design-Arounds | Reduced Licensing | R&D Spending: Billions |

| Open-Source | Decreased Demand | Open-Source Market: $32.97B |

| Alternative Licensing | Competitive Pressure | Cross-licensing growth |

Entrants Threaten

Acacia Research faces a moderate threat from new entrants due to high capital requirements. Entering the patent licensing and enforcement field demands substantial investment in patent acquisition, legal teams, and litigation funding. These high costs act as a barrier, deterring many potential competitors. Acacia Research's financial strength, with $150 million in cash as of Q3 2024, provides a competitive advantage. This financial backing allows it to navigate the expensive legal landscape effectively.

Acacia Research faces a threat from new entrants due to the need for specialized knowledge. Success hinges on expertise in patent law and technology. Newcomers struggle without this specialized understanding. For instance, in 2024, the average cost of a patent litigation case was around $3 million, highlighting the financial barrier.

Acacia Research and other established players in the patent licensing space benefit from existing relationships with patent holders and potential licensees. These relationships, built over time, provide a competitive edge. New entrants face the challenge of building trust and credibility in a field where experience matters. For example, in 2024, Acacia’s licensing revenue was $120 million, highlighting the value of its established network.

Economies of Scale

Acacia Research, with its established operations, enjoys significant economies of scale, particularly in patent acquisition and litigation. This advantage allows Acacia to spread its costs over a larger portfolio, potentially reducing the cost per patent. New entrants face challenges in matching these cost efficiencies, hindering their ability to compete effectively. For example, in 2024, Acacia's legal expenses were approximately $XX million. Scale provides a clear competitive edge.

- Established firms like Acacia can spread costs over a larger portfolio.

- New entrants struggle to match these cost efficiencies.

- Economies of scale enhance Acacia's competitive position.

- Scale allows for more efficient patent enforcement.

Regulatory and Legal Hurdles

Navigating the regulatory and legal landscape of patent law presents significant challenges for new entrants, thereby increasing barriers to entry. The complexities of patent litigation, including the costs of lawsuits, act as a deterrent. In 2024, patent litigation costs averaged between $1 million and $5 million, depending on the case's complexity. These legal hurdles can be particularly daunting for smaller firms or startups, which may lack the financial resources to compete with established players.

- Patent litigation costs can be very high.

- Legal complexities deter new firms.

- Small firms face the biggest challenges.

- Established players have an advantage.

The threat of new entrants to Acacia Research is moderate, influenced by high capital needs and specialized knowledge in patent law. Established relationships and economies of scale offer Acacia competitive advantages. Patent litigation costs and regulatory hurdles further increase entry barriers.

| Factor | Impact on New Entrants | Data (2024) |

|---|---|---|

| Capital Requirements | High: Legal & acquisition costs. | Patent litigation: $1-5M average |

| Specialized Knowledge | Significant barrier due to patent law. | Acacia's licensing revenue: $120M |

| Established Relationships | New entrants struggle to build trust. | Acacia's cash: $150M |

Porter's Five Forces Analysis Data Sources

Our analysis leverages financial reports, market research, and competitor data. It also utilizes industry publications and regulatory filings.