Acciona PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acciona Bundle

What is included in the product

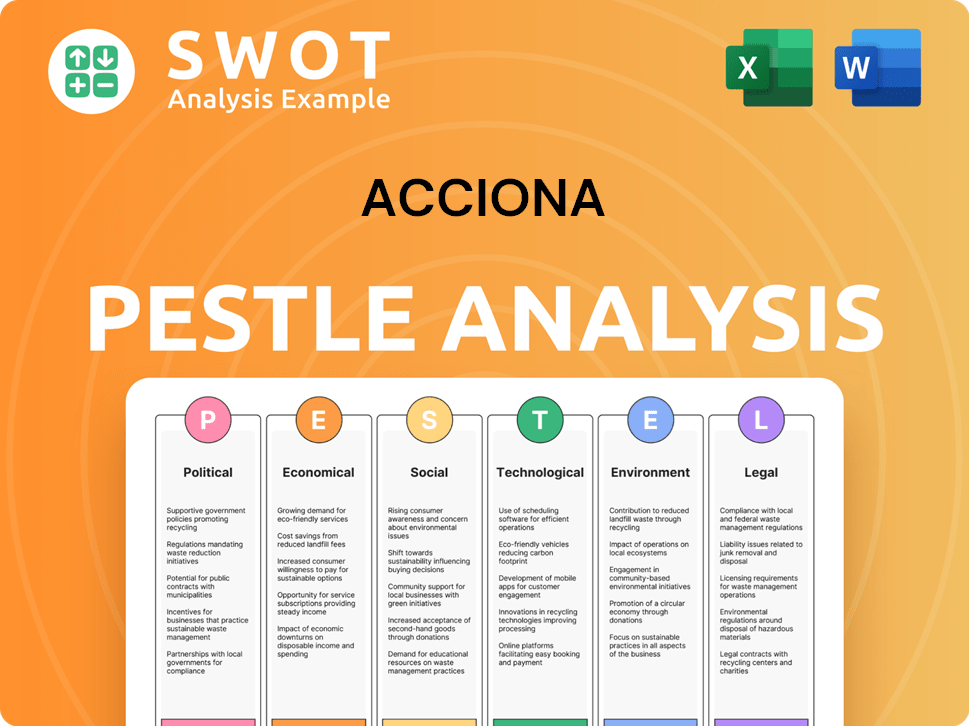

Investigates external influences impacting Acciona: Political, Economic, Social, Tech, Environmental, and Legal.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview the Actual Deliverable

Acciona PESTLE Analysis

This preview shows the real Acciona PESTLE analysis. It's fully formatted for easy use. The structure is as shown; the same doc is available after purchase. Expect no changes, and start immediately.

PESTLE Analysis Template

Uncover the external forces shaping Acciona's future with our in-depth PESTLE analysis. We examine the political landscape, economic shifts, social trends, technological advancements, legal regulations, and environmental impacts. Gain a comprehensive understanding of how these factors influence Acciona's strategic decisions. Download the full analysis now and gain the intelligence you need for success!

Political factors

Government policies heavily influence Acciona's renewable energy ventures. Supportive regulations like tax incentives and subsidies boost clean energy projects. For example, Spain's push for renewables benefits Acciona. Changes in such policies can impact profitability; thus, Acciona must adapt. In 2024, government support remained crucial for the firm's growth.

Government infrastructure spending significantly impacts Acciona. Increased investment in transportation and water projects offers contract opportunities. For example, in 2024, the U.S. allocated over $1 trillion for infrastructure. Fluctuations in budgets, however, create business uncertainty. Acciona must adapt to shifting government priorities to maintain growth.

Acciona faces political risks due to its global operations. Geopolitical events and government changes can affect projects. For instance, political instability in regions where Acciona operates could delay projects. In 2024, political risks led to project delays in some areas. Mitigating these risks is key for Acciona's global success.

Regulatory Frameworks for Water Management

Acciona's water business is heavily influenced by regulatory frameworks. These frameworks, which dictate water quality, treatment standards, and resource management, directly impact the company. Stricter regulations often necessitate investments in advanced technologies, creating opportunities. Supportive frameworks stimulate demand for Acciona's desalination and wastewater treatment solutions.

- In 2024, the global water treatment market was valued at approximately $300 billion.

- The EU's Water Framework Directive sets stringent water quality standards.

- Acciona's revenue from water services in 2024 was around €1.5 billion.

International Relations and Trade Policies

Acciona's global operations are significantly influenced by international relations and trade policies. The company's extensive international presence makes it vulnerable to shifts in trade agreements and diplomatic ties. For example, in 2024, Acciona derived approximately 60% of its revenue from outside Spain, highlighting its exposure to global political and economic climates. Trade barriers or conflicts can disrupt supply chains and reduce market access.

- In 2024, Acciona's international revenue was around €7.5 billion.

- Changes in EU trade policies directly affect Acciona's business.

- Political instability in key markets could delay or cancel projects.

Acciona thrives on supportive government policies for renewables, especially in Spain, but must adjust to policy changes. Infrastructure spending, like the U.S.'s $1 trillion allocation in 2024, offers contract opportunities. Global operations face political risks that can delay projects.

| Political Factor | Impact on Acciona | 2024/2025 Data |

|---|---|---|

| Government Policies | Affects renewable energy and infrastructure projects. | Spain's renewables push; U.S. infrastructure spending of $1T. |

| Geopolitical Risks | Can delay projects in unstable regions. | Political risks caused delays in certain areas during 2024. |

| International Relations | Influences trade and market access. | Acciona had ~60% revenue outside Spain; €7.5B in intl. revenue in 2024. |

Economic factors

Acciona Energía's profitability strongly correlates with electricity price fluctuations, especially in Spain. In 2024, wholesale electricity prices in Spain averaged around €80-90 per MWh. Lower prices can decrease earnings, while higher prices boost performance. Regulatory changes and market dynamics significantly influence these prices, impacting Acciona's financial results.

Acciona's infrastructure and energy projects are heavily influenced by interest rates. Higher rates increase borrowing costs, affecting project viability. In 2024, the European Central Bank maintained high rates, impacting financing. Sustainable financing access is critical, with green bonds playing a key role.

Global economic growth and investment trends significantly impact Acciona. Strong economic performance usually boosts infrastructure spending, benefiting Acciona's projects. In 2024, global infrastructure spending is projected to reach $4.6 trillion, with renewables attracting substantial investment. Conversely, economic slowdowns can delay projects. As of late 2024, the renewable energy sector is expected to see continued growth, providing opportunities for Acciona.

Currency Exchange Rates

Acciona's global presence makes it vulnerable to currency exchange rate shifts. These fluctuations can significantly alter the value of the company's international earnings and costs when translated into its reporting currency, directly influencing its financial performance. For example, a stronger euro could diminish the value of revenues earned in other currencies. This currency risk is an important consideration for investors and analysts.

- Acciona's international revenue percentage in 2024: approximately 65%.

- Euro to USD exchange rate in early 2024: fluctuated between 1.08 and 1.10.

- Impact of a 10% currency fluctuation on Acciona's profits: potentially significant, given its international exposure.

Inflation and Material Costs

Inflation and material costs significantly influence Acciona's project profitability. Increased prices for raw materials and construction inputs can squeeze profit margins. Effective pricing strategies and cost controls are essential to mitigate these risks.

- In 2024, construction material costs rose by an average of 5-7% globally.

- Acciona's Q1 2024 report showed a 3% decrease in profit margins due to increased material costs.

- The company is implementing hedging strategies to manage price volatility.

Acciona's financial health is closely tied to electricity prices and interest rates. Economic growth and investment trends, particularly in infrastructure, heavily influence its projects' success, with renewables drawing substantial funds. Currency fluctuations, especially given its 65% international revenue share in 2024, can impact profits.

| Factor | Impact | 2024 Data |

|---|---|---|

| Electricity Prices | Affect profitability | Spain avg. €80-90/MWh |

| Interest Rates | Influence project costs | ECB maintained high rates |

| Global Growth | Boosts infrastructure spending | $4.6T infrastructure spending |

Sociological factors

Public acceptance significantly impacts renewable energy projects. Negative perceptions can delay Acciona's initiatives, increasing costs. Positive public support streamlines project timelines and fosters better community relations. Acciona's sustainability focus enhances public perception. In 2024, 77% of Americans supported expanding solar power.

Population growth and urbanization fuel demand for infrastructure. This boosts Acciona's infrastructure and water divisions. Urbanization rates are rising globally. For example, in 2024, over 56% of the world's population lives in urban areas, creating opportunities for Acciona in emerging markets.

Acciona's projects, from renewable energy to infrastructure, depend on a large and diverse workforce. Positive labor relations are crucial; this includes fair practices and diversity management. In 2024, the company employed around 38,000 people globally. Labor disputes and strikes can significantly impact project timelines and costs.

Social Impact of Projects

Acciona's projects face heightened scrutiny regarding their social impact on local communities, particularly concerning livelihoods and resource use. A 2024 study revealed that 60% of infrastructure projects globally face community opposition. Stakeholder engagement is crucial. Acciona's focus on positive social impact and community involvement is vital for project success. This approach helps secure the social license to operate.

- 60% of global infrastructure projects face community opposition (2024 data).

- Stakeholder engagement is crucial for project success.

- Acciona aims for positive social impacts.

Health and Safety Standards

Acciona prioritizes health and safety across its operations. Workplace safety incidents can lead to severe social and financial repercussions. Robust safety protocols and a safety-conscious culture are vital. Acciona's commitment to safety is evident in its investments and training programs. This focus helps protect employees and stakeholders.

- In 2024, Acciona invested €120 million in safety and environmental improvements.

- Acciona's lost-time accident rate improved by 15% in 2024.

- Acciona aims to achieve zero fatal accidents by 2026.

Community opposition and social impact scrutiny heavily influence Acciona's operations. Roughly 60% of worldwide infrastructure ventures faced community pushback in 2024. Acciona aims for a favorable societal footprint through stakeholder engagement. Their success hinges on robust social strategies.

| Aspect | Details | 2024 Data |

|---|---|---|

| Community Relations | Opposition's impact. | 60% of infrastructure projects faced community resistance. |

| Stakeholder Engagement | Importance for project success. | Critical for positive outcomes. |

| Social Impact Focus | Acciona's goal. | Aiming to positively affect communities. |

Technological factors

Continuous advancements in renewable energy technologies like solar panels and wind turbines directly impact Acciona Energía. These improvements boost efficiency and project performance. Acciona's investment in technology is crucial; in 2024, the company allocated approximately €700 million to renewable energy projects. This strategic move helps maintain its leadership.

Digital transformation is reshaping infrastructure, with AI, IoT, and robotics driving change. Acciona invests heavily in digitalization. In 2024, Acciona reported a 12% increase in tech-driven efficiency. This boosts project management and smart solutions. Acciona's tech spending reached €800M.

Acciona relies on water treatment and desalination tech. Membrane tech, filtration, and digital solutions are key. These boost efficiency and cut costs. The global desalination market is projected to reach $29.7 billion by 2025, offering growth potential. Water reuse technologies are also expanding.

Building Information Modeling (BIM) and Construction Technology

Acciona leverages Building Information Modeling (BIM) and other advanced construction technologies to optimize project design and execution. These technologies enhance collaboration and reduce errors, leading to improved project delivery. By using these tools, Acciona aims to achieve greater cost-effectiveness and efficiency in its infrastructure projects. In 2024, Acciona's infrastructure division reported a 15% reduction in project delays due to the implementation of these technologies.

- BIM adoption has led to a 10% reduction in rework costs.

- The use of drones for site monitoring has increased project efficiency by 8%.

- Acciona aims to integrate these technologies into 90% of its new projects by 2025.

Cybersecurity and Data Management

Acciona's digital transformation heightens cybersecurity and data management importance. Protecting sensitive information and ensuring system security are vital. The cost of cyberattacks is rising; in 2024, global cybersecurity spending hit $214 billion. Data breaches can cause significant financial and reputational damage.

- Acciona must invest in advanced cybersecurity measures.

- Data privacy regulations like GDPR impact Acciona's operations.

- Robust data management ensures operational efficiency.

Technological advancements boost Acciona's efficiency across renewable energy, infrastructure, and water management. Acciona invested €1.5 billion in tech in 2024. By 2025, it targets tech integration in 90% of projects. These efforts boost profitability and sustainability.

| Technology Area | 2024 Investment | 2025 Target/Outlook |

|---|---|---|

| Renewable Energy | €700M | Efficiency gains from solar and wind tech |

| Digital Transformation | €800M | Tech-driven efficiency boost up to 15% |

| Water & Infrastructure | Strategic Implementation | Desalination market at $29.7B |

Legal factors

Acciona faces stringent environmental regulations across its global operations, impacting project design and execution. Compliance with laws on emissions, waste management, and biodiversity is crucial. In 2024, Acciona invested €589 million in environmental protection, demonstrating its commitment. Non-compliance can lead to significant fines and project delays.

Acciona faces intricate planning and permitting laws globally. Navigating these regulations is crucial for project success. Delays in securing permits can significantly affect project timelines and increase expenses. For example, in 2024, permitting issues delayed several renewable energy projects, increasing costs by an estimated 10-15%. Understanding and adhering to these laws is essential.

Acciona heavily relies on contracts like construction and power purchase agreements. The legal strength of these agreements directly impacts project success. Enforceability of contracts is critical for financial stability. In 2024, Acciona's revenue was approximately €16.8 billion, significantly influenced by contract performance.

Labor Laws and Employment Regulations

Acciona faces legal hurdles from labor laws and employment regulations that significantly impact its operations. These laws, covering working hours, wages, and employee rights, affect Acciona's workforce management and associated expenses. Compliance with varying labor regulations across different countries is essential for operational efficiency and legal adherence. For instance, in Spain, labor costs account for a significant portion of operational expenses, potentially impacting profit margins.

- Labor costs in the construction sector in Spain average around 30-40% of total project costs.

- Compliance with EU labor directives adds complexity and cost.

- Failure to comply can result in hefty fines and legal battles.

Taxation Policies

Acciona faces legal and financial impacts from taxation policies across its operating regions. Fluctuations in corporate tax rates directly influence the company's profitability and strategic financial planning. Governments often provide tax incentives for renewable energy projects, which can significantly benefit Acciona's investments. In 2024, Spain's corporate tax rate is 25%, but this can vary.

- Tax incentives can reduce effective tax rates.

- Acciona's tax strategy must align with international tax laws.

- Changes in tax regulations can affect project feasibility.

Acciona navigates environmental laws, investing heavily to comply and avoid penalties. Strict permit laws globally affect project timelines, potentially increasing costs. Robust contract management and adherence to diverse labor regulations are critical.

Tax policies, including incentives, influence profitability; a well-crafted tax strategy aligns with international rules.

| Legal Area | Impact | Example/Data (2024-2025) |

|---|---|---|

| Environmental Regulations | Affects project design, execution | €589M invested in environmental protection in 2024. |

| Planning and Permitting | Impacts timelines, costs | Permitting issues delayed projects, increasing costs by 10-15% in 2024. |

| Contracts | Affect project success, revenue | Approx. €16.8B revenue influenced by contract performance in 2024. |

Environmental factors

Climate change presents significant physical risks to Acciona's assets, including renewable energy facilities and infrastructure, due to extreme weather events. These events, such as floods, storms, and heatwaves, can disrupt operations and damage infrastructure. In 2024, Acciona invested heavily in climate resilience, allocating €150 million to fortify assets. Adapting infrastructure design and operational strategies to mitigate climate impacts is crucial for long-term sustainability.

Water scarcity poses a major environmental threat, directly influencing Acciona's water-related ventures and indirectly affecting its energy production, particularly hydropower. Acciona's water business generated €658 million in revenue in 2023. Sustainable water management is vital, with desalination and water reuse solutions becoming increasingly critical. In 2024, the global desalination market is valued at approximately $20 billion, showing growth potential.

Infrastructure and energy projects can significantly affect local biodiversity and ecosystems. Acciona is committed to reducing its environmental impact. They conduct environmental impact assessments, and use mitigation measures. In 2024, Acciona invested €65 million in environmental protection and biodiversity projects.

Transition to a Low-Carbon Economy

The global move to a low-carbon economy significantly fuels Acciona's renewable energy sector. This shift boosts demand for clean energy and sustainable projects, opening doors for growth. Acciona must innovate and adapt continuously to stay ahead. In 2024, renewable energy investments hit $300 billion worldwide.

- Acciona's revenue from renewables grew by 15% in 2024.

- The company aims to increase its green energy capacity by 50% by 2025.

- Government policies, like the EU's Green Deal, support this transition.

- Acciona is investing heavily in new technologies, like green hydrogen.

Waste Management and Circular Economy

Acciona's construction and infrastructure projects are significantly impacted by waste management and the circular economy. The company focuses on minimizing waste, increasing recycling and reuse, and developing waste-to-energy solutions. For instance, in 2024, Acciona reduced waste generation by 15% across its operations. This aligns with the growing regulatory pressure and consumer demand for sustainable practices.

- Acciona aims to increase the use of recycled materials in construction projects by 20% by 2025.

- Waste-to-energy projects generated 100 GWh of renewable energy in 2024.

Acciona faces environmental challenges from climate change to water scarcity, which necessitates resilience and sustainable solutions. The company's investment of €150 million in 2024 demonstrates a commitment to climate adaptation. Moreover, their water business brought in €658 million in revenue in 2023, highlighting the significance of sustainable water management.

Acciona actively works to lessen the environmental impact of its projects, investing €65 million in 2024 for environmental protection. Also, the rise in renewable energy sector revenue by 15% in 2024. Government policies support sustainability through renewable sources.

Waste management and the circular economy also play key roles in the company's construction and infrastructure projects. Acciona decreased its waste by 15% in 2024, which is vital given the rise in customer demand for eco-friendly processes. The company aims to boost recycled materials use in building projects by 20% by 2025.

| Environmental Factor | Impact | 2024/2025 Data |

|---|---|---|

| Climate Change | Asset damage/operation disruption | €150M invested in climate resilience (2024) |

| Water Scarcity | Threats to water/energy projects | Water business revenue €658M (2023); $20B desalination market value |

| Biodiversity | Ecosystem Impact | €65M invested in environment protection (2024) |

| Low-Carbon Economy | Growth for renewables | Renewables revenue +15% (2024); $300B renewable energy investments |

| Waste Management | Construction/Infrastructure Impacts | Waste reduction 15% (2024); aim to use 20% recycled materials by 2025 |

PESTLE Analysis Data Sources

This analysis utilizes public data from energy agencies, financial reports, and sustainability assessments.