ACCO Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACCO Brands Bundle

What is included in the product

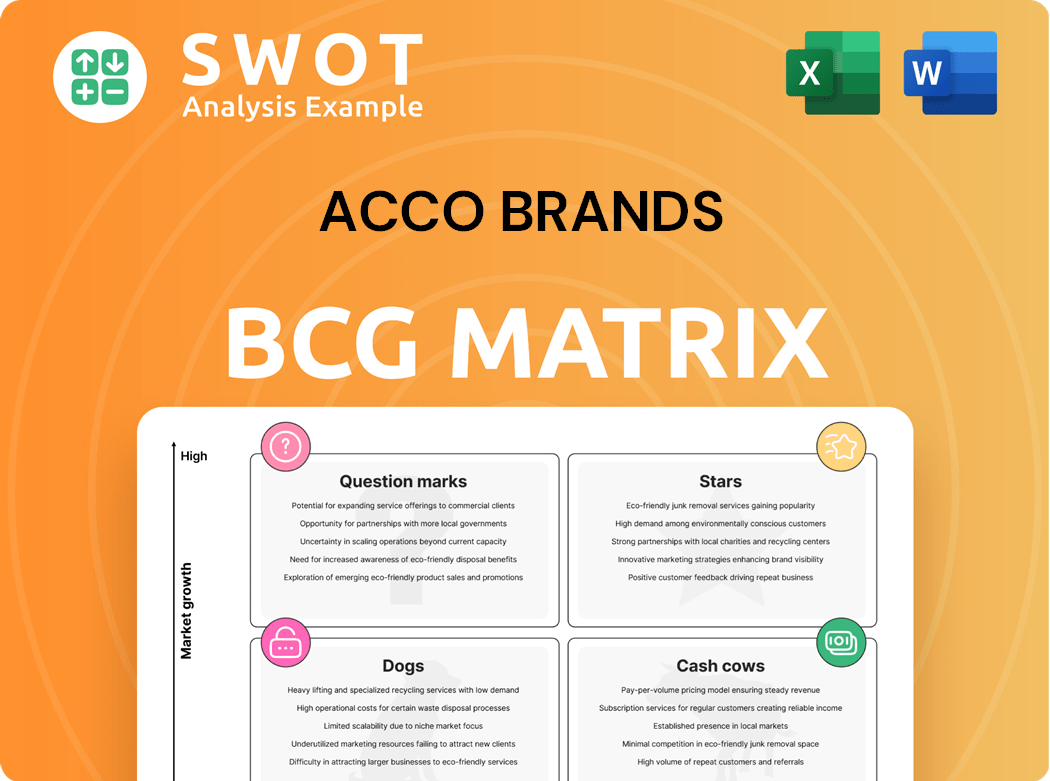

ACCO Brands' BCG Matrix analysis guides resource allocation across its portfolio.

Easily share the ACCO Brands BCG Matrix as a visual, helping strategic decision-making.

Full Transparency, Always

ACCO Brands BCG Matrix

The BCG Matrix preview showcases the complete document you receive post-purchase. Instantly downloadable, the final report offers ACCO Brands-specific insights for strategic decision-making.

BCG Matrix Template

ACCO Brands, a titan in office and school supplies, faces dynamic market challenges. This snippet reveals a glimpse of their product portfolio's potential within the BCG Matrix. Understand where brands like Swingline or Kensington truly fit: Stars, Cash Cows, or Dogs? This knowledge is vital for strategic planning. The sneak peek gives you a taste, but the full BCG Matrix delivers deep, data-rich analysis, strategic recommendations, and ready-to-present formats—all crafted for business impact.

Stars

ACCO Brands' technology accessories, including gaming products, are a growing "star" in its portfolio. This segment benefits from new product launches and international expansion. In 2024, the accessories segment showed strong growth, with a 7% increase in sales. Further investment could lead to increased market share and overall company growth.

ACCO Brands views ergonomic products as a growth opportunity, seeing initial success in this area. Demand for comfortable workspaces is rising, especially with remote work. Investing in innovation and marketing could position ACCO Brands as a leader. In 2024, the global ergonomic furniture market was valued at $56.4 billion.

Swingline, a century-old brand, is a Star in ACCO Brands' BCG Matrix. Its strong brand recognition and quality reputation support sustained growth. ACCO's 2024 revenue was approximately $2.15 billion. Investing in Swingline's innovation and sustainability can boost its market share.

International Expansion

ACCO Brands shines internationally, especially in Japan, boosted by fresh products and alliances. Expanding geographically and adapting offerings locally fuels growth. Focus on marketing and distribution in new markets boosts expansion. In 2024, ACCO's international sales were a key driver.

- Japan success: new products and partnerships.

- Geographic expansion: key for future growth.

- Marketing investment: accelerates expansion.

- 2024: international sales were a key driver.

Cost Reduction Program

ACCO Brands' cost reduction program, a "Star" in its BCG Matrix, yielded substantial savings in 2024. These savings, approximately $50 million, are being reinvested in growth areas. Streamlining operations and enhancing productivity are key. This boosts profitability and strengthens the company.

- $50 million in savings achieved in 2024.

- Reinvestment in growth initiatives.

- Focus on operational efficiency.

ACCO Brands' Stars include Swingline, tech accessories, and cost reduction, all demonstrating strong growth. International expansion, particularly in Japan, has proven beneficial, driving revenue. The company's cost savings program has boosted profitability and growth initiatives.

| Star Segment | Key Driver | 2024 Impact |

|---|---|---|

| Swingline | Brand recognition | Sustained growth |

| Tech Accessories | New product launches | 7% sales increase |

| Cost Reduction | Operational Efficiency | $50M savings |

Cash Cows

AT-A-GLANCE, under ACCO Brands, is a cash cow. The brand boasts high recognition and a loyal customer base in a mature market. ACCO Brands' revenue was about $2.2 billion in 2024. To maintain market share, focus on efficient production, targeted marketing, and digital planning integration.

Five Star School Supplies, a flagship brand under ACCO Brands, exemplifies a Cash Cow within the BCG Matrix. The brand holds a significant market share in the school supplies sector, a market that, while not rapidly expanding, offers consistent demand. ACCO Brands should focus on sustaining Five Star's established brand image, ensuring product quality and competitive pricing. In 2024, the school supplies market saw approximately $12 billion in sales, with Five Star maintaining a strong position.

Mead, a staple in paper products, is a cash cow for ACCO Brands. Its notebooks and stationery enjoy wide distribution and affordability. ACCO should optimize supply chains. In 2024, the paper products segment contributed significantly to ACCO's revenue.

Business Essentials

ACCO Brands, within the BCG matrix, is a "Cash Cow" due to its consistent revenue from essential office products. Despite shifts in demand, segments like filing solutions remain profitable. In 2024, ACCO Brands reported a net sales decrease of 1.6% compared to the previous year, yet its strong position in key markets supports its cash-generating status. The focus should be on optimizing operations and product offerings to maintain profitability.

- 2024 Net Sales Decrease: 1.6%

- Focus: Streamlining operations and product offerings

- Key Segment: Filing and storage solutions

- Market Position: Strong in key markets

Kensington Computer Accessories (Core Products)

Kensington, a key part of ACCO Brands, excels in computer accessories like security locks and docking stations. These products generate consistent revenue despite tech market changes. In 2024, ACCO Brands reported strong sales in its core business segments, showing Kensington's stable contribution. Innovation and partnerships are key for Kensington to stay competitive.

- Kensington's security locks are a market leader, with a significant share in corporate and educational sectors.

- Docking stations continue to be essential for modern workplaces, driving steady demand.

- ACCO Brands invests in product development, with a focus on user experience and design.

- Strategic alliances with tech companies help Kensington integrate new technologies.

ACCO Brands' "Cash Cows" like AT-A-GLANCE and Five Star generate stable revenue in mature markets. These brands focus on efficiency and maintaining strong market positions. In 2024, ACCO's filing solutions remained profitable, supporting its cash-generating status, despite a 1.6% net sales decrease.

| Brand | Segment | Focus |

|---|---|---|

| AT-A-GLANCE | Office products | Efficient production, targeted marketing |

| Five Star | School supplies | Brand image, quality, pricing |

| Mead | Paper products | Supply chain optimization |

Dogs

Traditional office supplies, like staplers, are Dogs in ACCO Brands' portfolio due to digital shifts. These products show low growth and market share. In 2024, the office supplies market saw a continued decline, with sales down 5% year-over-year. ACCO should consider exiting these declining segments.

ACCO Brands has strategically exited lower-margin businesses in North America. These moves aim to enhance profitability by discontinuing product lines with low growth. For example, in 2024, ACCO focused on streamlining operations. Eliminating underperforming segments improves efficiency and financial performance. The company's focus is on high-growth areas.

ACCO Brands confronts fierce private label competition in some segments, especially in the U.S. This can lead to a decline in market share and price cuts for these products. For example, in 2024, private label brands captured about 20% of the office supplies market. ACCO needs to assess the profitability of these lines and strategize differentiation. This could involve innovation, branding, or partnerships.

Products with Weak Back-to-School Performance

Weak back-to-school performance in the Americas for ACCO Brands indicates potential issues. These products might struggle to grow, demanding substantial investment. ACCO should consider shifting resources to more promising areas.

- ACCO Brands' Americas segment saw back-to-school sales declines in specific categories during 2024.

- These underperforming products could have limited growth potential moving forward.

- Significant investment would be needed to boost these products' performance.

- Reallocating resources to higher-growth categories may be a strategic move.

Lower-Growth Regions (Specific Products)

Specific products in regions like Brazil saw demand softening, affecting sales. These items might struggle against local rivals or shifting consumer tastes. ACCO Brands needs detailed market research to find out why and rethink its product lines or distribution.

- ACCO Brands' Q3 2023 sales in Latin America decreased by 1.8%.

- Brazil's GDP growth in 2023 was around 2.9%.

- ACCO's gross margin decreased by 230 basis points in Q3 2023.

- Competition in the Brazilian office supplies market is intense, with both local and international players.

Dogs in ACCO Brands' BCG Matrix include traditional office supplies. These face low growth and market share, as digital alternatives rise. In 2024, the office supplies market continued to shrink, declining by 5% year-over-year. ACCO should consider exiting or restructuring these underperforming segments.

| Category | Market Share | Growth Rate (2024) |

|---|---|---|

| Office Supplies | Low | -5% |

| Private Label | 20% | Variable |

| Back-to-School | Variable | Declining in Americas |

Question Marks

ACCO Brands is venturing into sustainable computer products, aiming for the eco-conscious market. This segment is ripe for growth, mirroring the global push for sustainability. ACCO can capitalize on this by investing in R&D, as the green tech market is expected to reach $1.1 trillion by 2024. Strategic partnerships will be key.

ACCO Brands has found success in gaming partnerships, fueled by new product introductions and international expansion. The company could face challenges from industry changes, but this area still has growth potential. Investing in gaming products and expanding partnerships can help ACCO capitalize on the growing gaming market. For example, in 2024, the global gaming market was valued at approximately $200 billion.

ACCO Brands could broaden its reach by entering adjacent categories like art supplies. This expansion diversifies their offerings and targets fresh markets. Although initial investment is needed, growth potential is significant, possibly boosting market share. Market research and innovative products are key to success. In 2024, the global art supplies market was valued at approximately $6.7 billion.

New Distribution Channels

ACCO Brands is actively pursuing new distribution channels to broaden its market reach. This strategic move involves significant investment in partnerships and infrastructure. The goal is to boost sales and capture a larger market share. Exploring online platforms, specialty stores, and direct-to-consumer options is key.

- In 2024, ACCO Brands reported net sales of $1.8 billion.

- The company aims to leverage digital channels, which accounted for over 20% of sales in 2024.

- Strategic partnerships are crucial; ACCO has expanded distribution through collaborations with major retailers.

- Direct-to-consumer initiatives include enhanced e-commerce platforms.

Learning and Creative Product Categories

ACCO Brands is strategically focusing on learning and creative product categories, aiming for growth. This move aligns with the rising demand for educational and artistic tools. The company can fortify its market position by investing in product innovation, marketing, and strategic partnerships.

- ACCO Brands' revenue in 2023 was approximately $2.1 billion.

- The global education market is projected to reach $7.3 trillion by 2028.

- Creative market growth, particularly in art supplies, is experiencing a surge.

- Strategic partnerships can expand market reach.

Question Marks represent high-growth, low-share business units. ACCO needs to decide whether to invest or divest these. Examples include new product categories or markets. Success hinges on identifying and capitalizing on growth opportunities, while also carefully managing risks.

| Category | Characteristics | ACCO's Strategy |

|---|---|---|

| Examples | New markets, new products | Assess potential, invest strategically |

| Market Growth | High | Focus on growth and market share |

| Risk | High | Manage risks, explore partnerships |

BCG Matrix Data Sources

The ACCO Brands BCG Matrix leverages financial statements, industry reports, and market research data. It combines growth forecasts with expert opinions for precision.