ACS Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACS Solutions Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Clean, distraction-free view optimized for C-level presentation to improve strategic decision making.

Delivered as Shown

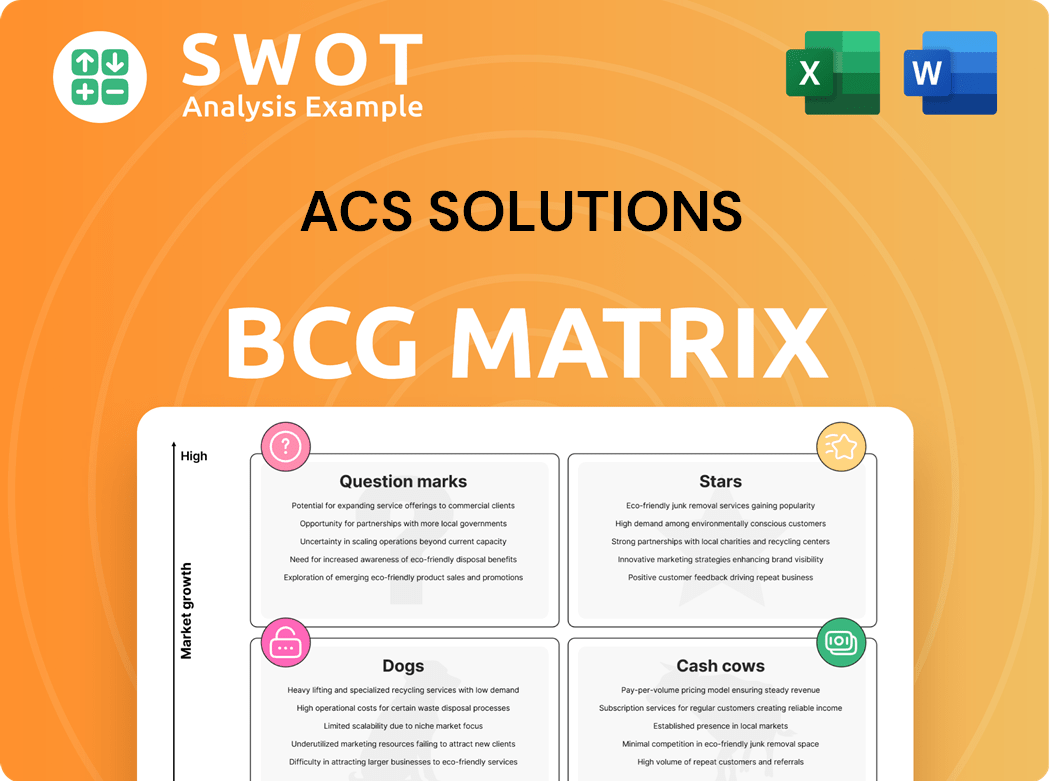

ACS Solutions BCG Matrix

The BCG Matrix you're viewing is the same one you'll download after purchase. This report, ready for strategic planning, offers clear insights. Edit, share, and utilize the full document immediately.

BCG Matrix Template

ACS Solutions' BCG Matrix offers a snapshot of its product portfolio. See how its offerings fare in the market: Stars, Cash Cows, Dogs, or Question Marks. This glimpse barely scratches the surface of strategic insights.

Discover where ACS Solutions thrives and where improvements are needed. The full BCG Matrix provides a complete breakdown, with detailed quadrant placements.

Uncover data-backed recommendations and a roadmap to smarter investment choices. Purchase the full report for comprehensive analysis and a competitive edge.

Stars

ACS Solutions' secure cloud services, especially for healthcare and government, are likely a Star in the BCG Matrix. In 2024, the cloud computing market grew, with secure cloud solutions experiencing high demand. For example, the global cloud computing market was valued at $670.8 billion in 2024. This indicates strong growth potential and market share.

Data Analytics Solutions likely represent a Star in ACS Solutions' BCG Matrix due to the burgeoning data analytics market. In 2024, the global data analytics market reached approximately $274.3 billion, showcasing substantial growth. Given ACS's specialization, these solutions likely command a significant market share within their focus industries, fueling further expansion.

Cybersecurity services fit the "Stars" quadrant due to high market growth and ACS Solutions' strong position. The global cybersecurity market is projected to reach $345.7 billion in 2024, showing substantial expansion. ACS Solutions' focus on critical infrastructure cybersecurity aligns with this growth, offering specialized solutions. Their investments in this area reflect a commitment to capitalizing on market opportunities.

Digital Transformation Initiatives

ACS Solutions' digital transformation initiatives, particularly those centered on AI-driven automation and cloud migration, are positioned as Stars. This is supported by the substantial market growth in digital transformation, with a projected global market size of $767.8 billion in 2024. The company's focus on cutting-edge technologies aligns with the increasing demand for digital solutions across various industries. These services could generate significant revenue and market share gains for ACS Solutions.

- 2024 Digital Transformation market size is $767.8 billion.

- AI-driven automation and cloud migration are key growth areas.

- ACS Solutions' initiatives match market demand.

- Potential for significant revenue growth.

Government Sector IT Solutions

Government sector IT solutions, particularly those for secure data management and citizen services, fit the "Star" category in the BCG Matrix. This is due to consistent demand and growing investment. The U.S. government IT spending in 2024 is projected to reach $108.6 billion. This signifies a significant market.

- High Growth: Continuous expansion in government tech needs.

- Market Leadership: ACS Solutions can potentially lead in this area.

- Major Investments: Significant capital inflows are present.

- Strong Demand: Consistent need for secure, efficient services.

ACS Solutions' cloud, data analytics, cybersecurity, digital transformation, and government IT services are "Stars" in the BCG Matrix. These segments benefit from high market growth and strong potential for ACS Solutions. Their focus on these expanding sectors positions them for substantial revenue and market share growth.

| Service Area | 2024 Market Size (approx.) | Growth Driver |

|---|---|---|

| Cloud Computing | $670.8 billion | Security Needs |

| Data Analytics | $274.3 billion | Data-Driven Insights |

| Cybersecurity | $345.7 billion | Threat Landscape |

| Digital Transformation | $767.8 billion | Automation |

| Government IT | $108.6 billion (US) | Secure Data |

Cash Cows

ACS Solutions likely generates substantial revenue from legacy IT infrastructure management. This includes maintaining older systems for clients not yet fully transformed. In 2024, many firms still rely on these services. For instance, Gartner projected global IT spending to reach $5.06 trillion in 2024, with a portion allocated to legacy systems. This segment provides a stable, if not rapidly growing, revenue stream.

ACS Solutions' healthcare solutions, including EHR and clinical data analytics, are likely cash cows. These established offerings generate steady revenue with modest growth. In 2024, the EHR market reached $33.1 billion, showing stable growth. ACS's focus on this area ensures consistent cash flow.

Finance sector IT support, like basic maintenance, is a potential cash cow. These services generate steady revenue with minimal investment. In 2024, the IT services market in finance was valued at approximately $180 billion. This sector's stability stems from the ongoing need for secure, compliant IT solutions. This makes it a reliable, low-risk revenue stream.

Traditional Business Solutions

ACS Solutions' traditional business solutions, like ERP and CRM, offer reliable cash flow. These solutions, while stable, often show slower growth compared to innovative services. The 2024 market for ERP systems is valued at approximately $50 billion, reflecting steady demand. CRM tools also contribute significantly, with a global market exceeding $80 billion.

- ERP and CRM solutions provide stable, though not explosive, revenue streams.

- The growth rate for these traditional solutions hovers around 5-7% annually.

- They form a crucial part of ACS's revenue base, ensuring financial stability.

- These solutions are essential for many businesses.

Long-Term Government Contracts

Long-term IT contracts with government agencies serve as cash cows for ACS Solutions. These contracts offer a stable, predictable revenue stream, requiring little extra investment. In 2024, government IT spending is projected to reach $120 billion. ACS Solutions, with its established contracts, can capitalize on this. This ensures consistent financial returns.

- Predictable Revenue

- Minimal Investment

- Government IT Spending

- Consistent Returns

ACS Solutions' cash cows deliver stable revenue with moderate growth, critical for financial stability. Legacy IT infrastructure, though not fast-growing, contributes steadily to the company's cash flow. Established healthcare and finance IT support provide consistent returns. Government contracts add to the dependable revenue streams.

| Segment | Revenue Stream | 2024 Market Size (approx.) |

|---|---|---|

| Legacy IT | Maintenance services | $5.06 trillion (global IT spending) |

| Healthcare Solutions | EHR, data analytics | $33.1 billion (EHR market) |

| Finance IT Support | IT services | $180 billion (IT services in finance) |

Dogs

Outdated technologies at ACS Solutions, with minimal market demand, are categorized as Dogs in the BCG Matrix. For instance, if ACS still supports older systems like Windows Server 2008, which had only 0.4% market share in 2024, it fits this profile. The cost of maintaining these can be significant, potentially reducing profits. ACS needs to evaluate the discontinuation of these services.

Dogs represent offerings with low market share and growth. For ACS Solutions, this could include outdated software or niche services. Such ventures often require significant investment with limited returns. Data from 2024 suggests that unsuccessful products can drain up to 15% of a company's resources. These ventures should be carefully considered for divestiture.

Dogs represent services in niche markets with dwindling demand. For instance, the pet grooming market saw a 4.8% revenue decline in 2023. This decline reflects shifts in consumer preferences and technological advancements. Addressing these challenges requires strategic pivots or exits.

Low-Margin, High-Effort Projects

Low-margin, high-effort projects in the ACS Solutions BCG Matrix represent ventures demanding substantial resources yet yielding slim profits. These projects often struggle due to fierce competition or shifting market landscapes. For instance, a 2024 analysis showed that companies in highly competitive sectors like retail often face tight margins, with some reporting profit margins as low as 2-3%. Such projects can be a significant drain on resources, potentially hindering overall profitability.

- High resource consumption.

- Low profit margins.

- Intense market competition.

- Potential for losses.

Uncompetitive Service Offerings

Uncompetitive service offerings within ACS Solutions’ portfolio can lead to low market share and minimal growth. This occurs when services lag behind competitors in features, pricing, or technology. For example, in 2024, companies with outdated tech saw a 15% drop in market share.

- Outdated technology services struggle against modern solutions.

- Poor pricing strategies drive customers to cheaper alternatives.

- Lack of innovation results in fewer new customers.

Dogs in the BCG Matrix for ACS Solutions signify low market share and growth offerings, like outdated services.

These ventures, consuming resources with minimal returns, demand critical evaluation. In 2024, 15% of resources were drained by unsuccessful products.

ACS must consider divestiture or strategic pivots for these underperforming areas.

| Category | Characteristic | Impact |

|---|---|---|

| Outdated Tech | Low Market Share | Resource Drain |

| Niche Services | Dwindling Demand | Strategic Pivot |

| Low Margin Projects | High Effort, Slim Profit | Potential Losses |

Question Marks

AI-driven healthcare solutions like AI Doctor Assistant and AI Healthcare Manager are Question Marks. These require substantial investment to capture market share. The global AI in healthcare market was valued at $12.9 billion in 2023. It’s projected to reach $194.4 billion by 2032, growing at a CAGR of 34.9% from 2024 to 2032.

Blockchain applications, especially in emerging areas like supply chain, are question marks. These solutions, though promising, face uncertainty regarding market acceptance and profitability. In 2024, blockchain market size was valued at $21.09 billion. The growth is expected to reach $94.05 billion by 2029. This category requires significant investment and strategic evaluation.

ACS Solutions' smart city ventures, leveraging data analytics for urban planning and resource management, fit the "Question Marks" quadrant in a BCG matrix. This is due to high growth potential, yet uncertain market share. In 2024, the smart city market is projected to reach $861 billion globally. However, ACS's specific share remains to be seen, indicating its position in this segment.

IoT Security Solutions

ACS Solutions' IoT security solutions are a question mark in the BCG matrix, given the evolving IoT landscape and the critical need for robust security. This segment demands strategic investment to capitalize on market growth. The global IoT security market was valued at $12.6 billion in 2023 and is projected to reach $38.1 billion by 2028.

- High growth potential exists due to increasing IoT device adoption.

- Significant investment is needed to develop and market effective security solutions.

- Market share is not yet established, requiring aggressive strategies.

- The success of ACS Solutions in this area will depend on innovation and market positioning.

Emerging Green Technology Solutions

Emerging green technology solutions, such as smart grid data analytics, would be classified as a question mark in the BCG matrix. These offerings have high growth potential but uncertain market adoption. This is common for new services in evolving sectors like renewable energy infrastructure. The financial viability and consumer acceptance of these technologies are still developing.

- Market growth in green technologies is projected to be significant, with the global renewable energy market valued at $881.1 billion in 2023.

- Uncertainty exists due to fluctuating government policies and technological advancements.

- Successful question marks can become stars, driving future growth for ACS Solutions.

- Investments need careful evaluation, focusing on market research and pilot programs.

AI-driven healthcare solutions are Question Marks, needing investment to gain market share. The AI in healthcare market was $12.9B in 2023, projected to hit $194.4B by 2032. Blockchain applications, like supply chain solutions, are also Question Marks.

| Category | Market Value (2024) | Growth Rate (CAGR) |

|---|---|---|

| AI in Healthcare | $19.2B (Projected) | 34.9% (2024-2032) |

| Blockchain | $21.09B | - |

| Smart City | $861B (Projected) | - |

| IoT Security | $15.3B (Projected) | - |

BCG Matrix Data Sources

The ACS Solutions BCG Matrix leverages data from company financials, market analyses, and competitive landscapes to inform its strategic classifications.