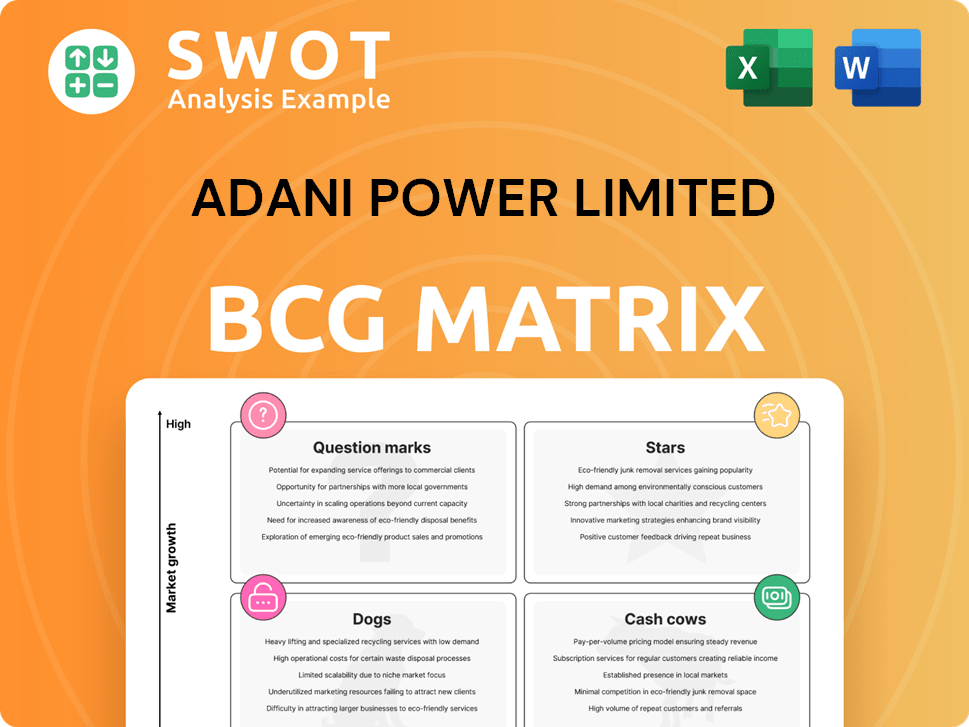

Adani Power Limited Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adani Power Limited Bundle

What is included in the product

The Adani Power BCG Matrix analyzes its power plants and projects. It suggests investment, holding, or divestment strategies.

Printable summary optimized for A4 and mobile PDFs, offering a quick visual analysis of Adani Power's portfolio.

Full Transparency, Always

Adani Power Limited BCG Matrix

The BCG Matrix preview showcases the identical Adani Power Limited analysis you'll obtain upon purchase. This report is a complete, ready-to-use document, offering strategic insights and actionable data for informed decision-making.

BCG Matrix Template

Adani Power Limited's BCG Matrix offers a snapshot of its diverse energy portfolio. Early analysis suggests a mix of growth opportunities and potential challenges within its various power generation assets. Understanding the placement of each business unit is vital for strategic investment. This simplified view only scratches the surface of the competitive landscape. Uncover detailed quadrant placements, strategic recommendations, and data-backed insights for Adani Power.

Stars

Adani Power is India's largest private thermal power producer, with a capacity of 13.61 GW in FY24. They plan to expand their thermal capacity to 30.67 GW by FY31. This expansion strategy aims to boost their market share significantly. In FY24, Adani Power's revenue was ₹42,864 crore.

Adani Power is significantly boosting its thermal power capacity. It aims to reach 30.67 GW by FY31, a substantial increase from its 17.55 GW. This growth strategy includes expanding existing facilities and acquiring distressed power assets. Secured financing and land acquisitions are backing these expansion plans. This reinforces the company's commitment to long-term growth.

Adani Power showcases strong financials. In FY24, revenue grew 29.9% YoY, and EBITDA soared 81%. This robust performance fuels expansion plans and lowers short-term funding reliance.

Strategic Acquisitions

Adani Power's strategic acquisitions are a cornerstone of its growth strategy, particularly in the BCG Matrix as a "Star." These acquisitions of stressed assets, often at favorable valuations, have been pivotal. They've allowed Adani Power to expand its operational capacity, significantly boosting its market share. The firm's ability to revitalize these acquired power plants solidifies its leadership in the power sector.

- Acquired assets at attractive valuations.

- Enhanced operational capacity.

- Improved financial metrics.

- Turnaround expertise.

Favorable Regulatory Environment

Adani Power has thrived due to a supportive regulatory landscape. The company successfully resolved domestic coal shortfall issues. This allowed for the recovery of alternative fuel costs via Power Purchase Agreements (PPAs), strengthening its finances. This stability supports Adani Power's growth and profitability.

- Full resolution of regulatory matters related to domestic coal shortfall.

- Ability to recover alternate fuel costs under PPAs.

- Conducive environment for operational expansion.

- Enhanced financial stability and profitability.

Adani Power's "Star" status is evident in its aggressive capacity expansion, targeting 30.67 GW by FY31. Acquisitions of stressed assets at favorable terms have fueled growth, boosting market share and operational capacity. The company's FY24 revenue of ₹42,864 crore and 29.9% YoY growth highlight its financial prowess.

| Aspect | Details |

|---|---|

| Expansion | Targeting 30.67 GW by FY31 |

| Revenue (FY24) | ₹42,864 crore |

| YoY Revenue Growth (FY24) | 29.9% |

Cash Cows

Adani Power's established thermal plants, including Mundra and Tiroda, are cash cows due to their PPAs and efficient operations. These plants generate consistent revenue, supporting the company's financial stability. In FY24, Adani Power's consolidated revenue reached ₹42,864 crore. Improving the PLF boosts profitability, as seen with increased power sales.

Adani Power's long-term Power Purchase Agreements (PPAs) are a cornerstone of its "Cash Cows" status. These PPAs with state boards and industrial clients ensure predictable revenue. Securing these agreements for plants guarantees a steady cash flow. In fiscal year 2024, Adani Power reported ₹40,949 crore in revenue, largely from these stable contracts.

Adani Power's specialized O&M teams ensure efficient plant operations. Their expertise helps keep costs down. The company's turnaround skills boost efficiency. These efforts maximize cash flow. For example, in FY24, Adani Power's plant availability factor was over 85%.

Coal Sourcing Advantage

Adani Power's strength lies in its coal sourcing, leveraging the Adani Group's global presence in coal mining. This strategic advantage reduces the risk of raw material shortages, ensuring a steady fuel supply. The robust coal linkages contribute to the profitability of its thermal power plants. Consequently, this solidifies its position as a 'Cash Cow' within the BCG matrix.

- Adani Power's coal imports in FY24 were approximately 40 million metric tonnes.

- The company has long-term coal supply agreements.

- This sourcing strategy helps in cost management.

- Adani Group's global presence enhances its bargaining power.

Resolution of Regulatory Dues

Adani Power's resolution of regulatory dues is a cash cow, significantly boosting its financial health. This resolution, coupled with healthy cash inflows, enhances revenue visibility. The company's ability to invest in new projects is bolstered by this financial stability. In 2024, Adani Power saw a substantial increase in cash flow due to these resolutions.

- Full recovery of dues improved cash flow.

- Past regulatory matters resolution increased revenue.

- Financial stability allows for new investments.

- Cash flow improved in 2024.

Adani Power's established thermal plants are cash cows due to PPAs and efficient operations, generating consistent revenue. Long-term Power Purchase Agreements (PPAs) ensure predictable revenue and stable cash flow. In FY24, Adani Power's consolidated revenue reached ₹42,864 crore, solidifying its financial stability.

| Feature | Details |

|---|---|

| Revenue FY24 | ₹42,864 crore |

| Coal Imports FY24 | Approx. 40 MMT |

| Plant Availability Factor FY24 | Over 85% |

Dogs

Inefficient or aging plants within Adani Power, like some older units, face challenges. They often have lower plant load factors (PLFs). These plants may struggle with outdated tech and higher costs. Recent reports show Adani Power's average PLF around 60-65% in 2024, with some units potentially below this. Turnaround plans are typically not effective, making divestiture a likely strategy.

Thermal power plants with expired PPAs, like some of Adani Power's, face the "Dogs" classification in a BCG matrix. These plants struggle to secure new long-term contracts, exposing them to merchant market volatility. In 2024, Adani Power's merchant power sales were significantly impacted.

High-cost power generation units at Adani Power are categorized as "Dogs" in the BCG Matrix. These units suffer from low market share and growth, primarily due to factors like outdated technology or expensive fuel. For instance, in 2024, certain older plants may face operational challenges. Their profitability is hampered by high operating expenses, making it difficult to compete.

Environmentally Problematic Plants

Environmentally problematic plants within Adani Power Limited's portfolio fall into the "Dogs" quadrant of the BCG matrix. These plants grapple with environmental compliance issues, potentially leading to operational shutdowns and financial burdens. Such plants often require costly upgrades to meet regulatory standards, posing a risk to their long-term viability. These factors position them as assets that should be minimized.

- Compliance challenges lead to operational disruptions.

- Upgrades require substantial investments.

- Risk of closure impacts profitability.

Plants Facing Fuel Supply Issues

Plants facing fuel supply issues fall into the "Dogs" quadrant of the BCG Matrix. These thermal power plants struggle with securing reliable and affordable fuel, impacting their operations. Fuel supply disruptions lead to reduced generation and lower profitability, as seen in 2024 with several plants. Expensive turnaround plans should be avoided.

- Fuel supply disruptions directly hit profitability.

- Turnaround plans often fail to resolve the core issue.

- Focus should be on securing stable fuel sources.

- Plants in this category may struggle financially.

Aging, inefficient plants with low plant load factors (PLFs) are "Dogs." Adani Power's average PLF was ~60-65% in 2024. Expired PPA thermal plants, facing merchant market volatility, are categorized as "Dogs," impacting sales.

High-cost units, due to old tech or expensive fuel, struggle with low market share. Environmentally problematic plants also fall into this category. Fuel supply issues cause generation cuts.

| Category | Issue | Impact |

|---|---|---|

| Inefficient Plants | Low PLF | Lower profitability |

| Expired PPAs | Merchant market | Sales volatility |

| High-Cost Units | Outdated tech | Low market share |

Question Marks

Adani Power's ultra-supercritical tech adoption is a Question Mark in its BCG matrix. This tech boosts efficiency, but the high initial costs and tech risks are a concern. In 2024, Adani's power generation capacity is around 15,250 MW. Investing heavily could boost market share, or a sale might be considered.

Adani Power's 10 GW overseas hydroelectric projects are Question Marks in its BCG matrix. These projects face political, regulatory, and financial risks, like potential delays and cost overruns. The company needs to quickly increase market share or consider divestment. In 2024, Adani's renewable energy portfolio saw significant investment, but international projects pose unique challenges.

Adani Power's ventures into solar and wind projects fit the "Question Marks" quadrant. These ventures show growth potential but face tough competition. In 2024, the renewable energy sector saw investments surge, but Adani Power's market share is still developing. High investment needs and uncertain returns define this stage; strategic decisions are key. Consider that in 2024, the renewable energy sector's growth was approximately 20%.

Merchant Power Capacity

Adani Power's merchant power capacity, not bound by long-term Power Purchase Agreements (PPAs), is categorized as a Question Mark in the BCG matrix. This capacity has the potential to capitalize on peak demand scenarios, but it is vulnerable to the fluctuations in merchant power prices. The marketing strategy targets market adoption of these offerings, requiring strategic decisions.

- Merchant power prices are highly volatile, influenced by factors like fuel costs and demand.

- In 2024, Adani Power's merchant capacity faced price volatility, impacting profitability.

- Adani Power must decide whether to invest in expanding this capacity or divest.

- Investment could lead to higher market share, while selling reduces risk.

Expansion into Nuclear Energy

Adani Power's ambitious nuclear energy expansion, aiming for 30 GW of capacity, squarely positions this initiative as a Question Mark in its BCG matrix. This strategic move demands substantial capital investment and faces intricate technological and regulatory challenges. The nuclear sector, while representing a growing market, requires Adani Power to rapidly gain market share to avoid becoming a Dog. Success hinges on navigating complex project execution and securing necessary approvals.

- High capital expenditure is needed for nuclear projects.

- Technological complexities are substantial in nuclear energy.

- Regulatory hurdles can significantly delay project timelines.

- The market share needs to grow fast in the nuclear sector.

Adani Power’s ultra-supercritical tech is a Question Mark, due to high costs and tech risks; its 15,250 MW capacity needs strategic decisions. Overseas hydroelectric projects, also Question Marks, face political and financial risks; rapid market share growth is critical. Investments in solar and wind fit this category, too, with surging sector growth (20% in 2024), requiring strategic choices. Merchant power capacity’s volatility and Adani’s nuclear energy expansion, both Question Marks, demand quick market share gains, needing massive investment.

| Aspect | Challenge | Decision |

|---|---|---|

| Ultra-Supercritical Tech | High initial costs, tech risks | Invest/Divest |

| Overseas Hydro Projects | Political, financial risks | Increase market share/Divest |

| Solar/Wind Ventures | Competition, investment needs | Strategic investment |

| Merchant Power | Price volatility | Expand/Divest |

| Nuclear Expansion | High capital, regulations | Rapid market share growth |

BCG Matrix Data Sources

Adani Power's BCG Matrix utilizes annual reports, market data, financial statements, and industry research for data-driven strategic assessments.