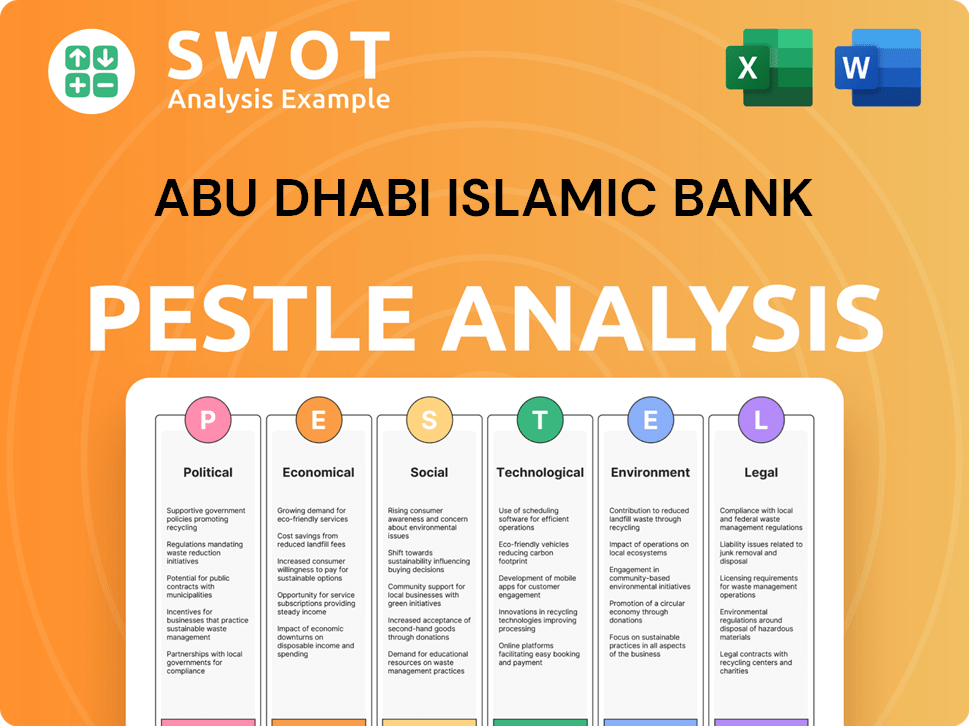

Abu Dhabi Islamic Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Abu Dhabi Islamic Bank Bundle

What is included in the product

Examines how external macro-factors impact Abu Dhabi Islamic Bank's Political, Economic, Social, Tech, Env., and Legal aspects.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

Abu Dhabi Islamic Bank PESTLE Analysis

What you're previewing here is the actual Abu Dhabi Islamic Bank PESTLE Analysis document—fully formatted and ready to download. You'll receive the complete analysis with sections covering Political, Economic, Social, Technological, Legal, and Environmental factors. The document includes in-depth insights. No surprises!

PESTLE Analysis Template

Explore Abu Dhabi Islamic Bank through a detailed PESTLE lens. Uncover crucial external factors shaping its financial strategies. Analyze political shifts, economic trends, and societal impacts. Learn how technology and legal changes are influencing operations. Identify environmental considerations affecting its sustainability efforts. Gain a complete market view by accessing the full PESTLE analysis and make smarter, informed decisions.

Political factors

The UAE government strongly backs Islamic finance, benefiting Abu Dhabi Islamic Bank (ADIB). This includes favorable regulations and initiatives. Government support promotes Islamic finance both locally and globally. ADIB's expansion is aided by this backing. In 2024, Islamic banking assets in the UAE reached $240 billion, a 10% increase from 2023, reflecting strong government support.

Political stability in the UAE is paramount for ADIB. The UAE's stable government minimizes sovereign risk, fostering a predictable environment. This attracts investment, boosting ADIB's operations and expansion, reflecting the nation's strong economic outlook. In 2024, the UAE's GDP growth is projected at 4%, underlining its robust financial stability.

Regional geopolitical instability presents a risk for ADIB. The UAE's economic activity and investor confidence could be affected. Market volatility, driven by these tensions, may influence ADIB's financial performance. For instance, in 2024, the Middle East saw a 3.2% decrease in FDI due to regional conflicts, which could impact ADIB's operations. ADIB must be prepared to handle these uncertainties.

Government Initiatives for Economic Diversification

The UAE government's drive for economic diversification presents significant opportunities for Abu Dhabi Islamic Bank (ADIB). This shift away from oil-dependency fuels growth in sectors like technology, tourism, and renewable energy, creating demand for Sharia-compliant financial solutions. ADIB is well-positioned to capitalize on these trends by expanding its product offerings and customer base. The UAE's non-oil sector grew by 5.9% in 2023, highlighting the diversification's impact.

- Non-oil GDP growth in the UAE reached 5.9% in 2023.

- ADIB's net profit for Q1 2024 was AED 661 million, a 15% increase.

Regulatory Environment and Policy Changes

Changes in banking regulations and government policies directly impact Abu Dhabi Islamic Bank (ADIB). The Central Bank of the UAE (CBUAE) regularly updates regulations on capital adequacy, liquidity, and governance. ADIB must comply with these evolving rules. Failure to adapt could lead to penalties or operational restrictions.

- CBUAE mandates a minimum Capital Adequacy Ratio (CAR) for banks.

- Consumer protection laws are continually updated.

- ADIB must align with the latest anti-money laundering (AML) and counter-terrorist financing (CTF) regulations.

The UAE government's backing and financial regulation greatly influence Abu Dhabi Islamic Bank (ADIB). Stable political environments help ADIB attract investment and fuel business expansion. Regional geopolitical issues create uncertainty for ADIB.

| Factor | Impact | 2024 Data |

|---|---|---|

| Government Support | Favorable regulations | Islamic banking assets: $240B (UAE) |

| Political Stability | Attracts investment | UAE GDP growth: 4% (projected) |

| Geopolitical Instability | Market Volatility | Middle East FDI decrease: 3.2% |

Economic factors

ADIB's fortunes are closely linked to the UAE's economic health. The non-oil sector's growth boosts business and consumer spending. In Q1 2024, the UAE's non-oil GDP grew by 3.9%. This fuels ADIB's profitability and asset expansion.

Changes in interest rates, influenced by the Central Bank of the UAE, impact ADIB's net interest margins. Higher rates can boost financing income, but also affect borrowing demand. ADIB manages assets and liabilities in response. In 2024, the UAE's base rate tracked the US Federal Reserve's, influencing ADIB's financial strategies. The Central Bank of the UAE's key interest rate was at 5.4% as of May 2024.

Despite the UAE's economic diversification efforts, oil prices remain a crucial factor. Oil price volatility directly affects government revenue, impacting spending and investment. For instance, a 10% drop in oil prices could reduce the UAE's GDP growth by 0.5%. ADIB, as a major financial institution, is indirectly exposed to this volatility through lending and investment activities. The bank's profitability is thus linked to the wider economic sentiment influenced by oil prices.

Inflationary Pressures

Inflationary pressures are a key economic factor for Abu Dhabi Islamic Bank (ADIB). Rising inflation can increase ADIB's operational costs, potentially squeezing profit margins. It also affects the purchasing power of ADIB's customers, impacting their ability to repay loans. High inflation rates may lead to decreased consumer spending, which could affect the bank's loan portfolio quality.

- UAE's inflation rate in 2024 is projected to be around 3.5%.

- ADIB's operating expenses increased by 12% in 2023 due to inflationary pressures.

- Consumer spending in the UAE grew by 4.8% in Q1 2024, showing resilience.

Growth in Islamic Finance Industry Assets

The growth in Islamic finance assets globally and regionally is a key economic factor for ADIB. This expansion offers ADIB significant opportunities to increase its market share. As of 2024, the global Islamic finance industry's assets reached approximately $4 trillion. ADIB, as a prominent Islamic bank, can capitalize on this trend.

- Global Islamic finance assets reached ~$4 trillion in 2024.

- ADIB aims to expand its market share within the UAE.

- ADIB is looking to expand internationally.

The UAE's economic health significantly impacts ADIB, with non-oil GDP growing 3.9% in Q1 2024. Interest rates, influenced by the Central Bank, shape ADIB's margins, currently at a base rate of 5.4% in May 2024. Oil price volatility and inflation, projected at 3.5% for 2024, also influence ADIB’s profitability and operational costs, though consumer spending showed resilience with 4.8% growth in Q1 2024.

| Economic Factor | Impact on ADIB | 2024/2025 Data |

|---|---|---|

| Non-Oil GDP Growth | Boosts business & consumer spending | 3.9% (Q1 2024) |

| Interest Rates (CBUAE) | Influences net interest margins | 5.4% base rate (May 2024) |

| Inflation | Affects operational costs & loan repayment | Projected 3.5% (2024) |

Sociological factors

Abu Dhabi Islamic Bank (ADIB) thrives on the rising need for Sharia-compliant financial products. This demand stems from religious convictions and the growing interest in ethical investments. In the UAE, approximately 16% of the population are Muslim. Globally, the Islamic finance sector is projected to reach $4.94 trillion by 2025.

Changing consumer preferences are reshaping banking. Younger, tech-savvy customers drive demand for digital services and personalized experiences. In 2024, digital banking adoption in the UAE reached 80%, highlighting this shift. ADIB must adapt to these evolving expectations to stay competitive, focusing on digital solutions and tailored services. Failing to do so could result in customer churn and reduced market share.

The UAE's population, including Abu Dhabi, has grown significantly, with projections indicating continued expansion, potentially reaching 10 million by 2030. This growth, driven by factors like business-friendly policies, increases ADIB's customer base. ADIB can customize products for diverse demographics. For example, in 2024, the UAE saw a rise in the number of high-net-worth individuals.

Financial Literacy Levels

Financial literacy significantly influences the uptake of financial products. ADIB’s financial education programs aim to boost understanding of Islamic finance, potentially increasing customer engagement. Globally, only 33% of adults are financially literate. Increased financial literacy is linked to better financial decisions. ADIB's initiatives, therefore, are crucial.

- 33% global financial literacy rate.

- ADIB's education programs enhance understanding.

- Financial literacy impacts financial decisions.

Cultural and Religious Values

Abu Dhabi Islamic Bank (ADIB) thrives by adhering to Islamic Sharia principles. This resonates with the cultural and religious values of many customers, especially in its main markets. This faith-based approach builds trust, encouraging people to choose ADIB's services. ADIB's commitment to ethical banking aligns with the preferences of customers seeking Sharia-compliant financial solutions.

- Approximately 90% of UAE residents identify as Muslim, the primary consumers of Sharia-compliant banking.

- ADIB's Sharia-compliant assets have shown consistent growth, reflecting strong customer preference.

ADIB prospers by offering Sharia-compliant financial products, appealing to religious and ethical values. Consumer demand for digital services is growing, with UAE digital banking adoption reaching 80% in 2024. Financial literacy programs by ADIB are vital, as globally, only 33% of adults are financially literate.

| Factor | Impact | 2024 Data/Projections |

|---|---|---|

| Sharia Compliance | Builds Trust | Islamic finance sector expected $4.94T by 2025 |

| Digital Demand | Enhances Competitiveness | 80% UAE digital banking adoption (2024) |

| Financial Literacy | Improves Engagement | 33% global financial literacy |

Technological factors

Rapid advancements in FinTech are reshaping banking. ADIB invests in digital transformation, including AI and automation. In 2024, ADIB's digital banking transactions increased by 25%. This boosts efficiency and customer experience. They are also developing innovative Sharia-compliant products.

Cybersecurity and data protection are paramount for Abu Dhabi Islamic Bank (ADIB) as digital platforms expand. ADIB must invest significantly in cybersecurity. According to a 2024 report, global cybersecurity spending is projected to reach $215 billion. This investment is crucial to protect customer data. Maintaining trust in digital services is essential for ADIB's reputation and financial stability.

Mobile banking and online services are booming due to widespread smartphone and internet use. ADIB is enhancing its digital services, with over 70% of transactions now online. This shift aligns with the UAE's digital drive, where mobile banking users grew by 15% in 2024.

Integration of Emerging Technologies

Abu Dhabi Islamic Bank (ADIB) is actively integrating emerging technologies to improve its services. This includes exploring generative AI and digital assets. ADIB Ventures partners with FinTechs, boosting tech adoption. In 2024, the global FinTech market was valued at $152.7 billion, projected to reach $300 billion by 2025.

- ADIB's tech investments are part of a broader trend.

- FinTech partnerships accelerate innovation.

- Market growth indicates the potential.

- Focus on AI and digital assets is strategic.

Competition from FinTechs and Neobanks

ADIB faces competition from FinTechs and neobanks. These tech-driven firms offer innovative financial solutions, potentially disrupting traditional banking models. ADIB can partner with FinTechs to boost services, but must also compete with their agility. In 2024, FinTech investments in the Middle East and North Africa (MENA) region reached $2.5 billion.

- FinTech investments in MENA reached $2.5B in 2024.

- Neobanks offer digital-first banking, increasing competition.

- Partnerships with FinTechs can enhance ADIB's offerings.

- ADIB must innovate to stay competitive.

ADIB is leveraging FinTech to reshape banking and digital services. The bank saw a 25% increase in digital transactions in 2024, with over 70% of all transactions occurring online. This digital push aligns with a broader trend of growing mobile banking. Cybersecurity investment is key, with the global cybersecurity market reaching $215 billion in 2024.

| Technology Factor | Impact on ADIB | 2024/2025 Data |

|---|---|---|

| FinTech Adoption | Increased Efficiency & Innovation | $2.5B FinTech investments in MENA in 2024 |

| Digital Banking | Enhanced Customer Experience | 70%+ online transactions; 25% digital growth in 2024 |

| Cybersecurity | Data Protection & Trust | Global cybersecurity market reached $215B in 2024 |

Legal factors

Abu Dhabi Islamic Bank (ADIB) is deeply rooted in Sharia compliance. As an Islamic bank, ADIB rigorously follows Sharia principles. This influences all operations and products. The bank has a Sharia Supervisory Committee. In 2024, ADIB's net profit was AED 2.04 billion.

Abu Dhabi Islamic Bank (ADIB) operates under the strict regulations of the Central Bank of the UAE. These regulations govern crucial aspects like capital adequacy, ensuring the bank maintains a strong financial base. In 2024, the UAE’s banking sector saw a 10% increase in regulatory scrutiny. ADIB must adhere to liquidity requirements to manage its cash flow efficiently.

Abu Dhabi Islamic Bank (ADIB) adheres to stringent corporate governance standards, crucial for transparency and ethical operations. These standards, mandated by regulatory bodies, dictate the structure and duties of the board of directors and its committees. In 2024, ADIB reported a strong commitment to governance, reflected in its board's oversight of risk management and compliance, as highlighted in its annual reports. For example, ADIB's 2024 report would showcase the percentage of independent directors on the board, which is usually over 50% as per the best governance practices.

Consumer Protection Laws

Consumer protection laws in the UAE significantly influence ADIB's operations, ensuring fair customer treatment. These laws mandate transparency in product offerings, complaint resolution mechanisms, and data protection protocols. ADIB must comply to avoid penalties and maintain customer trust. In 2024, the UAE saw a 15% increase in consumer complaints against financial institutions.

- Compliance is essential to avoid legal issues and maintain a positive reputation.

- Data protection is crucial, especially with increasing cyber threats.

- ADIB must regularly update its practices to reflect evolving consumer protection standards.

International Regulations and Standards

ADIB's global presence requires adherence to international banking regulations, increasing legal complexities. Compliance with standards from bodies like the Basel Committee is crucial. This involves adapting to diverse regulatory frameworks, impacting operational strategies. In 2024, ADIB's compliance costs rose by 7% due to these international standards. This includes regular audits and reporting to various international financial authorities.

- Basel III implementation continues to shape ADIB's capital requirements.

- The bank must adhere to anti-money laundering (AML) and counter-terrorism financing (CTF) regulations globally.

- Data privacy regulations, such as GDPR (if operating in Europe), are critical.

- Changes in international trade laws can affect ADIB's trade finance activities.

ADIB must rigorously follow UAE laws for Sharia compliance, operational standards, and consumer protection, which shape all bank aspects. The Central Bank of the UAE closely regulates ADIB, governing capital adequacy and liquidity. ADIB adapts to international banking laws, dealing with standards like Basel III and anti-money laundering.

| Legal Aspect | Regulatory Body | Compliance Requirement |

|---|---|---|

| Sharia Compliance | UAE Fatwa Council | Adherence to Islamic finance principles in all operations |

| Capital Adequacy | Central Bank of the UAE | Maintaining sufficient capital levels as per Basel III standards |

| Consumer Protection | UAE Central Bank and Ministry of Economy | Transparency, fair practices, and data protection protocols |

Environmental factors

The global and regional emphasis on sustainable finance and ESG principles is intensifying. ADIB is actively integrating sustainability into its core strategy. In 2024, ADIB issued $750 million in green sukuk. The bank's commitment to sustainable finance is evident in its strategic initiatives.

The UAE has ambitious decarbonization targets, aiming for net-zero emissions by 2050. ADIB is actively aligning with these national goals. In 2024, ADIB allocated $500 million towards green financing. The bank focuses on reducing its carbon footprint. ADIB finances projects supporting a lower-carbon economy.

ADIB is actively integrating environmental risks into its risk management. It assesses the environmental impact of financed projects and integrates ESG factors. In 2024, sustainable finance grew, with green bonds reaching $1.3 trillion globally. ADIB's focus aligns with UAE's Net Zero 2050 strategy.

Growing Demand for Green Products

Growing environmental awareness fuels demand for green financial products. ADIB can offer Sharia-compliant options, capitalizing on this trend. The global green finance market is projected to reach $30 trillion by 2030. This presents a significant opportunity for ADIB to attract environmentally conscious investors.

- Green bonds issuance surged to $475 billion in 2023.

- ADIB could offer green Sukuk to align with Islamic finance principles.

- Sustainable investing assets grew by 15% in 2024.

Operational Environmental Impact

Abu Dhabi Islamic Bank (ADIB) focuses on minimizing its operational environmental impact. This includes managing energy use, waste, and water consumption across its locations. ADIB's sustainability efforts aim to enhance its environmental performance. In 2024, ADIB invested $1.5 million in green initiatives.

- ADIB aims to reduce carbon emissions by 10% by 2025.

- Waste recycling rates at ADIB branches increased by 15% in 2024.

- ADIB is implementing water-saving measures in all new office designs.

ADIB actively pursues environmental sustainability, reflected in its green initiatives and sustainable finance focus. The bank is aligned with the UAE's net-zero goals, targeting reduced carbon emissions. ADIB leverages green financial products to meet growing investor demand, aiming to enhance environmental performance across operations.

| Key Environmental Factor | ADIB Initiatives | Data & Statistics (2024-2025) |

|---|---|---|

| Green Finance | Issuance of Green Sukuk, Green Financing | Green Sukuk issued $750M (2024), $500M green financing (2024). Sustainable investing assets +15% (2024) |

| Carbon Footprint Reduction | Focus on Lower-Carbon Economy projects | Target: Reduce emissions by 10% by 2025, Global green bond market $1.3T (2024) |

| Operational Impact | Energy, waste, & water management | $1.5M invested in green initiatives (2024), Recycling +15% at branches (2024). |

PESTLE Analysis Data Sources

This analysis draws on global economic databases, regulatory updates, and industry reports, ensuring data accuracy.