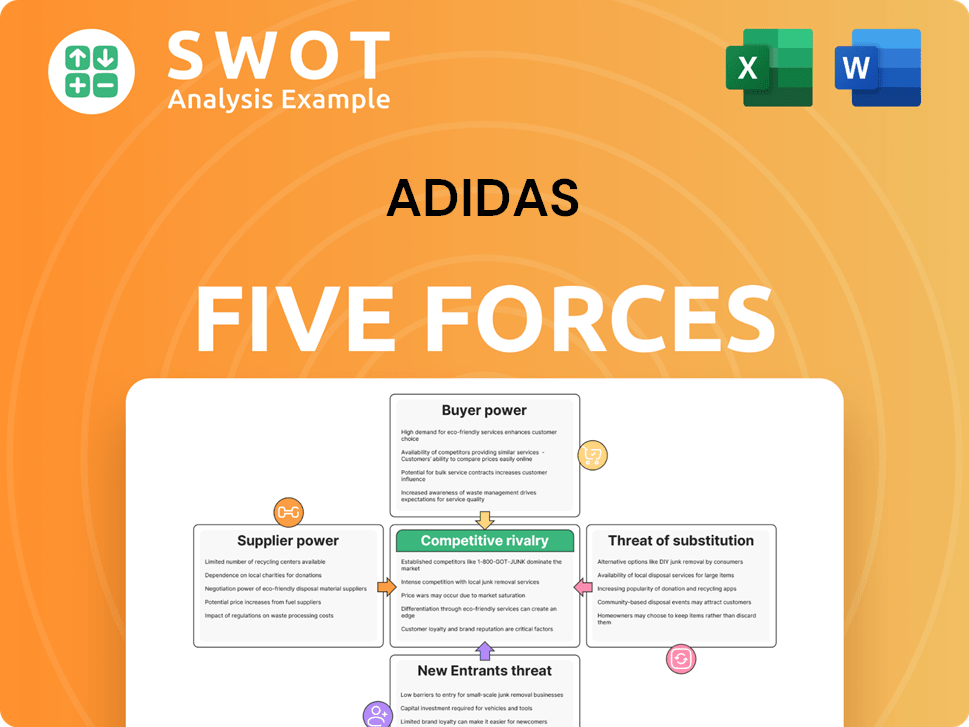

Adidas Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adidas Bundle

What is included in the product

Assesses Adidas's competitive environment, detailing threats from rivals, buyers, suppliers, and new entrants.

Assess competitive dynamics easily by using adjustable weightings on each force.

What You See Is What You Get

Adidas Porter's Five Forces Analysis

You're previewing the actual document. This Adidas Porter's Five Forces analysis examines competitive rivalry, the bargaining power of suppliers and buyers, threat of substitutes, and the threat of new entrants. It provides a comprehensive understanding of Adidas's industry landscape. The document uses detailed examples and data to support its conclusions, giving you a complete analysis. Once purchased, this file is immediately available for download, providing instant access.

Porter's Five Forces Analysis Template

Adidas navigates a complex landscape shaped by powerful forces. Rivalry is intense, with Nike and others vying for market share. Buyer power is significant, influenced by consumer choice and brand loyalty. The threat of substitutes, like emerging athleisure brands, is ever-present. Supplier power, particularly for materials, impacts profitability. New entrants constantly challenge Adidas's dominance.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Adidas’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Adidas confronts moderate supplier power, primarily due to concentrated raw material suppliers. Cotton and rubber, vital for production, are sourced from a limited number of providers. Alternative suppliers offer some relief, but specialized component providers wield more influence. In 2024, Adidas's cost of sales was approximately €11.2 billion.

Adidas faces input cost pressures, particularly from raw materials. Cotton and synthetics price changes directly affect profitability. Suppliers, controlling key resources, can push for higher prices. In 2024, cotton prices fluctuated, impacting margins. Adidas needs strong supply chain management to counter these supplier dynamics.

Adidas's supplier switching costs can be moderate, particularly for unique materials. Strong supplier relationships offer stability, but over-reliance on a few suppliers heightens risk. In 2024, Adidas sourced from approximately 1,000 suppliers globally. Adidas spent €23.266 billion on cost of sales in 2024.

Forward Integration Threat

The threat of suppliers integrating forward into manufacturing or branding their own athletic wear poses a low risk for Adidas. Suppliers generally focus on providing raw materials and components. Adidas benefits from this established supply chain dynamic. However, Adidas must remain vigilant.

- Adidas's revenue in 2023 was approximately €21.4 billion.

- The athletic footwear market is highly competitive.

- Forward integration would require significant investment from suppliers.

- Adidas's brand strength offers a barrier to entry.

Labor Cost Influence

Labor costs are a significant factor in Adidas's supply chain. Suppliers in regions with lower labor costs can offer better pricing. Adidas must balance cost with ethical considerations. In 2024, labor costs in key manufacturing hubs like Vietnam and Bangladesh have been a focus.

- Adidas's sourcing from Asia is crucial.

- Labor cost fluctuations directly impact product prices.

- Ethical sourcing is a key component of Adidas's strategy.

- Rising labor costs in some areas are a concern.

Adidas faces moderate supplier power due to concentrated raw material sources. Input cost pressures, like those from cotton and synthetics, directly affect profitability. Strong supply chain management is crucial to counter these dynamics. In 2024, Adidas's cost of sales was €23.266 billion, highlighting its importance.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Key Materials | Cost Volatility | Cotton prices fluctuated |

| Supplier Base | Concentration Risk | Approx. 1,000 suppliers |

| Cost of Sales | Financial Pressure | €23.266 billion |

Customers Bargaining Power

Customers show moderate price sensitivity, especially in developing markets. Adidas balances its premium brand with competitive prices. In 2024, Adidas's average selling price increased by 8% globally. Discounting and value-added services affect buying choices, demonstrated by a 10% rise in online sales during promotional periods.

Strong brand loyalty somewhat reduces buyer power. Adidas's brand, enhanced by marketing, allows it to retain customers. In 2024, Adidas's brand value reached approximately $14.7 billion. However, loyalty can decrease if product quality or value perceptions diminish.

The availability of many substitutes boosts customer power. Consumers can readily choose alternatives to Adidas. In 2024, the global athletic footwear market was valued at over $100 billion. Adidas faces competition from Nike, Under Armour, and others. Adidas must innovate to retain customers.

Customer Concentration

Adidas's customer concentration is relatively low due to its diverse sales channels, including retail partners and direct-to-consumer platforms. No single customer significantly impacts overall sales. However, large retailers can still leverage their size to negotiate better terms, affecting profitability. In 2024, direct-to-consumer sales represented about 40% of Adidas's total revenue, decreasing reliance on any single retailer.

- Diverse Sales Channels: Adidas uses retail partners and direct platforms.

- Low Concentration: No single customer heavily impacts sales.

- Retailer Influence: Large retailers can negotiate favorable terms.

- DTC Impact: Direct-to-consumer sales are around 40% of total revenue in 2024.

Information Availability

Customers' ability to access information significantly boosts their bargaining power. They can easily compare Adidas products, prices, and competitors. Online reviews and social media heavily influence their buying choices, making it crucial for Adidas to be transparent. This informed consumer behavior impacts pricing strategies and brand loyalty.

- Price comparison websites allow consumers to easily compare prices across different retailers.

- Social media platforms provide consumers with peer reviews and brand reputation insights.

- In 2024, e-commerce sales are expected to constitute over 20% of total retail sales.

- Adidas's digital sales grew by 18% in 2023, highlighting the importance of online presence.

Customer bargaining power is moderate due to price sensitivity and substitutes. Adidas's brand strength helps retain customers but faces competition. Diverse sales channels and online access influence buyer decisions, impacting pricing.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | Moderate | Avg. price increase: 8% |

| Substitutes | High availability | Global footwear market: $100B+ |

| Information Access | High | E-commerce sales >20% |

Rivalry Among Competitors

The athletic apparel market is fiercely competitive. Adidas competes with Nike, Puma, and Under Armour. This rivalry is evident globally. Differentiation and innovation are vital for Adidas. In 2024, Nike held ~31% of the market, Adidas ~13%.

The athletic footwear market's growth, while positive, faces intense competition. Adidas competes with Nike, and other brands. Slower growth in some areas heightens rivalry. Adidas must focus on expanding segments to boost its market share. In 2024, the global sportswear market reached approximately $400 billion.

Adidas distinguishes itself through technology, design, and brand image. The ease of imitation heightens competition. Adidas's 2023 revenue was €21.4 billion. Continuous innovation and IP protection are vital. Adidas's net income from continuing operations was €242 million in 2023.

Switching Costs

Switching costs in the athletic footwear market are relatively low, intensifying competition. Consumers can readily switch between Adidas and competitors like Nike or Puma based on factors such as price, design, or technology. This ease of switching necessitates that Adidas focuses on building robust brand loyalty through marketing and innovation. Adidas's 2024 marketing spend was approximately €3.1 billion, reflecting its commitment to customer retention.

- Low switching costs intensify competitive pressure.

- Consumers can easily choose between brands.

- Adidas focuses on brand loyalty to retain customers.

- Adidas spent around €3.1 billion on marketing in 2024.

Exit Barriers

High exit barriers, like Adidas’s long-term contracts and factory investments, fuel intense rivalry. These barriers make leaving the market costly, keeping competitors engaged. Adidas's 2023 annual report showed significant investments in its supply chain. This situation leads to aggressive competition. Adidas must strategically manage its investments to navigate this.

- Adidas's 2023 revenue was around €21.4 billion.

- The company's long-term debt stood at roughly €4.8 billion.

- Significant investments in marketing and R&D are ongoing.

- Adidas faces pressure from competitors like Nike and Puma.

Competitive rivalry in the athletic apparel sector remains fierce. Adidas contends with Nike, Puma, and Under Armour. Differentiation through innovation is key. Adidas's 2024 marketing spend was about €3.1B. Switching costs are low, intensifying competition.

| Rivalry Aspect | Impact | Adidas's Response |

|---|---|---|

| Market Share | Intense competition | Innovate, expand segments |

| Switching Costs | Easy brand changes | Build brand loyalty |

| Exit Barriers | Keeps rivals engaged | Strategic investment management |

| Marketing Spend | €3.1B in 2024 | Focus on customer retention |

SSubstitutes Threaten

Generic athletic wear and footwear present a moderate threat to Adidas, especially for budget-conscious consumers. These alternatives provide comparable functionality at a reduced price point. In 2024, the global sportswear market was valued at approximately $400 billion. Adidas needs to highlight its premium quality, design, and brand reputation to maintain its market share. Adidas's 2024 revenue was around €21.4 billion, which shows the need to justify higher prices.

Retailers' private label brands pose a rising threat, providing budget-friendly choices. These brands often copy popular Adidas styles and tech. In 2024, private label athletic footwear sales increased by 8%, showing their growing market share. Adidas needs robust branding and innovation to compete.

Non-athletic footwear and apparel pose a substitution threat to Adidas, especially in lifestyle markets. Fashion trends significantly influence consumer choices; for example, in 2024, casual footwear sales surged, impacting athletic shoe demand. Adidas must adapt its product lines, potentially investing more in lifestyle-focused designs. In Q3 2024, Adidas's lifestyle segment grew by 15%, showing the impact of these shifts.

Second-Hand Market

The second-hand market poses a limited substitution threat to Adidas. Platforms like eBay and specialized resale shops offer consumers cheaper options for athletic wear. This trend is fueled by increased demand for sustainable fashion. Adidas's 2023 revenue was approximately €21.4 billion, highlighting the scale of its primary market.

- The global resale market is projected to reach $77 billion by 2025.

- Adidas could develop its own resale programs or partner with existing platforms.

- Focus on product durability and design to mitigate the threat.

- Circular economy initiatives can strengthen brand image.

Activity Alternatives

The threat of substitutes for Adidas is significant due to the rise of diverse fitness activities. Alternatives like yoga, Pilates, and home workouts compete with traditional sports, affecting demand for athletic wear. To mitigate this, Adidas must expand its product range to include gear suitable for various activities and lifestyles. This diversification is crucial for maintaining market relevance.

- Market research indicates a 20% growth in the home fitness market in 2024.

- Adidas's competitors are already offering products for yoga and Pilates.

- Expanding into athleisure could boost sales by 15% in 2024.

Adidas faces substitution threats from budget brands, private labels, and non-athletic apparel, impacting its market. The surge in casual footwear and athleisure poses significant challenges.

Second-hand markets and diverse fitness trends further amplify these threats. Adidas needs strategic product diversification and brand innovation.

Adapting to evolving consumer preferences and lifestyle shifts is critical for Adidas's sustained market presence.

| Substitute Type | Impact | Mitigation Strategy |

|---|---|---|

| Budget Brands | Price sensitivity | Highlight quality, brand value |

| Private Labels | Copycat designs | Branding, innovation |

| Non-Athletic Wear | Lifestyle trends | Product diversification |

Entrants Threaten

High capital needs are a major hurdle for new sports apparel companies. Setting up manufacturing, distribution, and marketing networks demands significant funds. A strong global brand presence like Adidas requires a huge upfront investment. Adidas uses its existing infrastructure to its advantage, and had a revenue of €21.4 billion in 2023.

Adidas leverages economies of scale in manufacturing, marketing, and distribution. New entrants face high barriers to entry, struggling to match Adidas's cost efficiency. Adidas's 2024 revenue was €21.4 billion. New firms find it hard to compete on price. Maintaining these economies is vital for Adidas's market position.

Adidas's strong brand recognition and customer loyalty act as a formidable barrier. Consumers tend to stick with established brands, making it tough for newcomers. In 2024, Adidas's brand value reached approximately $15.7 billion, showcasing its powerful market presence. New entrants face hefty marketing costs to compete. Adidas's marketing expenses were around $2.6 billion in 2023.

Access to Distribution Channels

New entrants face hurdles accessing distribution channels, a key threat. Adidas's established retail relationships and online presence offer a significant advantage. Securing shelf space and online visibility is difficult for newcomers. This barrier protects Adidas's market share. Limited distribution access restricts potential growth for new competitors.

- Adidas's revenue in 2023 was €21.4 billion.

- Adidas's direct-to-consumer sales grew by 10% in 2023.

- New brands often allocate significant marketing budgets to gain visibility.

- Established brands have existing partnerships.

Government Regulations

Government regulations pose a significant threat to new entrants in the athletic apparel market. Compliance involves adhering to labor laws, environmental standards, and trade policies, adding complexity. Adidas, for example, has established compliance processes, a hurdle for newcomers. New entrants face substantial costs and operational challenges.

- Adidas' revenue in 2023 was approximately €21.4 billion.

- Nike's revenue in fiscal year 2023 was about $51.2 billion.

- New companies must meet these standards to compete.

- Regulatory burdens can slow market entry.

New entrants face high capital costs to compete with Adidas. Brand recognition and customer loyalty present significant barriers. Securing distribution channels is also a major challenge.

| Factor | Adidas Advantage | Impact on New Entrants |

|---|---|---|

| Capital Needs | €21.4B Revenue (2023) | High investment to match scale |

| Brand Recognition | $15.7B Brand Value (2024) | Large marketing costs |

| Distribution | Established networks | Limited access and visibility |

Porter's Five Forces Analysis Data Sources

This Adidas analysis is based on financial reports, market research, industry publications, and competitive analysis to evaluate market forces.