Admiral Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Admiral Group Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Clean, distraction-free view optimized for C-level presentation.

What You See Is What You Get

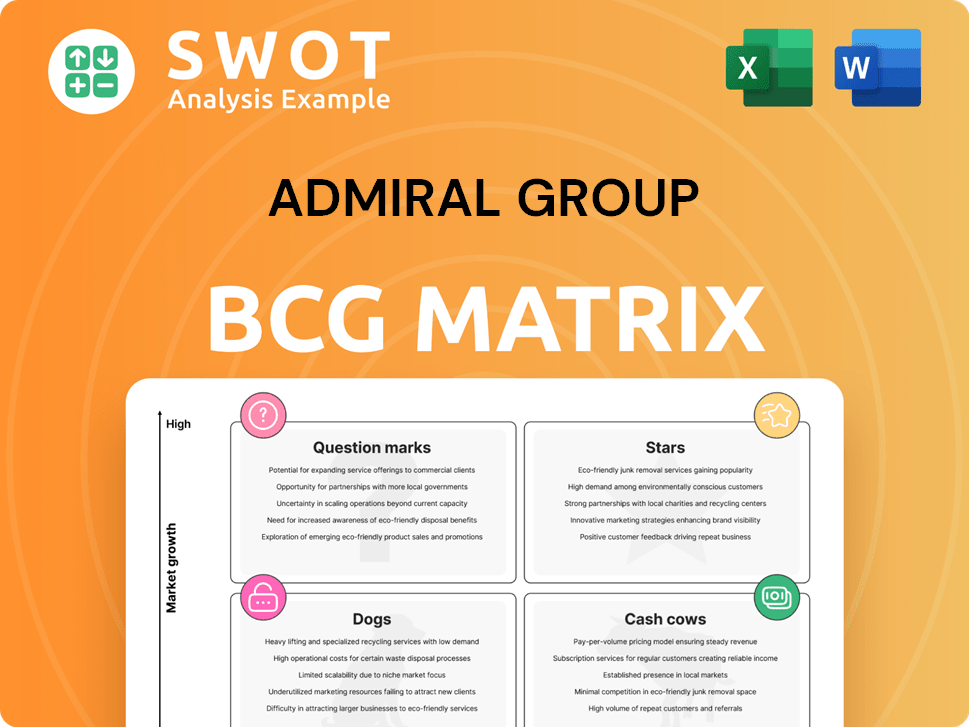

Admiral Group BCG Matrix

The Admiral Group BCG Matrix you're previewing mirrors the final report upon purchase. Get immediate access to a complete, customizable version without any extra steps—perfect for your strategic planning.

BCG Matrix Template

Admiral Group's BCG Matrix showcases its diverse product portfolio within the insurance market. See how its products are categorized—Stars, Cash Cows, Dogs, and Question Marks—based on market share and growth. Understanding these positions is key to strategic decision-making. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Admiral's UK motor insurance is a "Star" in its BCG Matrix due to robust performance. It significantly boosts group profitability, with the UK market experiencing premium growth. Admiral's competitive pricing and underwriting strategy capitalizes on this. In 2024, they saw a 19% increase, reaching 8.8 million customers.

Admiral Group's digital transformation, fueled by partnerships like Google Cloud, enhances customer experience and operational efficiency. Data analytics, machine learning, and AI provide a competitive edge. These initiatives allow for personalized offers and streamlined processes. In 2024, Admiral's investment in digital projects increased by 15%, boosting customer satisfaction scores.

Admiral Group excels in competitive pricing. In 2024, they reduced prices, driven by factors like easing inflation. This strategy attracts customers, boosting market share. For instance, Admiral's UK motor policies increased to 8.69 million in 2023. Their focus on value is key to their success.

Strong Underwriting Performance

Admiral Group's "Stars" status in its BCG matrix stems from its strong underwriting, a key performance indicator. In 2024, Admiral's combined ratio, a measure of profitability, remained competitive. This showcases their effective risk assessment and pricing models. Admiral's strategic focus on expertise and innovation solidifies its market position.

- Competitive combined ratio in 2024, indicating strong underwriting.

- Effective risk management and pricing strategies.

- Focus on expertise and innovation.

Customer Growth and Retention

Admiral Group's focus on customer satisfaction and competitive pricing has led to substantial customer growth and impressive retention. In 2024, the company added 1.4 million customers. This customer-centric strategy boosts long-term value. This shows how well their approach works.

- Customer Growth: 1.4 million new customers in 2024.

- Retention Rates: High retention rates indicate customer loyalty.

- Competitive Pricing: Offers attractive insurance premiums.

- Customer Satisfaction: Prioritizes positive customer experiences.

Admiral's "Stars" like UK motor insurance drove profitability, with 8.8M customers in 2024. Digital transformation boosted efficiency, investing 15% more in 2024. Competitive pricing, with 8.69M UK policies in 2023, fueled market share and added 1.4M customers in 2024. This customer-centric strategy is working.

| Metric | 2023 | 2024 |

|---|---|---|

| UK Motor Policies (Millions) | 8.69 | 8.8 |

| Digital Investment Increase | - | 15% |

| New Customers (Millions) | - | 1.4 |

Cash Cows

Admiral Group's home insurance is a Cash Cow. Pre-tax profit surged in 2024, reflecting robust growth. The RSA acquisition boosted market position. This segment diversifies revenue. In 2024, the home insurance business contributed significantly.

Admiral Money, a personal loan business, is a cash cow for Admiral Group. It has shown substantial growth in gross loan balances, providing a steady income stream. In 2024, profits reached £13 million, up from £10 million in 2023. Gross loan balances also grew by 23% year-on-year.

Admiral Group's "Cash Cows" status is bolstered by add-on products, crucial for revenue. These extras boost customer value and profits. In 2023, add-ons played a key role in Admiral's financial performance, contributing significantly to its overall revenue. However, regulatory changes regarding add-ons could affect this income stream, which is a risk to watch.

Efficient Operations

Admiral Group excels as a "Cash Cow" through efficient operations, focusing on cost management to boost cash flow. This approach allows them to adapt swiftly to market shifts. Their operational excellence enables investments in growth and shareholder value. In 2024, Admiral's cost-to-income ratio was around 14.5%, showcasing their efficiency.

- Cost-to-income ratio: Approximately 14.5% in 2024.

- Adaptability: Agile response to market changes.

- Investment: Funding growth opportunities.

- Shareholder value: Returning value to shareholders.

Dividend Payments

Admiral Group's consistent dividend payments highlight its financial strength, a key characteristic of a Cash Cow in the BCG Matrix. The Board proposed a dividend of 121.0 pence per share, significantly up from 52.0 pence in 2023. This includes a normal dividend of 91.4 pence and a special dividend of 29.6 pence, with the final payment scheduled for June 13, 2025.

- Dividend Yield: The proposed dividend reflects a strong dividend yield, attractive to investors seeking income.

- Financial Stability: Consistent dividend payments underscore Admiral's robust financial health.

- Shareholder Value: Dividends directly enhance shareholder value, a hallmark of a Cash Cow.

- Capital Allocation: The ability to distribute profits indicates effective capital allocation and management.

Admiral Group's "Cash Cows" like home insurance and personal loans show financial strength. They deliver steady revenue and profit growth. The company's efficient operations and high dividend payments confirm their status. A strong cost-to-income ratio of 14.5% in 2024 supports their position.

| Feature | Details |

|---|---|

| Profit in 2024 | £13 million (Admiral Money) |

| Dividend per share | 121.0 pence (Proposed) |

| Cost-to-income ratio | 14.5% (2024) |

Dogs

Admiral's international insurance operations, outside Europe, have struggled, with customer numbers decreasing in certain areas. The international insurance customer base decreased by 3% year-on-year, reaching 2.1 million. These operations might need substantial investment to improve or could be sold off.

Admiral Group's travel insurance, a "Dog" in its BCG matrix, reported losses in 2024. These losses, totaling £12 million, were largely due to integration expenses. Despite offering diversification, the segment's financial performance raises concerns. The acquisition of More Than books from RSA impacted profitability.

Veygo, Admiral's pay-as-you-go car insurance, could be a 'Dog' in the BCG Matrix. It competes in the UK, France, Italy, Spain, and the US. If it lacks market share or isn't profitable, it may be considered a 'Dog'. In 2024, Admiral's overall profit decreased.

Diamond (Female Targeted Insurer)

Diamond, Admiral's female-focused insurer, could be a 'Dog' if it lags behind other brands in profitability. This assessment considers its performance against Admiral, Admiral Business, Admiral Money, Bell, Elephant, Gladiator, Admiral Pioneer, and Veygo. In 2024, Admiral Group's overall profit might influence Diamond's status. Its success is measured by metrics like market share and customer satisfaction compared to competitors.

- Diamond operates within the Admiral Group, which had a profit of £396.3 million in 2023.

- The financial performance of Diamond is crucial in determining its position in the BCG matrix.

- Market analysis will show Diamond's position relative to its competitors in the insurance sector.

- Admiral Group's strategic decisions affect Diamond's potential as a 'Dog'.

Elephant Insurance (US Motor Business) - Divested

Admiral Group's decision to divest Elephant Insurance, its U.S. motor business, marks a strategic shift. The sale to J.C. Flowers is set to conclude in Q4 2025. Elephant Insurance incurred a £19.6 million loss in 2023.

However, it rebounded with a £14 million net profit in 2024. This move allows Admiral to concentrate on its primary markets in the UK and Europe, streamlining its operations.

- Sale to J.C. Flowers.

- £19.6M loss in 2023.

- £14M profit in 2024.

- Focus on UK/Europe.

Several Admiral Group segments face 'Dog' status risks. Travel insurance lost £12 million in 2024 due to integration costs.

Veygo and Diamond's profitability challenges could also classify them as 'Dogs'. Elephant Insurance was sold to J.C. Flowers, after a £19.6M loss in 2023, but £14M profit in 2024, highlighting strategic changes.

These segments underperform, needing investment or divestiture to improve their standing within Admiral Group.

| Segment | Status Risk | Financial Notes (2024) |

|---|---|---|

| Travel Insurance | Dog | £12M Loss |

| Veygo | Dog Potential | Profitability concerns. |

| Diamond | Dog Potential | Profitability relative to competitors. |

| Elephant Insurance (sold) | Transitioned | £14M Profit in 2024. |

Question Marks

Admiral's pet insurance is a question mark in its BCG matrix. It has growth potential, particularly after acquiring RSA's renewal rights. However, the market is competitive, requiring marketing and product development investments. In 2024, pet insurance saw a loss of £5m, highlighting the challenges.

Admiral Pioneer, Admiral Group's venture-building arm, is focused on developing new products. This unit, carrying high risk, requires significant investment for future growth. The 2024 losses reflect continued investment in new product development. For instance, Admiral partnered with Insurtech fleet insurer Flock in 2024.

Admiral Group's foray into Electric Vehicle (EV) insurance is a question mark, representing high growth potential but uncertain market share. In 2024, EV sales surged, indicating a growing customer base for specialized insurance products. A strategic investment in EV insurance could help Admiral capture a share of this expanding market. This market is expected to reach $50 billion by 2030.

Telematics-Based Policies

Admiral Group's telematics-based policies, spearheaded by brands like Bell, represent a 'Question Mark' in its BCG matrix. These policies target younger drivers and those wanting usage-based insurance, offering potential for high growth but also significant risk. Between 2020 and 2024, there was a 21-percentage point increase in telematics policy sales for drivers aged 17-20. Further investment could propel growth and refine risk assessment.

- Telematics policies target younger drivers and those seeking usage-based insurance.

- 21% increase in telematics policy sales for 17-20 year-olds between 2020-2024.

- Further investment could drive growth and improve risk assessment.

Partnerships with Insurtechs

Admiral's partnerships with Insurtechs, like the one with Flock, are a strategic move to foster innovation. These collaborations aim to create advanced products and services, enhancing Admiral's market offerings. The Admiral Pioneer initiative, which includes such partnerships, saw continued investment in 2024.

- Partnerships with Insurtechs drive innovation.

- Admiral invests in new product development.

- Collaboration with Flock started in 2024.

Admiral Group views pet insurance, EV insurance, telematics, and new ventures as "Question Marks" in its BCG matrix. These areas have high growth potential but face market uncertainties and require significant investments. In 2024, pet insurance showed a loss, while telematics saw increased sales among younger drivers. These areas need strategic investment to succeed.

| Area | Status | 2024 Performance |

|---|---|---|

| Pet Insurance | Question Mark | £5m Loss |

| EV Insurance | Question Mark | Growing Market |

| Telematics | Question Mark | Sales Up 21% (2020-2024) |

BCG Matrix Data Sources

The Admiral Group BCG Matrix uses company financials, market data, and industry analysis to define each strategic position.