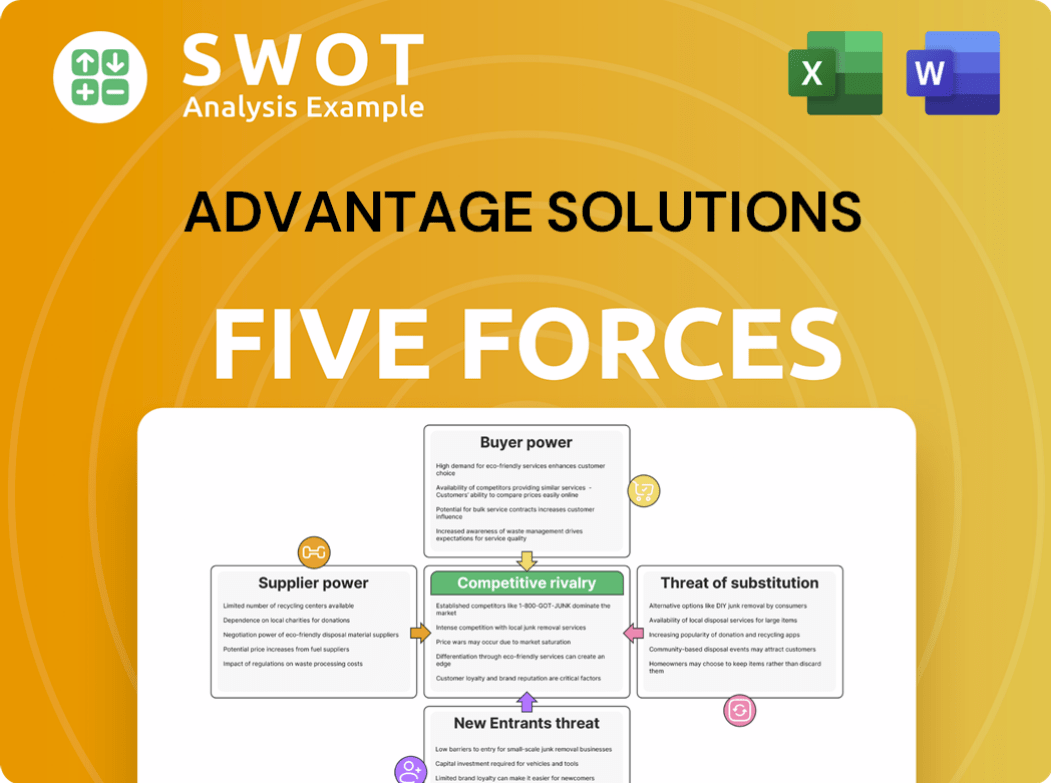

Advantage Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advantage Solutions Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Swap in your own data, labels, and notes to reflect current business conditions.

Preview Before You Purchase

Advantage Solutions Porter's Five Forces Analysis

This preview presents the complete Porter's Five Forces analysis for Advantage Solutions. You're viewing the identical document you'll receive immediately after purchase. It's a ready-to-use, professionally written analysis.

Porter's Five Forces Analysis Template

Advantage Solutions operates in a dynamic market shaped by forces like supplier bargaining power and the threat of new entrants. The analysis reveals the intensity of competition, impacting profitability and strategic positioning. Understanding these forces is crucial for informed decision-making. The existing rivalry and buyer power are also key considerations. This snapshot offers only a glimpse.

Unlock key insights into Advantage Solutions’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

Advantage Solutions benefits from a fragmented supplier landscape. This includes providers of marketing materials, tech services, and staffing. The diverse base limits any single supplier's leverage. Advantage Solutions can secure better deals due to competitive options. In 2024, the company's cost of services was approximately $4.8 billion, reflecting its ability to manage supplier costs effectively.

Advantage Solutions' services, like demos and merchandising, use standardized inputs, lessening supplier power. This allows easy switching to alternatives. In 2024, the company's standardized approach helped manage costs. They reported a gross profit of $1.1 billion in 2024, showcasing effective supplier leverage. This standardization is key to maintaining profitability.

Advantage Solutions likely benefits from low switching costs when sourcing inputs for its services. This means it's relatively easy for them to change suppliers. This ease of switching keeps suppliers competitive. It limits their ability to control prices. In 2024, this could translate to better deals.

Supplier Dependence on Advantage Solutions

Some suppliers of specialized services or technologies could depend on Advantage Solutions for substantial revenue. This dependence gives Advantage Solutions more bargaining power. If Advantage Solutions is a key market channel for suppliers, this power dynamic strengthens. For instance, in 2024, suppliers heavily reliant on major retailers faced pressure on pricing and terms.

- Reliance on major clients can significantly impact supplier profitability.

- Advantage Solutions' market position influences supplier negotiations.

- Specific technology suppliers may be especially vulnerable.

- Market channel control enhances Advantage Solutions' leverage.

Negotiating Leverage through Volume

Advantage Solutions wields significant bargaining power over suppliers, thanks to its substantial size and scale. This allows the company to negotiate advantageous terms, including discounts and favorable contract conditions. The company's capacity to purchase in bulk enhances its ability to secure better deals. Advantage Solutions' vast operations provide considerable leverage in supplier negotiations. In 2024, the company's purchasing volume likely resulted in cost savings, as indicated by its gross profit margin of 24.8%.

- Bulk buying enables discounts.

- Extensive operations provide leverage.

- Favorable contract terms are secured.

- 2024 gross profit margin of 24.8%.

Advantage Solutions has strong bargaining power over suppliers. This power comes from a diverse supplier base and standardized inputs. Low switching costs and bulk buying capabilities further enhance its leverage. In 2024, its gross profit margin was 24.8%, reflecting effective cost management.

| Factor | Impact on Bargaining Power | 2024 Data Point |

|---|---|---|

| Supplier Diversity | Reduces supplier leverage | $4.8B cost of services |

| Standardized Inputs | Enables easy switching | $1.1B Gross Profit |

| Switching Costs | Low costs increase power | Competitive market |

Customers Bargaining Power

Advantage Solutions faces strong customer bargaining power because its clients are primarily large retailers. These major retailers, like Walmart and Kroger, control significant order volumes, which gives them leverage. This concentration allows them to negotiate lower prices and better service agreements. In 2024, Walmart's revenue was about $648 billion, showcasing its immense buying power.

Advantage Solutions offers valuable services, but they aren't always essential for retailers. Retailers possess bargaining power due to available alternatives, such as internal development or other service providers. In 2024, the retail industry saw a 2.5% increase in in-house marketing teams, reflecting this trend. This optionality allows retailers to negotiate favorable terms.

Retailers, facing stiff competition, are highly price-sensitive, which increases their bargaining power. Advantage Solutions must offer competitive pricing to secure contracts. Retailers consistently seek cost reductions, influencing pricing negotiations. For example, Walmart, known for its cost focus, exemplifies this pressure. In 2024, retail sales are projected to reach $7.1 trillion, highlighting the sector's scale and price sensitivity.

Service Differentiation Limitations

Advantage Solutions faces limitations in differentiating its services, boosting customer bargaining power. Retailers can easily switch between providers due to this, impacting pricing. The commoditization of services further reduces Advantage Solutions' leverage. In 2024, the market saw a 5% increase in firms offering similar services, intensifying competition.

- Switching costs are low, increasing customer bargaining power.

- Commoditization of services reduces differentiation.

- Increased competition in 2024, intensifying pricing pressure.

Availability of Internal Alternatives

Large retailers pose a threat to Advantage Solutions by developing internal sales and marketing services, thereby diminishing their need for external providers. This shift boosts retailers' bargaining power, allowing them to push for better deals. For example, Walmart, with its substantial resources, could internalize some of these functions. This increases the pressure on Advantage Solutions.

- Walmart's revenue in 2024 was approximately $611 billion.

- Internalization reduces reliance on external services.

- Retailers leverage this for better terms.

- Advantage Solutions must compete.

Advantage Solutions experiences strong customer bargaining power from large retailers like Walmart. These retailers use their size and order volumes to negotiate favorable terms. The availability of alternative service providers and the ability to develop in-house services further enhance their bargaining power.

| Factor | Impact | Data (2024) |

|---|---|---|

| Concentration of Customers | Higher bargaining power | Walmart's revenue: ~$648B |

| Service Alternatives | Increased leverage | In-house marketing team increase: 2.5% |

| Price Sensitivity | Heightened negotiation | Retail sales projection: ~$7.1T |

Rivalry Among Competitors

The outsourced sales and marketing services industry is fiercely competitive. Advantage Solutions faces rivalry from many firms providing similar services. This competition drives down prices and demands high service quality. In 2024, the industry saw a 7% increase in M&A activity, indicating a consolidation trend amidst competition.

Differentiating services in outsourced sales and marketing is tough. Many firms offer similar solutions, which blurs distinctiveness. This intensifies competition. For example, Advantage Solutions' revenue in 2023 was $3.6 billion, showing the scale of the market. The industry's competitiveness pressures pricing and innovation.

Competitive pressures can trigger price wars among service providers, like in the retail sector. Companies might slash prices to secure contracts, which hurts profitability. This happened in 2024, with some firms seeing profit margins shrink by 5-10%. The drive to cut costs intensifies rivalry. For example, in Q3 2024, several firms reported a 7% drop in revenue due to price competition.

Consolidation Trends

The industry sees consolidation, with larger firms acquiring smaller ones. This intensifies competition as bigger companies battle for market share. Mergers and acquisitions reshape the competitive environment. Advantage Solutions has been involved in acquisitions, such as the purchase of Daymon Worldwide. In 2024, the market experienced significant M&A activity.

- Advantage Solutions acquired multiple companies in recent years to expand its service offerings.

- The market for outsourced sales and marketing services is highly fragmented, leading to consolidation.

- M&A activity in the sector totaled billions of dollars in 2024.

- Consolidation aims to improve efficiency and expand service portfolios.

Focus on Innovation

Competitive rivalry in the market is significantly shaped by a strong focus on innovation. Companies are continually investing in new technologies and service enhancements to differentiate themselves. This constant drive to improve and adapt services heightens the level of competition. The need to stay ahead compels businesses to seek out new methods to attract and retain customers.

- Advantage Solutions increased its investments in technology by 15% in 2024.

- The market for innovative retail solutions is expected to grow by 8% annually through 2025.

- Competitors like Acosta are also heavily investing in digital platforms.

- Recent data shows a 10% increase in the adoption of AI-driven solutions within the industry.

Competitive rivalry in outsourced sales and marketing is intense, fueled by many firms offering similar services. This leads to pricing pressures, with some companies experiencing profit margin declines. Consolidation through M&A further intensifies competition; in 2024, the market saw billions in M&A activity.

| Aspect | Data Point (2024) | Impact |

|---|---|---|

| M&A Activity | 7% increase | Consolidation & heightened competition |

| Profit Margin Decline | 5-10% for some firms | Price wars due to rivalry |

| Tech Investment | Advantage Solutions up 15% | Drive for innovation & differentiation |

SSubstitutes Threaten

Retailers and consumer goods manufacturers might opt to build their own sales and marketing teams, which directly replaces Advantage Solutions' services. This shift to internal capabilities is a considerable threat, particularly for larger clients who have the resources to do so. In 2024, many companies are reevaluating outsourcing, with about 30% considering bringing functions in-house to cut costs and gain more control. This trend poses a challenge for Advantage Solutions.

Advancements in technology, like AI-powered marketing tools, pose a threat to Advantage Solutions. Automation reduces the need for human sales and marketing. Digital solutions are a growing threat. For instance, the global marketing automation market was valued at $4.89 billion in 2024.

Manufacturers increasingly use direct marketing, sidestepping retail and in-store services. Direct-to-consumer (DTC) models reduce reliance on companies like Advantage Solutions. Online sales are a key substitute channel, changing market dynamics. In 2024, DTC sales are up, impacting traditional sales strategies. For example, the DTC market is projected to reach $213.9 billion in 2024.

Alternative Marketing Agencies

The marketing landscape features numerous agencies that can substitute Advantage Solutions' services, especially in digital marketing and brand promotion. Companies can choose from various agencies for their marketing needs, increasing the threat of substitution. The market is competitive, with a wide array of specialized agencies available. The competition among marketing agencies is fierce, impacting pricing and service offerings.

- In 2024, the global advertising market reached $715 billion, showcasing the vastness of available alternatives.

- Digital marketing agencies account for a significant portion of the market, with a growth rate of 12% in 2024.

- The average cost for marketing services varies; however, smaller agencies often provide cost-effective solutions.

- Specialized agencies focusing on niche markets, like influencer marketing, have grown by 20% in 2024.

Consulting Services

Consulting services represent a notable threat of substitution for Advantage Solutions. Consulting firms can offer strategic advice that helps companies optimize sales and marketing. This can reduce the need for ongoing outsourced services. In 2024, the consulting market's revenue reached approximately $160 billion in the US alone. This provides alternative approaches to improve sales and marketing performance.

- Consulting engagements offer strategic guidance as a substitute for tactical execution.

- The global consulting market is projected to reach $1 trillion by 2026.

- Companies might choose consultants for specific projects instead of long-term outsourcing.

- Consultants can provide specialized expertise in areas like digital transformation and sales strategy.

Advantage Solutions faces substitution threats from in-house teams, technology, and direct sales channels. These substitutes offer alternatives to traditional sales and marketing services. The options are varied, creating pressure on pricing and service models. In 2024, the global advertising market hit $715 billion.

| Substitute Type | Description | Impact on Advantage Solutions |

|---|---|---|

| In-House Teams | Companies build their own sales and marketing departments. | Reduces demand for outsourced services, particularly for larger clients. |

| Technology | AI-powered marketing tools and automation. | Lowers the need for human sales and marketing efforts. |

| Direct Sales | Manufacturers using direct-to-consumer (DTC) models. | Bypasses traditional retail and in-store services. |

Entrants Threaten

The sales and marketing services sector often sees low initial capital requirements. This makes it easier for new competitors to enter the market. In 2024, the cost to launch a digital marketing firm can range from $5,000 to $50,000. Digital tools further reduce entry barriers, increasing the threat.

The outsourced sales and marketing services market is notably fragmented, which lowers barriers to entry for new competitors. This structure allows newcomers, like smaller firms, to concentrate on specific niches or geographic areas. For instance, in 2024, the market saw several specialized agencies emerge, focusing on digital marketing or particular industries. This fragmentation intensifies competition.

Technological disruption poses a significant threat to Advantage Solutions. New technologies and digital platforms allow entrants to offer innovative services, potentially disrupting established models. Advancements lower entry barriers, as seen with the rise of AI-driven sales platforms. Digital marketing is easily leveraged; in 2024, digital ad spend hit $366 billion, highlighting the ease of market access for new firms.

Established Relationships

New entrants face challenges in securing relationships with major retailers and consumer goods manufacturers, essential for success in the industry. Established companies like Advantage Solutions already have these crucial partnerships. Building trust and credibility can take years, creating a significant barrier. These existing ties give established players a notable competitive advantage.

- Advantage Solutions reported over 1,200 client relationships in 2024.

- New entrants often need years to build similar trust levels.

- Market share is heavily influenced by existing partnerships.

- Major retailers prefer established, reliable partners.

Reputation and Scale

Building a solid reputation and achieving significant scale are critical for effectively competing in the market. New entrants often face challenges due to their lack of established brand recognition and operational capabilities, unlike Advantage Solutions. Scale provides cost advantages and operational efficiencies. Advantage Solutions' extensive network and client base create barriers. These factors make it difficult for new companies to quickly gain a foothold.

- Advantage Solutions has a strong market presence, serving over 3,000 clients.

- The company employs over 60,000 people.

- Advantage Solutions' revenue in 2024 was approximately $3.5 billion.

- Their scale allows for better negotiation with suppliers.

The threat from new entrants for Advantage Solutions is moderate due to a fragmented market and lower capital requirements, especially in digital marketing. However, established client relationships and the need for significant scale create barriers. In 2024, the digital marketing industry saw numerous entrants, yet Advantage Solutions maintained a strong market position.

| Factor | Impact | Example |

|---|---|---|

| Low Capital Needs | Increases Threat | Digital firm launch costs ($5K-$50K in 2024). |

| Fragmented Market | Increases Threat | Specialized agencies focusing on niches emerged in 2024. |

| Existing Relationships | Reduces Threat | Advantage Solutions' 1,200+ client relationships in 2024. |

Porter's Five Forces Analysis Data Sources

Advantage Solutions' analysis uses financial reports, market share data, and industry publications. Data includes competitive landscape details & supplier/buyer analyses.