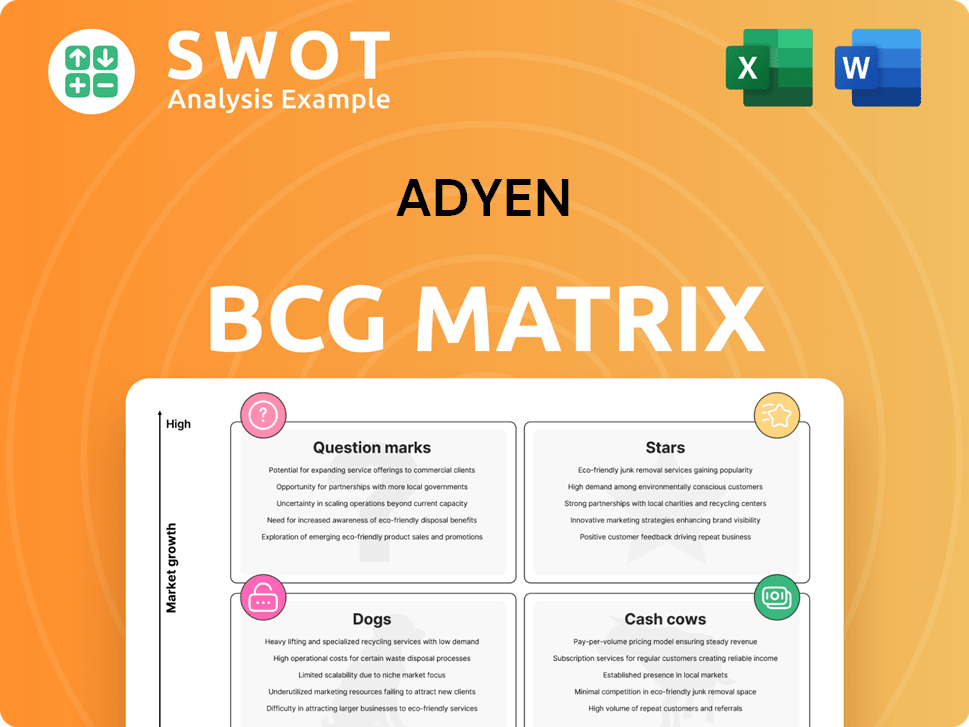

Adyen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adyen Bundle

What is included in the product

Tailored analysis for Adyen's product portfolio across the BCG Matrix.

Clean, distraction-free view optimized for C-level presentation

Full Transparency, Always

Adyen BCG Matrix

This preview offers the complete Adyen BCG Matrix document you'll receive. After purchase, download the same file, fully editable and ready for your strategic financial analysis.

BCG Matrix Template

Adyen, a global payments platform, operates in a dynamic market with various product offerings. Its BCG Matrix helps visualize product portfolio performance, like acquiring and issuing. This preview unveils a glimpse into product positioning within the growth-share matrix. Understand which areas demand investment and which offer strong returns.

The complete BCG Matrix reveals exactly how Adyen is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Stars

Adyen's unified commerce platform, integrating online and in-store payments, holds high market share within the flourishing omnichannel market. This platform enables merchants to connect all channels, enhancing customer experience and driving growth. In 2024, Adyen processed €43.7 billion in in-store payments, showcasing its strength. The platform's expansion solidifies its Star status.

Adyen for Platforms (AfP) is growing fast, as platforms need integrated financial services. It combines payments with compliance, offering a full infrastructure. AfP's potential as a revenue driver is clear. In 2023, Adyen processed €939.6 billion, showing its large scale.

Adyen's global expansion strategy has been marked by substantial investments in North America and EMEA. In 2024, North America's revenue surged, reflecting a 'double-down' strategy. EMEA also showed strong growth, fueled by new clients and service expansions. These investments aim to boost market leadership.

AI-Driven Optimization Tools

Adyen's strategic focus on AI-driven optimization is evident in its Intelligent Payment Routing and Adyen Uplift tools. These innovations boost authorization rates, cut expenses, and boost conversion rates for merchants. This technology gives Adyen a competitive edge, showcasing its dedication to innovation and effectiveness in financial transactions. The continued expansion of AI capabilities promises substantial value for merchants.

- Intelligent Payment Routing has improved authorization rates by up to 2%.

- Adyen Uplift reduces operational costs by 5-10%.

- AI-driven tools contribute to a 1-3% increase in conversion rates.

Direct Connections to Payment Networks

Adyen's direct connections to payment networks, such as Faster Payments in the UK and FedNow in the US, offer faster payouts and better control over infrastructure. These direct links increase the reliability and efficiency of Adyen’s platform. This strategic advantage helps Adyen attract merchants looking for superior payment processing. It can further solidify Adyen's market position.

- Adyen processed €422.8 billion in payments in H1 2024.

- Faster Payments processes over £2.5 billion daily.

- FedNow processed over 1 million transactions in 2023.

- Adyen's net revenue grew by 21% in H1 2024.

Adyen's Stars are characterized by high growth and market share in dynamic markets. This includes the unified commerce platform, AfP, and its global expansion, especially in North America and EMEA. In H1 2024, Adyen's net revenue grew by 21%, supporting its Star status.

| Feature | Description | 2024 Data |

|---|---|---|

| Unified Commerce | Integrates online and in-store payments. | €43.7B in-store payments |

| Adyen for Platforms (AfP) | Provides integrated financial services. | €939.6B processed in 2023 |

| Global Expansion | Focus on North America and EMEA. | North America revenue surged |

Cash Cows

Adyen's payment processing in Europe is a cash cow, fueling substantial cash flow. Despite slower growth, high market share and large volumes boost profitability. In H1 2024, Adyen processed €436.9B, showing its strength. Focus on efficiency and customer retention remains key for maximizing returns.

Adyen's large enterprise clients, like Microsoft and Uber, are a cornerstone of its "Cash Cows." These clients, processing vast transaction volumes, ensure a stable revenue stream. In 2024, these key accounts contributed significantly to Adyen's €739.8 million in net revenue. Their reliance on Adyen's global payment solutions reinforces this strong, predictable income.

Adyen's IPP tech is a "Cash Cow" in its BCG Matrix. It boosts the payment experience via customer-facing displays. This tech merges traditional terminals with multimedia platforms like the SFO1. In 2024, Adyen's revenue rose, showing IPP's strong contribution. IPP's revenue growth is essential for Adyen's overall financial health.

Embedded Financial Products Suite

Adyen's "Cash Cows" in the BCG Matrix include its Embedded Financial Products (EFP) suite, which enables businesses to offer financial services. A prime example is Adyen's Issuing product, where issuing volumes saw a remarkable +258% year-over-year increase. This EFP suite allows Adyen to generate revenue by enabling its clients to create new revenue streams. This is a significant component of Adyen's strategy in 2024.

- Issuing volumes grew +258% YoY.

- EFP suite enables businesses to offer financial services.

- Adyen generates revenue via its clients' new revenue streams.

- Part of Adyen's 2024 strategy.

Recurring Revenue from Subscriptions

Adyen's subscription model delivers consistent revenue through ongoing platform access. This predictable income stream aids in long-term financial strategies. Customer satisfaction and retention are vital for sustaining subscription value. In 2024, subscription services accounted for a significant portion of Adyen's revenue, showcasing its reliability.

- Recurring revenue ensures stable cash flow.

- Customer retention is key for subscription value.

- Adyen's subscription model provides access to its platform.

- Predictable income supports long-term financial planning.

Adyen's "Cash Cows" in its BCG Matrix provide reliable, high-margin revenue streams. These include payment processing and subscription models. In H1 2024, Adyen's net revenue reached €739.8 million, supported by these key areas. The focus is on maintaining efficiency and strong client relationships.

| Cash Cow | Description | 2024 Data Highlights |

|---|---|---|

| Payment Processing (Europe) | High market share, slower growth, strong volumes | €436.9B processed in H1 2024 |

| Key Enterprise Clients | Stable revenue from clients like Microsoft, Uber | Contributed significantly to €739.8M net revenue |

| Embedded Financial Products (EFP) | Enables financial services offerings | Issuing volumes increased +258% YoY |

Dogs

Adyen's LatAm region showed slower growth in 2024, potentially becoming a "Dog." Revenue growth in LatAm was around 15% in 2024, significantly lower than in other regions. This underperformance requires strategic reassessment.

Commoditized payment methods, like those in the Dogs category, typically have low margins and little differentiation, posing challenges for Adyen. These methods might not significantly boost revenue, demanding strict cost control. For instance, in 2024, the average transaction fee for basic card payments hovered around 1.5-3%. Adyen could explore higher-margin payment solutions to enhance profitability, potentially boosting their 2024 net revenue which was €2.6 billion.

Unsuccessful product pilots are classified as Dogs in the Adyen BCG Matrix. These are products or services that did not gain market traction after pilot programs. Reevaluation or discontinuation is often needed to avoid wasting resources. In 2024, 15% of new product launches in the fintech sector failed to meet initial targets. Focusing on successful product lines will drive greater returns.

Low-Value, High-Maintenance Clients

Low-value, high-maintenance clients, akin to "Dogs" in the BCG matrix, represent clients that consume substantial resources without generating commensurate revenue. Such clients can significantly diminish profitability. For instance, in 2024, companies found that 15% of their clients accounted for 50% of support costs. Addressing this requires strategic shifts.

- Resource Drain: These clients demand significant support.

- Profitability Impact: They negatively affect overall profit margins.

- Strategic Alternatives: Consider revenue enhancement or transitioning.

- Cost Analysis: Evaluate the cost-benefit of each client relationship.

Legacy Technology

Legacy Technology, in the Adyen BCG Matrix, represents outdated systems. These systems often demand high maintenance and provide limited features. Replacing them with scalable technology can boost efficiency and cut expenses. Eliminating legacy systems is vital for staying competitive. For example, in 2024, many financial institutions spent over 30% of their IT budgets maintaining legacy systems, according to a report by Gartner.

- High Maintenance Costs: Legacy systems often require significant resources for upkeep.

- Limited Functionality: They may lack modern features and integration capabilities.

- Reduced Efficiency: Outdated technology can hinder operational performance.

- Strategic Imperative: Modernization is key for long-term success and cost reduction.

Dogs in Adyen’s BCG matrix include LatAm underperformance, slow revenue growth, and commoditized payment methods. Unsuccessful product pilots and low-value, high-maintenance clients also fall into this category. Legacy tech further burdens the "Dogs" segment.

| Category | Characteristic | Impact |

|---|---|---|

| LatAm Region | 15% Revenue Growth | Strategic reassessment needed |

| Commoditized Payments | Low margins, little differentiation | Strict cost control |

| Unsuccessful Pilots | Failed market traction | Reevaluation or discontinuation |

Question Marks

Adyen's foray into new markets like India and Japan fits the Question Mark quadrant. These regions boast high growth potential, but also pose investment risks. For example, Adyen's 2023 revenue in Asia-Pacific was €168.6 million, indicating growth potential but also challenges. Success hinges on strategic partnerships and rigorous market analysis.

Emerging payment technologies, such as stablecoins and crypto, fit into the Question Mark quadrant. These innovative technologies have significant growth potential, but they also come with regulatory uncertainties and market volatility. In 2024, the global cryptocurrency market was valued at approximately $1.11 trillion, demonstrating its potential. Monitoring market trends and adapting to evolving regulations are crucial for success in this area.

New product innovations, like Adyen Uplift, are Question Marks, needing substantial investment. These have the potential to become Stars if merchants adopt them successfully. As of 2024, Adyen invested heavily in R&D, spending €240 million in H1 2024. Marketing and education are key for adoption, fueling their growth trajectory.

Embedded Finance Beyond Payments

Expanding embedded finance beyond payments, like business accounts and lending, is a Question Mark in Adyen's BCG Matrix. These services could boost revenue but come with risk and regulatory hurdles. A solid embedded finance strategy is key. For example, the embedded finance market is projected to reach $138 billion by 2026.

- Revenue Potential: New services can significantly increase Adyen's revenue streams.

- Risk Management: Lending and accounts require robust risk assessment and mitigation.

- Regulatory Compliance: Navigating diverse financial regulations is crucial.

- Strategic Planning: A clear strategy is vital for successful expansion.

Partnerships with Emerging Platforms

Adyen's partnerships with emerging platforms and marketplaces are considered Question Marks in the BCG Matrix. These collaborations offer access to new customer segments, potentially driving growth. However, they demand careful due diligence and integration efforts to ensure success. Selecting the right partners and aligning business objectives are essential for maximizing the value of these ventures. This approach is particularly relevant in the evolving landscape of digital commerce.

- Partnerships with emerging platforms and marketplaces represent a Question Mark.

- These partnerships offer access to new customer segments.

- Careful due diligence and integration are required.

- Selecting the right partners and aligning business goals are crucial.

Question Marks in Adyen's BCG Matrix include new markets, payment technologies, and product innovations. These ventures promise high growth, but also involve investment risks and uncertainties. A strategic approach is essential for navigating regulatory and market volatilities to succeed.

| Area | Characteristic | Data |

|---|---|---|

| New Markets | Expansion Risk | Adyen's APAC revenue in 2023: €168.6M |

| Emerging Tech | Market Volatility | Crypto market value in 2024: ~$1.11T |

| New Products | Investment Needs | Adyen R&D spend H1 2024: €240M |

BCG Matrix Data Sources

This BCG Matrix utilizes publicly available financial reports, industry-specific market data, and expert analyst opinions for a comprehensive evaluation.