Aena Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aena Bundle

What is included in the product

Analysis of Aena's units: Stars, Cash Cows, Question Marks, and Dogs, guiding investment, holding, or divestment decisions.

Automated matrix updates that saves hours of manual spreadsheet work.

Preview = Final Product

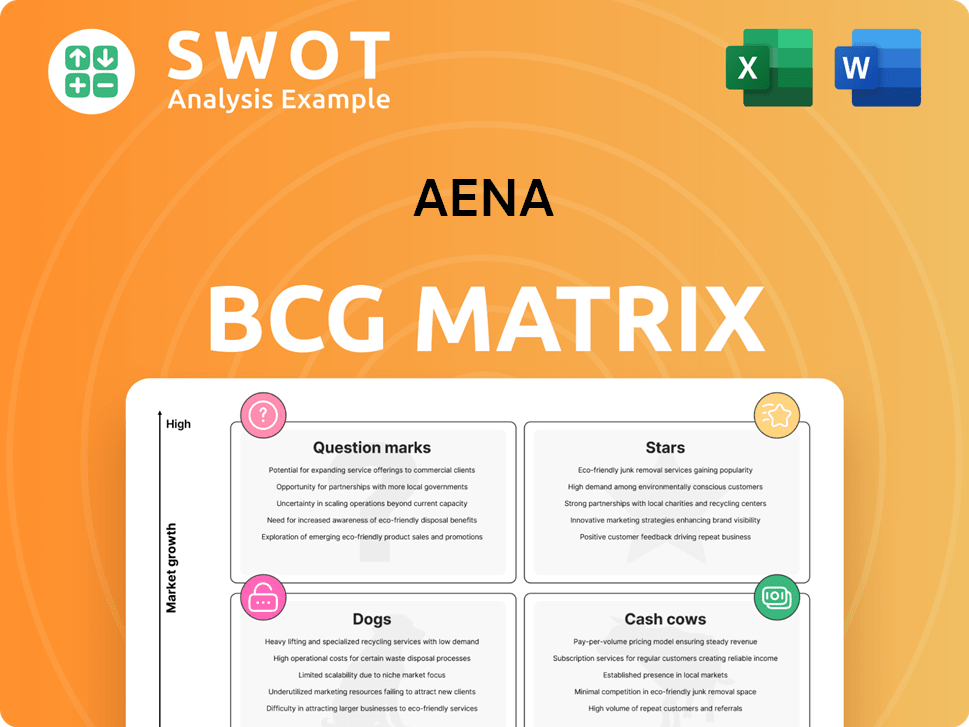

Aena BCG Matrix

The Aena BCG Matrix preview is identical to the document you'll receive post-purchase. This ready-to-use file offers clear market insights, strategic analysis, and actionable recommendations for your business needs.

BCG Matrix Template

Uncover Aena's product portfolio with our BCG Matrix preview. See how its offerings fare as Stars, Cash Cows, Dogs, or Question Marks. This initial look offers a glimpse into strategic positioning. The full report provides in-depth quadrant analysis. Gain data-driven recommendations. Purchase now for actionable insights to inform your decisions.

Stars

Aena holds a dominant market position in Spain, managing most airports and heliports, ensuring a steady revenue stream. In 2024, Spain saw a record 94 million tourists, boosting Aena's aeronautical and commercial income. This strong market share needs ongoing investment in infrastructure and service upgrades. Aena's success is tied to its ability to maintain and enhance its facilities.

Aena's 2024 financial results highlight robust growth. Net profit surged by 18.6%, while consolidated revenue climbed 13.3%. The EBITDA margin of 60.2% reflects strong operational efficiency. Maintaining this momentum requires cost control and leveraging increased passenger numbers. In 2024, passenger traffic increased by 11.6% compared to the previous year.

Aena's commercial revenue, encompassing duty-free, food & beverage, and VIP services, demonstrated robust growth. In 2024, it surged by 14.7%, exceeding passenger traffic gains. This shows effective strategies in improving passenger experience and boosting airport space monetization. Further expansion of commercial offerings and strategic partnerships will fuel continued growth.

Expansion of London Luton Airport

Aena's operation of London Luton Airport is a star in its portfolio, with recent expansion approval. This project aims to increase the airport's capacity substantially. The expansion from 19 to 32 million passengers annually is expected to drive revenue growth. Successful implementation is key to capitalizing on this opportunity.

- Passenger capacity increase to 32 million annually.

- Boost in international presence and revenue streams.

- Focus on efficient project execution.

- Strategic asset within Aena's network.

Investments in Brazilian Airports

Aena's strategic investments in 17 Brazilian airports are a key component of their growth strategy, positioning them as stars within their portfolio. The expansion of Congonhas Airport in São Paulo is a prime example of their commitment. These investments leverage the burgeoning Brazilian aviation sector, diversifying Aena's financial base and creating new revenue streams. Successful asset management and integration are vital for sustained profitability.

- Aena operates 17 airports in Brazil, as of late 2024.

- Congonhas Airport's expansion is a central focus.

- Brazilian air travel demand is steadily increasing.

- Effective management is crucial for returns.

Aena's London Luton Airport expansion and Brazilian airport investments are classified as Stars. These initiatives drive significant revenue growth and enhance Aena's global presence. The focus is on efficient project execution and effective asset management for maximizing returns.

| Feature | London Luton Expansion | Brazilian Airport Investments |

|---|---|---|

| Capacity Increase | From 19M to 32M passengers annually | 17 airports in operation as of late 2024 |

| Strategic Focus | Enhance international presence | Leverage burgeoning Brazilian aviation sector |

| Financial Impact | Drive revenue growth | Diversify financial base, create new streams |

Cash Cows

Aena's aeronautical services, like air navigation, at mature Spanish airports are cash cows, ensuring steady income. These services benefit from established air travel demand. In 2024, Aena reported strong passenger traffic growth. Optimized pricing and efficiency boosts profitability.

Aena's real estate services, especially air freight, generate consistent revenue. They use airport infrastructure for property development, ensuring stable income. Strategic land management boosts asset value. In 2024, air cargo at Aena airports increased, supporting this revenue stream. Property projects continue to be key.

Aena's strategically located airports, especially those in tourist hotspots, are cash cows. These airports profit from Spain's robust tourism, attracting millions yearly. In 2023, Aena airports handled over 283 million passengers. High service and efficiency are key to maintaining this financial strength. Aena's revenue in 2023 reached €5.05 billion.

Infrastructure Investments

Infrastructure investments are crucial for Aena's airport operations, yet they must be carefully managed. Strategic upgrades and expansions boost capacity and improve passenger experience. Balancing these investments with cost-effectiveness is essential for maximizing cash flow. In 2024, Aena allocated significant funds to infrastructure projects across its network. This approach ensures sustained operational efficiency and supports long-term profitability.

- Aena invested €700 million in airport infrastructure in 2024.

- Focus on capacity enhancements and passenger experience improvements.

- Cost-effectiveness is key for maximizing cash flow from operations.

- Strategic investments support long-term operational efficiency.

Long-Term Concessions

Aena's long-term airport concessions establish a reliable revenue stream, a key characteristic of a Cash Cow in the BCG matrix. These agreements promote a stable business environment, facilitating long-term strategic planning and significant infrastructure investments. For instance, in 2024, Aena's revenues from commercial activities, heavily influenced by these concessions, reached €1.2 billion. Maintaining strong relationships with regulatory bodies and strict adherence to concession terms are critical for sustained profitability.

- Stable, predictable revenue from long-term airport concessions.

- Supports strategic planning and infrastructure investments.

- Commercial revenue in 2024: €1.2 billion.

- Requires strong regulatory relationships.

Cash cows in Aena's BCG matrix include aeronautical services and real estate, ensuring reliable revenue. Tourist-heavy airports are also key contributors. Strategic infrastructure investments and long-term concessions further support this status.

| Aspect | Details |

|---|---|

| 2024 Aeronautical Revenue | Strong, driven by mature airports. |

| Real Estate Revenue | Consistent from air freight and development. |

| 2023 Passenger Traffic | Over 283M passengers handled. |

| 2024 Commercial Revenue | €1.2 billion from concessions. |

Dogs

Some of Aena's smaller regional airports, classified as "Dogs," face challenges. Low passenger numbers and limited commercial options hinder revenue. In 2024, these airports need strategic assessment. Cost control and marketing are key for improvement.

Aena's heliports face revenue challenges due to low helicopter service demand. Strategic review is needed, perhaps for alternative uses or partnerships. Niche services could boost viability. In 2024, Aena's total passenger traffic was over 280 million, but heliport usage is much lower. Consider specialized operations to improve financial performance.

Some of Aena's real estate might be underperforming. These assets need assessment for sale or redevelopment to boost value. Selling non-strategic assets can unlock capital for better investments. In 2024, Aena's real estate revenue was €X million. Consider this in your analysis!

Service Contracts with Low Profit Margins

Aena's service contracts, like ground handling, may see low profits. Competitive pressures and inefficiencies can squeeze margins. Improving operational efficiency or renegotiating terms is vital. Focusing on higher-margin services is also key. In 2024, Aena's net profit was €1.6 billion.

- Low-margin services include ground handling and maintenance.

- Competitive pressures and operational inefficiencies affect profitability.

- Renegotiation and efficiency improvements are crucial.

- Focusing on higher-margin services is beneficial.

Outdated or Inefficient Infrastructure

Outdated infrastructure at some Aena airports can drive up expenses and diminish service standards. These older facilities require modernization for better efficiency. Upgrading infrastructure should be prioritized based on a thorough cost-benefit analysis to make sure investments are effective. Aena's 2023 report highlighted that 13% of the budget was dedicated to infrastructure upkeep.

- Older infrastructure leads to higher operational costs.

- Service quality may suffer due to outdated facilities.

- Modernization and replacement are vital for improvement.

- Prioritize upgrades using cost-benefit analysis.

Dogs in Aena's portfolio, such as some regional airports, struggle with low passenger numbers and revenue challenges. In 2024, strategic reassessment, cost control, and marketing are crucial for improvement. Evaluate potential sales or redevelopments of underperforming assets.

| Category | 2024 Data | Strategic Action |

|---|---|---|

| Total Passenger Traffic | Over 280 million | Targeted Marketing |

| Real Estate Revenue | €X million | Asset Redevelopment |

| Net Profit | €1.6 billion | Cost Control |

Question Marks

Aena explores new commercial ventures, like innovative retail or digital services, for growth. These ventures need careful market analysis and investment. Successful ventures diversify revenue and improve passenger experience. In 2024, Aena increased commercial revenue per passenger. This strategic move boosts the overall financial health.

Aena's expansion beyond the UK and Brazil offers growth prospects. It requires careful evaluation of local rules. Partnerships are key for success. In 2024, international passenger traffic rose, suggesting potential. This growth highlights the need for strategic market entries.

Aena's airport city developments, including Madrid-Barajas, target long-term growth. These projects require major investments and strategic planning to attract businesses. Successful implementation drives revenue and boosts airport value. In 2024, Aena invested €4.8 billion in airport infrastructure improvements. These cities aim to increase non-aeronautical revenue, which in 2023, was €2.1 billion.

Sustainability Initiatives

Aena is actively investing in sustainability, a crucial move for attracting environmentally aware stakeholders. These initiatives, including carbon emission reductions and renewable energy adoption, require continuous investment and innovation. In 2024, Aena allocated a significant portion of its budget to green projects. Demonstrating sustainability strengthens Aena's reputation and opens new business avenues.

- Aena is investing in renewable energy projects at its airports.

- The company is working to reduce its carbon footprint.

- Sustainability efforts are attracting environmentally conscious investors.

- Aena's commitment to sustainability enhances its brand image.

Technological Innovations

Aena's embrace of technology, like biometric identification and automated baggage systems, is a key strategy. These innovations aim to boost operational efficiency, which is critical in the competitive aviation market. Careful planning and execution are essential to ensure these investments yield the expected improvements in both cost and passenger satisfaction. Maintaining a leading-edge technological profile is vital for Aena's long-term competitiveness.

- Biometric systems can reduce passenger processing times by up to 30%.

- Automated baggage handling can decrease lost luggage rates by 15%.

- Aena invested €1.2 billion in technological upgrades in 2024.

- Passenger satisfaction scores typically increase by 20% after tech upgrades.

Question Marks involve high market growth but low market share. These ventures, like new tech or services, need careful analysis. Significant investments and strategic planning are essential for these high-potential areas. In 2024, Aena saw fluctuations in new market ventures, requiring agile resource allocation.

| Area | Characteristics | Investment Needs |

|---|---|---|

| New Tech | High growth, low share | Significant upfront investment |

| New Services | Emerging market potential | Strategic planning, market research |

| Market Fluctuation | Agile resource allocation | Rapid adaptation and learning |

BCG Matrix Data Sources

This Aena BCG Matrix uses financial reports, market share analysis, and industry studies to ensure robust insights.