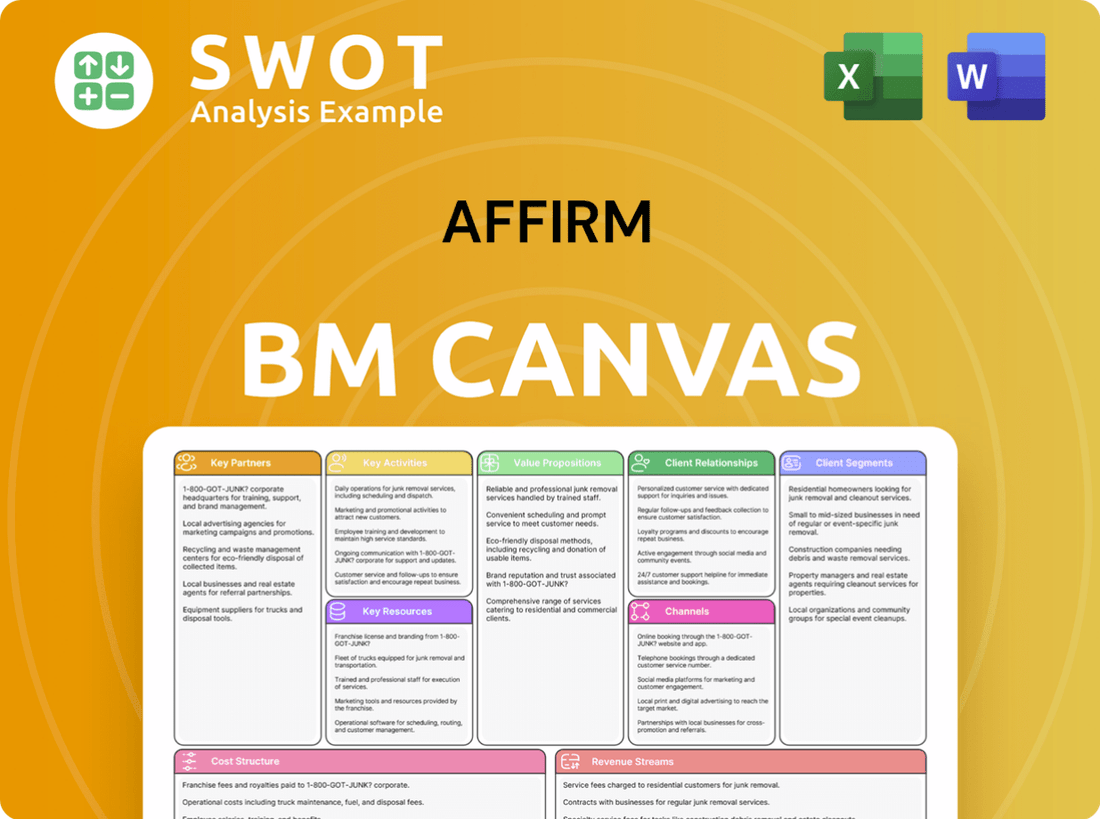

Affirm Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Affirm Bundle

What is included in the product

Affirm's BMC details customer segments, value, channels, and costs.

The Affirm Business Model Canvas provides a one-page business snapshot.

Preview Before You Purchase

Business Model Canvas

This is a direct preview of the Affirm Business Model Canvas document you will receive. What you see is the actual file, fully complete. Purchasing unlocks the same professionally designed, ready-to-use document. You’ll get the exact format and content as shown, ready for your use. No hidden content or different versions.

Business Model Canvas Template

Explore Affirm's strategic architecture with the Business Model Canvas. Discover key partners, customer segments, and value propositions. This concise framework reveals how Affirm generates revenue and manages costs. Uncover its competitive advantages and growth drivers. Download the full Business Model Canvas for in-depth analysis and strategic insights!

Partnerships

Affirm's success hinges on robust merchant partnerships. As of late 2024, they partner with over 235,000 merchants. This integration into online and in-store checkouts boosts Affirm's visibility. Key collaborations with major retailers drive user acquisition. These partnerships were critical in processing $6.1 billion in gross merchandise volume in Q3 2024.

Affirm's partnerships with capital providers are crucial. They include financial institutions and investors, providing the funds for consumer loans. These relationships are key to scaling and meeting consumer financing needs. As of December 31, 2024, Affirm had over $22 billion in funding capacity. This strong capital position supports its operational growth.

Affirm's tech platform partners, such as Shopify and Adyen, are crucial for its BNPL service integration. These collaborations ease the technical setup for merchants. This approach enables Affirm to broaden its reach and offer seamless payment options. In 2024, Affirm's partnership with Shopify facilitated $2.6 billion in gross merchandise volume (GMV).

Banking Partners

Affirm's banking partnerships are critical to its business model. They work with banks like Stride Bank and Cross River Bank, which issue cards and support Affirm's services. These relationships enable Affirm to provide financial products, including the Affirm Card. In 2024, Affirm's revenue was approximately $1.7 billion, underscoring the importance of these partnerships.

- Partnerships with banks like Stride Bank and Cross River Bank facilitate card issuance.

- These collaborations support Affirm's financial product offerings.

- They are essential for providing services like the Affirm Card.

- Affirm's 2024 revenue reflects the significance of these partnerships.

Credit Bureaus

Affirm collaborates with credit bureaus such as Experian to share loan data, fostering transparency and promoting responsible lending practices. This partnership supports consumers in establishing credit histories, while also providing lenders with the information needed for informed decision-making. Reporting loan data to credit bureaus strengthens Affirm's service credibility and contributes to financial well-being.

- In 2024, Experian reported that 70% of consumers who established a credit history through installment loans improved their credit scores.

- Affirm's partnerships with credit bureaus enable it to reach a wider audience, with over 17 million active consumers as of the end of 2024.

- Approximately 80% of Affirm's loan data is reported to credit bureaus, influencing millions of credit reports.

Affirm's banking partnerships are pivotal for issuing cards. They collaborate with institutions like Stride Bank and Cross River Bank, providing essential financial services, including the Affirm Card. In 2024, Affirm's revenue was approximately $1.7 billion, highlighting the impact of these crucial alliances.

| Partnership Type | Partner Examples | Impact |

|---|---|---|

| Banking | Stride Bank, Cross River Bank | Facilitates card issuance, supports financial products, contributed to $1.7B revenue in 2024 |

| Credit Bureaus | Experian | Shares loan data, promotes responsible lending, influenced millions of credit reports |

| Tech Platform | Shopify, Adyen | Integrates BNPL, facilitates seamless payments, enabled $2.6B GMV (Shopify) in 2024 |

Activities

Affirm's core activity centers on loan underwriting, evaluating consumer credit at purchase. This process determines interest rates and manages risk effectively. In 2024, Affirm's machine learning models facilitated real-time credit assessments. This approach helped approve loans while minimizing defaults, a key factor in maintaining profitability.

Merchant acquisition is crucial for Affirm's success. They actively seek and maintain partnerships with businesses. This includes promoting their services, finalizing agreements, and integrating Affirm into merchant platforms. As of December 31, 2024, Affirm boasted 337,000 active merchants. A robust merchant network is key for transaction volume and revenue.

Affirm's tech development is crucial. They constantly update their platform, including the app and website, for better user experience and security. This includes scaling to manage growing transactions. In 2024, Affirm's tech spend was significant, reflecting its commitment to innovation. They are expanding into new areas like healthcare, offering more payment options.

Risk Management

Risk management is a core activity for Affirm, crucial for its financial health. This involves closely monitoring loan performance and adjusting lending criteria as needed. Affirm actively employs collection strategies to mitigate potential losses. Their risk management approach aims for a target revenue, less transaction costs, of 3%-4% of gross merchandise value.

- Credit losses for the fiscal year 2024 were approximately 2.7% of the total gross merchandise volume (GMV).

- Affirm's risk management includes dynamic pricing, which adjusts interest rates based on the borrower's creditworthiness.

- In 2024, Affirm’s provision for credit losses was around $1.1 billion.

- The company uses a combination of internal and external data to assess credit risk.

Customer Support

Customer support is a cornerstone of Affirm's operations, ensuring customer satisfaction and building trust. They handle inquiries, resolve payment issues, and address disputes. This dedication to service enhances Affirm's brand image and encourages repeat business. Affirm's policy of no late fees or compound interest on late payments further supports customer-centric practices.

- Affirm's customer satisfaction scores consistently rank high compared to industry standards, reflecting effective support.

- In 2024, Affirm processed over $25 billion in gross merchandise volume (GMV), demonstrating a strong customer base.

- Affirm's support team resolves a high percentage of issues on the first contact, improving efficiency.

- The absence of late fees is a major selling point, appealing to a broad customer demographic.

Affirm's key activities also include loan underwriting, merchant acquisition, tech development, risk management, and customer support.

Tech updates, particularly in 2024, have focused on user experience and security. Risk management in 2024 included dynamic pricing and collection strategies.

Customer support focuses on inquiries and resolving issues, with no late fees as a key feature.

| Activity | Focus | 2024 Data |

|---|---|---|

| Risk Management | Credit loss mitigation | 2.7% of GMV in credit losses |

| Merchant Acquisition | Partnership with businesses | 337,000 active merchants |

| Tech Development | Platform Updates | Significant tech spend |

Resources

Affirm's technology platform is a key resource, crucial for processing loans and managing transactions. This includes the software, hardware, and infrastructure. In 2024, Affirm's platform handled a significant volume of transactions, supporting its growth. The robust platform is essential for scaling operations. Affirm's gross merchandise volume (GMV) reached $5.9 billion in Q1 2024.

Affirm's data analytics are central to its operations. They use data to assess credit risk, personalize offers, and streamline processes. In 2024, Affirm processed over $24 billion in gross merchandise volume, showing the scale of their data-driven operations. Machine learning models are key for real-time creditworthiness evaluations.

Affirm's funding capacity is crucial, allowing consumer loan extensions and growth. This relies on capital partners, warehouse facilities, and securitization. A strong base meets consumer demand and scales operations. As of December 31, 2024, Affirm boasted over $22 billion in funding capacity.

Brand Reputation

Affirm's brand reputation is a crucial asset, built on transparency and responsible lending. This positive image attracts both consumers and merchants, fostering growth. Affirm's commitment to no hidden fees and focus on improving financial lives enhances this reputation. The company's approach helps build trust and encourages wider adoption of its services.

- Affirm's 2024 report highlighted a 90% customer satisfaction rate, reflecting its strong brand image.

- In 2024, Affirm processed over $24 billion in gross merchandise volume (GMV), showcasing the impact of its brand.

- Affirm's partnerships with major retailers, such as Amazon, further solidify its brand reputation and reach.

- The company's focus on financial wellness has resonated with consumers, contributing to its positive brand perception.

Partnership Network

Affirm's robust partnership network is essential for its growth, offering diverse payment solutions and expanding its market presence. These partnerships span retailers, e-commerce platforms, and financial institutions, creating value for both consumers and merchants. As of December 31, 2024, Affirm's network included 337,000 active merchants, demonstrating its wide reach. This network is a key resource, enabling Affirm to provide seamless and flexible payment options.

- Merchant Relationships: Affirm's partnerships with retailers and e-commerce platforms are vital for providing its services.

- Financial Institutions: Collaborations with banks and other financial entities support funding and operations.

- Network Expansion: The partnership network enables Affirm to extend its reach and user base.

- Value Creation: These partnerships create value for both consumers and merchants, driving adoption.

Affirm's key resources include its technology platform, data analytics, funding capacity, brand reputation, and partnership network, all pivotal for its business model. The platform facilitates loan processing and transactions, while data analytics drive credit risk assessment. A strong brand, highlighted by 90% customer satisfaction in 2024, boosts trust and adoption.

| Resource | Description | 2024 Impact |

|---|---|---|

| Technology Platform | Software and infrastructure for loan processing. | GMV of $5.9B in Q1. |

| Data Analytics | Used for credit risk assessment and personalization. | Processed over $24B in GMV. |

| Funding Capacity | Capital partners and securitization. | Over $22B in funding capacity. |

Value Propositions

Affirm’s transparent financing is a core value proposition. They offer clear payment terms without hidden fees or compounding interest. This builds trust, enabling responsible financial management. In 2024, Affirm facilitated $24.4 billion in gross merchandise volume. They show consumers the total cost upfront, differentiating them from traditional credit options.

Affirm's flexible payment plans allow customers to spread costs over time, fitting various budgets. This boosts purchasing power, making bigger buys easier. In 2024, Affirm's payment options, including bi-weekly or monthly installments, facilitated transactions. Affirm reported a 25% increase in active consumers in Q3 2024, reflecting the appeal of flexible payments.

Affirm's value proposition centers on responsible lending, assessing each transaction individually. This method contrasts with traditional credit models. Affirm avoids late fees, ensuring its earnings align with consumer financial health. In 2024, Affirm's focus on transparency and ethical lending practices continues to be a key differentiator in the market, attracting customers.

Increased Purchasing Power

Affirm boosts consumer purchasing power, allowing purchases that might be unaffordable otherwise. This drives sales and benefits consumers and merchants. Merchants saw over 70% lift in average cart sizes in fiscal year 2024. Affirm's financing options expand what consumers can buy. This is a win-win for both sides.

- Consumer Financing: Affirm offers flexible payment plans, enabling consumers to buy now and pay later.

- Merchant Benefits: Merchants using Affirm see higher average order values and increased sales.

- Economic Impact: Increased purchasing power stimulates economic activity and growth.

- Real-World Data: Merchants reported a more than 70% lift in average cart sizes in fiscal year 2024.

Seamless Integration

Affirm's value proposition centers on seamless integration, simplifying BNPL adoption for merchants. This ease of integration drives merchant adoption and improves the customer experience. Affirm streamlines credit access at checkout, boosting conversion rates. In 2024, Affirm processed $24.2 billion in gross merchandise volume (GMV), reflecting its integration success.

- Easy Integration: Affirm's platform offers smooth integration.

- Enhanced Shopping: Improves customer experience.

- Checkout Access: Credit is easily accessible.

- GMV Growth: $24.2B GMV in 2024.

Affirm's value proposition includes transparent financing with no hidden fees and flexible payment options, increasing purchasing power for consumers. This approach builds trust and boosts sales for merchants. In 2024, Affirm’s GMV hit $24.4B, demonstrating its impact.

| Value Proposition | Key Benefit | 2024 Data |

|---|---|---|

| Transparent Financing | Builds trust and improves financial management | Facilitated $24.4B GMV |

| Flexible Payment Plans | Increases purchasing power | 25% increase in active consumers (Q3) |

| Responsible Lending | Aligns earnings with consumer financial health | No late fees |

Customer Relationships

Affirm's self-service portal allows customers to manage accounts and payments. This feature offers convenience and control over financing. In 2024, digital self-service saw a 30% increase in customer adoption. This platform helps enhance customer satisfaction by providing quick access to information.

Affirm's customer support team is available to help with questions and issues, ensuring quick and effective assistance. This approach boosts customer satisfaction and loyalty, which is crucial for repeat business. In Q3 2024, Affirm saw a 15% increase in customer satisfaction scores thanks to these efforts.

Affirm offers educational materials on its platform to educate customers about BNPL and promote responsible financial behavior. This includes articles, FAQs, and financial literacy guidance, helping users make informed choices. As of 2024, Affirm has seen a 20% increase in repeat customer transactions, suggesting the resources are effective. These resources aim to improve customer financial health and encourage responsible spending habits.

Personalized Communication

Affirm's customer relationships are built on personalized communication, sending tailored emails and notifications. These reminders about payments and account updates aim to prevent missed payments. Affirm also offers personalized payment options to fit individual financial situations. This proactive approach fosters trust and responsible financial behavior. In 2024, such strategies helped Affirm maintain a strong customer retention rate, around 80%.

- Personalized emails and notifications.

- Reminders for upcoming payments.

- Account updates and payment options.

- High customer retention.

Feedback Mechanisms

Affirm actively seeks customer feedback to refine its offerings. They use surveys and reviews to understand user experiences and identify areas for enhancement. This data-driven approach allows Affirm to meet customer needs effectively. In 2024, Affirm's customer satisfaction scores remained high, reflecting their commitment to service.

- Net Promoter Score (NPS): Historically, Affirm has maintained a strong NPS, often exceeding industry averages. Data for 2024 is still being compiled, but the trend is expected to continue.

- Review Analysis: Affirm's analysis of customer reviews helps them pinpoint specific issues or areas of praise.

- Survey Frequency: Affirm regularly conducts customer surveys to collect real-time feedback.

Affirm's customer relationships focus on personalized communications and proactive support. They offer self-service tools and an available customer support team to manage inquiries efficiently. Educational resources help customers understand BNPL and manage finances responsibly. In 2024, Affirm maintained an 80% retention rate.

| Customer Relationship | Description | 2024 Data |

|---|---|---|

| Personalized Communication | Tailored emails and notifications, payment reminders. | Maintained 80% retention rate. |

| Customer Support | Quick assistance for inquiries and issues. | 15% increase in customer satisfaction (Q3). |

| Educational Resources | Articles, FAQs, financial literacy. | 20% increase in repeat transactions. |

Channels

Affirm's integration on merchant websites is a core aspect of its business model. It allows customers to choose buy-now-pay-later (BNPL) at checkout. This integration is designed for a smooth user experience, making financing accessible. In 2024, Affirm partnered with over 250,000 merchants. This shows the widespread adoption of its checkout financing solutions.

Affirm collaborates with physical stores, letting shoppers use BNPL for in-person buys. This boosts its reach beyond online sales, offering options at self-checkout kiosks. In 2024, Affirm's in-store partnerships expanded significantly, with a reported 15% increase in transactions through this channel. This growth signals a strong consumer preference for flexible payment choices in physical retail settings.

Affirm's mobile app is a central hub for users. It allows them to manage accounts and discover new merchants. The app offers a user-friendly way to access Affirm's services. Customers can use Affirm debit cards directly within the app. In Q3 2024, Affirm processed $6.3 billion in transactions, showing the app's importance.

Affirm Card

The Affirm Card is a key part of Affirm's strategy, offering a physical card for purchases with installment loan options. This card allows users to convert eligible transactions into manageable payment plans, enhancing spending flexibility. As of 2024, the Affirm Card is designed to integrate seamlessly with Affirm's existing digital payment solutions. It provides consumers with an easy-to-use omnichannel payment method, expanding Affirm's reach.

- Offers a physical card for purchases.

- Enables installment loans for eligible transactions.

- Enhances flexibility and convenience for spending.

- Serves as an omnichannel payment method.

Digital Wallets

Affirm's integration with digital wallets, such as Apple Pay, is a key distribution channel. This partnership allows customers to use Affirm's BNPL services directly within these platforms, streamlining the payment process. In October 2024, Klarna's BNPL service was integrated into Apple Pay, offering interest-free installment options to users. This integration enhances user convenience and boosts Affirm's market presence by tapping into the vast user base of digital wallet services.

- Digital wallet integration expands Affirm's reach.

- BNPL services are accessible via platforms like Apple Pay.

- Klarna's Apple Pay integration occurred in October 2024.

- This enhances the user experience.

Affirm's diverse channels include merchant integrations for online purchases, partnerships with physical stores for in-person transactions, and a mobile app for account management. The Affirm Card offers a physical payment option with installment plans, enhancing consumer spending flexibility. Digital wallet integrations, such as with Apple Pay, streamline payments, expanding Affirm's reach.

| Channel | Description | 2024 Data/Facts |

|---|---|---|

| Merchant Integrations | BNPL at checkout | 250,000+ merchants |

| Physical Stores | In-store BNPL | 15% increase in transactions |

| Mobile App | Account management & discovery | $6.3B transactions (Q3) |

Customer Segments

Affirm focuses on online shoppers seeking flexible payments. This segment values convenience and transparency. In 2024, e-commerce sales hit $1.1 trillion in the U.S. Affirm offers point-of-sale financing to this market. They provide payment options, increasing affordability.

Millennials and Gen Z are pivotal for Affirm, drawn to BNPL and digital payments. These groups value transparency and flexibility, key Affirm features. In 2024, these cohorts drove significant BNPL adoption, with usage up 30% within this demographic. Affirm's focus aligns well with their tech-savviness and financial preferences.

Affirm's customer base includes consumers without credit cards, such as young adults and those with limited credit history. In 2024, over 36% of U.S. adults didn't have a credit card. Affirm's transparent lending practices attract these customers. This segment is crucial for Affirm's growth, as they seek accessible financing options.

Budget-Conscious Consumers

Affirm targets budget-conscious consumers looking for financial control. These users value predictable payments and transparency. Affirm's clear terms and no hidden fees resonate with these consumers. This approach helps users manage their finances effectively.

- 2024: Affirm's user base is 17.5 million active consumers.

- 2023: Affirm facilitated $24.4 billion in gross merchandise volume (GMV).

- Q1 2024: Affirm reported a 22% increase in revenue year-over-year.

Luxury Goods Buyers

Affirm's customer base now includes luxury goods buyers, who use its services to finance high-end purchases. This enables them to acquire premium items while efficiently managing their finances. The adoption of pay-later options is growing among affluent consumers. This trend is supported by data showing increased BNPL usage in higher-income households.

- Luxury brands are increasingly integrating BNPL options.

- Affirm's partnerships with luxury retailers are expanding.

- Wealthier consumers are more frequently using BNPL.

- BNPL offers financial flexibility for premium purchases.

Affirm's customer segments include online shoppers, particularly those using BNPL. Millennials and Gen Z are key users, attracted by flexibility. Consumers without credit cards also rely on Affirm. Budget-conscious buyers and luxury shoppers round out the customer base.

| Segment | Description | Key Benefit |

|---|---|---|

| Online Shoppers | E-commerce buyers seeking flexible payments. | Convenience and payment options. |

| Millennials/Gen Z | Tech-savvy, value flexibility and transparency. | Aligns with digital payment preferences. |

| No Credit Card Users | Young adults, limited credit history. | Accessible financing solutions. |

Cost Structure

Funding costs are a substantial part of Affirm's expenses, covering interest on debt and fees for capital partners. These costs fluctuate with the loan volume. In Q1 2024, Affirm's total operating expenses were $510.3 million. Securing affordable capital is crucial for offering competitive consumer terms and maintaining profitability. Affirm's ability to manage these costs directly impacts its financial health.

Transaction costs for Affirm involve processing fees, servicing expenses, and potential loan losses. These costs are incurred with every transaction on the platform. In Q1 2024, RLTC (Revenue Less Transaction Costs) as a percentage of GMV was above the 3-4% target. Managing these costs is key for Affirm's financial health.

Affirm's cost structure includes significant investments in technology and development. This encompasses expenses like engineering salaries and software licenses. In 2024, R&D spending for fintech firms averaged around 20-25% of revenue. These investments are crucial for platform enhancement. Continued innovation is key to staying competitive.

Marketing and Sales

Marketing and sales are crucial for Affirm's growth, driving merchant and customer acquisition. These costs include advertising, promotions, and sales team salaries. In 2024, marketing expenses were substantial. Affirm invested heavily to maintain its expansion.

- 2024 marketing expenses reached $425 million.

- Significant investment in advertising and promotions.

- Sales team salaries contribute to the overall cost.

- Effective marketing is key for adoption.

Credit Losses

Credit losses are a significant cost for Affirm, reflecting unrecovered loan amounts. This includes both direct write-offs and reserves for anticipated defaults. Affirm's ability to manage these losses directly impacts its profitability. Effective risk management and underwriting are crucial to controlling these expenses.

- In Q4 2024, Affirm reported a net charge-off rate of 3.5%.

- Affirm uses machine learning to assess creditworthiness.

- Provisions for credit losses are a key expense.

- Credit losses fluctuate with economic conditions.

Affirm's cost structure includes funding costs, like interest on debt, and transaction costs, such as processing fees. Marketing and sales expenses, including advertising, are substantial for growth. Credit losses represent unrecovered loan amounts, impacting profitability.

| Cost Category | Description | Key Metric |

|---|---|---|

| Funding Costs | Interest on debt and fees for capital partners. | Impacts profitability. |

| Transaction Costs | Processing fees and loan losses. | RLTC % of GMV. |

| Marketing & Sales | Advertising and sales team salaries. | 2024 expenses: $425 million. |

| Credit Losses | Unrecovered loan amounts. | Q4 2024 net charge-off rate: 3.5%. |

Revenue Streams

Affirm's merchant discount fees are a key revenue stream. They charge merchants a percentage per transaction. This rate is a primary revenue source. In 2024, Affirm's total revenue was approximately $1.7 billion, with a significant portion from these fees. Affirm earns when transactions occur on its platform.

Affirm generates substantial revenue through interest income derived from consumer loans. Interest rates fluctuate based on factors like a borrower's credit score and the loan's duration. This revenue stream is particularly vital for longer repayment plans. In Q1 2024, interest income surged by 42%, mainly due to the expansion of loans held for investment.

Affirm generates revenue through interchange fees when consumers use its card products on networks like Visa and Mastercard. These fees are a percentage of each transaction, similar to how traditional credit cards operate. In 2024, the average interchange fee in the US was around 1.5% to 3.5% depending on the card type and merchant. Affirm's income from these fees depends on the volume of transactions processed through its card. This revenue stream is crucial for Affirm's profitability and growth.

Gain on Sales of Loans

Affirm profits by selling its loans to investors. This is how Affirm recognizes the gain on the sale of loans. The gain is the difference between the price of the sale and the loans' book value. In 2023, the gain on the sale of loans surged by 138%, illustrating its importance. This growth shows Affirm’s ability to efficiently manage and sell its loan portfolio.

- Revenue: Gain on Sales of Loans

- 2023 Growth: Up 138%

- Mechanism: Sale of Loans to Investors

- Profit: Difference between sale price and book value

Servicing Income

Affirm generates servicing income by managing and collecting payments on loans, even those sold to third parties. This revenue stream is crucial for maintaining financial stability. Servicing income exhibited a robust growth of 28% in 2024, mirroring the expansion of their off-balance sheet platform portfolio. This indicates efficient loan management and collection practices. It contributes to the overall profitability and sustainability of Affirm's business model.

- Servicing income stems from managing and collecting loan payments.

- The off-balance sheet platform portfolio saw similar growth.

- Steady revenue stream is a key factor.

- This income is crucial for financial stability.

Affirm's revenue streams encompass merchant discount fees, interest income, and interchange fees. Merchant fees contributed significantly, with approximately $1.7 billion in total revenue in 2024. Interest income surged by 42% in Q1 2024, while interchange fees depend on transaction volume. Affirm also profits from the sale and servicing of loans.

| Revenue Stream | Description | 2024 Data (approx.) |

|---|---|---|

| Merchant Discount Fees | Fees charged to merchants per transaction | Significant portion of $1.7B total revenue |

| Interest Income | Income from consumer loans | Q1 2024 surge of 42% |

| Interchange Fees | Fees from card transactions | Dependent on transaction volume |

Business Model Canvas Data Sources

Affirm's canvas leverages financial reports, market analyses, and competitor insights. These elements provide an accurate and data-backed overview.