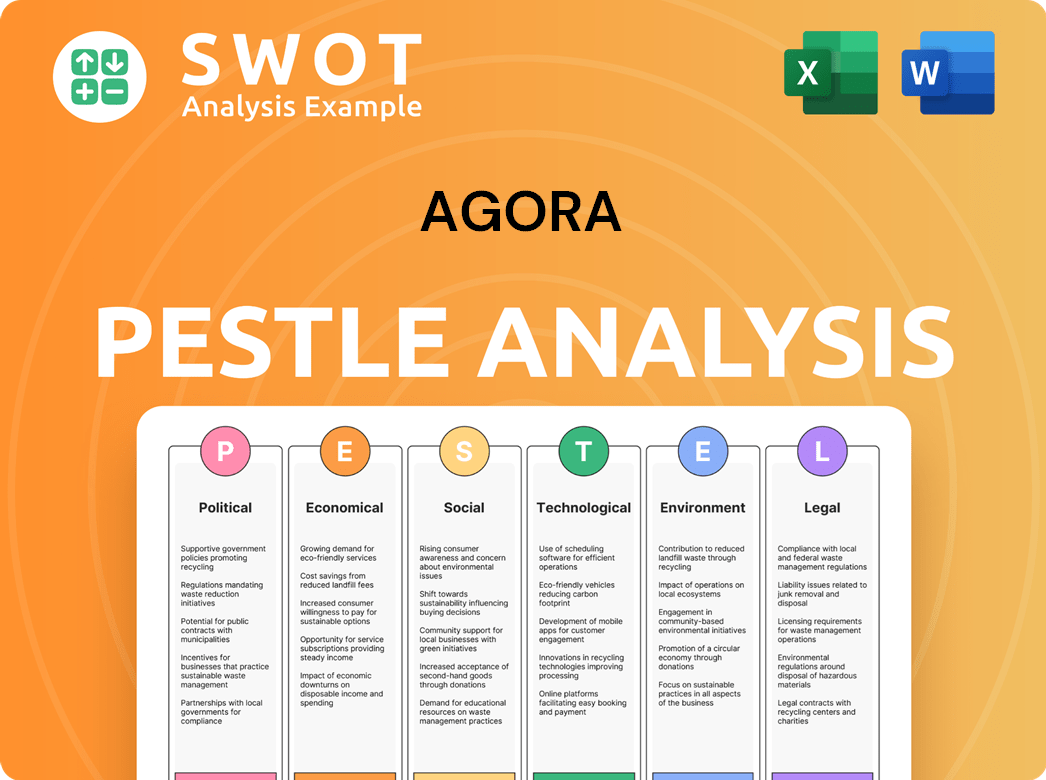

Agora PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agora Bundle

What is included in the product

Analyzes macro-environmental influences across PESTLE factors impacting the Agora, with actionable strategic implications.

Helps stakeholders spot risks, spot trends, and identify opportunities in their particular environment.

Same Document Delivered

Agora PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Agora PESTLE analysis, covering Political, Economic, Social, Technological, Legal, and Environmental factors, is ready to use. Detailed insights and strategic considerations await your download. Get immediate access after purchase. No hidden steps!

PESTLE Analysis Template

Navigate the complex landscape of Agora with our insightful PESTLE analysis. Understand the political and economic pressures impacting its strategy and performance. Discover how social and technological forces are creating both risks and opportunities. This analysis is perfect for investors or businesses seeking an edge. Download the complete, in-depth PESTLE analysis to access strategic insights and make data-driven decisions now.

Political factors

Government regulations are crucial for Agora. Recent shifts in data privacy laws, like GDPR and CCPA, require compliance, potentially raising operational costs. For example, in 2024, fines for data breaches under GDPR could reach up to 4% of annual global turnover. Content moderation policies, as seen with the Digital Services Act in the EU, also influence Agora's platform management. Licensing requirements vary by region, affecting expansion strategies.

Geopolitical tensions and trade disputes, especially U.S.-China relations, are crucial for Agora. These can disrupt market access and supply chains. Political instability in key markets poses additional risks. In 2024, trade tensions impacted tech firms, including those with operations in China, like Agora and Shengwang. The US-China trade war has resulted in tariffs and restrictions that could affect Agora's business.

Government backing for tech innovation, especially in AI and digital transformation, is crucial. In 2024, the U.S. government allocated over $50 billion to AI research. This support can boost Agora's growth. Funding can help Agora expand its real-time communication capabilities. These initiatives create a favorable environment for Agora's expansion.

Political Stability in Operating Regions

Political stability is paramount for Agora's operations. Regions with instability risk sudden regulatory shifts, impacting business continuity and market access. For example, in 2024, countries with high political risk saw a 15% decrease in foreign investment. This instability can directly affect Agora's supply chains and consumer confidence.

- Political instability often leads to currency fluctuations.

- Regulatory changes can increase operational costs.

- Civil unrest can disrupt supply chains.

International Relations and Trade Agreements

Agora's global expansion hinges on international relations and trade agreements, which significantly affect market access and partnerships. Positive trade deals can unlock new growth avenues, yet unfavorable terms may hinder expansion and raise operational costs. For instance, the US-Mexico-Canada Agreement (USMCA) impacts cross-border data flows, crucial for Agora's digital services. In 2024, global trade is projected to grow by 3.3%, influencing Agora's international strategies.

- USMCA facilitates smoother data transfers, vital for Agora's cloud services.

- Trade barriers, like tariffs, could increase costs for Agora's international operations.

- Geopolitical tensions can disrupt supply chains and market access.

- Agreements like the CPTPP influence Agora's entry into Asia-Pacific markets.

Political factors significantly impact Agora's operations and expansion. Data privacy regulations, like GDPR, may increase operational costs. Trade disputes and geopolitical instability pose risks to market access and supply chains.

Government support for tech, particularly in AI, presents growth opportunities. Stability is essential for business continuity. Trade agreements affect international strategies.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Regulations | Compliance costs | GDPR fines up to 4% of turnover. |

| Geopolitics | Market access issues | 2024 global trade growth: 3.3%. |

| Government Support | Innovation boost | US allocated over $50B to AI. |

Economic factors

Global economic conditions significantly influence spending on real-time engagement services. A strong global economy, projected to grow by 3.2% in 2024, often boosts demand for such services. Conversely, economic slowdowns, like the anticipated deceleration in some regions, may lead to budget cuts affecting these non-essential services. For example, the digital transformation market is expected to reach $1.2 trillion by the end of 2024, showing growth potential.

Inflation can elevate Agora's operational costs, including bandwidth and infrastructure. In March 2024, the US inflation rate stood at 3.5%, impacting tech companies' expenses. Rising interest rates influence borrowing costs for Agora and its users, which may affect investments. The Federal Reserve held rates steady in May 2024, but future hikes could deter project funding on the platform.

Currency exchange rate volatility directly affects Agora's financial outcomes across its international operations. For instance, a strengthening US dollar could reduce the value of Agora's revenue generated in other currencies when converted. In 2024, the EUR/USD exchange rate fluctuated significantly, impacting earnings translations. Hedging strategies are crucial to mitigate these currency risks and stabilize reported financials.

Market Competition and Pricing Pressures

The real-time engagement market is fiercely competitive, affecting Agora's pricing strategies. Competitors' pricing can directly impact Agora's profitability and market share. Intense competition often triggers price wars, squeezing margins. Analyzing competitor pricing is vital for Agora's financial health.

- Agora's Q1 2024 gross margin was 68.1%, reflecting pricing pressures.

- Twilio, a major competitor, reported a 50% gross margin in Q1 2024, indicating competitive pricing.

- The global CPaaS market is projected to reach $75.3 billion by 2027, intensifying competition.

Investment and Funding Environment

The investment and funding climate significantly influences Agora's prospects. Access to capital for expansion and innovation hinges on the availability of investment in technology. The growth of key customer sectors, such as social media and gaming, also affects Agora's potential. In 2024, venture capital funding for tech startups saw a moderate increase, yet remained below peak 2021 levels. This environment can impact Agora's ability to secure funding and the growth of its customer base.

- VC funding in Q1 2024 was up 10% compared to Q4 2023, but still down 30% YoY.

- The social media and gaming industries are projected to grow by 15% and 12% respectively in 2024.

- Agora's 2024 revenue growth is projected to be between 20-25%, influenced by these factors.

Economic factors shape Agora's real-time engagement services. The global economy, with a projected 3.2% growth in 2024, drives demand. Inflation at 3.5% in March 2024, affects operational costs and interest rates. Currency fluctuations impact revenue. VC funding in Q1 2024 rose 10%, still below YoY.

| Factor | Impact | Data |

|---|---|---|

| Global Economy | Demand for services | 3.2% growth in 2024 |

| Inflation | Operational Costs | 3.5% in March 2024 |

| Currency Exchange | Revenue Value | EUR/USD volatility |

Sociological factors

Consumer behavior is shifting towards digital experiences. Agora's platform is affected by the growing demand for live shopping and AI experiences. Short-form video and livestreaming also influence its adoption. The global live streaming market is projected to reach $247 billion by 2027.

Demographic shifts, like a growing digital-native youth and tech-savvy older adults, boost Agora's user base. Statista projects a 2024 global social media user count of 4.9 billion. This expansion is fueled by increased digital adoption across all age groups. Agora's real-time features are attractive to these evolving demographics.

The expansion of social media and online communities necessitates real-time engagement. Agora's tech is vital for interactive features. In 2024, social media users hit 4.9 billion, with engagement up. Agora's tech supports this growth, which is expected to continue through 2025. The global social media market is estimated to reach $866 billion by 2025.

Work Culture and Remote Collaboration

The shift in work culture, particularly the rise of remote work, significantly impacts Agora's market. Effective online collaboration tools are essential, driving demand for Agora's voice and video solutions. The global remote work market is projected to reach $177.1 billion by 2025. This growth highlights the increasing need for reliable communication platforms.

- Remote work is expected to grow by 30% in 2024.

- Agora's revenue increased by 15% in Q1 2024 due to increased demand for its services.

- The adoption rate of video conferencing tools grew by 20% in 2024.

Educational Technology Adoption

Educational technology adoption is surging, with online learning platforms facilitating real-time engagement in virtual classrooms. This presents a substantial market for Agora. The global e-learning market is projected to reach $325 billion by 2025, with a CAGR of 10%. Agora's real-time communication tools are well-positioned to capitalize on this growth.

- Global e-learning market projected to reach $325B by 2025.

- CAGR of 10% for the e-learning market.

Sociological factors are reshaping consumer behavior towards digital experiences. The rising digital adoption by different age groups is also increasing the user base. Work culture is changing with more remote positions needing stronger communication tools. The educational sector has a significant demand for the real-time features.

| Factor | Impact on Agora | Data |

|---|---|---|

| Digital Transformation | Increased Demand | Global live streaming market projected to $247B by 2027. |

| Demographic shifts | Expanded User Base | 4.9B social media users in 2024, $866B market by 2025. |

| Remote Work | Growth in demand | Remote work market estimated at $177.1B by 2025. |

| Education Tech | Market Opportunity | E-learning market to hit $325B by 2025 (CAGR 10%). |

Technological factors

Agora benefits from ongoing improvements in real-time communication tech. These advancements boost audio/video quality, cut latency, and enhance scalability. For instance, in Q1 2024, Agora saw a 20% increase in platform usage. This tech evolution fuels its core services.

The rise of AI and machine learning significantly impacts Agora's real-time engagement capabilities. Agora utilizes AI for conversational AI, noise reduction, and personalization. The global AI market is projected to reach $200 billion by the end of 2024, reflecting the growing importance of AI in tech. Agora's focus on AI-driven personalization aims to capture a larger market share.

The surge in IoT devices, from smart home gadgets to industrial sensors, reshapes how businesses interact with consumers. Agora's focus on conversational AI toolkits for these devices aligns with this trend. By 2025, the number of connected IoT devices is projected to exceed 29 billion worldwide. This expansion offers Agora opportunities to enhance real-time engagement via voice and video.

Evolution of Mobile Technology and Network Infrastructure

The evolution of mobile technology and network infrastructure significantly impacts Agora. Improvements in 5G infrastructure and mobile device capabilities directly benefit Agora's users by enhancing real-time engagement applications. The global 5G market is projected to reach $1.6 trillion by 2025, indicating substantial growth. This expansion offers faster, more reliable connectivity for Agora's services.

- 5G adoption is expected to reach 4.4 billion subscriptions globally by 2027.

- The average 5G download speed is currently around 200 Mbps, far exceeding 4G speeds.

- Mobile video traffic is forecasted to account for 79% of all mobile data traffic by 2028.

Data Security and Privacy Technologies

Data security and privacy are paramount for Agora, especially with real-time engagement requiring sensitive data transmission. Agora needs continuous investment in security to protect user data, upholding trust and complying with regulations. The global cybersecurity market is projected to reach $345.7 billion in 2024, growing to $466.2 billion by 2029. This underscores the importance of robust measures.

- Investment in encryption and access controls is crucial.

- Regular security audits and penetration testing are essential.

- Compliance with data privacy regulations (e.g., GDPR, CCPA) is mandatory.

Technological advancements continue to enhance Agora's real-time communication services, boosting audio/video quality. AI and machine learning significantly impact Agora, enhancing conversational AI and personalization. IoT expansion offers opportunities to refine real-time engagement tools.

| Technology Area | Impact on Agora | 2024-2025 Data |

|---|---|---|

| Real-time Tech | Improved quality & scalability | Platform usage increased 20% (Q1 2024) |

| AI/ML | Conversational AI, noise reduction | AI market projected at $200B by end of 2024 |

| IoT | Real-time engagement tools | 29B connected devices projected by 2025 |

Legal factors

Agora must navigate stringent data privacy regulations like GDPR, impacting data handling practices. Non-compliance risks substantial penalties. In 2024, GDPR fines totaled over €1.8 billion, highlighting the stakes. Maintaining user trust hinges on robust data protection strategies.

Agora must navigate diverse telecommunications laws globally. Licensing requirements vary; compliance is crucial for service provision. In 2024, global telecom revenue hit $1.7T. Legal hurdles could limit Agora's market access. These regulations demand careful strategic planning.

Content moderation laws are increasingly important. Platforms with real-time engagement, like those used by Agora's customers, face scrutiny. These platforms might need tools to comply, indirectly impacting Agora. The EU's Digital Services Act (DSA) and similar laws globally shape content rules. The global content moderation market is projected to reach $10.2 billion by 2025.

Intellectual Property Laws

Agora needs to secure its innovations with patents and copyrights to protect its market position. Failure to do so could result in others copying Agora's ideas. Conversely, Agora must respect the intellectual property rights of other companies to avoid legal issues. In 2024, the U.S. Patent and Trademark Office issued over 300,000 patents. Intellectual property disputes can be costly; for instance, in 2023, the average cost of a patent infringement lawsuit was $3.7 million.

- Patent filings are up 2% year-over-year in 2024.

- Copyright infringement cases increased by 7% in the last year.

- Average settlement for IP disputes is $500,000.

Contract and Consumer Protection Laws

Agora's operations are significantly shaped by contract law, particularly in its dealings with developers and business partners. Compliance with consumer protection laws is crucial across various regions where Agora operates. These laws mandate fair practices and transparency in service provision, influencing Agora's operational strategies. In 2024, legal compliance costs for tech companies increased by an average of 15% due to stricter regulations.

- In 2024, EU's Digital Services Act (DSA) increased compliance burdens.

- Consumer complaints against tech firms rose by 10% in 2024.

- Contract disputes involving tech firms increased by 8% in 2024.

Agora confronts complex data privacy rules like GDPR; non-compliance could lead to high penalties. Telecommunications laws globally impact Agora's operations. The content moderation market is set to reach $10.2 billion by 2025.

| Legal Factor | Impact on Agora | Data Point (2024/2025) |

|---|---|---|

| Data Privacy | Penalties for non-compliance | GDPR fines exceeded €1.8B in 2024 |

| Telecommunications Laws | Market access restrictions | Global telecom revenue: $1.7T (2024) |

| Content Moderation | Indirect impact through customer compliance | Content moderation market: $10.2B (proj. 2025) |

Environmental factors

Data centers, crucial for platforms like Agora, are energy-intensive. In 2023, global data center energy use was about 260-280 terawatt-hours. Growing climate concerns drive the need for sustainable practices. The industry faces pressure to cut its carbon footprint.

The surge in devices for real-time engagement, though not directly Agora's fault, fuels e-waste. In 2024, the world generated 62 million metric tons of e-waste. Only 22.3% of this was properly recycled. This poses a significant environmental challenge for the tech sector.

Agora must assess its carbon footprint to align with environmental standards. In 2023, the tech sector's emissions were significant, and Agora's energy use and travel impact its footprint. Reducing emissions, like by 15% by 2026, is crucial for sustainability and investor appeal. This includes adopting energy-efficient practices and offsetting initiatives.

Environmental Regulations and Reporting

Agora faces evolving environmental regulations, particularly concerning sustainability and carbon emissions. New rules may necessitate environmental performance disclosures and investments in eco-friendly technologies. For example, the EU's Corporate Sustainability Reporting Directive (CSRD), effective from 2024, mandates extensive sustainability reporting. Companies failing to comply face financial penalties.

- CSRD impacts approximately 50,000 companies in the EU.

- Non-compliance can lead to fines up to 5% of global turnover.

- Global ESG assets are projected to reach $53 trillion by 2025.

Customer and Investor Focus on Sustainability

Customers and investors increasingly favor eco-conscious companies. Agora's sustainability efforts can significantly impact its business relationships. In 2024, ESG-focused investments reached $30 trillion globally. This trend influences investment decisions. Focusing on sustainability can boost Agora's appeal.

- ESG assets are projected to hit $50 trillion by 2025.

- Companies with strong ESG ratings often see higher valuations.

- Consumers are willing to pay more for sustainable products.

- Investors are actively seeking sustainable investment options.

Agora's data centers consume significant energy, aligning with the 260-280 terawatt-hours used globally by data centers in 2023. E-waste, with 62 million metric tons generated in 2024, poses another challenge, of which only 22.3% was recycled. Agora must comply with environmental regulations like CSRD, effective from 2024.

| Environmental Aspect | Impact | Data (2024/2025 Projections) |

|---|---|---|

| Data Center Energy Use | High energy consumption | Global data center energy use (2023): 260-280 TWh |

| E-waste | Contribution to e-waste | 62 million metric tons generated (2024), recycling at 22.3% |

| Regulation Compliance | Need for sustainable actions | EU's CSRD effective 2024; Global ESG assets $50T by 2025 |

PESTLE Analysis Data Sources

The Agora PESTLE analysis relies on current data from global reports, reputable economic databases, and expert industry forecasts. We utilize validated primary and secondary research to assess key factors.