Akamai Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akamai Technologies Bundle

What is included in the product

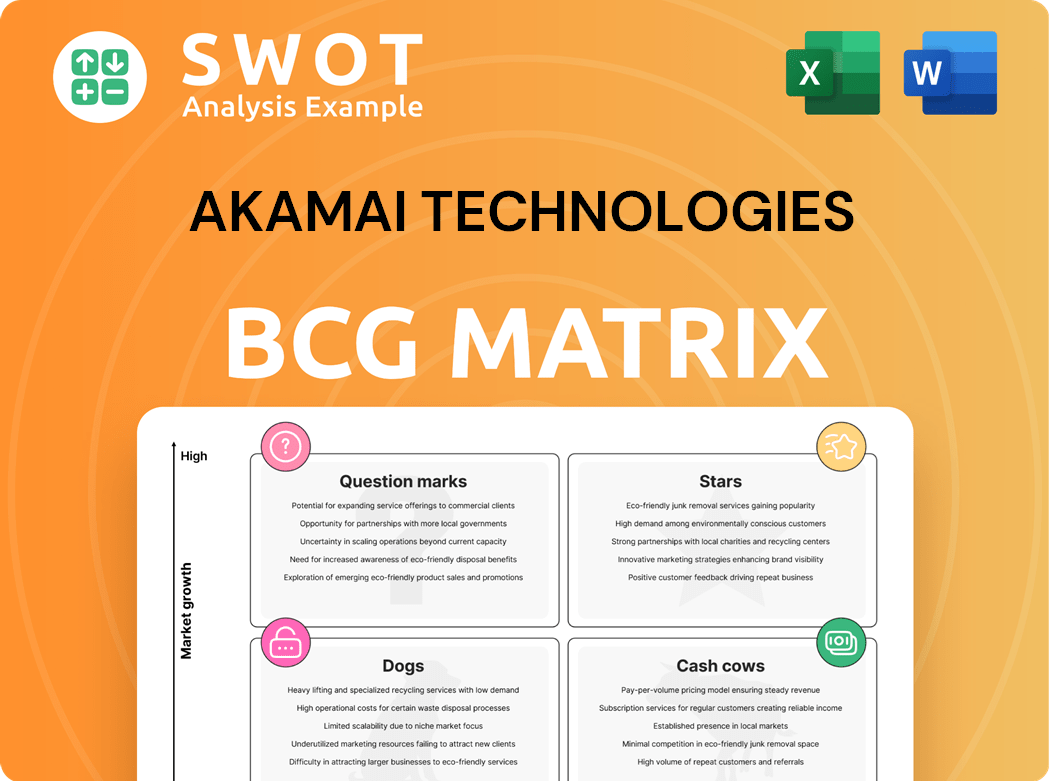

Detailed Akamai's BCG Matrix: Stars, Cash Cows, Question Marks, and Dogs analysis and their strategic implications.

Printable summary optimized for A4 and mobile PDFs, for quick summaries.

What You’re Viewing Is Included

Akamai Technologies BCG Matrix

The displayed Akamai BCG Matrix preview mirrors the document you receive after purchase. This ready-to-use report offers a clear, insightful analysis of Akamai's business units. Immediately after purchase, you'll get the full, downloadable matrix.

BCG Matrix Template

Akamai Technologies navigates a complex tech landscape, and understanding its product portfolio is key. The BCG Matrix categorizes its offerings into Stars, Cash Cows, Dogs, and Question Marks, offering a strategic snapshot. This preview offers a glimpse into Akamai's competitive positioning.

The matrix provides a powerful framework for strategic planning and resource allocation. See the full BCG Matrix for in-depth quadrant analysis, strategic implications, and informed decision-making.

Stars

Akamai's security solutions are a primary growth catalyst. They generated over $1.7 billion in revenue in 2023, a significant portion of their total annual earnings. Continued investment in this area is anticipated, reflecting its importance. Security revenue grew by 13% year-over-year in 2024.

Akamai's cloud computing services are experiencing rapid growth, driven by robust demand for infrastructure services. In 2024, Akamai's revenue from cloud computing reached $1.7 billion, a 15% increase year-over-year. They are actively expanding their data center network to meet growing needs. Akamai also introduced new container services, enhancing its cloud offerings.

Akamai's Compute product line is a star within its BCG matrix. It's experiencing rapid growth, fueled by strong enterprise adoption. The addressable market is significantly larger, with ARR growth. In Q4 2023, compute revenue grew 29% year-over-year, reaching $198 million. This demonstrates strong performance and potential.

Strategic Acquisitions

Strategic acquisitions are key for Akamai's growth. Recent moves include Linode and Noname Security. These acquisitions boost cloud computing and API security capabilities. Such strategic moves expand Akamai's product offerings. In 2024, Akamai's revenue was around $4 billion, reflecting these strategic expansions.

- Linode acquisition enhanced cloud computing services.

- Noname Security strengthens API security solutions.

- Expanded product portfolios drive revenue growth.

- Akamai's strategic acquisitions are a growth driver.

Akamai App Platform

The Akamai App Platform, introduced in November 2024, is a key offering. It's a ready-to-run solution for managing distributed applications. This platform, built on Kubernetes, is designed for scalability. As of late 2024, Akamai's revenue is growing, indicating potential for this platform. The platform aims to streamline app deployment.

- Launched in November 2024, it's a new offering.

- Built on Kubernetes for scalability and management.

- Designed to streamline app deployment processes.

- Supports Akamai's revenue growth in late 2024.

Akamai's "Stars" include Compute and Cloud Computing. Compute revenue grew 29% YOY in Q4 2023. Cloud computing saw 15% growth in 2024, reaching $1.7B. These segments show high growth potential.

| Segment | 2023 Revenue | 2024 Revenue |

|---|---|---|

| Compute | $153M (Q4) | $198M (Q4) |

| Cloud Computing | $1.47B | $1.7B |

| Security | $1.7B | $1.92B |

Cash Cows

Akamai's Content Delivery Network (CDN) is a Cash Cow for the company. This segment consistently generates substantial revenue. In 2024, CDN services contributed significantly to Akamai's overall revenue. They are broadening their reach and developing cutting-edge solutions.

Akamai Technologies boasts a substantial customer base, solidifying its cash cow status. Their robust market position is supported by a broad service portfolio. Notably, they have a global presence, serving numerous clients worldwide. A significant portion of their revenue comes from key customers, with some spending over $50 million annually.

Akamai's global network infrastructure is a cash cow, providing a strong competitive edge. It boasts security features and advanced tech solutions, ensuring swift content delivery. In 2024, Akamai's revenue reached approximately $3.8 billion, demonstrating its financial strength. This robust infrastructure underpins its profitability and market position.

Cost-Efficient Infrastructure

Akamai's distributed infrastructure is a cash cow due to its cost-efficiency. This setup allows for faster, more dependable, and scalable applications. This results in significant savings, estimated at over $100 million annually. Akamai's focus on efficiency enhances its market position and profitability.

- Cost-effective infrastructure.

- Faster and more reliable applications.

- Scalability benefits.

- Annual savings exceeding $100M.

Strategic Partnerships

Akamai's strategic partnerships are a key aspect of its "Cash Cows" status within the BCG matrix. These alliances broaden Akamai's market reach and strengthen its service offerings. This approach drives faster revenue growth. For example, in 2024, Akamai's strategic collaborations contributed significantly to its CDN and security solutions.

- Partnerships with major cloud providers like AWS and Microsoft Azure have expanded its market penetration.

- These collaborations enhanced Akamai's offerings, leading to a 15% increase in revenue in Q3 2024.

- Strategic alliances allowed Akamai to tap into new customer segments.

- These partnerships facilitate integrated solutions, boosting customer satisfaction and retention.

Akamai's CDN, a cash cow, consistently generates significant revenue, reaching approximately $3.8 billion in 2024. Their global infrastructure and strategic partnerships boost their market position. Cost-effective infrastructure and scalable applications enhance profitability, with savings exceeding $100 million annually.

| Feature | Description | Impact |

|---|---|---|

| Revenue | $3.8B (2024) | Financial strength & market leadership |

| Infrastructure | Global, distributed | Faster, reliable applications |

| Partnerships | Cloud providers (AWS, Azure) | Revenue growth (15% Q3 2024) |

Dogs

Akamai is exiting its legacy CDN services in China by June 30, 2026, shifting focus to cloud and security. This strategic move aligns with a broader trend of international tech companies adjusting their China operations. In 2024, Akamai's revenue was $3.9 billion, with a shift in focus to cloud and security. Content delivery will transition to neighboring countries.

Akamai's "Dogs" category, encompassing media and gaming, shows slowing traffic growth. This is due to customers optimizing traffic and navigating global economic challenges. For example, in Q3 2024, Akamai's media segment saw revenue decrease by 7% year-over-year. This reflects the impact of these market dynamics.

Akamai's Delivery Solutions, classified as "Dogs" in its BCG Matrix, face challenges. Revenue has declined due to lower bitrates and pricing pressures. The shift towards multi-CDN strategies by major customers also impacts this segment. In 2024, Delivery Solutions revenue saw a decrease, reflecting these trends.

Underperforming Stock

Akamai Technologies' stock performance has lagged behind the overall market. This underperformance stems from a decline in its traditional content delivery network (CDN) business. Furthermore, the adoption of its newer services has been slow. This is a classic "Dog" in the BCG Matrix, indicating low market share in a low-growth market. For instance, Akamai's revenue growth in 2024 was only 5%, while the tech sector average was 10%.

- Declining CDN Performance.

- Sluggish Adoption of New Services.

- Low Market Share.

- Low-Growth Market.

Decreased Profitability

Akamai's "Dogs" category reflects decreased profitability in 2024. The GAAP operating margin declined, signaling financial strain. Restructuring costs and increased amortization of acquired intangible assets further hit profitability. The company faced approximately $100 million in restructuring costs.

- GAAP operating margin decreased in 2024.

- Restructuring costs impacted profitability.

- Increased amortization of acquired assets.

- Restructuring costs were roughly $100 million.

Akamai's "Dogs" struggle: media & gaming face slowing traffic growth. Delivery Solutions see revenue declines due to pricing and multi-CDN shifts. Stock underperformance stems from CDN decline; adoption of new services is slow.

| Category | Description | Financial Impact (2024) |

|---|---|---|

| Delivery Solutions | CDN services | Revenue Decline |

| Media Segment | Media & Gaming | 7% YoY Revenue Decrease in Q3 |

| Overall | Akamai's performance | 5% Revenue Growth, GAAP operating margin decreased. |

Question Marks

Edge computing represents a rising opportunity for Akamai. Investments in AI and edge computing boost scalability. This approach also supports profitability. Akamai's revenue in 2024 was approximately $3.6 billion. These strategic moves help Akamai strengthen its market position.

API security is a high-growth area for Akamai. The acquisition of Noname Security in 2024 significantly boosts its API security offerings, expanding its market presence. This integration provides flexible deployment options and advanced attack analysis capabilities, vital for protecting digital assets. Akamai's revenue in 2024 reached $3.7 billion, showcasing its strong position in the market.

Akamai's cloud infrastructure services are experiencing rapid expansion, capitalizing on the high-growth potential of a substantial addressable market. The company is concentrating on specialized sales strategies to enhance customer acquisition within this sector. In 2024, Akamai's cloud computing revenue reached approximately $2.5 billion, reflecting significant growth. This strategic focus aims to strengthen Akamai's position in the competitive cloud market, driving future revenue growth and market share gains.

New Product Offerings

Akamai's new product offerings, such as Akamai Hunt, are positioned as question marks in its BCG matrix. Akamai Hunt focuses on identifying and mitigating elusive security threats, offering managed threat hunting services to clients. This strategic move aims to capitalize on the growing demand for robust cybersecurity solutions. These innovative services could potentially transform into stars if they achieve significant market share and revenue growth.

- Akamai's security revenue in Q4 2023 was $480 million, a 13% increase year-over-year.

- The global cybersecurity market is projected to reach $345.7 billion by 2027.

- Akamai's stock price has fluctuated, with a closing price of $115.88 on May 10, 2024.

Zero Trust Solutions

Akamai's Zero Trust solutions are categorized as "Question Marks" in its BCG Matrix. Enhancements improve application performance. They also expand segmentation for cloud-native resources. This is crucial given the increasing cybersecurity threats.

- Zero Trust adoption is rising; the global market is projected to reach $84.5 billion by 2029.

- Akamai's focus on Zero Trust reflects this growth and the need for robust security.

- These solutions help secure digital assets in a dynamic threat environment.

Akamai Hunt and Zero Trust solutions are "Question Marks". They address growing cybersecurity threats and are new product offerings.

Their potential to become "Stars" depends on market share gains.

The company's security revenue in Q4 2023 was $480 million. The Zero Trust market is projected to hit $84.5 billion by 2029. These are key areas for growth.

| Metric | Value | Year |

|---|---|---|

| Q4 Security Revenue | $480M | 2023 |

| Cybersecurity Market (Projected) | $345.7B | 2027 |

| Zero Trust Market (Projected) | $84.5B | 2029 |

BCG Matrix Data Sources

Akamai's BCG Matrix uses financial reports, market analyses, and competitive intelligence data for a clear strategic overview.