Aker Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aker Solutions Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Export-ready design allows quick drag-and-drop into any presentation.

Delivered as Shown

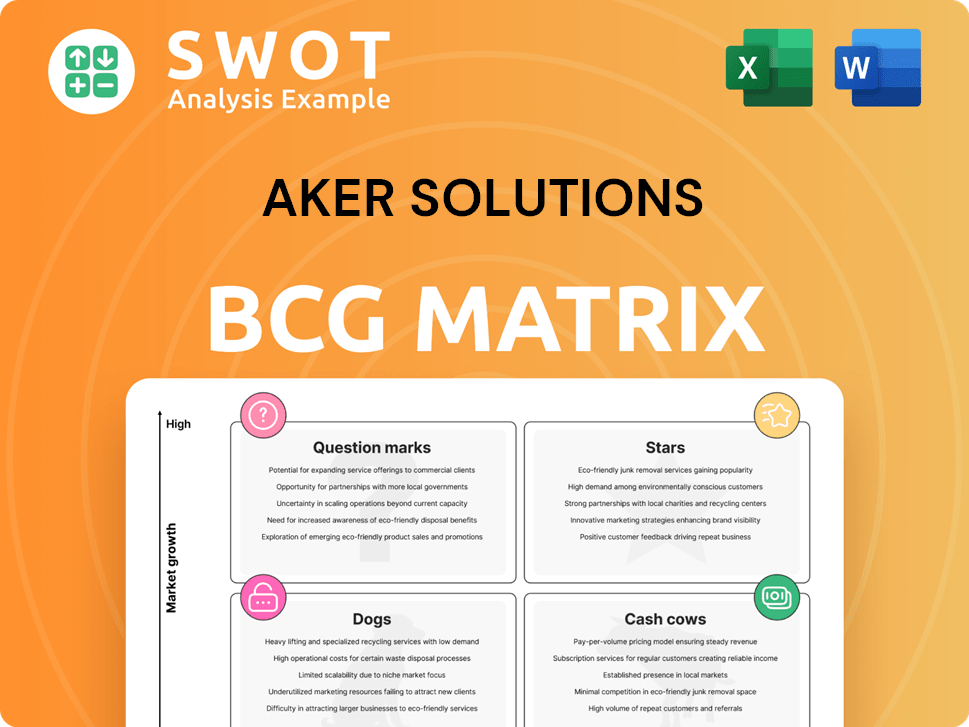

Aker Solutions BCG Matrix

The Aker Solutions BCG Matrix preview mirrors the complete, downloadable document. Upon purchase, you receive the full, professionally crafted strategic analysis tool. This ready-to-use matrix offers instant insights—no extra steps required. Get immediate access to a detailed report designed for impactful decision-making.

BCG Matrix Template

Aker Solutions' diverse portfolio spans from subsea systems to renewable energy solutions. Understanding where each product sits in the market is key. This preview touches on how the BCG Matrix categorizes their offerings.

Explore the "Stars," potential "Cash Cows," risky "Question Marks," and underperforming "Dogs." The full matrix clarifies resource allocation strategies for growth and stability.

This glimpse hints at Aker Solutions' strategic balance and market position. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Aker Solutions shines in subsea systems, a market poised for significant expansion. This is fueled by deepwater exploration and advanced subsea tech. Their expertise in subsea production equipment solidifies their leadership. For 2024, the subsea market is valued at approximately $40 billion, with an expected annual growth of 5-7%.

The Renewables and Field Development segment at Aker Solutions is a star, demonstrating substantial revenue growth and improved margins. This segment's success is fueled by strong project execution and a strategic focus on the expanding energy sector. Aker Solutions' 2024 revenue increased by 18% year-over-year, with the renewables sector contributing significantly. Delivering standardized solutions for CCUS projects further solidifies its market position.

Aker Solutions' engineering consultancy services, a "Star" in its BCG matrix, saw robust revenue growth in 2024, especially in renewables. Their consultancy business showed a 15% increase in revenues. Early market engagement in transitional energy projects fosters new client relationships and future growth, with a 20% increase in project wins in these areas.

Carbon Capture and Storage (CCS) Projects

Aker Solutions is actively involved in Carbon Capture and Storage (CCS) projects, demonstrating its commitment to sustainable solutions. The company has secured contracts for major CCS initiatives, including the Northern Lights project. This strategic focus allows Aker Solutions to offer standardized solutions across the CCUS value chain. Their experience in CCS is helping to reduce costs and establish Norway as a leader in this domain.

- In 2024, Aker Solutions secured a NOK 1.5 billion contract for the Northern Lights project.

- The company aims to reduce CCS costs by 30% by 2026 through standardization and innovation.

- Norway's CCS initiatives are expected to capture and store 5-10 million tonnes of CO2 annually by 2030.

- Aker Solutions' CCS projects support the global goal of achieving net-zero emissions.

Integrated Solutions for Low-Carbon Oil and Gas Production

Aker Solutions specializes in integrated solutions for low-carbon oil and gas production, serving the global energy industry. Their focus on sustainability helps clients reduce emissions, aligning with market trends. This expertise positions them well for future growth. In 2024, the company's revenue reached approximately NOK 30 billion, with a growing emphasis on sustainable solutions.

- Focus on low-carbon solutions.

- Strong revenue in 2024.

- Adaptation to market demands.

- Integrated service approach.

Aker Solutions' "Stars" include subsea systems, renewables, field development, and engineering consultancy, all exhibiting robust growth. These segments drive significant revenue gains and margin improvements, fueled by strategic market positioning and strong project execution. In 2024, key areas like renewables saw substantial increases.

| Segment | 2024 Revenue Growth | Key Drivers |

|---|---|---|

| Subsea Systems | 5-7% market growth | Deepwater exploration, advanced tech. |

| Renewables | 18% YoY revenue increase | Strong project execution, expanding energy sector. |

| Engineering Consultancy | 15% revenue increase | Focus on renewables, transitional energy projects. |

Cash Cows

Aker Solutions' Life Cycle Services is a Cash Cow, demonstrating consistent performance. In 2024, this segment improved EBITDA margins, thanks to strong operational performance. These services, including maintenance and modifications, are crucial for safe and efficient customer operations. They provide a stable revenue stream, with room for enhanced efficiency.

Aker Solutions' maintenance and modification services are a Cash Cow. They have a strong partnership with Vår Energi. This relationship, and their status as a preferred partner, shows customer value. A frame agreement ensures consistent revenue. In 2024, Aker Solutions secured a contract extension with Vår Energi, worth approximately NOK 1.5 billion.

Aker Solutions focuses on Engineering, Procurement, and Construction (EPC) projects within the oil and gas sector. The company is committed to aiding clients in minimizing their environmental impact, which is a key market driver. Their EPC expertise and reliable project execution are highly valued. Aker Solutions targets projects with a balanced risk-reward ratio to ensure profitability; in 2024, the company's revenue reached approximately $3.5 billion.

Subsea Umbilical, Risers and Flowlines (SURF)

The subsea market, particularly for SURF, is set for substantial investment, with operator spending on the rise. Aker Solutions is a key player, leveraging its SURF expertise and integrated solutions to capture market share. Their focus on cost reduction aligns with industry demands, positioning them for success. In 2024, the subsea market is estimated to be worth over $60 billion globally.

- Aker Solutions' SURF segment is expected to see increased demand.

- Focus on integrated solutions is a key competitive advantage.

- Cost reduction strategies are critical for profitability.

Partnership with Aker BP

Aker Solutions' partnership with Aker BP is a prime example of a "Cash Cow" within its BCG matrix. This partnership, built on a well-established alliance model, significantly contributes to a robust order backlog, ensuring a stable revenue stream. The alliance model offers a reliable foundation for growth, allowing Aker Solutions to capitalize on its expertise in EPC projects and subsea systems. Close collaboration with Aker BP facilitates a consistent flow of projects. The secured order backlog with Aker BP was approximately NOK 17 billion in 2024.

- The alliance model secures a steady revenue stream for Aker Solutions.

- EPC projects and subsea systems are key areas of expertise.

- Collaboration with Aker BP fosters innovation.

- The order backlog with Aker BP was about NOK 17 billion in 2024.

Cash Cows, like Aker Solutions' Life Cycle Services and partnerships with Vår Energi and Aker BP, generate consistent revenue.

These segments benefit from established relationships and strong operational performance, supporting their status.

In 2024, Aker Solutions' order backlog with Aker BP was approximately NOK 17 billion, highlighting the financial strength of these partnerships.

| Segment | Description | 2024 Revenue/Backlog |

|---|---|---|

| Life Cycle Services | Maintenance & Modifications | Improved EBITDA margins |

| Vår Energi Partnership | Frame Agreement | NOK 1.5 billion (contract extension) |

| Aker BP Partnership | Alliance Model | NOK 17 billion (order backlog) |

Dogs

Additional losses in legacy renewables projects, slated for 2025 completion, have impacted Aker Solutions' results. These projects, nearing their end, may be classified as dogs due to limited returns. For Q4 2023, the company reported a loss of NOK 1.2 billion, partially due to these projects. Aker Solutions must prioritize minimizing losses and shifting to more profitable areas.

Aker Solutions' diversification efforts haven't always succeeded, with some ventures underperforming. These underachieving areas are classified as dogs, failing to yield strong returns and possibly consuming resources. For instance, in Q3 2024, a specific project saw a 15% cost overrun. Aker Solutions must assess these ventures. They should consider selling or reorganizing them to boost profits.

Some of Aker Solutions' fixed-price contracts have faced cost overruns, diminishing profits. These contracts, underperforming financially, are classified as dogs. Aker Solutions must closely manage these contracts to curb losses. In 2024, the company reported a decrease in profitability due to project cost overruns.

Services in declining markets

Aker Solutions might find certain services in declining markets, potentially classifying them as "dogs" within the BCG matrix. These services may struggle to generate substantial revenue and face heightened competition. For instance, in 2024, the subsea market saw a slight contraction, indicating potential challenges for related Aker Solutions services. The company should consider strategic actions like divestiture or restructuring to reallocate resources.

- Subsea market contraction in 2024.

- Increased competition in declining markets.

- Strategic options: divestiture or restructuring.

- Focus on more profitable areas.

Investments in sunsetting technologies

Investments in sunsetting technologies by Aker Solutions could be classified as dogs within the BCG matrix. These investments, in technologies becoming obsolete, may not yield expected returns and could diminish in value. Aker Solutions needs to thoroughly assess these assets and possibly divest or repurpose them to mitigate losses. For instance, in 2024, Aker Solutions faced challenges in certain legacy projects, reflecting potential risks in outdated technologies.

- Obsolescence Risks: Investments in outdated tech face value erosion.

- Financial Impact: Underperforming assets can drag down profitability.

- Strategic Response: Divestment or repurposing can unlock value.

- Real-World Example: Legacy projects may show declining returns.

Aker Solutions categorizes underperforming ventures, such as legacy renewables projects slated for 2025 completion, as "dogs" in its BCG matrix. These projects, nearing completion, contributed to a Q4 2023 loss of NOK 1.2 billion. Diversification efforts, including projects with 15% cost overruns in Q3 2024, also fell into this category. To mitigate losses, Aker Solutions considers selling or restructuring these ventures.

| Category | Issue | Financial Implication |

|---|---|---|

| Legacy Projects | Cost overruns, completion risks | Q4 2023 loss: NOK 1.2 billion |

| Diversification | Underperforming ventures | Project cost overrun: 15% in Q3 2024 |

| Strategic Action | Divestiture or restructuring | Improve profitability |

Question Marks

Aker Solutions is strategically investing in energy transition technologies. These include innovations like floating wind foundations and subsea cooling systems. Currently, these technologies exhibit high growth potential. However, they still have a relatively low market share. To capture significant market share, Aker Solutions must increase its investments.

Aker Solutions is venturing into data-driven services, leveraging its expertise. These services aim to create new revenue and boost efficiency. Despite potential, they currently have low market share. Scaling up these services demands significant investment, as seen in 2024's financial reports.

Aker Solutions' CCUS ventures, despite securing contracts, operate in a nascent market. This positions CCUS technologies as "Question Marks" in its BCG matrix. These technologies show significant growth potential yet currently hold a low market share. Aker Solutions should increase its investments in CCUS, aiming to build partnerships, to gain a competitive advantage. In 2024, the global CCUS market was valued at approximately $5 billion, showing a rapid growth trajectory.

Solutions for Offshore Wind

Aker Solutions is focusing on offshore wind solutions, including floating wind foundation designs. Despite the rapidly expanding offshore wind market, the company currently holds a low market share. To capitalize on this growth, significant investment in these solutions is crucial for Aker Solutions. This strategic move aims to increase market share and establish the company as a key player in the offshore wind sector.

- Market growth: The global offshore wind market is projected to reach $1.3 trillion by 2030.

- Investment: Aker Solutions plans to invest significantly in its offshore wind capabilities.

- Strategic Goal: Increase market share to become a leader in offshore wind.

- Competitive Landscape: Facing strong competition from established players.

New Build Projects

Aker Solutions' involvement in new build projects places them in the "Question Marks" quadrant of the BCG Matrix. These projects often boast high growth potential, but Aker Solutions may have a low market share initially. They require significant upfront investment, which might not yield immediate financial returns.

Careful management is crucial to ensure these projects align with Aker Solutions' broader strategic objectives. The company must assess risks and opportunities thoroughly.

This strategic approach helps Aker Solutions capitalize on growth opportunities effectively.

- New build projects are characterized by high growth prospects.

- These projects necessitate substantial capital investments.

- Returns on investment may not be immediate.

- Strategic alignment is essential for success.

Aker Solutions' "Question Marks" include CCUS and offshore wind. They have high growth potential but low market share. Significant investment is needed to gain ground, despite the market risks.

| Aspect | Details | Financial Impact |

|---|---|---|

| CCUS Market (2024) | $5B, rapidly growing | Requires high investment. |

| Offshore Wind | $1.3T market by 2030 | Significant investment needed. |

| New Build Projects | High growth, initial low share | Upfront investment, strategic importance. |

BCG Matrix Data Sources

This BCG Matrix is built on reliable data from company financial statements, market research, and industry forecasts for accurate insights.