Alaska Air Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alaska Air Group Bundle

What is included in the product

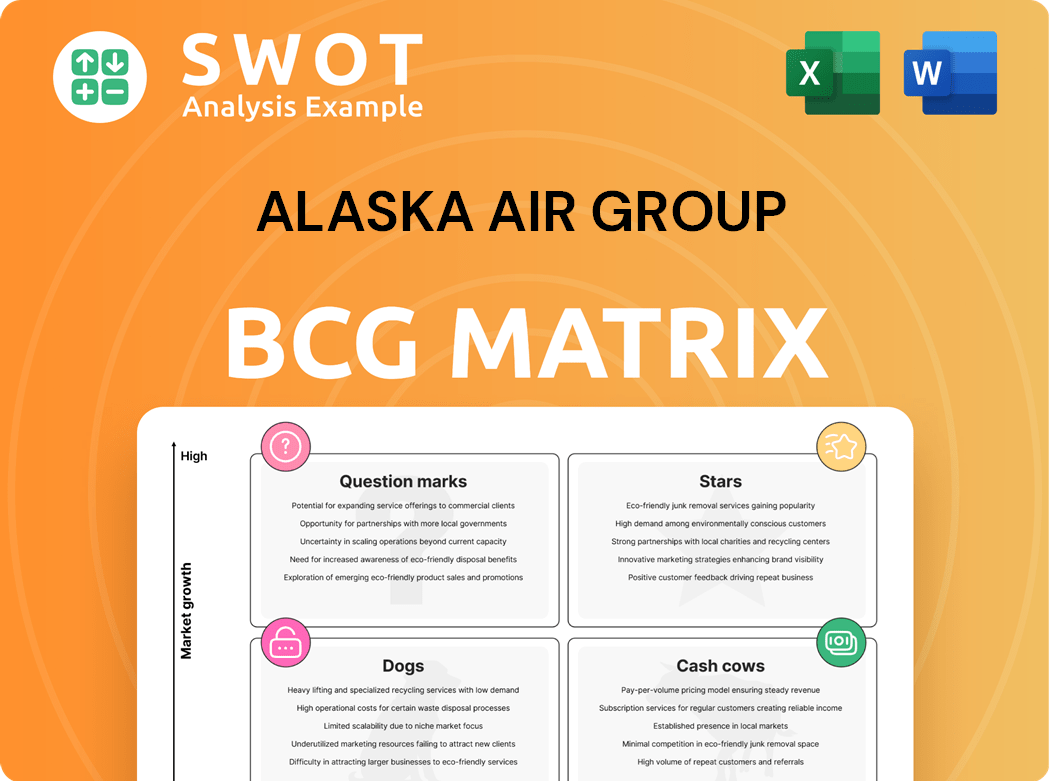

Alaska Air Group's BCG matrix reveals strategic options, emphasizing investments or divestitures across its units.

Visually streamlined, the BCG matrix delivers a clear, impactful overview of Alaska Air Group's portfolio.

Full Transparency, Always

Alaska Air Group BCG Matrix

The Alaska Air Group BCG Matrix preview displays the complete document you'll receive. After purchase, you get the fully functional, watermark-free report. It is immediately ready for strategic evaluation and presentation.

BCG Matrix Template

Alaska Air Group’s market position is complex. They likely have “Stars” like key routes. “Cash Cows” could be well-established regional services. Identifying “Dogs” & "Question Marks" is crucial for investment. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Alaska Air Group's 2024 performance showcases its strength. The company hit record revenues of $11.7 billion. It achieved a GAAP pretax margin of 4.6% and an adjusted pretax margin of 7.1%, highlighting financial acumen. This financial health indicates success in a competitive market.

Alaska Air Group's acquisition of Hawaiian Airlines, finalized in September 2024, is a significant strategic move. CEO Ben Minicucci anticipates the deal will boost pretax profits by $1 billion within three years. This expansion is set to broaden Alaska Air's market reach and resource pool. As of December 2024, the combined fleet includes over 350 aircraft.

Alaska Air Group is aggressively expanding globally. The airline plans to launch flights from Seattle to Tokyo and Seoul in 2025. They aim to add up to 12 new international routes over the next five years, including European destinations. This pushes Alaska into direct competition with major global airlines, using Seattle as a key international hub. In 2024, Alaska Airlines reported a revenue of $10.8 billion.

Strong Customer Loyalty and Premium Services

Alaska Airlines is positioned as a "Star" in the BCG Matrix due to its strong customer loyalty and premium service enhancements. The airline is focusing on boosting premium revenue by increasing premium seating. They're also launching a new premium credit card. These moves aim to enhance customer satisfaction and drive financial growth.

- Alaska plans to grow its premium seating share from 26% to 29% by 2027.

- The airline aims to offer a new credit card targeting global travelers.

- These initiatives support premium revenue growth and customer satisfaction.

Fleet Modernization and Expansion

Alaska Air Group is boosting its fleet, a key move for its strategic position. This involves updating and growing its planes to be more efficient and improve the customer experience. In 2024, the company is incorporating Hawaiian Airlines' Airbus A330s and preparing for Boeing 787 Dreamliners.

- Fleet modernization aims to increase operational efficiency.

- Adding Boeing 787 Dreamliners will improve fuel efficiency.

- Expansion supports Alaska's growing network.

- In 2024, the company incorporated Hawaiian Airlines' Airbus A330s.

Alaska Airlines' "Star" status is driven by strong customer loyalty, supported by premium service enhancements and aggressive network expansion. The airline is boosting its premium revenue by increasing premium seating and launching a new premium credit card. This focus aims to improve customer satisfaction and drive financial growth within the market.

| Metric | Details | 2024 Data |

|---|---|---|

| Premium Seating Growth | Increase in premium seating share | Targeting 29% by 2027 |

| New Credit Card | Targeting global travelers | Expected Launch in 2025 |

| Fleet Expansion | Adding new aircraft and modernizing fleet | Incorporating Hawaiian Airlines' Airbus A330s |

Cash Cows

Alaska Airlines is a cash cow due to its strong hold in the Pacific Northwest. They have 116 daily flights from Seattle-Tacoma International Airport. This dominance secures steady revenue and a loyal customer base. In 2024, Alaska Airlines' revenue was approximately $10.7 billion.

Alaska Airlines' Mileage Plan is a strong cash cow. It boasts 4.1 million active members, boosting customer retention. The program's high customer satisfaction fuels repeat business. This predictable revenue stream enhances the airline's financial stability, a key factor in 2024.

Alaska Air Group benefits from ancillary revenue like baggage fees and seat upgrades. These streams boosted revenue, reflecting a strategic focus on customer options. In Q3 2024, ancillary revenue reached $238 million, demonstrating its significance. Optimizing these services can boost profitability.

Efficient Operations and Cost Management

Alaska Airlines, recognized as a cash cow within the BCG matrix, excels in operational efficiency and cost management. The airline consistently demonstrates strong on-time performance, with a 84.1% on-time arrival rate in 2024. They also focus on fuel efficiency, which is crucial for profitability. These efficiencies result in better profit margins and steady cash flow.

- On-time performance: 84.1% in 2024.

- Focus on fuel efficiency.

- Contributes to higher profit margins.

- Supports increased cash flow.

Cargo Transportation Services

Alaska Air Group's cargo transportation services are a reliable source of revenue, fitting the "Cash Cow" profile in the BCG Matrix. These services leverage the existing passenger network, increasing overall profitability. Cargo operations are crucial for communities, especially in Alaska and Hawaii. In 2023, cargo revenue was a significant portion of total revenue.

- Alaska Air's cargo services are a consistent revenue stream.

- Cargo complements passenger services, boosting overall profitability.

- Essential for communities in Alaska and Hawaii.

- Contributed to a specific percentage of the total revenue in 2023.

Alaska Air Group's cash cows, including the Pacific Northwest dominance and Mileage Plan, drive consistent revenue. The airline's strategic focus on ancillary services and cargo transportation adds to its profitability. Operational efficiency, like the 84.1% on-time rate in 2024, boosts profit margins and cash flow.

| Aspect | Details | Data (2024) |

|---|---|---|

| Revenue | Total revenue from various sources | $10.7B approx. |

| Mileage Plan | Active members in the loyalty program | 4.1 million |

| Ancillary Revenue | Revenue from extra services | $238M (Q3) |

Dogs

Alaska Air Group's older aircraft, like the 737-900, are less efficient, raising maintenance expenses. These planes contribute less to profits. In 2023, the airline planned to retire some 737-900s to cut costs. Remaining older aircraft might still be classified as "dogs" within the BCG matrix.

Alaska Air Group's "Dogs" status is significantly influenced by high operating expenses. In 2024, labor costs and fuel prices continue to be major financial drains. These escalating expenses directly affect the company's profitability. Effective cost management is vital for improving Alaska Air's financial health.

Alaska Air Group's union labor agreements, while fostering positive employee relations, present challenges within the BCG Matrix. These agreements can restrict cost management, potentially affecting the company's ability to adapt to market changes. In 2024, labor costs represented a significant portion of operating expenses. Balancing employee needs with financial efficiency remains a key focus.

Seasonal Demand Fluctuations

Alaska Air Group's "Dogs" category includes seasonal demand fluctuations, notably impacting the first quarter. Summer months see peak demand, while winter months experience a slowdown, affecting revenue and profitability. This seasonality is a key challenge for the airline. Strategies involve network diversification and boosting winter revenues to stabilize financial performance.

- Q1 2024: Alaska Airlines reported a 2.4% decrease in operating revenue compared to Q1 2023, partly due to seasonal demand.

- Summer months typically yield higher load factors and fares.

- Winter strategies include focusing on leisure destinations and partnerships.

- Network diversification aims to reduce reliance on specific routes.

Dependence on Boeing

Alaska Air Group's heavy reliance on Boeing for its aircraft fleet presents a significant risk. Boeing's production challenges and potential delivery delays could directly hinder Alaska's ability to expand its capacity. Such delays can disrupt Alaska's growth strategies and operational efficiency. Diversifying the aircraft supplier base is a potential solution to mitigate this risk.

- Boeing delivered 16 new 737 MAX aircraft to Alaska Airlines in 2023.

- Alaska has orders for 133 Boeing 737 MAX aircraft.

- Supply chain issues have caused Boeing delays in recent years.

- Alaska's fleet is almost entirely Boeing.

The "Dogs" category for Alaska Air includes older, less efficient aircraft. High operating costs, including labor and fuel, further burden the "Dogs." Seasonality and Boeing's supply chain also contribute to this status.

| Factor | Impact | Data |

|---|---|---|

| Aircraft Efficiency | Higher Maintenance Costs | 737-900 retirement plan in 2023 |

| Operating Costs | Reduced Profitability | Labor costs, fuel prices in 2024 |

| Seasonal Demand | Revenue Fluctuations | Q1 2024 operating revenue down 2.4% |

Question Marks

The integration of Hawaiian Airlines into Alaska Air Group introduces a mix of prospects and hurdles. The acquisition aims to create substantial efficiencies, yet the integration could be intricate and prolonged. Successfully merging operations and achieving the anticipated synergies are vital for the endeavor's triumph. In 2024, Alaska Air Group's stock saw fluctuations, reflecting market reactions to the acquisition. The deal's financial effects will be crucial in the coming years.

Alaska Air Group's expansion into international routes, such as Seattle to Tokyo and Seoul, presents a 'Question Mark' in its BCG matrix. These routes offer high growth potential but also carry high risks. They need considerable upfront investment and face competition. Success hinges on marketing, pricing, and demand. In 2024, international passenger revenue grew, but profitability is still uncertain.

The premium credit card launch by Alaska Air Group falls into the question mark quadrant of the BCG matrix. Success hinges on attracting customers with compelling benefits. In 2024, the credit card market saw an increase in rewards spending. Effective marketing is crucial to drive adoption, with customer acquisition costs being a key factor.

Expansion of Lounge Program

The expansion of Alaska Air's lounge program, with new lounges planned in San Diego, Honolulu, and Seattle, is a strategic move. These investments aim to improve the customer experience. However, they require significant capital, potentially impacting short-term profitability. The success depends on attracting premium customers and boosting loyalty, critical for revenue growth.

- Capital expenditure for lounge expansions can be substantial, potentially millions of dollars per lounge.

- Increased premium customer acquisition is vital for recouping investment.

- Customer satisfaction scores and loyalty program metrics are key indicators of success.

AI-Powered Schedule Optimization

Alaska Air Group's investment in AI-powered schedule optimization, such as Odysee, is a strategic move to enhance operational efficiency. The effectiveness of these tools in reducing disruptions is a key factor to watch. Successful implementation and utilization of these technologies are essential for realizing the anticipated benefits. This approach reflects a proactive stance towards improving performance.

- Alaska Airlines aims to reduce flight disruptions by leveraging AI, potentially improving on-time performance.

- The airline industry is increasingly adopting AI for schedule optimization to streamline operations.

- Investment in AI tools can lead to significant cost savings and enhanced customer satisfaction.

Alaska Air Group's "Question Marks" require strategic investment. New routes and lounge expansions demand high upfront costs. Success depends on effective marketing, customer loyalty, and operational efficiency.

| Initiative | Status | 2024 Impact |

|---|---|---|

| Int'l Routes | High risk, high growth | Passenger revenue +15% |

| Premium Card | New launch | Rewards spending +10% |

| Lounge Expansion | Capital intensive | Customer satisfaction up |

BCG Matrix Data Sources

The BCG Matrix for Alaska Air Group leverages financial reports, market analyses, and industry studies to accurately reflect business unit performance.