Albertsons Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Albertsons Bundle

What is included in the product

Tailored analysis for Albertsons' product portfolio, highlighting strategic investment, holding, or divest decisions.

Export-ready design for quick drag-and-drop into PowerPoint, so you can quickly present the analysis.

What You’re Viewing Is Included

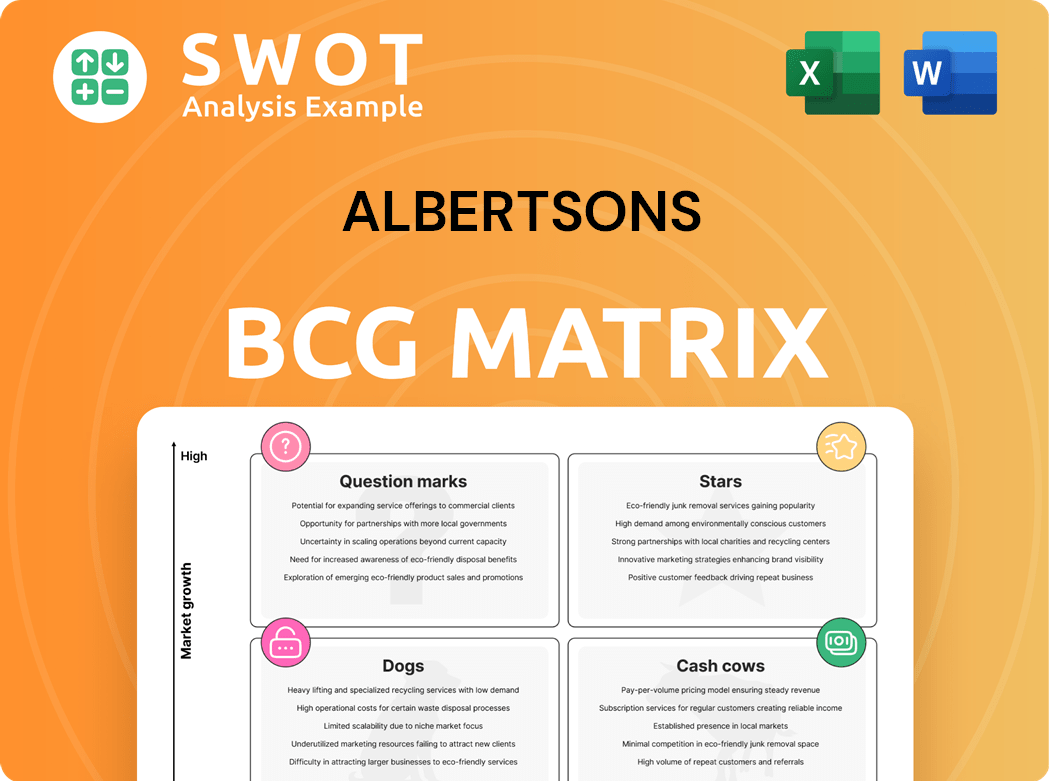

Albertsons BCG Matrix

The preview is the complete Albertsons BCG Matrix you'll receive. It's the finished, ready-to-use document with market data and strategic insights. Get the full analysis with a single, secure purchase; what you see is what you get.

BCG Matrix Template

Albertsons faces a dynamic market. This preview showcases key products across the BCG Matrix quadrants. Understand where its strengths and weaknesses lie. See how it strategizes its portfolio. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Albertsons' pharmacy sales are a star, showing strong growth. They saw an 18% year-over-year increase in Q4 2024. This pharmacy success drives overall sales up. It's a key revenue source, helping the company.

Albertsons saw a 24% rise in digital sales during Q4 2024, showcasing strong e-commerce investments. This growth highlights the effectiveness of their digital strategies in attracting customers. The expansion of online grocery shopping is a key factor in Albertsons' market position. They are well-placed to capitalize on the increasing digital grocery demand.

Albertsons has strategically expanded its loyalty program. Membership surged by 15% to 45.6 million members in Q4 2024. This boosts customer retention and provides data for personalized marketing. The program drives engagement and sales growth for Albertsons.

Private Label Brands

Albertsons' private label brands, including Signature Select and O Organics, are considered Stars in its BCG Matrix. These brands are crucial differentiators attracting customers. They provide affordable alternatives to national brands, aligning with current consumer value preferences. As of 2024, private label sales account for a significant portion of Albertsons' revenue, reflecting their continued strength.

- Private label brands drive traffic and sales.

- Offer value-focused alternatives.

- Align with consumer preferences.

- Generate a significant portion of revenue.

Strategic Investments

Albertsons is making strategic investments to boost its future. They're putting money into tech, store upgrades, and digital platforms. These moves aim to improve how they operate, engage customers, and offer shopping options. Such investments are key for Albertsons to stay competitive.

- In fiscal year 2024, Albertsons allocated a significant portion of its capital expenditures toward technology and digital initiatives.

- Store remodels are a key area, with plans to revamp numerous locations annually to enhance the shopping experience.

- The company is expanding its omnichannel capabilities, including online grocery services and delivery options, to meet changing consumer preferences.

Albertsons' Stars include pharmacy sales and digital growth, both thriving in 2024. Private label brands also shine, boosting revenue. Strategic investments in tech and store upgrades ensure future success.

| Metric | Q4 2024 Data | Strategic Focus |

|---|---|---|

| Digital Sales Growth | 24% increase | Expand e-commerce, enhance digital platforms |

| Loyalty Program | 45.6M members | Boost customer retention, personalize marketing |

| Private Label | Significant Revenue | Value-focused brands, drive traffic, sales |

Cash Cows

Albertsons boasts a vast network of established stores, ensuring a steady revenue stream. Their stores, spanning 34 states, offer diverse products and services. This extensive network provides a dependable foundation for cash generation. In 2024, Albertsons reported over $77 billion in sales. This solid infrastructure supports consistent financial performance.

Albertsons showcases a diverse product portfolio, encompassing groceries, pharmacy services, and private label brands. This diversification strategy enables the company to serve a wide customer base and tap into various market segments. Diverse offerings help Albertsons generate consistent revenue streams. In Q3 2024, Albertsons reported $18.3 billion in sales.

Albertsons' 'Customer for Life' strategy emphasizes lasting customer relationships. It involves personalized promotions, loyalty programs, and community engagement. This approach boosts customer retention and lifetime value. Albertsons' focus on customer satisfaction aims for a sustainable edge. In 2024, customer loyalty programs saw a 15% rise in engagement.

Productivity Improvements

Albertsons is boosting operational efficiency to cut costs. They're using tech, optimizing the supply chain, and streamlining processes. This helps boost profitability and cash flow. Productivity improvements are key for strong financial performance. In 2024, Albertsons' focus on efficiency is evident.

- Cost of sales decreased by 1.1% in Q1 2024.

- Capital expenditures were $276 million in Q1 2024.

- Gross profit increased to $7.8 billion in Q1 2024.

Strong Brand Recognition

Albertsons, operating brands like Safeway and Vons, boasts strong brand recognition. This recognition is key to attracting and keeping customers. Their established reputation helps maintain a loyal customer base. In fiscal year 2024, Albertsons reported a revenue of $77.3 billion.

- Albertsons operates well-known brands.

- Strong brand recognition attracts customers.

- Loyal customer base generates consistent sales.

- Revenue reached $77.3 billion in 2024.

Albertsons' Cash Cows benefit from a wide store network and diverse offerings. This leads to consistent revenue. Customer loyalty programs add to their financial stability. Focus on efficiency boosts profitability.

| Key Metric | Q3 2024 Data | FY 2024 Data |

|---|---|---|

| Sales | $18.3 billion | $77.3 billion |

| Cost of Sales Decrease (Q1 2024) | 1.1% | N/A |

| Customer Loyalty Program Engagement Rise | N/A | 15% |

Dogs

Albertsons likely has underperforming stores, possibly due to market saturation or competition. These stores may struggle with low revenue and consume cash. Underperforming locations negatively impact Albertsons' profitability. In 2024, store closures and consolidations were part of Albertsons' strategy to improve profitability.

Albertsons battles fierce rivals like Walmart and Kroger, especially in specific regions. Intense competition can hinder Albertsons' ability to grow market share and profits. Competitive areas often force Albertsons to adjust its pricing and promotional tactics. In 2024, the grocery sector saw aggressive price wars, impacting margins. Albertsons needs smart strategies to stay competitive.

Some of Albertsons' products might be losing popularity due to shifts in what consumers want or because of new options. These items can become "cash traps," using up resources without making much profit. To avoid problems, Albertsons needs to keep a close eye on its product range. In 2024, Albertsons' sales dipped by 1.2% in the first quarter, indicating potential challenges in certain areas.

High Debt Levels

Albertsons, categorized as a "Dog" in the BCG matrix, grapples with high debt, hindering its financial flexibility. This substantial debt burden restricts investments in growth initiatives, impacting its market competitiveness. High debt also elevates the risk during economic downturns, potentially affecting its financial health. Effective debt management is crucial for Albertsons' long-term viability.

- Albertsons' debt-to-equity ratio: around 2.0 as of late 2024, indicating high leverage.

- Interest expenses have been a significant portion of its operating costs.

- Refinancing or reducing debt is a key strategic priority.

- High debt can negatively impact credit ratings.

Unsuccessful Merger Attempts

Albertsons' failed merger with Kroger in 2024, valued at $24.6 billion, has introduced instability. This has potentially redirected resources from other essential plans. Unsuccessful mergers can harm worker morale and investor trust. Albertsons must concentrate on internal expansion and strategies to boost value.

- Merger Failure: The $24.6 billion Kroger merger attempt in 2024.

- Resource Diversion: Potential shift of resources away from existing plans.

- Impact on Morale: Negative effects on employee and investor confidence.

- Strategic Shift: Focus on organic growth and value creation.

In the BCG matrix, Albertsons is classified as a "Dog" due to its high debt and underperformance. This status reflects the company's challenges in generating significant profits and market share. Albertsons struggles with financial constraints and the need to focus on cost-cutting measures. Strategic efforts like store closures and debt management are crucial for improvement.

| Key Issue | Impact | 2024 Data |

|---|---|---|

| High Debt | Limits Growth | Debt-to-Equity Ratio: ~2.0 |

| Underperformance | Low Profit | Q1 Sales Decline: 1.2% |

| Merger Failure | Instability | Kroger Merger: $24.6B |

Question Marks

Albertsons is focusing on emerging brands through programs like the Innovation Launchpad. These brands could tap into new customer bases and boost revenue. Success hinges on marketing and distribution investments to gain market share. In 2024, Albertsons' net sales and other revenue were approximately $77.3 billion.

Albertsons is expanding its omnichannel capabilities, focusing on e-commerce, digital platforms, and in-store tech. Digital sales are increasing, but still form a small part of total revenue. In 2024, Albertsons' digital sales grew, though specific figures vary. The company must keep innovating its omnichannel approach to gain market share.

Albertsons' health and wellness initiatives represent a question mark in its BCG Matrix. With consumer focus on health, expanding organic and locally sourced foods is key. Offering personalized nutrition advice and health services could boost growth. Albertsons must carefully curate its offerings to align with customer needs. In 2024, the health and wellness market grew, indicating potential for Albertsons to capitalize.

Personalized Shopping Experiences

Albertsons is looking into personalized shopping experiences using data analytics and targeted marketing, a strategy that could boost customer engagement and loyalty. This approach aligns with the industry trend where 70% of consumers expect personalized interactions. However, it's crucial for Albertsons to implement these strategies effectively to avoid customer alienation.

- Data-driven personalization can lead to higher customer lifetime value.

- Ineffective personalization can result in a loss of trust and customer churn.

- Albertsons must balance personalization with data privacy concerns.

New Store Formats

Albertsons' exploration of new store formats can be seen as a "Question Mark" in the BCG matrix. This strategy involves venturing into unproven markets or with new products, like smaller urban stores or specialized outlets. Success hinges on effective execution and consumer acceptance, which carries significant risk. However, if successful, these formats could become "Stars," driving future growth.

- New formats let Albertsons target new customer segments.

- They require significant upfront investment and carry higher risk.

- Success could lead to substantial market share gains.

- Failure could result in financial losses and resource misallocation.

Albertsons' new store formats face uncertainty, fitting the "Question Mark" category, like smaller stores or new product lines. High upfront investment and execution risk are present, with potential for significant gains if successful. In 2024, new store formats saw mixed results, reflecting these challenges.

| Aspect | Details |

|---|---|

| Risk Level | High |

| Investment Needs | Significant |

| Market Share Impact if successful | Substantial |

BCG Matrix Data Sources

Albertsons BCG Matrix leverages SEC filings, market analysis, and industry reports for informed quadrant placement.