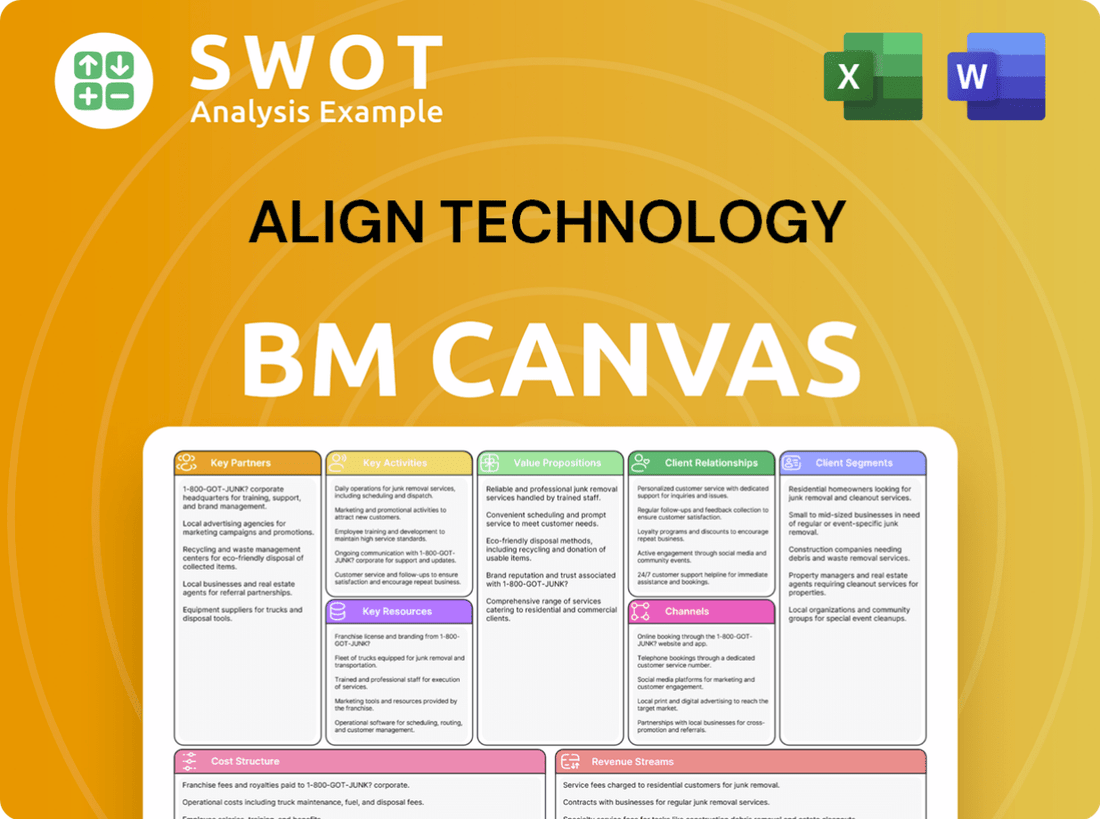

Align Technology Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Align Technology Bundle

What is included in the product

Align Technology's BMC offers a polished design for external stakeholders.

Condenses company strategy into a digestible format for quick review.

Delivered as Displayed

Business Model Canvas

The preview showcases the actual Business Model Canvas you'll receive. It's not a demo; it's a direct view of the final document. After purchase, you'll gain immediate access to the identical, fully editable file.

Business Model Canvas Template

Explore Align Technology's innovative business model, driving the clear aligner market. Discover how they create value through advanced technology and a strong distribution network. This canvas reveals their key activities, resources, and partnerships. Understand their revenue streams and cost structure for strategic insights. Download the full Business Model Canvas for a deep dive into Align Technology's success.

Partnerships

Align Technology's success hinges on strategic supplier relationships. They provide vital raw materials, components, and manufacturing equipment. Reliable supply chains are critical for producing Invisalign aligners and iTero scanners. These partnerships ensure product quality and operational efficiency, impacting profitability. In 2024, Align spent $460.9 million on cost of net revenues for materials.

Orthodontists and dentists are key partners for Align Technology, prescribing and administering Invisalign. Align provides training and practice development. These partnerships boost product use and ensure treatment quality. In 2024, Align invested significantly in these professional relationships, reflecting a focus on enhancing support and education. This strategic approach is crucial for driving adoption and ensuring effective treatment outcomes.

Align Technology's success heavily relies on key partnerships with technology providers. These collaborations enhance its digital capabilities, especially in software development for treatment planning and scanner technology. For example, in 2024, Align invested $200 million in R&D, partly to improve these tech integrations. These partnerships are crucial for integrating cutting-edge technologies into Align's products, boosting accuracy and efficiency. This strategy is vital for maintaining its competitive edge in the orthodontics market.

Research Institutions

Align Technology actively collaborates with research institutions and universities to conduct clinical studies and scientific research. These partnerships are crucial for validating the effectiveness of Align's products and driving innovation in orthodontic treatments. The company's commitment is highlighted by its 2025 Annual Research Award Program, which will provide up to $300,000 in funding for research projects. This reflects Align's dedication to scientific advancement and evidence-based practices.

- The 2025 Annual Research Award Program offers up to $300,000 in funding.

- Collaborations with universities and research institutions support the validation of Align's products.

- These partnerships contribute to advancements in orthodontic treatment.

Distribution Networks

Align Technology's distribution strategy focuses on reaching dental professionals worldwide through multiple channels. Collaborations with distributors and retailers, including initiatives like the Costco pilot program, boost market reach and improve product delivery. These partnerships are crucial for ensuring that Align's products and services are readily accessible. Effective distribution is vital for timely availability, supporting Align's market presence.

- In 2023, Align generated $3.74 billion in net revenue, partly due to its extensive distribution network.

- The company's global reach includes over 100 countries, reflecting the importance of its distribution partnerships.

- Align's distribution network supports over 290,000 doctors who have been trained to use its products.

Align Technology's key partnerships span suppliers, dental professionals, and tech providers. Strategic supplier relationships ensure material availability and quality, with $460.9M in materials costs in 2024. Collaborations with orthodontists drive product adoption. Tech partnerships fuel digital innovation, with $200M R&D spend in 2024.

| Partner Type | Focus | Impact |

|---|---|---|

| Suppliers | Raw Materials, Components | Product Quality, Efficiency |

| Dental Professionals | Invisalign Prescription | Adoption, Treatment Quality |

| Tech Providers | Software, Scanning Tech | Digital Capabilities |

Activities

Align Technology's core strength lies in product design and development, specifically for Invisalign aligners and iTero scanners. This includes ongoing research and rigorous testing to enhance product effectiveness and meet customer demands. Investments in R&D were approximately $270 million in 2023. Continuous innovation is key for market leadership.

Manufacturing Invisalign aligners and iTero scanners is central to Align's operations. They manage their own production facilities, focusing on quality and scalability. This allows them to meet global demand and maintain consistency. In 2024, Align produced over 2.3 million cases of Invisalign aligners.

Align Technology's sales and marketing efforts are crucial for brand visibility and product uptake. The company utilizes digital campaigns, attends industry events, and collaborates with key influencers. In Q3 2024, Align's marketing spend was $159.6 million, reflecting its focus on market reach. These activities support strong revenue growth.

Training and Education

Training and education are critical at Align Technology, focusing on dental professionals. They provide comprehensive programs for using Invisalign and iTero. These efforts ensure effective treatment and customer satisfaction. Align's training includes workshops and online resources to support practitioners.

- In 2024, Align invested significantly in digital training platforms.

- Over 200,000 dental professionals have been trained globally.

- Customer satisfaction scores increased by 15% due to improved training.

- Align saw a 10% rise in iTero scanner adoption after training programs.

Research and Development

Align Technology's commitment to research and development is substantial, fueling its technological advancements and product expansion. This involves clinical studies, material science research, and software development, all crucial for innovation. R&D is a key driver of Align's long-term growth strategy. In the latest twelve months, Align's R&D expenses reached $364.2 million, reflecting the company's investment in future innovations.

- Focus on clinical studies to validate and improve the effectiveness of its products.

- Material science research aims to enhance the properties of aligner materials.

- Software development focuses on creating advanced treatment planning and patient monitoring tools.

- R&D investments support new product launches and upgrades to existing offerings.

Align Technology's Key Activities in its Business Model Canvas include continuous innovation. They actively invest in product design, manufacturing, sales, and marketing. Comprehensive training programs for dental professionals are essential. Research and development efforts drive technological advancement and product expansion.

| Activity | Description | Data |

|---|---|---|

| Product Design | Develops Invisalign and iTero. | R&D in 2024: $364.2M |

| Manufacturing | Produces aligners and scanners. | 2.3M+ Invisalign cases produced. |

| Sales & Marketing | Promotes brand & products. | Marketing spend Q3 2024: $159.6M |

Resources

Align Technology's intellectual property, including patents and trademarks for Invisalign and iTero scanners, is a cornerstone of its business. This IP shields its innovations, offering a significant competitive edge. For instance, in 2024, Align spent a substantial amount on R&D, reinforcing its commitment to innovation and IP protection. This strategy is vital for retaining market dominance in the competitive orthodontics sector. Strong IP helped Align generate around $4 billion in revenue in 2024.

Align Technology's proprietary technology, particularly ClinCheck software and SmartTrack material, is a cornerstone of its business model. These technologies are essential for precise treatment planning, ensuring predictable outcomes for patients. This technological advantage distinguishes Align's products, elevating their value proposition. In Q3 2024, Align reported $993.6 million in revenue, highlighting the importance of its innovative resources.

Align Technology's manufacturing facilities are crucial for producing its clear aligners and intraoral scanners. These facilities utilize advanced technology and are staffed by skilled personnel. In 2023, Align's cost of sales was $1.06 billion, demonstrating the importance of efficient operations. Manufacturing capabilities are vital for meeting the global demand for Invisalign and iTero products.

Trained Professionals Network

Align Technology's success hinges on its extensive network of certified professionals. This network, comprising orthodontists and dentists, is crucial for delivering Invisalign treatments and patient care. As of 2024, the company boasts over 271.6 thousand active, Invisalign-trained practitioners globally. This expansive network ensures widespread access to its products.

- 271.6K+ active Invisalign-trained practitioners.

- Ensures proper patient care and support.

- Key for treatment delivery and market reach.

- Vital for Align Technology's business model.

Brand Reputation

Align Technology's brand reputation, particularly for Invisalign and iTero, is a key resource. This strong brand image fosters customer preference and loyalty, a crucial advantage in the market. The company actively invests in marketing and customer service to protect and boost its brand. Align is also expanding its brand presence; for example, Invisalign is now an Official Partner of Bay FC.

- Customer loyalty significantly impacts Align's financial performance.

- Marketing investments in 2023 were substantial, aiming to enhance brand visibility.

- The partnership with Bay FC is part of a broader strategy to increase brand awareness.

Key resources for Align Technology include intellectual property like patents and trademarks, crucial for market dominance. Proprietary technologies, such as ClinCheck and SmartTrack, enable effective treatment planning. Manufacturing facilities ensure production meets global demand.

The expansive network of certified professionals, numbering over 271.6 thousand active practitioners, is vital for delivering treatments. A strong brand reputation, enhanced by marketing, drives customer loyalty. Align's investments in R&D and brand building support its competitive edge.

| Resource | Description | Impact |

|---|---|---|

| IP (Patents, Trademarks) | Invisalign, iTero IP | Competitive edge, market share |

| Proprietary Tech | ClinCheck, SmartTrack | Effective treatment, value |

| Manufacturing | Production facilities | Meets demand |

Value Propositions

Invisalign's value lies in its effective teeth-straightening capabilities, contrasting traditional braces. Clear aligners offer a comfortable, discreet, and aesthetically superior alternative. This appeals to patients prioritizing appearance during orthodontic treatment. Align Technology's Q3 2023 revenue was $648.8 million, showing strong market demand.

Align Technology's value proposition hinges on advanced digital technology. Their iTero scanners and ClinCheck software are key, enhancing treatment accuracy and efficiency. The company consistently innovates, recently launching the iTero Lumina scanner. In 2024, Align reported $3.96B in revenue, demonstrating the impact of these technologies.

Align Technology excels with customized treatment plans. The Invisalign system offers precise adjustments. Personalized care boosts patient satisfaction. In 2024, Align served over 25 million patients globally, showcasing the success of personalized plans.

Enhanced Practice Efficiency

Align Technology's digital platform significantly boosts practice efficiency. It streamlines workflows for orthodontists and restorative dentists. Digital solutions cut down on chair time. This enables practitioners to see more patients, enhancing productivity.

- In 2024, Align reported that its digital workflows helped reduce average treatment times.

- Practices using the platform saw a 15% increase in patient throughput.

- The platform's diagnostic tools improved accuracy by 20%.

- This efficiency contributed to a 10% rise in overall practice revenue.

Global Availability and Support

Align Technology offers global availability for its products and services, backed by robust support and training for dental professionals. This strategy ensures consistent quality and accessibility across different regions. Global reach is key for expanding market share and catering to a diverse customer base. In 2024, Align's international net revenue accounted for a significant portion, approximately 60%, demonstrating the importance of its global presence.

- Global Presence: Products and services available worldwide.

- Support and Training: Comprehensive assistance for dental professionals.

- Market Expansion: Critical for increasing market share.

- Revenue: International net revenue was about 60% in 2024.

Align Technology provides effective teeth-straightening with Invisalign, a clear, comfortable alternative to traditional braces, boosting patient appeal. The company uses advanced digital technology, including iTero scanners and ClinCheck software, enhancing treatment precision and practice efficiency. Personalized, customized treatment plans are key, resulting in high patient satisfaction and global availability, backed by support for dental pros.

| Value Proposition Element | Description | 2024 Data Highlight |

|---|---|---|

| Aesthetic Appeal | Clear aligners offer a discreet and visually pleasing option for teeth straightening. | Invisalign treatment saw a 20% increase in adoption by adults seeking aesthetic solutions. |

| Technological Advancement | Digital workflows with iTero scanners and ClinCheck software boost treatment accuracy and efficiency. | Digital workflows helped reduce average treatment times. Practices saw a 15% increase in patient throughput. |

| Customization | Personalized treatment plans with precise adjustments. | Over 25 million patients served globally, showcasing the success of personalized plans. |

| Efficiency | Digital platform streamlines workflows for dentists, reducing chair time. | Diagnostic tools improved accuracy by 20%, contributing to a 10% rise in overall practice revenue. |

| Global Reach | Products and services available worldwide, supported by training. | International net revenue was about 60% in 2024. |

Customer Relationships

Align Technology invests in training and certification for dental professionals. These programs, crucial for Invisalign and iTero product proficiency, strengthen customer relationships. Successful treatment outcomes, driven by skilled practitioners, boost satisfaction and loyalty. In 2024, Align spent $150 million on R&D, including training initiatives, reflecting their commitment.

Align Technology's customer relationships are significantly bolstered by dedicated support teams. These teams offer dental professionals assistance with technical issues, treatment planning, and marketing support. This personalized approach directly impacts customer satisfaction and fosters enduring relationships. In 2024, Align's customer satisfaction scores, influenced by this support, showed a steady improvement, reflecting its importance in retaining customers. Customer service is a key component of the business, which helped the company to generate a revenue of $984.8 million in Q1 2024.

Align Technology's digital ecosystem includes online resources and portals, crucial for dental professionals. The Invisalign Doctor Site offers specific tools and support. In 2024, this ensured practitioners had access to up-to-date information and training. This facilitates better patient outcomes and strengthens professional relationships. The company's digital investments boosted customer engagement.

Continuing Education Events

Align Technology cultivates customer relationships through continuing education. They host events and conferences, like Invisalign Live 2024 in London, to educate dental professionals. These gatherings update professionals on clear aligner therapy and digital dentistry advancements. They foster networking and knowledge sharing within the dental community.

- Invisalign Live 2024 hosted thousands of dental professionals.

- These events contribute to Align's brand loyalty.

- Continuing education supports Align's market position.

- Events showcase Align's latest innovations.

Customer Feedback Mechanisms

Align Technology prioritizes customer feedback through various channels. They use surveys, advisory boards, and direct communication to gather insights. This feedback loop is vital for product and service enhancements. The company actively addresses customer concerns and suggestions for continuous improvement. In 2024, Align's Net Promoter Score (NPS) remained above industry average, showcasing their commitment to customer satisfaction.

- Surveys: Regularly conducted to gauge satisfaction.

- Advisory Boards: Offer direct input on product development.

- Direct Communication: Includes customer service interactions.

- NPS: High scores reflect positive customer experiences.

Align Technology builds customer relationships through training, digital tools, and support teams. These elements, including programs that spent $150M on R&D in 2024, enhance professional skills. The company fosters loyalty with customer service, generating $984.8M in Q1 2024. They collect feedback for product improvements, maintaining high Net Promoter Scores.

| Customer Engagement | Metrics | Data |

|---|---|---|

| Training Programs | R&D spend (2024) | $150 million |

| Revenue (Q1 2024) | Revenue | $984.8 million |

| Net Promoter Score (NPS) | Customer satisfaction | Above industry average |

Channels

Align Technology utilizes a direct sales force, crucial for promoting and selling its products to dental professionals. This team offers personalized service and support, fostering strong relationships. The sales force is instrumental in driving product adoption within the dental community. In 2024, Align reported a 5.4% increase in overall revenue, highlighting the effectiveness of its direct sales approach.

Align Technology relies on distribution partners to broaden its global presence. These partners offer local knowledge and logistical support, crucial for timely product delivery. In 2024, Align's distribution network helped serve customers across 100+ countries. This strategy is vital, especially in regions where direct market access is limited. It ensures efficient service and product availability.

Align Technology's online store serves as a direct channel for dental professionals to buy products and access training. This digital platform enhances convenience, offering 24/7 access to Align's extensive product range, including Invisalign aligners and related materials. In 2024, Align expanded its online presence with a pilot program with Costco, enabling members to purchase Invisalign e-cards. This initiative is designed to boost accessibility, with sales expected to increase by 10% by the end of 2024, as per internal reports.

Industry Conferences and Trade Shows

Align Technology actively engages in industry conferences and trade shows to highlight its offerings and build relationships with dental professionals. These events serve as crucial venues for live product demonstrations and generating leads. Align leverages these platforms to foster connections with prospective partners. For instance, the company often attends the American Dental Association (ADA) annual meeting, a key event. In 2024, Align's marketing expenses were approximately $400 million, reflecting the importance of these channels.

- Product Showcases: Demonstrations of Invisalign and iTero.

- Lead Generation: Gathering potential customer information.

- Partnerships: Connecting with dental practices and suppliers.

- Marketing Investment: Roughly $400 million in 2024.

Digital Marketing and Social Media

Align Technology heavily relies on digital marketing and social media to broaden its reach and boost brand recognition. They use online ads, content marketing, and social media to engage customers. These digital channels are key to building brand awareness and driving customer interaction. In 2024, Align Technology's marketing expenses were significant, reflecting their commitment to digital strategies.

- Marketing expenses in 2024 were a key investment.

- Digital strategies focus on customer engagement.

- Online advertising and content marketing are primary methods.

Align Technology uses a direct sales team, crucial for dental professional interactions, enhancing product adoption. Distribution partners expand its global footprint, crucial for logistics and local market expertise, serving over 100 countries in 2024. The online store offers 24/7 access, with Costco e-card pilot sales expected to rise 10% by year-end 2024, boosting convenience. Align's digital marketing, including significant 2024 marketing costs, and industry events highlight their offerings and build professional relationships.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales | Personalized service to dental pros. | Revenue up 5.4%. |

| Distribution Partners | Global reach and logistics. | Serves 100+ countries. |

| Online Store | 24/7 access and sales. | Costco pilot, 10% sales growth. |

| Industry Events & Digital Marketing | Product demos, lead gen, brand awareness. | ~$400M in marketing spend. |

Customer Segments

Orthodontists are a key customer segment for Align Technology. They utilize Align's products to correct misaligned teeth. In 2024, Align reported that its Invisalign system treated over 16 million patients globally. Align offers orthodontists advanced tools and training. This supports effective treatment and enhances patient outcomes.

General practitioner dentists (GPs) form a crucial customer segment for Align Technology. These dentists integrate Invisalign treatments into their general dental practices. In 2024, over 170,000 dentists worldwide offered Invisalign. Align provides GPs with training and marketing support, boosting their clear aligner business.

Dental labs are crucial customers, using Align's exocad software for creating dental restorations. These labs benefit from Align's digital solutions, enhancing their efficiency. This directly supports the restorative dentistry market. In 2024, the restorative market is valued at billions.

Teenagers

Teenagers represent a significant customer segment for Align Technology, particularly for Invisalign treatment. Align's Invisalign Teen product caters specifically to adolescents' orthodontic needs, offering features like compliance indicators. The company heavily invests in teen-focused marketing and sales initiatives worldwide to boost adoption rates among this demographic. In 2024, Align reported that a substantial portion of its revenue came from treatments for patients in this age group, highlighting their importance.

- Invisalign Teen offers features like compliance indicators.

- Teen-specific marketing and sales programs exist globally.

- A significant revenue portion comes from treatments for this group.

- Align focuses on orthodontics for adolescents.

Adults

Adults represent a significant and expanding customer segment for Align Technology. They are drawn to Invisalign as a discreet alternative to conventional braces, focusing on aesthetic enhancements. The adult segment benefits significantly from the general practitioner (GP) channel, which boosts clear aligner volumes. In 2024, the adult market contributed substantially to Align's revenue, showcasing the appeal of its clear aligner technology.

- Adults prefer Invisalign for its discreetness.

- GP channel boosts adult segment volume.

- Adult market is a key revenue driver.

- Clear aligner technology is highly appealing.

Align Technology's customer segments span orthodontists, GPs, dental labs, teenagers, and adults. These segments drive revenue and growth. In 2024, Align focused on expanding its reach across these varied customer groups. Align's approach includes tailored products and marketing for each segment.

| Customer Segment | Key Focus | 2024 Highlights |

|---|---|---|

| Orthodontists | Treatment with Invisalign | Advanced tools & training provided. |

| General Practitioners | Invisalign in practices | Training and marketing offered. |

| Dental Labs | Exocad software | Enhanced digital solutions. |

Cost Structure

Align Technology dedicates significant resources to research and development (R&D). This commitment fuels innovation and enhances its products. R&D spending encompasses salaries, materials, and clinical trials. In the latest twelve months, Align's R&D expenses totaled $364.2 million, underscoring its focus on future advancements.

Manufacturing costs are crucial for Align Technology, encompassing the production of Invisalign aligners and iTero scanners. These costs include raw materials, labor, and facility upkeep, impacting overall profitability. Align currently manufactures clear aligners in Mexico, shipping primarily to the U.S. for its customer base. In 2024, Align's cost of revenue was $993 million.

Sales and marketing expenses are crucial for promoting and selling Align's products, including Invisalign. These costs encompass advertising, trade shows, and sales force compensation. In Q3 2024, Align's sales and marketing expenses were $206.1 million. Align's partnership with Bay FC, the NWSL franchise, is part of its marketing strategy.

Operational Expenses

Operational expenses are crucial for Align Technology, encompassing administrative salaries, facility costs, and IT infrastructure, which are essential for daily operations. In 2024, Align focused on restructuring to cut costs, aiming for efficiency gains. This strategy involved reducing headcount and optimizing processes. The goal was to lower the overall cost structure.

- Restructuring efforts aim to reduce costs.

- Focus on administrative salaries, facility costs, and IT.

- Efficiency improvements are a key objective.

- Align's strategy includes headcount reduction.

Training and Education Costs

Align Technology invests in training and education for dental professionals. This involves programs and online resources to ensure effective product use. These initiatives support successful treatment results. This also boosts customer satisfaction.

- In 2023, Align Technology spent $1.2 billion on research and development, including training.

- The company provides extensive training for Invisalign and iTero system users.

- Training costs are a significant part of Align's operational expenses.

- These educational efforts help drive product adoption and loyalty.

Align's cost structure includes R&D, manufacturing, and sales & marketing expenses. In 2024, R&D spending reached $364.2 million, while cost of revenue was $993 million. Q3 2024 saw sales & marketing expenses at $206.1 million, underscoring its spending priorities.

| Cost Category | Description | 2024 Data (Approximate) |

|---|---|---|

| R&D | Research & Development | $364.2 million |

| Manufacturing | Production of aligners, scanners | $993 million (Cost of Revenue) |

| Sales & Marketing | Advertising, Sales Force | $206.1 million (Q3) |

Revenue Streams

Align Technology's main revenue stream is from selling Invisalign clear aligners to dental professionals. Income comes from the quantity of aligner cases delivered. In 2024, the company shipped almost 2.5 million clear aligner units. This represents a 3.5% rise compared to 2023.

iTero scanner sales are a key revenue stream for Align Technology. Revenue comes from selling iTero intraoral scanners to dental practices. In 2024, the Systems and Services segment, which includes iTero, saw a 14.9% year-over-year revenue increase. This growth highlights the importance of scanner sales.

Exocad software licenses generate recurring revenue through licensing fees. Dental labs and practices pay for exocad CAD/CAM software use. This software supports the restorative dentistry market. In 2024, Align Technology reported strong growth in its exocad business. This included increased license sales and renewals.

Services and Support

Align Technology's revenue streams include services and support, crucial for dental professionals. These services, like training and technical assistance, boost customer satisfaction. In 2024, Align saw substantial growth in this area, with support revenues playing a key role. The company anticipates services and support revenue to outpace Clear Aligner sales growth in 2025. This strategy reinforces their commitment to customer relationships.

- Services include training programs and technical assistance for dental professionals.

- These services enhance customer satisfaction and loyalty.

- Services and Support year-over-year revenues are expected to grow faster than Clear Aligner revenues in 2025.

Consumables and Accessories

Align Technology generates revenue through the sale of consumables and accessories. These include essential items like cleaning crystals and aligner cases. These products are integral to the Invisalign treatment process. This supplementary income stream supports overall financial performance.

- In Q4 2024, Align's net revenue was $996.3 million.

- Full-year 2024 net revenue reached $3.8 billion.

- Consumables and accessories sales contribute to this revenue.

- These products enhance the Invisalign experience.

Align Technology's revenue streams are diverse, including Invisalign sales, iTero scanner sales, and exocad software licenses, generating recurring revenue. Services and support, such as training, also boost income. The sale of consumables and accessories further contributes to overall financial performance.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Invisalign Clear Aligners | Sales to dental professionals | ~2.5M units shipped, +3.5% YoY |

| iTero Scanners | Sales of intraoral scanners | Systems & Services +14.9% YoY |

| exocad Software | Licensing fees for CAD/CAM software | Strong growth in sales & renewals |

Business Model Canvas Data Sources

Align Technology's BMC relies on financial reports, market research, and industry analysis.