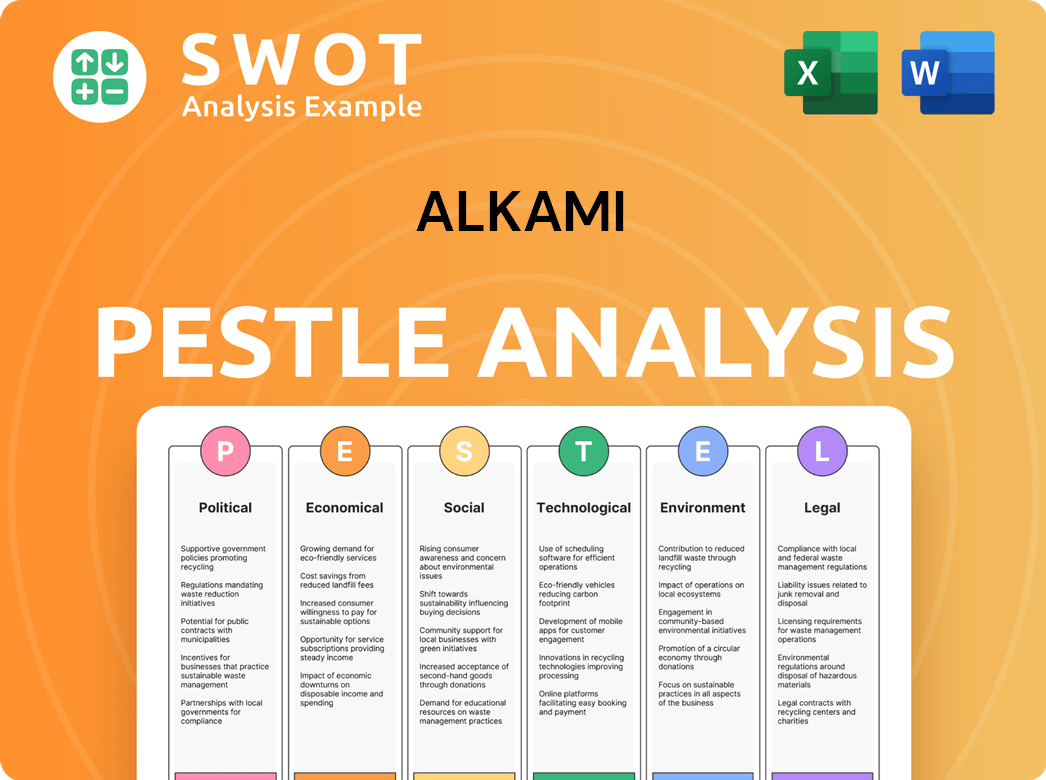

Alkami PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alkami Bundle

What is included in the product

A detailed assessment, exploring external forces impacting Alkami across six PESTLE dimensions.

Helps support discussions on external risk and market positioning during planning sessions.

What You See Is What You Get

Alkami PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. It's a complete Alkami PESTLE analysis document. Examine the content and structure; that's what you'll receive immediately. No editing needed—it's ready to use. See it, buy it, and instantly own it!

PESTLE Analysis Template

Navigate the complex landscape impacting Alkami with our tailored PESTLE Analysis. We dissect political, economic, social, technological, legal, and environmental factors. Understand the forces shaping Alkami’s strategic decisions and market position. Gain a competitive advantage with in-depth insights to boost your strategy. Download the full report now for actionable intelligence.

Political factors

Alkami operates within a complex U.S. fintech regulatory environment, lacking a single, overarching law. Regulations vary based on specific services, impacting Alkami's compliance across federal and state laws. This impacts Alkami's operations and growth strategies. Regulatory scrutiny on bank-fintech partnerships, like those Alkami engages in, is increasing to ensure safety and compliance. The global fintech market is projected to reach $324 billion in 2025.

Governments globally are backing digital banking with policies to modernize financial systems. This support boosts innovation in digital financial services, creating opportunities for companies like Alkami. For example, the U.S. government's focus on fintech could benefit Alkami. In 2024, investments in fintech hit over $100 billion globally.

Data privacy regulations significantly affect fintech firms like Alkami. The Gramm-Leach-Bliley Act (GLBA) and the California Consumer Privacy Act (CCPA) govern consumer data handling. The FTC's updated Safeguards Rule, effective May 2024, mandates breach reporting. Recent reports show a 10% rise in data breach incidents in the financial sector.

Geopolitical Stability and Cyber Threats

Geopolitical instability heightens cyber threats, impacting financial services. Nation-states and cybercriminals use sophisticated attacks. The current climate significantly affects cybersecurity risks for companies. The financial sector saw a 48% rise in cyberattacks in 2024. This includes data breaches and ransomware.

- Cyberattacks cost the financial sector $25.3 billion in 2024.

- Ransomware attacks increased by 30% in early 2025.

- Alkami must address these risks to protect its clients.

Regulatory Focus on Consumer Protection

Regulatory bodies are intensifying their scrutiny of consumer protection in digital banking. They're focusing on transparency, especially concerning deposit insurance, as online and mobile banking usage grows. Alkami must ensure its platform complies with these evolving consumer protection standards. This includes clear communication about deposit insurance to build trust and protect consumers. The FDIC insured over $10 trillion in deposits in 2024.

- Compliance with regulations is essential to avoid penalties and maintain consumer trust.

- Transparency in deposit insurance coverage is a key focus for regulators.

- Alkami's platform must adapt to meet these changing consumer protection priorities.

- The digital banking space sees increased regulatory oversight.

Political factors present significant challenges for Alkami, with regulations and government policies greatly affecting its operations. Increasing scrutiny of bank-fintech partnerships could lead to added compliance costs and affect expansion plans. Cybersecurity, exacerbated by geopolitical instability, is a major risk; cyberattacks cost the financial sector $25.3 billion in 2024.

| Area | Impact | Data |

|---|---|---|

| Regulatory Scrutiny | Increased Compliance | Global fintech market: $324B (2025) |

| Cybersecurity Threats | Operational Costs | Cyberattacks cost $25.3B (2024) |

| Data Privacy | Compliance Burdens | 10% rise in data breaches (2024) |

Economic factors

The digital banking platform market is booming, with projections showing substantial growth from approximately $6.8 billion in 2024 to an estimated $11.4 billion by 2028. This represents a robust compound annual growth rate of about 13.8% during this period. This expansion is fueled by increasing internet and mobile device usage and customer demand for online services. The move away from traditional banking boosts the demand for platforms like Alkami's.

The interest rate environment is still evolving. While inflation has cooled, the future holds potential for rate fluctuations. These shifts influence consumer spending and business investment, impacting Alkami's client institutions and their tech spending. For instance, the Federal Reserve held rates steady in early 2024, but forecasts vary. Lower rates may spur loan demand.

Investment in digital transformation is a major factor for Alkami, as banks increase spending on digital solutions. The fintech sector anticipates a rebound in investment and M&A, especially in AI for finance. Fintech funding reached $1.8 billion in Q1 2024. Digital banking is set to grow, with the global market valued at $10.5 trillion by 2027.

Operational Costs for Financial Institutions

Alkami's digital banking solutions can significantly cut operational costs for financial institutions. These platforms facilitate online and mobile banking, reducing reliance on expensive physical branches. Aite-Novarica Group data from 2024 shows that digital transformation can lower operational expenses by up to 30%. This cost efficiency is a key advantage for Alkami, especially as banks seek to optimize spending.

- Branch transactions cost 20-50x more than digital ones.

- Digital banking can reduce operational costs by up to 30%.

- Alkami's platform supports a leaner cost structure.

Competition in the Digital Banking Market

The digital banking market is fiercely contested, involving traditional banks, neobanks, and tech giants. This intense competition pushes for constant innovation and improvements in digital banking platforms to attract and keep customers. Alkami faces the challenge of differentiating its services and offering superior user experiences to stay competitive. The global digital banking market size was valued at USD 11.7 trillion in 2023 and is projected to reach USD 37.3 trillion by 2032, growing at a CAGR of 13.7% from 2024 to 2032.

- Competition from established banks with large customer bases and resources.

- The rise of neobanks, offering innovative features and lower costs.

- Big Tech companies entering the financial services sector.

The digital banking market, valued at $6.8B in 2024, is set to hit $11.4B by 2028, a 13.8% CAGR. Interest rate shifts impact consumer spending and bank tech investments, influencing demand for platforms. Fintech funding reached $1.8B in Q1 2024, fueling growth.

| Economic Factor | Impact on Alkami | Data Point (2024-2025) |

|---|---|---|

| Market Growth | Increased demand | Digital banking market: $6.8B (2024) to $11.4B (2028) |

| Interest Rates | Affects bank spending | Federal Reserve held rates steady in early 2024; forecasts vary |

| Fintech Investment | Drives innovation | Fintech funding: $1.8B (Q1 2024) |

Sociological factors

Consumer adoption of digital banking is crucial for Alkami. Younger generations favor mobile and online banking. A 2024 study shows 70% of millennials and Gen Z use digital banking regularly. By 2025, most online adults want all financial tasks on mobile apps. This trend boosts demand for user-friendly digital platforms.

Customer expectations for digital banking are rapidly changing. In 2024, 75% of consumers prefer digital banking. They want easy, personalized experiences on all devices. This includes financial advice and quick problem solving. Alkami's platform must evolve to keep customers happy and stay relevant.

There's a surge in demand for personalized banking. Financial institutions are using data to customize services. Alkami's solutions offer personalized interactions. This helps financial institutions boost customer engagement. In 2024, 68% of consumers preferred personalized banking experiences.

Shift Towards Mobile-First Interactions

Mobile banking is now the go-to for many customers, changing how they interact with banks. This trend demands a mobile-first strategy for digital banking platforms, emphasizing user experience across devices. Alkami must excel in this area for its clients to stay competitive. In 2024, over 70% of U.S. adults used mobile banking, a rise from 62% in 2020.

- 70% of U.S. adults use mobile banking.

- A mobile-first approach is essential.

- Alkami's mobile experience is key.

Customer Trust and Data Protection Concerns

Customer trust is crucial for Alkami's success in digital banking. Data breaches and privacy concerns are major issues. A 2024 study showed 68% of consumers worry about online financial security. To build trust, Alkami must prioritize robust cybersecurity and transparent data practices. This includes clear communication about data usage and protection measures.

- 68% of consumers worry about online financial security (2024 study).

- Alkami must prioritize cybersecurity and transparent data practices.

Societal trends significantly influence Alkami. Digital banking adoption is soaring, driven by younger users favoring mobile and online access. Customer expectations center on easy, personalized, and secure digital experiences. Trust, enhanced by robust cybersecurity, is essential for Alkami’s success.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Digital Adoption | Increased demand for mobile-first solutions. | 70% of millennials & Gen Z use digital banking regularly. Over 70% U.S. adults use mobile banking. |

| Customer Expectations | Demand for personalization & ease of use. | 75% prefer digital banking; 68% want personalized experiences. |

| Trust & Security | Need for robust security and data transparency. | 68% worry about online financial security. |

Technological factors

Alkami's cloud-based solutions leverage cloud computing advancements. The cloud banking market is booming, fueled by efficiency and security needs. Adoption is driven by cloud solutions' flexibility, scalability, and cost-effectiveness. The global cloud banking market is projected to reach $38.4 billion by 2025, growing at a CAGR of 18.5% from 2020 to 2025.

Artificial Intelligence (AI) and Machine Learning (ML) are transforming digital banking. AI personalizes services, detects fraud, and automates tasks. By 2025, AI in banking is expected to reach a market size of $36.6 billion. Alkami's use of AI/ML can significantly boost customer experience and operational efficiency. This technological integration is key for staying competitive.

Open banking and API adoption are reshaping finance by enabling data sharing. This fosters connected financial ecosystems and embedded finance. Alkami must support open banking and API connectivity. In 2024, the open banking market was valued at $48.1 billion, projected to reach $135.9 billion by 2029.

Cybersecurity Technologies and Threats

Cybersecurity threats, such as ransomware and AI-driven attacks, are becoming increasingly sophisticated, requiring significant investment in advanced cybersecurity technologies. Financial institutions and providers like Alkami must prioritize robust security to protect sensitive data and systems. The market for cybersecurity is projected to reach $345.7 billion by 2024. 'Cybersecurity as a Service' presents both opportunities and challenges.

- The global cybersecurity market is expected to grow to $403.8 billion by 2027.

- Ransomware attacks cost organizations an average of $5.69 million in 2023.

- The rise of AI-driven attacks is increasing the need for sophisticated defense mechanisms.

Development of Digital Identity Solutions

The rise of digital identity solutions is vital for digital banking. Secure authentication and onboarding processes are becoming increasingly important. This helps prevent fraud and ensures compliance. Alkami's solutions might need to integrate these technologies. The global digital identity solutions market is projected to reach $81.6 billion by 2025.

- Market growth is driven by the need for secure online transactions.

- Alkami must adapt to support these evolving security standards.

- Integration with digital identity solutions enhances customer trust.

Alkami benefits from cloud computing's efficiency, projected to $38.4B by 2025. AI/ML enhances digital banking; the market should hit $36.6B by 2025. Open banking and API integration drive innovation, aiming for $135.9B by 2029.

| Technology | Market Size/Forecast | Relevance to Alkami |

|---|---|---|

| Cloud Banking | $38.4B by 2025 | Core infrastructure; critical for scalability |

| AI in Banking | $36.6B by 2025 | Enhances CX, fraud detection |

| Open Banking | $135.9B by 2029 | Enables data sharing and embedded finance |

Legal factors

Alkami and its clients face rigorous financial regulations. These include federal and state rules on consumer protection and lending. Compliance is crucial, especially regarding financial crime prevention like AML. The need for continuous platform adaptation is driven by the complex and evolving regulatory landscape. For instance, in 2024, financial institutions faced over $2 billion in AML fines.

Alkami must adhere to strict data privacy laws like CCPA and the FTC's Safeguards Rule. These mandate robust data protection measures. Failing to comply can lead to hefty fines; for instance, in 2024, the FTC issued over $1 billion in penalties for data security violations. GDPR and global regulations set precedents, further influencing Alkami's data handling.

Federal banking agencies are increasing scrutiny on third-party risks, especially for bank-fintech partnerships. Financial institutions using Alkami must manage risks from third-party providers. According to a 2024 report, 60% of banks plan to enhance vendor risk management. Alkami needs to help clients meet these regulatory demands. This ensures compliance and maintains trust in the financial ecosystem.

Regulations on Digital Assets and Cryptocurrency

The U.S. regulatory landscape for digital assets and cryptocurrencies is continuously changing, with federal banking agencies showing increased interest. Future regulations could significantly affect digital banking platforms, influencing the services Alkami can provide. For instance, the SEC has increased scrutiny, with over 100 enforcement actions related to crypto in 2023. Alkami must closely monitor these developments to adapt to evolving legal requirements.

- SEC enforcement actions regarding crypto increased in 2023.

- Federal banking agencies are paying closer attention to digital assets.

- Future regulations may impact digital banking services.

Consumer Protection Regulations

Consumer protection regulations are vital in the financial sector, focusing on fair practices and transparent disclosures. These rules aim to prevent misleading information, ensuring consumer trust. With the rise of digital banking, regulators are intensifying their efforts to safeguard consumers online. Alkami's platform must help clients comply with these evolving regulations to maintain legal compliance and customer trust.

- The Consumer Financial Protection Bureau (CFPB) issued over $1 billion in penalties in 2024 for violations of consumer protection laws.

- Data from 2024 indicates a 30% increase in consumer complaints related to digital financial services.

- Alkami needs to ensure its platform supports compliance with the Electronic Fund Transfer Act (EFTA).

Alkami is significantly influenced by strict financial regulations and must adhere to consumer protection and lending rules. Data privacy laws, like CCPA and GDPR, necessitate robust data protection measures, and non-compliance leads to hefty fines. Third-party risk management is critical for bank-fintech partnerships, demanding continuous regulatory adaptation.

| Regulation Area | Compliance Requirement | Recent Data |

|---|---|---|

| AML/Financial Crime | Compliance with federal and state regulations | Over $2B in AML fines in 2024 |

| Data Privacy | Adherence to CCPA, GDPR, FTC | Over $1B in data security violation penalties in 2024 |

| Third-Party Risk | Enhance vendor risk management | 60% of banks planning improvements in 2024 |

Environmental factors

Environmental, Social, and Governance (ESG) factors are becoming increasingly significant in banking. Customers, investors, and regulators are pushing for stronger ESG initiatives, like sustainable financing. As a technology provider, Alkami can support clients with ESG reporting and data analytics. The ESG investment market is projected to reach $50 trillion by 2025, highlighting the growing importance of fintech tools.

There's a growing demand for 'Green Banking,' where customers want eco-friendly financial options. Banks focusing on sustainability could get an advantage. Alkami, with its digital banking tech, could help clients offer green features. For example, carbon tracking or green investment choices. In 2024, sustainable investments reached $2.4 trillion, showing this trend's strength.

Regulatory pressure on ESG disclosure is intensifying for financial institutions. The SEC's proposed rules in 2024 are a key example, demanding more detailed climate-related disclosures. Banks and credit unions require systems to track ESG activities. Alkami's data capabilities could help clients meet these reporting needs.

Environmental Impact of Data Centers

The environmental impact of data centers is a key consideration, particularly for cloud-based services. These centers consume significant energy, contributing to a substantial carbon footprint. While Alkami leverages cloud services, the direct environmental impact from their data center operations is managed by their cloud providers. The industry is seeing increased focus on sustainable data center practices.

- Data centers globally consumed approximately 2% of the world's electricity in 2023.

- The carbon emissions from data centers are projected to increase, with some estimates suggesting a rise of 20% by 2025.

- Renewable energy use in data centers is growing, with many aiming for carbon neutrality by 2030.

Climate Change Risk Integration in Financial Risk Management

Financial institutions are now deeply embedding climate change and environmental risks into their risk management. This involves evaluating both physical risks, like extreme weather, and transition risks, such as policy changes. Alkami's platform supports clients, but these institutions bear the primary responsibility for incorporating these risks. The platform could offer tools to help clients.

- In 2024, the Task Force on Climate-related Financial Disclosures (TCFD) framework is increasingly used by financial institutions.

- The market for climate risk analytics is projected to reach $2.8 billion by 2025.

Environmental factors heavily influence Alkami. Data centers consumed 2% of global electricity in 2023, with emissions rising. Renewable energy adoption and climate risk management are critical for financial institutions. Alkami supports clients through these changes, but institutions bear the primary responsibility.

| Aspect | Impact | Data |

|---|---|---|

| Data Center Energy | Significant Carbon Footprint | 2% global electricity (2023) |

| Emissions Increase | Rising Environmental Impact | Projected 20% rise by 2025 |

| Climate Risk Management | Integration into Finance | $2.8B Climate Risk Analytics (2025 est.) |

PESTLE Analysis Data Sources

Alkami's PESTLE analysis draws on global databases, financial reports, and government publications for accurate environmental context.