Allianz Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allianz Bundle

What is included in the product

Highlights competitive advantages and threats per quadrant

Export-ready design for quick drag-and-drop into PowerPoint.

Delivered as Shown

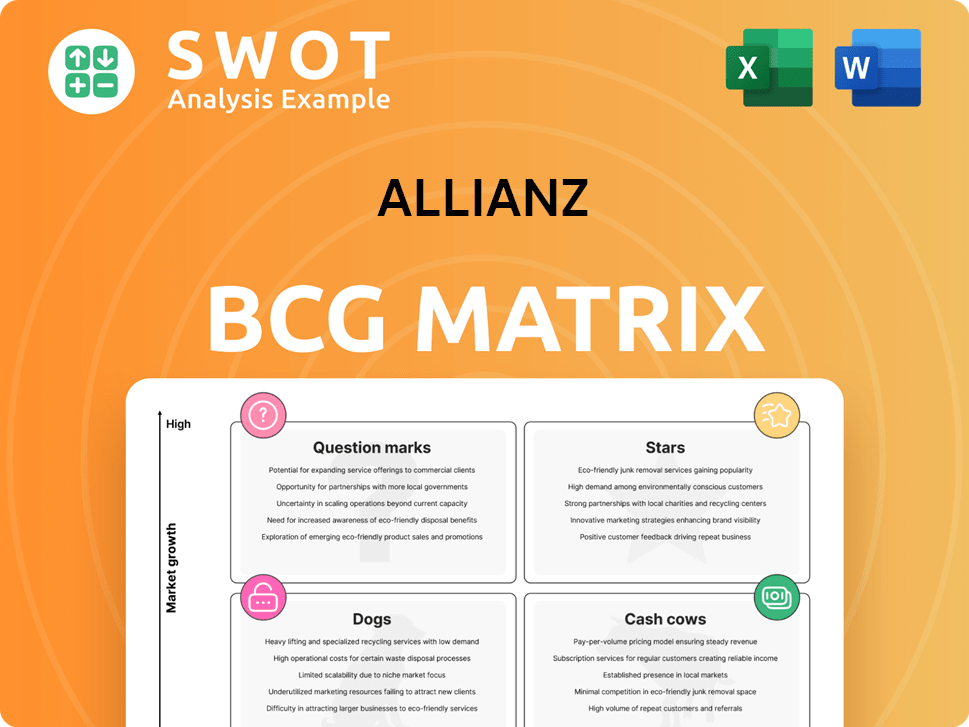

Allianz BCG Matrix

The Allianz BCG Matrix displayed is the same document you'll receive. This fully functional report is ready for download post-purchase, free from watermarks or alterations, and prepared for your strategic analysis.

BCG Matrix Template

This peek into Allianz's product portfolio reveals a snapshot of its strategic landscape. Understand where products sit: Stars, Cash Cows, Dogs, or Question Marks. Get the full BCG Matrix report for comprehensive analysis, strategic positioning, and investment recommendations.

Stars

Allianz's 2024 financial results showcase exceptional strength, reporting a record operating profit of €16.0 billion, an 8.7% increase. This growth, alongside an 11.2% rise in total business volume to €179.8 billion, underscores the "Star" status. Such robust performance across life/health and property-casualty segments solidifies their leading market position.

Allianz's Property-Casualty segment shines as a star, achieving a 14.3% rise in operating profit, reaching €7.9 billion in 2024. The total business volume expanded by 8.3% to €82.9 billion, driven by growth in both retail and commercial sectors. The combined ratio improved to 93.4% in 2024. This reflects strong underwriting and cost control.

The Life/Health insurance segment shines as a star in the Allianz BCG Matrix. Its premium growth is robust, with the present value of new business premiums reaching €81.8 billion, a 21.6% increase. Operating profit surged to €5.5 billion, exceeding expectations. This solidifies its role as a major growth engine for Allianz.

Asset Management Growth

Allianz's asset management segment shines as a star. Operating revenues surged to €8.3 billion, with operating profit reaching €3.2 billion, up 3.6%. This growth reflects strong investment performance and client demand. Third-party assets under management impressively increased to €1.92 trillion.

- Revenue Growth: Operating revenues reached €8.3 billion.

- Profitability: Operating profit rose 3.6% to €3.2 billion.

- AUM Growth: Third-party assets under management grew to €1.92 trillion.

- Performance: Driven by strong investment returns.

Strategic Growth Initiatives

Allianz's strategic initiatives, categorized as stars, emphasize smart growth, productivity, and resilience. The company leverages its trusted partner status to expand its customer base. This includes innovative protection and retirement solutions to ensure long-term value. Allianz reported a 6.5% increase in operating profit to €7.6 billion in 2023.

- Smart growth focuses on customer base expansion.

- Innovative solutions include protection and retirement options.

- Allianz's 2023 operating profit was €7.6 billion.

- Strategic initiatives aim for sustained value creation.

In the Allianz BCG Matrix, Stars represent high-growth, high-market-share business units. These segments, including Property-Casualty and Life/Health, drove significant revenue and profit increases in 2024. Strategic initiatives, such as smart growth, support sustained value. Allianz's 2024 results highlight its robust performance.

| Key Metrics (2024) | Property-Casualty | Life/Health |

|---|---|---|

| Operating Profit | €7.9B (+14.3%) | €5.5B (Surge) |

| Business Volume | €82.9B (+8.3%) | €81.8B (PV Premiums, +21.6%) |

| Combined Ratio | 93.4% | N/A |

Cash Cows

Allianz thrives in established insurance markets like Germany, France, and Italy, plus the U.S. life sector. These mature markets offer consistent cash flow, thanks to Allianz's strong market share. For example, Allianz generated €7.7 billion in operating profit in 2023 from its Life and Health business, showing its profitability. These areas are key for stable returns.

Allianz's global lines business, a cash cow, provides consistent earnings and diversification. It benefits from a strong brand and global operations. In 2023, Allianz's operating profit from Property-Casualty was €7.7 billion. The global lines contribute significantly to this figure, ensuring a steady income stream.

Allianz's asset management, particularly PIMCO, is a strong cash cow, generating significant fee income. This income consistently supports overall earnings, even when insurance results fluctuate. For example, in 2024, Allianz's asset management segment saw substantial inflows, boosting its fee income. This stable revenue stream enhances financial stability.

Sustainable Investments

Allianz views sustainable investments as a cash cow, capitalizing on the growing demand for environmentally and socially responsible financial products. In 2024, Allianz's sustainable investments grew to €171.9 billion, demonstrating substantial financial returns. The Property & Casualty business saw €4.9 billion in revenue from sustainable solutions, indicating a solid, steady income stream.

- Sustainable investments are a key focus area.

- €171.9 billion in sustainable investments in 2024.

- €4.9 billion revenue from sustainable solutions.

- Stable returns from sustainable solutions.

Customer Loyalty

Allianz's customer loyalty significantly bolsters its cash cow status. High customer satisfaction, reflected in a 72% outperformance in Net Promoter Score, drives retention and repeat business. This loyalty ensures a stable revenue stream, key for cash cows. Strong customer relationships provide a competitive edge.

- Customer retention rates are high due to positive experiences.

- Repeat business provides a reliable income stream.

- Loyalty reduces marketing costs.

- Customer advocacy boosts brand reputation.

Allianz leverages cash cows like global lines and asset management for stable income. Sustainable investments and customer loyalty further solidify this position. In 2024, the firm reported €171.9 billion in sustainable investments, illustrating strong cash generation.

| Key Cash Cow | 2024 Data | Significance |

|---|---|---|

| Global Lines | €7.7B Op. Profit (P&C) | Diversified, consistent earnings |

| Sustainable Investments | €171.9B invested | Growing, responsible income |

| Customer Loyalty | 72% NPS outperformance | High retention and repeat business |

Dogs

In the Allianz BCG Matrix, underperforming geographic regions with limited market share and low growth are "dogs." These areas often need costly recovery strategies. For example, Allianz might reassess its presence in regions where it struggles to compete effectively. Consider 2024 data on Allianz's market share in specific countries.

Dogs in Allianz's portfolio, like niche or outdated insurance products, struggle in low-growth markets with low market share. These offerings often fail to generate significant revenue or profit. For example, specific legacy insurance lines might see decreasing demand. In 2024, such products could represent a small fraction of Allianz's overall €150 billion in revenue.

Expensive turn-around projects, like those in the automotive industry, can become "dogs" if they need massive investment but don't boost market share. For example, a 2024 study showed that certain electric vehicle projects required billions but didn't significantly increase sales. These investments tie up capital without generating sufficient returns. This makes them less appealing investments.

Segments with High Combined Ratios

In the Allianz BCG Matrix, insurance segments with high combined ratios are often considered "dogs." These segments face challenges due to high claims and operational expenses compared to the premiums they generate. For instance, in 2024, certain property and casualty insurance lines showed combined ratios exceeding 100%, signaling losses. Such segments typically require major restructuring or might be divested to improve overall profitability.

- High combined ratios denote claims and expenses surpassing premiums.

- These segments often struggle to achieve profitability.

- Restructuring or divestment may be needed to improve performance.

- 2024 data shows some lines exceeding 100% combined ratio.

Business Units with Minimal Synergies

In Allianz's BCG Matrix, "Dogs" represent business units with weak market share in slow-growing markets, showing minimal synergy with core operations. These units, often independent, don't significantly boost Allianz's growth or profitability. Consider Allianz's 2024 Q1 results: net income attributable to shareholders was EUR 1.8 billion. Such units might be better off under different ownership. These units require strategic decisions.

- Low Market Share

- Minimal Synergies

- Independent Operations

- Strategic Evaluation

In Allianz's BCG matrix, "Dogs" have low market share in slow-growth markets. They often struggle to contribute significantly to overall profitability. Legacy insurance lines might fall into this category. In 2024, they might represent a small part of the company's revenue.

| Category | Characteristics | Example |

|---|---|---|

| Market Share | Low | < 2% in a segment |

| Growth Rate | Slow | < 1% annually |

| Financial Impact | Minimal | Low revenue contribution |

Question Marks

Allianz's new digital insurance offerings, like those in telematics, fit the question mark category. These products tap into expanding markets but currently hold a small market share. To boost market presence, Allianz needs substantial investments in marketing and customer engagement. For example, Allianz's digital sales in 2024 grew by 15%.

Allianz's push into emerging markets, like Southeast Asia, fits the question mark profile, indicating high growth potential with acceptance uncertainty. These expansions demand significant capital investments, with Allianz allocating €1 billion for growth initiatives in 2024. Success hinges on effective market penetration strategies.

Allianz's mobility ventures, including partnerships like the one with Chery International, represent question marks in its BCG Matrix. These ventures are in dynamic markets that require significant investment. For instance, the global electric vehicle market is projected to reach $823.8 billion by 2030. Success hinges on adapting to rapid changes and securing market share.

AI and Technology Integration

Investments in AI and technology integration are question marks for Allianz. These technologies could boost efficiency, yet success hinges on execution and adoption. Allianz's tech spending in 2024 reached €2.5 billion. The potential for increased automation and personalized services is substantial. However, the uncertain returns make these initiatives risky.

- 2024 tech spending: €2.5 billion

- Focus: Automation and personalization

- Risk: Uncertain returns

- Impact: Efficiency and innovation

Sustainable and Green Insurance Products

Sustainable and green insurance products are considered question marks within the Allianz BCG Matrix. These offerings, designed to support environmentally friendly initiatives, are experiencing rising demand. However, they require strategic marketing efforts to gain significant market share. To ensure success, these products must align with prevailing sustainability trends.

- In 2024, the global green insurance market was valued at approximately $20 billion.

- Projections indicate that the green insurance market could reach $40 billion by 2028.

- Successful market penetration hinges on effectively communicating the benefits of these products to environmentally conscious consumers.

- Strategic partnerships with sustainability-focused organizations can boost visibility and credibility.

Allianz's question marks involve high-growth, low-share areas needing investment. Digital insurance, like telematics, is a key focus, with 15% sales growth in 2024. Emerging markets and AI integration also fall into this category. Sustainable products, though in demand, also require focused marketing for market share gains.

| Feature | Description | Example |

|---|---|---|

| Market Position | High growth potential, low market share | Telematics insurance, emerging markets |

| Investment Needs | Significant capital for growth and market penetration | €1B in 2024 for growth, €2.5B tech spending |

| Strategic Focus | Marketing, partnerships, tech adoption | Sustainable insurance, AI initiatives |

BCG Matrix Data Sources

Allianz BCG Matrix uses financial reports, industry forecasts, and market research to categorize each business sector.