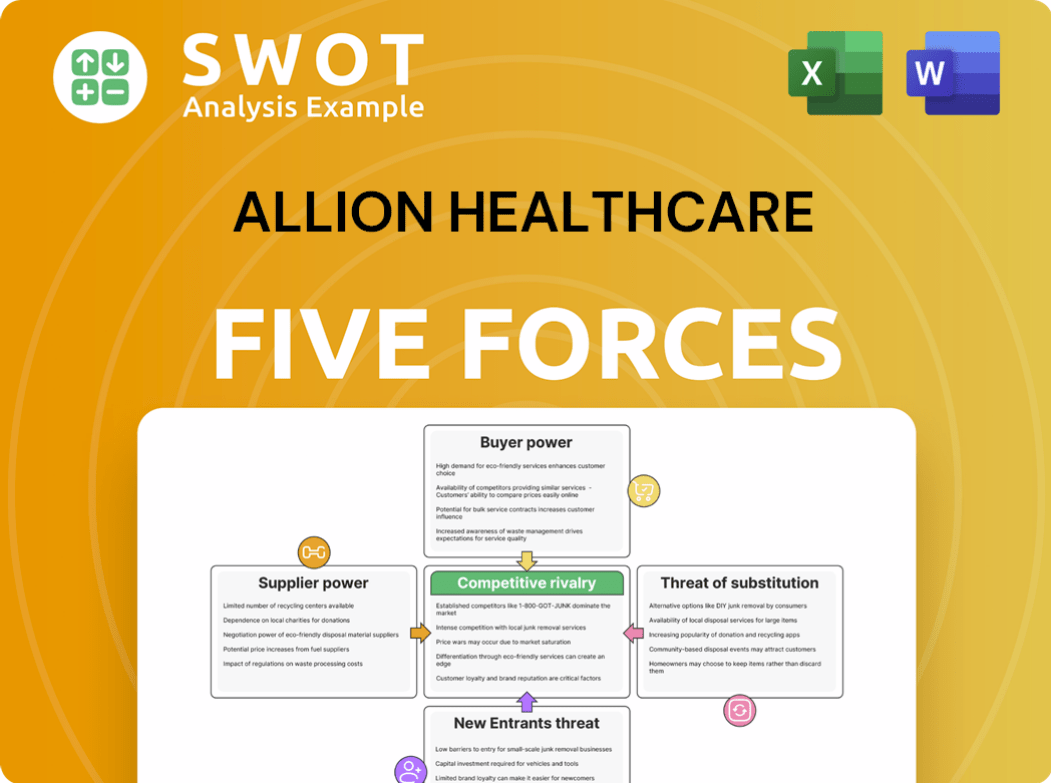

Allion Healthcare Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allion Healthcare Bundle

What is included in the product

Analyzes Allion Healthcare's position, identifying threats, influences, and dynamics within its competitive landscape.

Quickly analyze competitive pressures with a dynamic force-ranking system.

What You See Is What You Get

Allion Healthcare Porter's Five Forces Analysis

This is the complete, ready-to-use analysis file. The Allion Healthcare Porter's Five Forces Analysis assesses industry rivalry, supplier power, buyer power, threats of substitutes, and threats of new entrants. This preview showcases the full analysis, detailing each force's impact on Allion. It offers insights into competitive dynamics and market positioning. What you're previewing is what you get—professionally formatted and ready for your needs.

Porter's Five Forces Analysis Template

Allion Healthcare faces moderate rivalry, with established players and emerging competitors vying for market share. Buyer power is considerable, influenced by price sensitivity and insurance negotiations. Suppliers, including drug manufacturers, exert some influence, impacting cost structures. The threat of new entrants is moderate, given regulatory hurdles and capital requirements. Substitute products, such as generic alternatives, present a notable threat.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Allion Healthcare's real business risks and market opportunities.

Suppliers Bargaining Power

Allion Healthcare's costs are significantly influenced by the bargaining power of specialized labor. The healthcare sector's reliance on physicians, nurses, and therapists gives these professionals leverage. Labor shortages, especially in rural areas, can drive up wages. For example, the U.S. Bureau of Labor Statistics reported a median annual wage of $77,600 for registered nurses in May 2023.

Pharmaceutical suppliers, like those providing patented drugs, have strong bargaining power over Allion Healthcare. Their influence is amplified when Allion depends on unique drugs or medical devices, limiting Allion's pricing negotiation abilities. In 2024, the pharmaceutical industry's global market reached approximately $1.5 trillion, highlighting its economic clout. Specifically, branded drugs often command higher prices, increasing supplier leverage.

Medical equipment makers, crucial suppliers for Allion, significantly influence costs. Their power hinges on product differentiation and available substitutes. If equipment needs specialized service or software, it boosts suppliers. In 2024, the medical equipment market grew, with companies like Medtronic reporting over $30 billion in revenue. Allion must consider long-term service contracts, adding to expenses.

Healthcare IT vendors

Healthcare IT vendors, providing essential electronic health record (EHR) systems, wield significant bargaining power over Allion. Switching EHR systems is costly, giving vendors pricing power. Allion must consider long-term implications of IT vendor choices, including scalability. In 2024, the EHR market was valued at approximately $35 billion, with major vendors like Epic and Cerner controlling a large market share.

- High switching costs lock in customers.

- Vendor concentration limits Allion's options.

- Scalability and integration are key considerations.

- Market size shows vendor influence.

Group purchasing organizations (GPOs)

Group Purchasing Organizations (GPOs) significantly impact Allion Healthcare's supplier power. GPOs consolidate purchasing, influencing pricing for Allion. If Allion depends on a GPO, the GPO gains supplier strength. This can limit Allion's independent negotiation, yet provides favorable rates.

- GPOs negotiate roughly 60% of hospital supply contracts.

- In 2024, GPO membership included over 90% of U.S. hospitals.

- GPOs often offer 5-15% savings on medical supplies.

- Allion's profitability depends on GPO-negotiated supply costs.

Allion Healthcare faces supplier power from specialized labor, including medical professionals. Pharmaceutical suppliers, especially those with patented drugs, have strong influence due to market size of $1.5 trillion in 2024. Medical equipment makers also impact costs, with the market growing in 2024.

Healthcare IT vendors and GPOs further shape supplier dynamics.

| Supplier Type | Impact on Allion | 2024 Data |

|---|---|---|

| Pharmaceuticals | High Pricing | $1.5T global market |

| Medical Equipment | Cost Influence | Medtronic's $30B+ revenue |

| Healthcare IT | High switching cost | $35B EHR market |

Customers Bargaining Power

Patients now have more healthcare provider choices, armed with better information. Their ability to switch based on reputation, convenience, and cost strengthens their bargaining power. Allion Healthcare must prioritize patient satisfaction and cultivate a strong brand. In 2024, patient satisfaction scores significantly impact healthcare provider revenue, reflecting this shift.

Insurance plans significantly shape Allion Healthcare's financial landscape. These plans, including Medicare and Medicaid, influence patient choices, directing them towards specific providers. In 2024, approximately 60% of U.S. healthcare spending involved insurance negotiations. Allion's revenue is directly impacted by the reimbursement rates and coverage terms negotiated with these plans. Securing contracts with diverse insurance providers is vital, as evidenced by the 2024 trend where providers with broader insurance acceptance saw a 15% increase in patient volume.

Employer-sponsored healthcare significantly influences the bargaining power of customers. Many people get health coverage through their jobs. Employers negotiate with providers and insurers for better rates and benefits. Allion Healthcare must offer competitive pricing to attract employer groups. In 2024, about 49% of Americans get health insurance through their employers, showing this power.

Price sensitivity

Patients' price sensitivity is heightened due to rising healthcare costs, especially with high-deductible plans. This awareness encourages them to find cheaper alternatives or negotiate prices with providers. Allion Healthcare should be transparent about pricing and offer cost-effective care. In 2024, healthcare spending in the US is projected to reach $4.8 trillion.

- Increased patient awareness of healthcare costs.

- Rise of high-deductible health plans.

- Need for transparent pricing and cost-effective care.

- Healthcare spending in the US projected to reach $4.8T in 2024.

Demand for quality and outcomes

Patients, the ultimate customers, increasingly demand high-quality care and positive health outcomes, influencing their choice of healthcare providers. This focus gives them significant bargaining power. In 2024, patient satisfaction scores and health outcomes data are crucial for healthcare providers' reputations and financial performance. Allion Healthcare must prioritize demonstrating its commitment to quality and patient-centered care.

- Patient satisfaction scores directly affect reimbursement rates from payers, influencing revenue.

- Data-driven outcomes, like reduced readmission rates, showcase quality.

- Patient testimonials and reviews build trust and attract new patients.

- Failure to meet quality expectations can lead to patient attrition and decreased market share.

Allion Healthcare faces customer bargaining power from informed patients, insurance plans, and employers. Patients choose based on cost and quality, driving providers to be competitive. In 2024, rising healthcare costs and insurance influence patient choices.

| Factor | Impact | 2024 Data |

|---|---|---|

| Patient Awareness | Choice of providers | $4.8T US healthcare spend |

| Insurance Plans | Negotiated Reimbursement | 60% spending involves negotiation |

| Employer Influence | Price and benefit demands | 49% insured through employers |

Rivalry Among Competitors

Allion Healthcare encounters competition from local primary care practices and behavioral health clinics. The intensity hinges on the number and size of rivals, plus their services and prices. In 2024, the healthcare industry saw a rise in local clinic mergers, with about 7% increasing market share. Allion must differentiate through specialized care or better patient experiences to thrive.

Large hospital systems, like HCA Healthcare, with over 180 hospitals, pose significant competition due to their extensive resources. These systems often have established primary care networks. They may have greater brand recognition, providing them with a competitive edge in attracting patients. Allion Healthcare must emphasize its agility and patient-centric approach to compete effectively.

The healthcare sector is seeing significant consolidation. Mergers and acquisitions are creating larger, more dominant players. This intensifies competitive pressure on Allion Healthcare. Allion should consider strategic alliances to strengthen its position. In 2024, M&A activity in healthcare totaled over $200 billion, reflecting this trend.

Technology-driven competition

Technology-driven competition is intensifying in healthcare. Telehealth and digital health companies are emerging as strong rivals, offering convenient care. These competitors can disrupt traditional models. Allion must invest in telehealth and digital tools. The global telehealth market was valued at $61.4 billion in 2023.

- Market growth: The telehealth market is projected to reach $393.6 billion by 2030.

- Investment: Digital health companies raised $15.3 billion in funding in 2023.

- Adoption: Telehealth visits have increased by 38x since pre-pandemic levels.

- Competition: Over 10,000 digital health companies exist globally.

Value-based care models

The shift to value-based care is heating up competition in healthcare. Providers like Allion Healthcare are now battling to show they offer the best outcomes at the lowest cost. This model changes the game, focusing on quality and efficiency. Allion must prove its value through better patient results and lower expenses to stay competitive.

- In 2024, value-based care accounted for over 50% of U.S. healthcare payments.

- Providers are increasingly using data analytics to track and improve patient outcomes.

- Cost reduction is a key focus, with initiatives aimed at decreasing hospital readmissions.

- Allion needs to invest in technology and staff training to excel in this environment.

Competitive rivalry for Allion Healthcare involves local clinics, hospitals, and tech firms. The market is competitive. M&A activity in healthcare exceeded $200 billion in 2024, and digital health raised $15.3 billion in funding.

| Rival | Impact | Strategy |

|---|---|---|

| Local Clinics | Price/Service Competition | Specialize |

| Hospitals | Resource Advantage | Focus on Agility |

| Telehealth | Convenience | Digital Tools |

SSubstitutes Threaten

Retail clinics pose a threat by offering accessible, affordable alternatives to Allion Healthcare's primary care services. These clinics, often found in pharmacies and grocery stores, attract patients with minor health issues due to their convenience. In 2024, the retail clinic market is estimated to grow, with CVS Health and Walgreens expanding their clinic footprints. Allion must highlight its comprehensive care and the benefits of a long-term patient-physician relationship to counter this threat.

Urgent care centers pose a threat to Allion Healthcare by offering immediate care alternatives. These centers substitute primary or emergency room visits, especially for acute issues. The appeal lies in quicker access, potentially diverting patients. Allion can collaborate with these centers, improving access and care coordination. In 2024, the urgent care market is projected to reach $40.9 billion, highlighting their impact.

Telehealth services pose a significant threat to Allion Healthcare as they offer a convenient substitute for traditional in-person visits. This shift is fueled by the increasing adoption of digital health solutions; the global telehealth market was valued at USD 62.3 billion in 2023 and is projected to reach USD 257.0 billion by 2030. Telehealth provides remote access to various services, including primary care and mental health, making it attractive. To stay competitive, Allion Healthcare must integrate telehealth to meet evolving patient expectations and market demands.

Alternative medicine

The threat of substitutes in Allion Healthcare's market includes alternative medicine. Some patients opt for therapies like acupuncture, potentially reducing demand for traditional treatments. In 2024, the global alternative medicine market was valued at approximately $80 billion. Allion could integrate complementary therapies, offering a broader approach.

- Market size: The global alternative medicine market was about $80 billion in 2024.

- Patient preference: Some patients prefer holistic or non-pharmacological approaches.

- Strategic response: Allion can integrate complementary therapies.

Self-care and prevention

Patients increasingly turn to self-care, a substitute for Allion Healthcare's services. This involves lifestyle changes and managing conditions independently. Over-the-counter medications offer alternatives to prescribed treatments. Allion can encourage prevention and self-management to reduce service reliance.

- In 2024, the self-care market grew, with a 7% increase in over-the-counter drug sales.

- Preventive care spending rose by 5%, reflecting a shift towards proactive health management.

- Telehealth visits for minor ailments increased by 15%, suggesting a preference for accessible alternatives.

- Allion can create educational programs, and offer virtual consultations.

Retail clinics, offering accessible care, pose a threat, with a growing 2024 market. Urgent care centers provide quick alternatives, with an estimated $40.9 billion market in 2024. Telehealth's convenience also threatens, projected to reach $257 billion by 2030.

| Substitute | Impact | 2024 Market Data |

|---|---|---|

| Retail Clinics | Accessible, Affordable Care | Growing market; CVS, Walgreens expansion |

| Urgent Care Centers | Immediate Care for Acute Issues | $40.9 billion market |

| Telehealth | Convenient Remote Services | Projected to $257 billion by 2030 |

Entrants Threaten

Large healthcare systems pose a major threat to Allion Healthcare. These systems, with substantial financial backing and established brands, could easily enter the market. In 2024, the healthcare industry saw significant consolidation, with major players expanding their reach. To compete, Allion must focus on building strong patient and referral relationships.

Technology giants like Amazon and Google pose a threat to Allion. They have the resources and tech to disrupt healthcare. For example, Amazon's healthcare ventures showed a 20% revenue increase in 2024. To compete, Allion must embrace tech and partnerships.

Insurance companies pose a threat by potentially entering healthcare delivery. They can acquire or create primary care and care management services. This could control costs and improve care for their members. Allion must show its value and build partnerships to compete. In 2024, UnitedHealth Group's revenue was over $372 billion, showing the scale of insurance companies' influence.

Physician groups

Large physician groups and IPAs pose a threat, potentially expanding geographically to rival Allion Healthcare. These groups often boast established referral networks and strong payer relationships, offering competitive advantages. Allion must differentiate itself to counter this threat, focusing on specialized services and patient experience. In 2024, the healthcare industry saw a 12% rise in physician group acquisitions, indicating increased consolidation.

- Growing physician group acquisitions signal a shift in market dynamics.

- Established networks and payer relationships provide competitive advantages.

- Differentiation is crucial for Allion to maintain market share.

- Focus on specialized services and patient experience to thrive.

Venture-backed startups

The healthcare sector sees a constant influx of venture-backed startups introducing innovative solutions and business models. These new entrants, often targeting specific market segments or leveraging disruptive technologies, pose a significant threat to established companies like Allion Healthcare. Allion must proactively monitor these emerging competitors and remain agile to adapt to these innovations. In 2024, venture capital investments in health tech reached over $15 billion, signaling a robust pipeline of potential challengers.

- Rapid technological advancements enable startups to quickly develop and deploy new healthcare solutions.

- Startups often focus on niche markets, potentially eroding Allion's market share in specific areas.

- The ability of startups to disrupt traditional healthcare models with innovative business approaches.

- Allion must invest in research and development to stay competitive.

New entrants constantly emerge in healthcare. Venture capital fuels innovative startups. Allion must watch these competitors to stay ahead.

| Factor | Impact | 2024 Data |

|---|---|---|

| Venture Capital | Supports new tech | $15B in health tech |

| Startup Focus | Niche markets | Targeted solutions |

| Allion's Response | Adapt and innovate | R&D investment |

Porter's Five Forces Analysis Data Sources

Allion Healthcare's analysis uses annual reports, market studies, and government statistics, supplemented by competitor intelligence and economic indicators.