Alnylam Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alnylam Bundle

What is included in the product

Alnylam's pipeline analyzed across BCG Matrix quadrants, revealing investment and divestment strategies.

Printable summary optimized for A4 and mobile PDFs, allowing easy sharing of Alnylam's strategic overview.

Full Transparency, Always

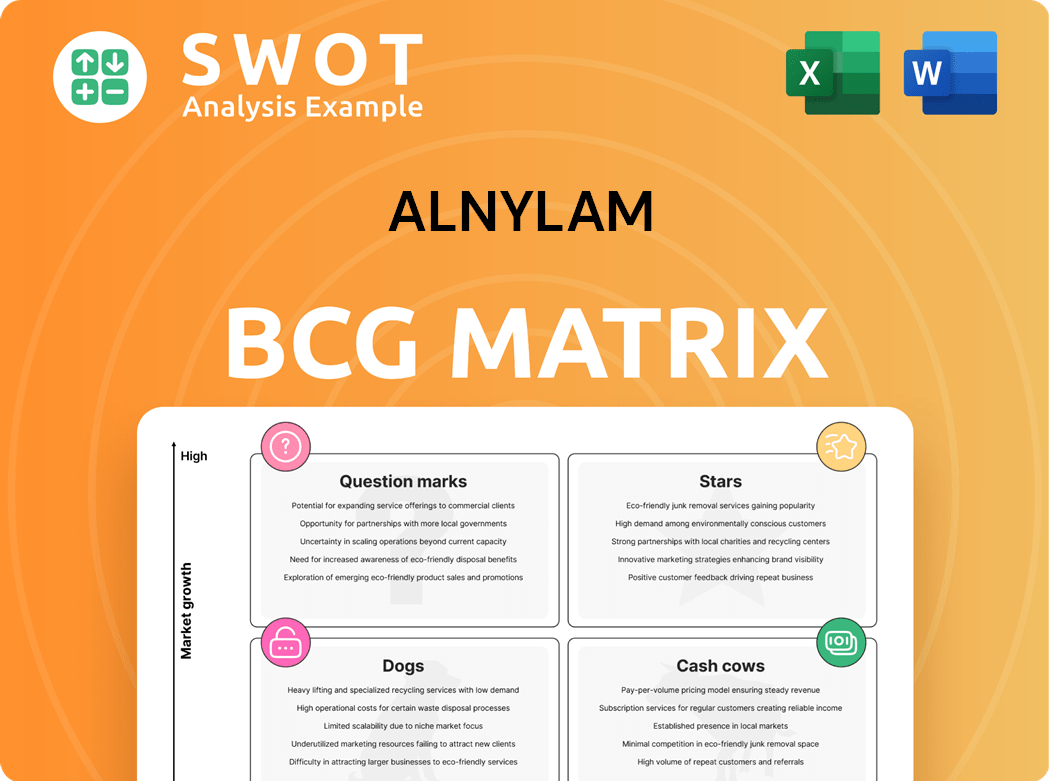

Alnylam BCG Matrix

The BCG Matrix preview is the identical report you receive after purchase from Alnylam. It is a fully formatted, downloadable document, ready to be used for strategic analysis. No hidden elements, just the complete professional report crafted for your needs. You'll get the exact same file.

BCG Matrix Template

Alnylam's potential is complex! This snippet shows some product placements within its BCG Matrix.

Is each drug a Star, Cash Cow, Dog, or Question Mark?

Understanding these quadrants is vital for strategic success. This simplified view only scratches the surface of the strategic implications.

Discover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment with the full BCG Matrix.

Purchase it now!

Stars

Amvuttra, used for hATTR amyloidosis, shows impressive growth. It's attracting new patients and seeing switches from Onpattro. In 2024, Amvuttra's sales reached $970.5 million, a 74% increase. Expansion into ATTR cardiomyopathy could further boost its market position.

Alnylam's RNAi platform is a core strength, creating innovative disease therapies. Their RNAi expertise makes them a leader, fostering partnerships. In 2024, Alnylam's R&D spending was substantial, reflecting their platform investment. This investment drives future growth, with RNAi's market expected to reach billions.

The TTR franchise, including ONPATTRO and AMVUTTRA, is vital for Alnylam. It's projected to earn $1.6-$1.725 billion in 2025, a 36% increase from the estimated 2024 revenue. This growth is mainly due to the expected ATTR-CM label expansion for vutrisiran. The TTR franchise is key to Alnylam's financial strategy.

Robust Clinical Pipeline

Alnylam's robust clinical pipeline boasts over 25 programs in the clinic. This pipeline is crucial for future revenue and market expansion. Advancements in the pipeline will drive long-term growth. In Q3 2024, Alnylam's R&D expenses were $466.8 million. It's a key focus for the company.

- Over 25 programs in the clinic.

- Multiple late-stage candidates.

- Significant revenue potential.

- Long-term growth driver.

Strategic Partnerships

Alnylam's strategic partnerships are crucial for its growth. Collaborations with Sanofi, Novartis, and Roche boost its reach and resources. These partnerships help Alnylam globally commercialize its RNAi therapeutics. They maximize the potential of Alnylam's pipeline and platform.

- In 2024, Alnylam reported over $1 billion in net product revenues, driven by collaborations.

- Partnerships have helped expand their global footprint across multiple markets.

- These collaborations support the advancement of numerous clinical trials.

- Alnylam's partnership with Roche focuses on developing treatments for neurological diseases.

Alnylam's "Stars" include strong growth drivers like Amvuttra, with 2024 sales at $970.5 million, and a promising clinical pipeline. The TTR franchise is expected to generate $1.6-$1.725 billion in 2025. Strategic partnerships with companies like Roche and Novartis support expansion.

| Product | 2024 Sales | Key Feature |

|---|---|---|

| Amvuttra | $970.5M | hATTR Amyloidosis |

| TTR Franchise (Projected 2025) | $1.6-$1.725B | Growth Potential |

| R&D Expenses (Q3 2024) | $466.8M | Pipeline Focus |

Cash Cows

Givlaari, approved for acute hepatic porphyria (AHP), is a cash cow for Alnylam. In 2024, Givlaari brought in $256 million in revenue. Though growth isn't as rapid as with Amvuttra, it remains a key financial contributor. Givlaari consistently generates substantial income for Alnylam.

Oxlumo, approved for primary hyperoxaluria type 1 (PH1), helps lower oxalate levels in patients of all ages. In 2024, Oxlumo brought in $167 million in revenue. This makes it a dependable source of income, similar to Givlaari. It supports Alnylam's financial health and expansion plans.

Alnylam's collaboration with Novartis for Leqvio is a "Cash Cow" in its BCG Matrix. Novartis holds exclusive rights to manufacture and commercialize Leqvio, an RNAi therapeutic for hypercholesterolemia. Alnylam earns royalties from Leqvio sales, generating a reliable revenue stream. In 2024, Leqvio's sales reached approximately $400 million, showcasing its significant contribution. This partnership minimizes Alnylam's financial risk, ensuring steady income.

Market Leadership in RNAi Therapeutics

Alnylam's market leadership in RNAi therapeutics is a cash cow due to its strong position in cardiovascular and rare diseases. This leadership enables premium pricing and favorable market access, boosting its revenue stream. Continued innovation is key to maintaining this advantage. Alnylam's 2024 revenue reached $1.2 billion, showcasing its market dominance.

- Market Leadership: Alnylam's top position in RNAi.

- Financial Performance: 2024 revenue of $1.2 billion.

- Competitive Advantage: Premium pricing and market access.

- Strategic Focus: Continuous innovation and execution.

Rare Disease Portfolio

Alnylam's rare disease portfolio, featuring drugs like Givlaari and Oxlumo, is a key cash cow. These drugs leverage orphan drug designations, ensuring market exclusivity and premium pricing. This strategic advantage significantly boosts Alnylam's financial performance. The rare disease segment is a crucial revenue driver for the company, underpinning its overall profitability.

- Givlaari's 2023 sales were approximately $402 million.

- Oxlumo's 2023 sales were around $260 million.

- Orphan drug status provides 7 years of market exclusivity in the US.

- The rare disease portfolio contributes over 50% of Alnylam's total revenue.

Alnylam's cash cows include Givlaari, Oxlumo, and Leqvio royalties. Givlaari and Oxlumo brought in $256M and $167M in 2024. Leqvio royalties added about $400M, and Alnylam's market leadership in RNAi contributed to $1.2B in revenue in 2024.

| Product | 2024 Revenue (USD Million) | Notes |

|---|---|---|

| Givlaari | 256 | Approved for AHP |

| Oxlumo | 167 | Approved for PH1 |

| Leqvio (Royalties) | 400 | Novartis Collaboration |

| Market Leadership | 1200 | Total 2024 Revenue |

Dogs

Alnylam's early-stage pipeline has programs with uncertain futures. These may struggle in clinical trials or during commercialization. Significant investment is needed, but returns are not guaranteed. In 2024, R&D spending was a key focus. Prioritizing these programs is crucial for efficient resource use.

Alnylam's "Dogs" face tough competition, potentially hindering market share and revenue. Competitors include established treatments and new entrants. For instance, in 2024, the RNAi therapeutics market saw increased competition, especially in the cardiovascular space. Alnylam must highlight its product's superior benefits to succeed. According to Q3 2024 data, Alnylam’s product sales are still growing, but the pace needs to accelerate to outpace rivals.

Certain Alnylam programs might focus on small patient groups, limiting their market reach. These ventures could generate modest revenue, potentially discouraging major financial backing. In 2024, Alnylam's focus shifted toward programs with broader commercial prospects. The company allocated resources to therapies with larger market opportunities, reflecting this strategic pivot. This approach is crucial for optimizing resource allocation and maximizing return on investment.

Onpattro (patisiran) due to Amvuttra switch

Onpattro, Alnylam's treatment, faces a decline as patients shift to Amvuttra. This switch is impacting Onpattro's market share, though it still contributes to revenue. Alnylam must navigate this transition strategically to maintain financial stability and minimize losses in 2024. Effective management is crucial for sustained success.

- Onpattro sales are decreasing, indicating a shift in patient preference.

- Amvuttra is gaining market share, becoming a primary treatment option.

- Alnylam needs to optimize the transition to prevent revenue decline.

- Financial strategies are necessary to mitigate the impact of market changes.

Fitusiran (partnered with Sanofi) - regulatory uncertainty

Fitusiran, an RNAi therapeutic for hemophilia A and B, is co-developed with Sanofi. Regulatory decisions are crucial, with the FDA's PDUFA date set for March 28, 2025. Approval is expected, but delays or rejection could affect Alnylam's finances. Sanofi's 2024 R&D expenses were $7.5 billion, reflecting their investment.

- Fitusiran targets hemophilia, a market projected to reach $14.6 billion by 2029.

- Alnylam's 2024 revenue was $1.2 billion, significantly impacted by fitusiran's approval.

- Sanofi's commitment includes significant investment in Phase 3 trials, totaling nearly $1 billion.

Alnylam's "Dogs" face fierce competition, potentially limiting market success. These products may struggle to gain market share against established treatments. Strategic focus and superior product benefits are essential for survival. For example, in 2024, the RNAi therapeutics market grew to $3.2 billion, with intense competition.

| Aspect | Details |

|---|---|

| Market Growth (2024) | RNAi therapeutics market: $3.2B |

| Competitive Pressure | Established & New Treatments |

| Strategic Need | Highlight product benefits |

Question Marks

Alnylam plans to launch a Phase 3 trial for nucresiran in ATTR amyloidosis with cardiomyopathy by mid-2025. This trial addresses a major need, but success isn't guaranteed. Positive outcomes could boost Alnylam's market value, potentially impacting its $25 billion market capitalization as of late 2024. The ATTR amyloidosis market is estimated to reach $3 billion by 2028.

Alnylam and Roche are set to launch a phase III study on zilebesiran for hypertension in late 2025. This could potentially yield a blockbuster drug. In 2024, the global hypertension drug market was valued at approximately $30 billion. Strategic investment by Alnylam is crucial to capitalizing on this opportunity.

Mivelsiran is a very early-stage project for Alzheimer's disease, a huge but tough market. In 2024, the global Alzheimer's market was valued at over $5 billion. Alnylam must be cautious with investment, given the high failure rate in Alzheimer's drug development. Strategic planning is key to navigating this risky, high-reward opportunity.

Elebsiran (partnered with Vir Biotechnology) for hepatitis B and D

Elebsiran, an RNAi therapeutic, teams with Vir Biotechnology for chronic hepatitis B and D. The market is substantial, yet competition is fierce. To succeed, Alnylam and Vir must highlight Elebsiran's unique advantages. Hepatitis B affects ~296 million people globally, with ~1.5 million deaths annually. The hepatitis D market is smaller but still significant.

- Partnership with Vir Biotechnology aims to leverage their expertise.

- The competitive landscape includes established and emerging therapies.

- Elebsiran's differentiation is key for market penetration.

- Market size: Hepatitis B and D are significant global health issues.

Programs Targeting Prevalent Diseases

Alnylam's strategic shift involves targeting prevalent diseases like cardio-metabolic and hepatic infectious diseases. These programs present significant revenue potential, aligning with the growing market for treatments in these areas. However, increased competition and stringent regulatory scrutiny pose challenges. Alnylam's success hinges on effective execution within these competitive markets.

- Cardio-metabolic diseases represent a large market with substantial unmet needs.

- Hepatic infectious diseases also offer considerable commercial opportunities.

- Increased competition necessitates strong clinical data and marketing.

- Regulatory hurdles require careful navigation to ensure market approval.

Alnylam's "Question Marks" include early-stage projects like Mivelsiran and upcoming trials. These ventures target significant markets such as Alzheimer's and hypertension, representing considerable commercial potential. The risks are high, necessitating careful investment and strategic planning. Successful execution could transform these projects into "Stars" or "Cash Cows."

| Drug | Market | 2024 Market Value |

|---|---|---|

| Mivelsiran | Alzheimer's | $5B+ |

| Zilebesiran | Hypertension | $30B |

| Nucresiran | ATTR Amyloidosis | $3B (by 2028) |

BCG Matrix Data Sources

Alnylam's BCG Matrix is built on reliable data. We leverage financial filings, market reports, and expert analysis to ensure precise, strategic insights.