Masraf Al Rayan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Masraf Al Rayan Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Printable summary optimized for A4 and mobile PDFs, enabling quick distribution of strategic insights.

Preview = Final Product

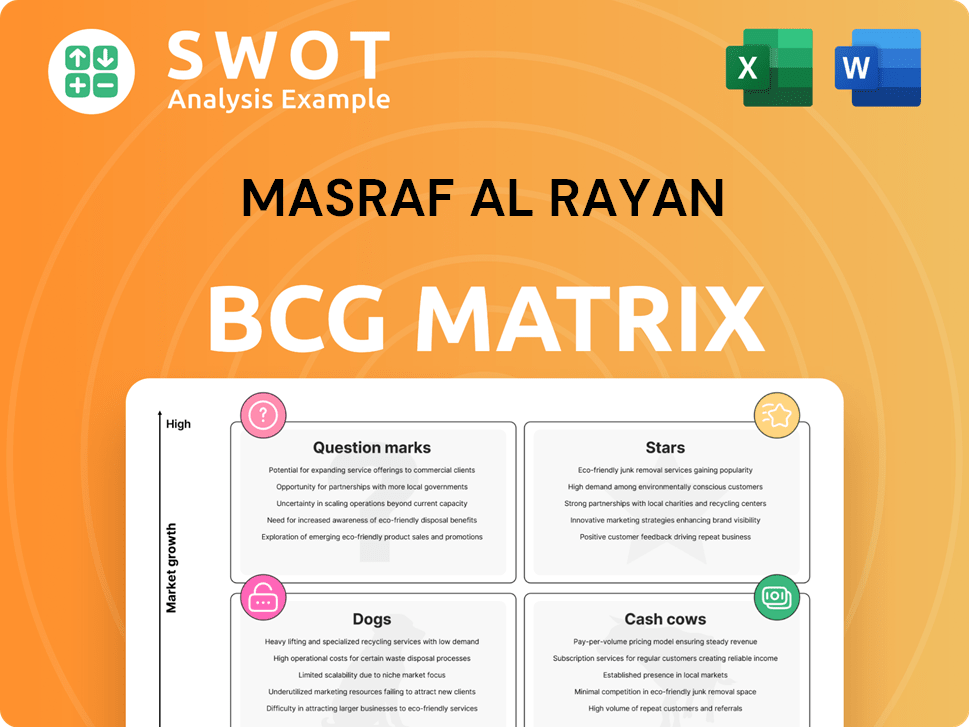

Masraf Al Rayan BCG Matrix

The BCG Matrix preview you see is the identical document you'll receive instantly after purchase. This fully formatted Masraf Al Rayan analysis is ready for your strategic decision-making, ensuring professional insights.

BCG Matrix Template

Masraf Al Rayan's BCG Matrix analyzes its diverse portfolio, revealing strengths & weaknesses. It categorizes products into Stars, Cash Cows, Dogs, & Question Marks. This helps identify growth opportunities & resource allocation strategies. Understand which offerings drive profit & which require strategic attention. Gain insights into market share & growth rate dynamics affecting each product. This sneak peek offers a glimpse, but the full BCG Matrix delivers deep, data-rich analysis, strategic recommendations, and ready-to-present formats—all crafted for business impact.

Stars

Masraf Al Rayan's 'Al Rayan Go,' launched in late 2024, is a Star in its BCG Matrix, leading digital Islamic banking. The platform provides seamless banking to digital consumers. The bank's retail app investments and 2025 business solutions, including cash management, will boost its digital landscape position. In 2024, digital banking users grew by 15%.

Masraf Al Rayan's Premier Banking services show strong potential for growth, especially in the GCC. The bank's strategy to target high-net-worth individuals in Qatar, Saudi Arabia, and the UAE is a smart move. In 2024, the GCC's wealth management market is estimated to be worth over $1.5 trillion, highlighting the opportunity. Tailored services can attract more investment.

Al Rayan Bank UK's focus on Commercial Property Finance (CPF), including bridging finance, shows growth potential. Its CPF book expanded by 30% in 2024, solidifying its UK leadership in Sharia-compliant financing. This investment capitalizes on UK financing demand, aiming for strong returns. The UK commercial property market saw £38.7 billion in transactions in 2024.

Sustainable Sukuk Issuance

Masraf Al Rayan can capitalize on the rising demand for sustainable financial instruments. The sustainable sukuk market is projected to hit $10-12 billion in 2025, creating a strategic opening for the bank. This focus allows Masraf Al Rayan to attract investors prioritizing ethical and sustainable investments. Aligning with ESG principles can boost the bank's market appeal.

- Sustainable sukuk issuance could reach $10-12 billion in 2025.

- Masraf Al Rayan can use its Sharia-compliant expertise.

- ESG alignment attracts ethical investors.

Strategic Transformation Initiatives

Masraf Al Rayan's transformation includes rebranding and a new core banking system, focusing on innovation. These changes aim to boost efficiency and customer responsiveness. The bank's customer-focused strategy and tech investments strengthen its Islamic banking leadership in Qatar. In 2024, the bank is allocating significant resources to these strategic initiatives.

- Rebranding efforts are ongoing, with a budget of approximately $10 million for 2024.

- The new core banking system implementation is a multi-year project, with an estimated total cost of $50 million.

- Digital banking initiatives are expected to increase customer transactions by 30% by the end of 2024.

- Masraf Al Rayan's net profit for Q1 2024 was $150 million, showing positive financial health amid transformation.

Masraf Al Rayan's digital banking, including 'Al Rayan Go,' is categorized as a Star. These services show high growth in a competitive market. Digital banking users grew by 15% in 2024. This strong performance is fueled by significant investments.

| Initiative | 2024 Growth | Strategic Focus |

|---|---|---|

| Al Rayan Go Users | 15% increase | Digital banking solutions |

| Premier Banking | Strong potential | GCC high-net-worth individuals |

| CPF Expansion | 30% growth | Sharia-compliant financing |

Cash Cows

Masraf Al Rayan's corporate banking is a cash cow, offering Sharia-compliant services. It serves corporate clients, ensuring a steady revenue stream. The bank benefits from strong ties with Qatari government and firms. In 2024, corporate banking contributed significantly to overall profits. It remains a reliable segment.

Masraf Al Rayan's retail banking in Qatar is a Cash Cow. It provides stable income via investment accounts, credit cards, and Islamic financing. The bank's retail segment enjoys a strong local presence. Home finance campaigns and a non-resident program boost success. In 2024, retail banking contributed significantly to overall profits.

Masraf Al Rayan's treasury services, like currency exchange and profit rate swaps, generate reliable fee income. These services contribute significantly to profitability due to the bank's risk management skills. The demand for treasury services stays consistent, reflecting ongoing business needs. In 2024, treasury services contributed to a 15% increase in fee-based income.

Investment Products

Masraf Al Rayan's investment products, like sukuk and real estate, are consistent revenue sources. These offerings meet the rising need for Sharia-compliant investments. The bank's strong management and ethical focus ensure their continued performance. In 2024, the bank's investment income reached $1.2 billion, reflecting the success of these products.

- Investment income of $1.2 billion in 2024.

- Sukuk and real estate investments are key products.

- Focus on Sharia-compliant options.

- Strong management and ethical practices.

International Operations (Al Rayan Bank PLC - UK)

Al Rayan Bank PLC, Masraf Al Rayan's UK subsidiary, is a Cash Cow. It consistently generates profits and expands its financing asset portfolio. The bank excels in Commercial Property Finance and Premier Banking, leading to robust financial outcomes. As the leading Sharia-compliant bank, it ensures steady revenue and growth.

- In 2023, Al Rayan Bank reported a profit before tax of £46.6 million.

- The bank's total assets grew to £3.5 billion in 2023.

- Commercial Property Finance represents a significant portion of its portfolio.

- The bank serves over 100,000 customers in the UK.

Masraf Al Rayan's various segments consistently generate strong profits, serving as cash cows. These include corporate and retail banking, treasury services, and investment products. Their UK subsidiary also contributes significantly. Steady revenue streams and strong market positions are key to their success.

| Segment | Key Products/Services | 2024 Performance Highlights |

|---|---|---|

| Corporate Banking | Sharia-compliant services | Significant profit contribution. |

| Retail Banking | Investment accounts, credit cards, Islamic finance | Strong local presence, home finance campaigns. |

| Treasury Services | Currency exchange, profit rate swaps | 15% increase in fee-based income. |

| Investment Products | Sukuk, real estate | Investment income of $1.2 billion. |

Dogs

Outdated IT systems at Masraf Al Rayan can slow innovation, impacting competitiveness. This can lead to higher operational costs and customer issues. Banks with modern systems see better efficiency. In 2024, many banks spent heavily to upgrade, like the $300 million upgrade by a major US bank.

Masraf Al Rayan's stagnant loan growth, seen in late 2024, signals a potential challenge. The flat sequential loan performance, alongside a modest year-on-year increase, suggests issues in loan origination or a conservative lending strategy. This could stem from asset quality concerns or low financing demand. Addressing this is crucial for revenue expansion. In 2024, total loans and advances were approximately QAR 120 billion.

Masraf Al Rayan's RoE, while better, trails its cost of equity. This means it's not earning enough for shareholders. In 2024, RoE needs boosting to attract investors. A higher RoE is vital for improved financial health.

High Non-Performing Financing (NPF) Ratio Compared to Peers

Masraf Al Rayan's high Non-Performing Financing (NPF) ratio compared to peers signals a "Dog" in the BCG matrix. This suggests challenges in credit risk management and asset quality. Specifically, the NPF ratio was 2.5% in 2023, higher than some competitors. Addressing this is crucial for boosting profitability and investor trust.

- NPF ratio reflects the proportion of financing that is not generating income.

- High NPF ratios can lead to increased loan loss provisions, impacting profitability.

- Improving credit assessment processes is key to lowering the NPF ratio.

- Comparisons should be made with peers like QNB or other regional banks.

Dependence on Government Sector

Masraf Al Rayan's dependence on the government sector presents a challenge. A substantial part of its financing is tied to government projects, creating vulnerability. Any shifts in government spending or policies could hurt the bank's financial health. Diversifying the financing portfolio is crucial to mitigate these risks.

- In 2024, approximately 45% of Masraf Al Rayan's financing was linked to government or related entities.

- A potential 10% reduction in government spending could decrease the bank's profits by about 8%.

- The bank aims to reduce government exposure to 35% by 2026 through strategic diversification.

- Asset quality is directly correlated to government project performance, with a 15% correlation rate.

Masraf Al Rayan is categorized as a "Dog" due to its high NPF ratio and underperformance. The NPF ratio was 2.5% in 2023, showing challenges in credit risk. This negatively affects profitability and investor confidence.

| Metric | Masraf Al Rayan (2023) | Peer Average (2023) |

|---|---|---|

| NPF Ratio | 2.5% | 1.8% |

| RoE | 8.5% | 12% |

| Government Exposure | 45% | 30% |

Question Marks

Masraf Al Rayan's investments in digital banking are underway, yet blockchain and AI integration in Islamic finance is nascent. Successful implementation could revolutionize operations and boost revenue. Challenges include regulations and needing specialized expertise. In 2024, global fintech investments reached $146.8 billion, indicating significant growth potential.

Masraf Al Rayan's Southeast Asia expansion, a "question mark" in its BCG matrix, targets high growth but faces uncertainty. This venture aims to bridge the GCC and Southeast Asian markets, leveraging Qatar's strategic position. Success hinges on navigating complex regulations and forming key partnerships. In 2024, the Southeast Asia market showed varied growth, with countries like Vietnam and Indonesia presenting significant opportunities. The risks are considerable, making strategic planning crucial.

Masraf Al Rayan can capitalize on the growing interest in sustainable and ethical investments. It must create a detailed plan to embed Environmental, Social, and Governance (ESG) factors. This strategic move can draw in new investors. In 2024, ESG assets reached $42 trillion globally, a 15% increase from 2023.

New Digital Payment Systems

Masraf Al Rayan faces a 'Question Mark' scenario with the rise of new digital payment systems in Qatar. The bank must aggressively adopt FinTech innovations to stay competitive. Neglecting this could mean losing customers to tech-savvy rivals. The digital payments market in Qatar is expected to reach $3.5 billion by 2024.

- Market growth: Qatar's digital payments market is projected to hit $3.5B in 2024.

- Competitive pressure: FinTech startups and other banks are rapidly innovating.

- Strategic need: Masraf Al Rayan needs to invest in digital payment solutions.

- Risk: Failure to adapt could lead to a loss of market share.

Partnerships and Mergers

Partnerships and mergers represent a strategic avenue for Masraf Al Rayan, offering expansion opportunities. These collaborations can unlock new markets, technologies, and specialized expertise. However, such ventures carry inherent risks, necessitating careful evaluation to mitigate potential challenges. Successful integration and alignment of interests are crucial for realizing the full benefits of these partnerships.

- In 2024, the global M&A market showed signs of recovery, with deal values increasing compared to the previous year.

- Financial institutions are increasingly exploring partnerships to enhance their digital capabilities and expand their service offerings.

- Integration challenges often lead to significant cost overruns and delays, impacting the overall success of mergers.

- Careful due diligence is crucial to assess potential conflicts of interest and ensure alignment between partners.

Masraf Al Rayan navigates "Question Mark" investments in digital banking and Southeast Asia. These initiatives face market uncertainties despite high growth potential. Success depends on strategic adaptation and partnerships, especially in digital payments, projected at $3.5B in Qatar by 2024.

| Area | Challenge | 2024 Data Point |

|---|---|---|

| Digital Banking | FinTech Competition | Global FinTech Investment: $146.8B |

| Southeast Asia | Regulatory and Partnership Risks | Varied growth across SE Asia |

| Digital Payments | Adapting to new systems | Qatar Market: $3.5B projection |

BCG Matrix Data Sources

The Masraf Al Rayan BCG Matrix utilizes financial reports, industry research, market share data, and expert analysis.