Alten Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alten Bundle

What is included in the product

Strategic evaluation of product portfolios using BCG Matrix, including investment and divestment insights.

Identify your best bets with this interactive dashboard.

Full Transparency, Always

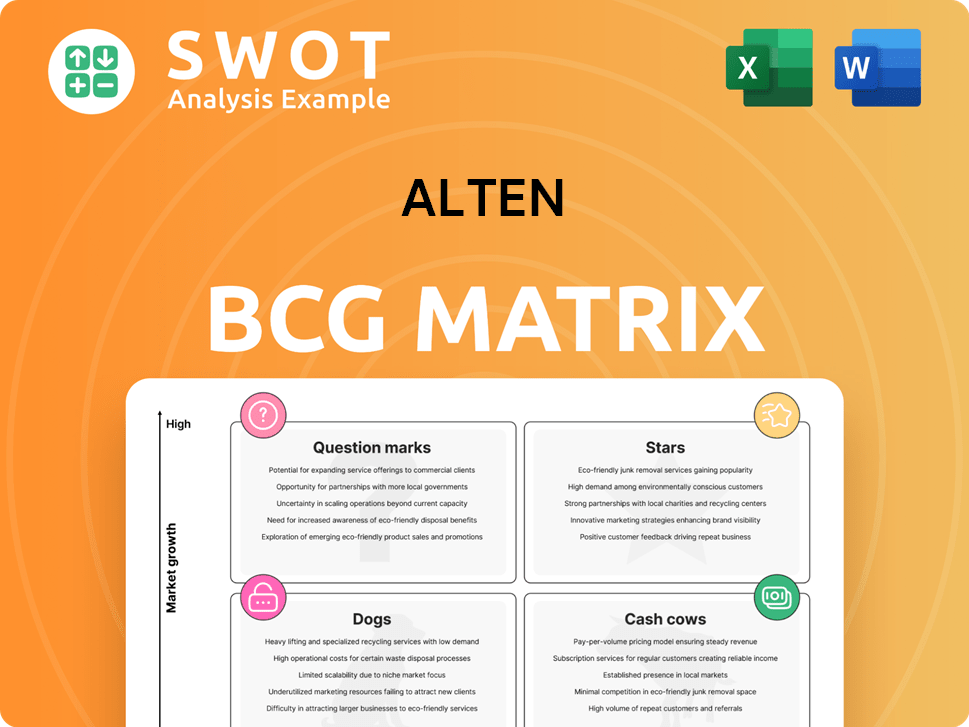

Alten BCG Matrix

The document you're previewing is the complete BCG Matrix you'll get after buying. This is the exact file, ready for your use—no additional steps or incomplete versions to expect.

BCG Matrix Template

See a snapshot of the Alten Group's product portfolio! This preview shows how different products are categorized based on market share and growth. Stars, Cash Cows, Dogs, and Question Marks—where do they all fit? This is just the start. Purchase the full BCG Matrix for detailed insights and actionable strategic recommendations.

Stars

Alten's Defense & Security and Civil Aeronautics sectors are stars, fueled by high growth. In 2024, the global aerospace and defense market was valued at over $800 billion. These sectors need constant investment. Alten is using AI to enhance supply chains and digital twins for design.

Alten's acquisition of Worldgrid boosts its energy sector presence, especially in nuclear. This segment is a high-growth "Star" due to rising demand for energy solutions. France, Germany, and Spain are key markets driving this growth. In 2024, nuclear energy saw a global investment of over $40 billion.

Alten's strong focus on innovation and R&D, particularly in data analysis, AI, and machine learning, positions these services as a star. The company actively participates in shaping industry standards, such as the ISO 56001 for Innovation Systems. In 2024, Alten reported a revenue increase, with a notable portion allocated to R&D, showcasing its commitment and potential for high growth.

Strategic Acquisitions

Alten's strategic acquisitions, such as those in software development in Asia and IT services in Poland, are stars. These moves boost Alten's market share and expand its service offerings. For example, in 2024, Alten's revenue grew by 10%, largely due to these acquisitions. They contribute to geographical expansion, making Alten a stronger player.

- Acquisitions boosted revenue by 10% in 2024.

- Expanded service offerings and market share.

- Increased geographical presence, especially in Asia and Europe.

- Strategic moves to achieve growth.

France and Southern Europe

France and Southern Europe shine as stars for Alten, demonstrating robust performance. Their satisfactory organic growth is fueled by a supportive economic environment. Successful project execution further solidifies their stellar status within Alten's operations.

- In 2023, Alten's revenue in France and Southern Europe grew by 15%, driven by strong demand.

- Key projects in these regions include digital transformation initiatives and engineering services.

- The regions benefit from a skilled workforce and strategic partnerships.

Stars represent high-growth sectors for Alten. The company invests in these areas. Acquisitions and strategic moves in software development and IT services contribute to Alten's revenue growth.

| Sector | Strategic Move | 2024 Impact |

|---|---|---|

| Defense & Security | AI Integration | Market valued at over $800B |

| Energy | Worldgrid Acquisition | Nuclear investment over $40B |

| Software & IT | Acquisitions in Asia | Revenue grew by 10% |

Cash Cows

Alten's ETC services are a European leader, providing a steady cash flow. These services encompass studies, design, and execution of R&D projects, solidifying its market position. In 2024, Alten reported a revenue of €4.3 billion. The ETC services, vital for mature markets, are key cash generators for the company.

Alten's IT services in mature markets, such as France, function as cash cows. They boast a solid market position and steady demand, leading to dependable revenue. In 2024, IT services in France saw a 5% revenue increase, reflecting their stable performance.

Alten's enduring client relationships in automotive, rail, and energy sectors yield stable revenue. These partnerships, requiring low maintenance, act as cash cows. In 2024, recurring revenue from key accounts represented a significant portion of Alten's total income. This model minimizes reinvestment needs, boosting profitability.

Offshore and Nearshore Delivery Centers

Alten leverages offshore and nearshore delivery centers, with a strong presence in India, to boost cost efficiency. These centers are cash cows, generating substantial revenue. They provide cost-effective services, enhancing profitability. Alten's strategy makes them a strong player.

- Alten's revenue in 2023 was €3.68 billion, with significant contributions from its global delivery model.

- Around 45% of Alten's employees work in offshore locations, contributing to cost savings.

- India-based centers are crucial for their cash-generating capabilities.

- Their operational model enhances profitability and positions them well in the market.

Global Presence in Over 30 Countries

Alten's extensive global footprint, spanning over 30 countries, is a key strength. This wide presence generates a consistent revenue stream, acting as a reliable cash cow for the company. The geographical diversification helps mitigate risks associated with economic downturns in any single region, ensuring stability. This broad reach is crucial for maintaining strong financial performance.

- Operating in over 30 countries provides Alten with diverse revenue streams.

- Geographical diversification reduces dependency on any single market.

- This stability enhances Alten's position as a reliable cash cow.

- The broad presence is crucial for financial resilience.

Alten's cash cows, including ETC and IT services, yield steady revenue. Their robust client relationships and offshore centers contribute to strong profitability. In 2024, these segments drove a significant portion of Alten's €4.3B revenue, demonstrating consistent financial health.

| Cash Cow | Key Features | 2024 Performance |

|---|---|---|

| ETC Services | European leader, R&D projects | €4.3B revenue |

| IT Services | Stable demand, France | 5% revenue increase |

| Client Partnerships | Automotive, rail, energy | Significant recurring revenue |

| Offshore Centers | India, cost-efficient | Substantial revenue generation |

Dogs

Alten's UK operations, especially in the Public Sector, have struggled, affecting profitability. The decline in business indicates potential issues. Goodwill impairments further suggest challenges. These might be classified as "dogs" in the BCG Matrix. Consider divestiture or restructuring.

Alten's automotive and telecom sectors in France face headwinds due to budget cuts. The automotive industry in France saw a 9.2% decrease in production in 2024. This downturn may position these sectors as dogs, requiring strategic action.

The divestiture of Alten's Asia (China/Japan) subsidiary suggests poor performance. This unit likely had low revenue and a small consultant base, fitting the "dog" profile. For instance, in 2023, similar underperforming tech subsidiaries in Asia saw sales declines. The sale aimed to reallocate resources to more profitable areas, reflecting a strategic pivot.

Civil Aeronautics (Program Delays)

Alten's civil aeronautics sector faces program delays, affecting finances. These delays could categorize certain projects as "dogs" within the BCG matrix, demanding attention. For example, in 2024, delayed projects contributed to a 5% decrease in projected revenue. Such situations need strategic evaluation.

- Program delays impact revenue and profitability.

- Certain projects in the civil aeronautics sector may be categorized as "dogs".

- Requires careful management or potential exit strategies.

- 2024 data reflects a 5% decrease in projected revenue.

Germany (Automotive and Civil Aeronautics)

Alten faced operational headwinds in Germany, especially in Automotive and Civil Aeronautics, impacting profitability. These sectors' struggles point towards potential "dog" status within the BCG matrix. Difficulties may include increased competition and rising operational costs.

- Operating profit was negatively affected.

- Strategic adjustments or divestiture might be needed.

- Challenges likely include increased competition.

- Rising operational costs are also a factor.

Several of Alten's business areas resemble "dogs" in the BCG Matrix due to underperformance. These include struggling UK public sector operations and French automotive/telecom sectors. Factors such as program delays in civil aeronautics and operational challenges in Germany further contribute. A strategic shift toward more profitable sectors is essential.

| Sector | Issue | Impact |

|---|---|---|

| UK Public Sector | Struggling operations | Profitability decline |

| French Automotive | Budget cuts, production decrease (9.2% in 2024) | Potential "dog" status |

| Civil Aeronautics | Program delays (5% revenue decrease in 2024) | Financial strain |

Question Marks

Alten's AI and digital transformation initiatives are classified as question marks. These ventures, while promising, have a low market share currently. The company is investing substantial capital, with digital transformation spending projected to reach €1.5 billion by 2024. Success hinges on converting this investment into market dominance and higher returns.

The North American and Asian markets, excluding Japan, pose a strategic question mark for Alten, with a slight dip in activity. These areas show growth prospects, yet require focused investments. For instance, in 2024, the Asia-Pacific region's IT spending reached $1.2 trillion. Strategic allocation is vital to boosting market presence and seizing opportunities in these dynamic regions.

Alten's IoT solutions are in the "Question Mark" quadrant of the BCG Matrix. The IoT market is booming, projected to reach $2.4 trillion by 2029. Alten is competing, yet its market share in this evolving sector is still forming. This requires strategic investment to capitalize on high growth, despite uncertain near-term returns.

Cybersecurity Projects

Alten's cybersecurity projects are positioned as question marks within the BCG matrix. These projects benefit from high growth potential, driven by rising cybersecurity threats and regulatory demands such as the European DORA. Their current market share is low, necessitating strategic investments to increase their presence. Capturing market share is critical for these projects to become stars.

- Cybersecurity spending is projected to reach $212 billion in 2024.

- The global cybersecurity market is expected to grow to $345.7 billion by 2028.

- DORA compliance is a significant driver for cybersecurity investments in Europe.

- Alten's strategic investments aim to capitalize on this growth.

Life Sciences Sector

The life sciences sector is a question mark for Alten, due to the shift towards outsourcing R&D and the ongoing digitization of factories. This presents both challenges and opportunities as Alten aims to gain market share. The company needs to strategically invest in this sector. Data from 2024 indicates a growing market, though competition is fierce.

- Outsourcing of R&D is increasing, impacting the sector.

- Digitization of factories is transforming operations.

- Strategic investments are crucial for market share.

- The life sciences market is growing in 2024.

Alten's projects classified as "Question Marks" require strategic investment due to low market share. Digital transformation spending reached €1.5 billion in 2024. North American and Asian markets represent growth potential, demanding focused allocation.

| Area | Market Share Status | Strategic Need |

|---|---|---|

| AI/Digital Transformation | Low | Investment for Market Dominance |

| North America/Asia | Developing | Focused Investments |

| IoT Solutions | Forming | Strategic Investment |

BCG Matrix Data Sources

The Alten BCG Matrix is created with company financials, market size data, competitor analysis, and expert viewpoints to give strategic precision.