Amazon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amazon Bundle

What is included in the product

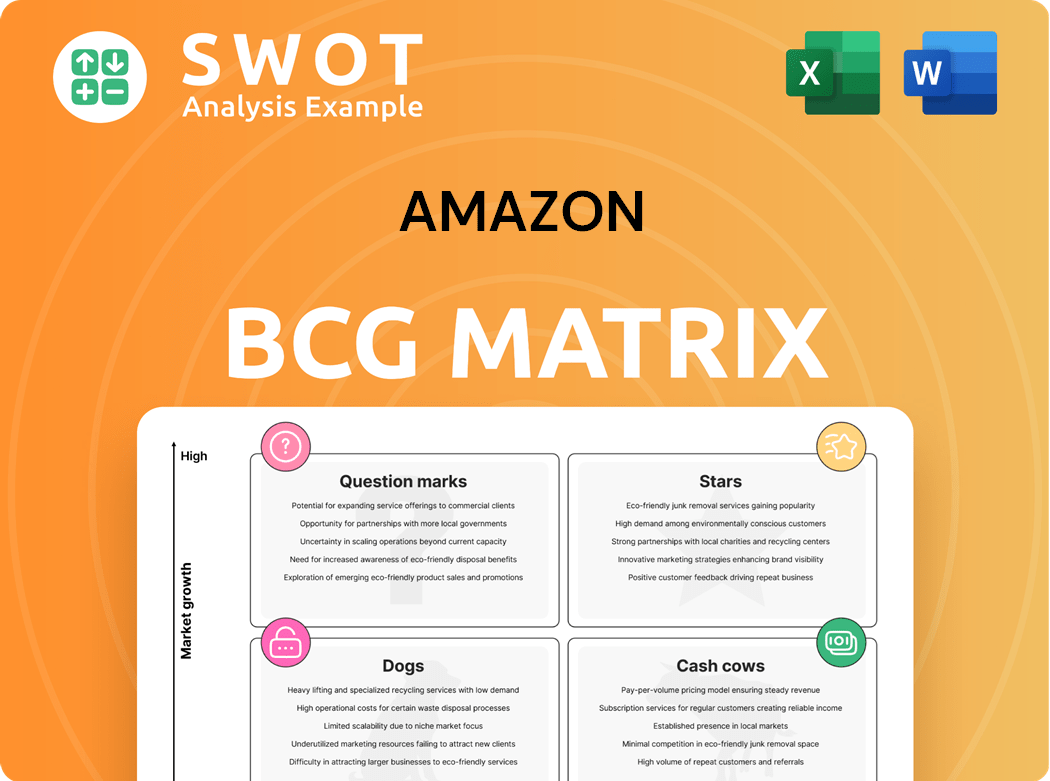

Amazon's BCG Matrix: Strategic analysis of its diverse business units across four quadrants, guiding investment and divestment decisions.

Clear Amazon business unit classifications simplify strategic decision-making.

What You See Is What You Get

Amazon BCG Matrix

The BCG Matrix you're previewing mirrors the final, downloadable report. Receive a fully-editable document post-purchase, designed for strategic insights and clear communication, perfect for immediate application.

BCG Matrix Template

Amazon's BCG Matrix categorizes its vast offerings. We see potential "Stars" like AWS and "Cash Cows" such as e-commerce. Understanding the placement helps pinpoint growth areas. "Dogs" may face strategic decisions. This overview is just a glimpse.

Get the full BCG Matrix to unlock detailed analysis, strategic guidance, and a clear investment roadmap.

Stars

Amazon Web Services (AWS) is a star in Amazon's BCG Matrix, dominating the cloud computing market. AWS continues to expand, including AI and the Trainium2 AI chip, fueling Amazon's growth. In Q4 2023, AWS generated $24.2 billion in revenue. Amazon should keep investing in AWS to stay ahead.

Amazon Prime is a Star in the BCG Matrix, fueled by its massive subscriber base and consistent subscription revenue. Prime boosts customer loyalty with perks like fast shipping and streaming. As of 2024, Amazon Prime has over 200 million subscribers globally. Continuous expansion of Prime's services is key to maintaining its stellar status.

Amazon's e-commerce platform, a Star in its BCG Matrix, is a major revenue driver. In 2024, Amazon's online stores generated over $230 billion in sales. This platform benefits from a vast product selection and strong brand recognition. Prioritizing logistics improvements is key for continued growth.

Advertising Services

Amazon's advertising services, a Star in its BCG matrix, have seen substantial growth. This is fueled by sellers using sponsored listings and the rise of streaming video ads on Amazon Prime. The advertising expansion offers a full-funnel approach, boosting brand awareness and conversions. Focusing on ease of use and effectiveness will drive continued growth.

- Amazon's ad revenue in Q4 2023 was $14.65 billion, a 26% increase year-over-year.

- Sponsored Products and Sponsored Brands are key advertising formats for sellers.

- Streaming video ads on Amazon Prime are expanding.

- Amazon aims to improve advertising accessibility and effectiveness.

AI Software and Hardware

Amazon's focus on AI, especially through AWS, is a major growth area. They are investing heavily in AI software and hardware, like the Trainium2 chip. These investments help improve performance and give them an edge in cloud computing.

- AWS saw a 13% revenue increase in Q1 2024, showing strong growth.

- Amazon invested $17 billion in R&D in 2023, much of which went to AI.

- Trainium2 offers significant performance gains, enhancing Amazon's AI capabilities.

- The AI market is predicted to reach $200 billion by 2026.

Amazon's e-commerce operations, recognized as Stars, remain a powerhouse for revenue. Amazon's online stores saw over $230 billion in sales in 2024. Efficient logistics are key for sustained success in this arena.

| Metric | Value (2024) |

|---|---|

| Online Store Sales | Over $230 Billion |

| Growth Drivers | Logistics, Brand Recognition |

Cash Cows

Amazon's North American e-commerce is a cash cow, generating massive revenue with a dominant market share. This well-established segment in a mature market provides significant financial stability. In 2024, Amazon's North American net sales reached $350 billion. The focus is on maintaining efficiency and optimizing operations. This ensures the maximum cash flow to fuel other ventures.

Kindle and e-books are a Cash Cow for Amazon, providing steady revenue in a settled market. Amazon dominates the e-book market, though it may not be as lucrative as other areas. With 2024 e-book sales estimated at $1.2 billion, the focus should be on maintaining these gains. This segment requires passive investment to keep its current profitability.

Third-party seller services are a major revenue source for Amazon. Over 2 million sellers utilize the platform. Although growth slowed in 2024, it still brought in billions. In Q3 2024, this segment generated $35.4 billion in revenue. Maintaining its cash flow requires ongoing marketplace optimization and seller support.

Subscription Services (excluding Prime)

Amazon's subscription services, excluding Prime, are cash cows, generating stable revenue. These services, such as Kindle Unlimited and Audible, hold a significant market share. They benefit from consistent demand, ensuring a reliable income stream. Focusing on maintenance and minor enhancements can sustain this revenue.

- Kindle Unlimited has over 4 million subscribers.

- Audible's revenue in 2023 was approximately $4 billion.

- These services offer consistent, predictable cash flow.

- They require less capital investment compared to growth areas.

Digital Advertising

Amazon's digital advertising is a cash cow, showcasing robust growth and profitability. It uses customer data for targeted ads, a key revenue driver. Amazon's ad revenue in 2024 is projected to be over $45 billion. Investments in ad accessibility and efficacy solidify its cash cow status.

- Projected 2024 ad revenue exceeds $45 billion.

- Leverages customer data for targeted advertising.

- Demonstrates strong growth and profitability.

- Continued investment in advertising effectiveness.

Amazon Web Services (AWS) is a cash cow, crucial for Amazon’s financial stability, and it leads the cloud computing market. In 2024, AWS generated over $90 billion in revenue. AWS's focus is on maintaining its robust infrastructure and service offerings. This generates significant cash flow for Amazon's investments.

| Key Metric | Value (2024) | Notes |

|---|---|---|

| AWS Revenue | $90B+ | Continues to dominate the cloud market |

| Market Share | 32% | Leading position among cloud providers |

| Growth Rate | 12% | Steady growth, less explosive than stars |

Dogs

Amazon MP3, a former player in digital music, now resides in the Dogs quadrant of the BCG matrix. The market for MP3 downloads has significantly declined, reducing its market share. In 2024, this segment generated minimal revenue compared to Amazon's overall $575 billion net sales. Divesting this underperforming asset could reallocate resources to more profitable ventures.

Amazon's physical stores, including Amazon Go and Amazon Fresh, hold a small market share. They contribute negligibly to Amazon's massive revenue stream. Financial data indicates a slow return on investment, with some stores underperforming. Strategic decisions, such as divestiture or restructuring, could be a viable option.

Amazon's Fire Phone, launched in 2014, flopped. With minimal market share and no growth, it's a clear "Dog" in the BCG Matrix. Amazon took a $170 million write-down on unsold Fire Phone inventory. Resources should be shifted away from this unprofitable venture.

Amazon Alexa (Potentially)

Alexa, once a leader, now struggles in the smart speaker market. It's become a "Dog" in Amazon's portfolio due to declining market share and facing stiff competition from Google and Apple. Amazon's smart speaker sales decreased by 20% in 2023. A strategic review is needed.

- Market share decline highlights Alexa's weakening position.

- Increased competition from Google and Apple impacts sales.

- Turnaround strategies or divestiture are potential options.

- Amazon's Q4 2023 earnings revealed challenges for Alexa.

Amazon Music (Potentially)

Amazon Music faces challenges compared to Spotify, with a smaller market share. This lower share suggests it could be a "Dog" within the BCG matrix. Strategic choices are crucial for Amazon Music's future, including decisions on investment or potential divestment.

- Spotify held around 31% of the global music streaming market share in 2024.

- Amazon Music's market share is significantly lower, roughly 13% in 2024.

- "Dogs" often require careful resource allocation or may be candidates for sale.

- Investment decisions need to consider profitability and growth prospects.

Several Amazon ventures are classified as "Dogs" in the BCG matrix due to low market share and growth prospects.

These include Amazon MP3, physical stores, Fire Phone, Alexa, and Amazon Music, each facing unique challenges.

Strategic options range from divestiture to restructuring, as illustrated by their performance in 2024.

| Business Unit | Market Share/Performance (2024) | Strategic Implications |

|---|---|---|

| Amazon MP3 | Minimal revenue, declining market | Divestiture |

| Physical Stores | Low ROI, negligible revenue | Divestiture/Restructuring |

| Fire Phone | Zero market share, $170M write-down | Resource reallocation |

| Alexa | Declining share, 20% sales drop (2023) | Strategic review |

| Amazon Music | 13% market share vs. Spotify's 31% (2024) | Investment/Divestment |

Question Marks

Amazon Fresh is classified as a Question Mark within Amazon's BCG Matrix. While it operates in the expanding grocery delivery sector, it struggles against strong competitors. In 2024, Amazon Fresh held a modest market share compared to industry leaders. Strategic decisions, like increased investment or divestiture, are crucial. The goal is to transform it into a Star.

Amazon's video-on-demand, like Prime Video, operates within a rapidly expanding streaming market. While its current market share might be modest compared to leaders, the growth potential is significant. The streaming market is projected to reach $1.2 trillion by 2028, indicating substantial room for expansion. To elevate its status, Amazon must invest in content and marketing to capture a larger share. This strategy could transition its video-on-demand into a Star within the BCG Matrix.

Amazon Pharmacy, a recent entrant, faces a competitive online pharmacy market. It currently holds a small market share, necessitating substantial investment for growth. In 2024, the U.S. pharmacy market totaled approximately $600 billion. Amazon's strategic choices will determine its success in this high-stakes industry. It must expand to compete.

International Expansion (Specific Markets)

International expansion, especially in competitive markets, positions Amazon as a Question Mark in the BCG Matrix. Amazon's venture into India, where local competitors are robust, exemplifies this. Success hinges on strategies to boost market penetration and drive growth. Penetrating these markets needs substantial investment and strategic agility.

- India's e-commerce market is projected to reach $200 billion by 2026, presenting both opportunity and challenge.

- Amazon invested over $6.5 billion in India as of 2024, indicating its commitment despite facing strong local players.

- Market share data in 2024 shows Amazon trailing behind local competitors in India, highlighting the challenges.

- Effective localized strategies are crucial for Amazon to gain ground and increase market share.

Self-Driving Cars

Amazon's self-driving car ventures, like Zoox, are question marks in its BCG matrix. These projects operate in a high-growth sector but currently hold a relatively small market share compared to industry leaders. Significant capital is needed to compete effectively, making it a cash-intensive endeavor. The strategic challenge lies in deciding whether to aggressively pursue market share through continued investment or to potentially scale back resources.

- Zoox, acquired by Amazon, is developing autonomous vehicles.

- The self-driving car market is projected to grow substantially.

- Amazon faces competition from established players like Waymo and Cruise.

- Decisions on investment levels will impact future market positioning.

Question Marks represent areas where Amazon has a low market share in a high-growth market. Amazon Fresh, Prime Video, Pharmacy, international expansion, and Zoox fit this category. These ventures require significant investment to grow and compete with established players. Strategic decisions will be critical to transform them into Stars, boosting market share.

| Category | Examples | Challenge |

|---|---|---|

| Low Market Share | Fresh, Video, Pharmacy, Zoox | Competition in growing markets. |

| High Growth | Grocery, Streaming, Pharmacy, Self-driving | Need for high investment. |

| Strategic Need | International expansion | Decision to increase share or decrease spending. |

BCG Matrix Data Sources

Amazon's BCG Matrix is built using financial reports, market analysis, consumer behavior data, and industry insights.