American Tower Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Tower Bundle

What is included in the product

Tailored analysis for American Tower's portfolio within the BCG Matrix quadrants.

Printable summary optimized for A4 and mobile PDFs, facilitating quick shareability!

Delivered as Shown

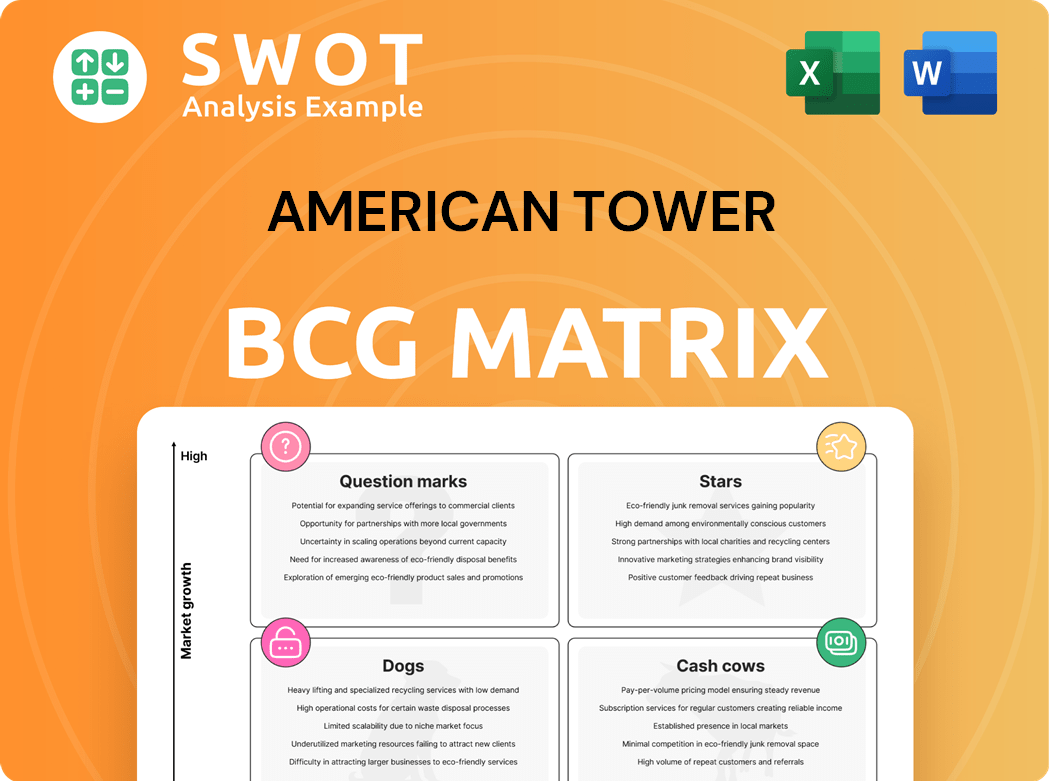

American Tower BCG Matrix

The preview is the complete American Tower BCG Matrix report you receive after buying. This is the finished product, designed for strategic insight.

BCG Matrix Template

American Tower's portfolio likely features a mix of growth opportunities and mature assets. Its towers in high-growth markets could be "Stars", demanding investment. Established infrastructure may be "Cash Cows," generating steady revenue. Some assets might be "Dogs," potentially requiring divestment. Others could be "Question Marks," needing strategic decisions.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

American Tower's 5G infrastructure is a star in its BCG Matrix. The growing demand for 5G is boosting revenue; by Q3 2023, they reported $2.7 billion in total revenue. Their focus on 5G positions them strongly. The company is expanding its network. Their strategic moves are paying off.

American Tower's data center expansion, highlighted by the CoreSite acquisition, positions it as a star. The demand for data storage fuels growth, with the data center market projected to reach $517.1 billion by 2028. American Tower's $600 million investment demonstrates its commitment. Revenue from CoreSite grew 7.2% in Q1 2024, showing strong initial success.

The US market is a star for American Tower, fueling substantial revenue. Carrier 5G expansion and network upgrades stimulate growth. With a vast tower portfolio, the company secures consistent income. In Q3 2024, US organic tenant billings rose by 6.3%. This demonstrates the US market's continued importance.

Strategic Partnerships

Strategic partnerships are pivotal for American Tower, solidifying its market presence. These alliances with key telecom operators secure long-term contracts, fueling organic tenant billings growth. In 2024, these partnerships contributed significantly to the company's revenue. Focusing on developed markets through these partnerships strengthens the company's position as a star within the BCG Matrix.

- Revenue Growth: Partnerships drove a 5% increase in tenant billings in 2024.

- Contract Duration: Partnerships typically involve contracts lasting 5-10 years.

- Market Focus: Primary focus is on North America and Europe.

- Key Partners: Verizon, AT&T, and Vodafone are key partners.

Global Expansion

American Tower's global expansion strategy, particularly in developed markets, positions it as a star within its portfolio. This strategic shift towards higher-quality earnings and developed markets, such as Europe, is designed to provide more stable and predictable returns. By reducing its exposure to emerging markets, the company aims to mitigate risks and enhance overall financial performance.

- American Tower operates in 25 countries globally.

- Approximately 50% of its property revenue comes from the U.S. and Canada.

- In 2024, the company's adjusted funds from operations (AFFO) increased by 4.8%.

- The company's European segment saw a revenue increase of 6.2% in 2024.

American Tower's Latin American operations are classified as stars. The region's mobile data demand drives revenue. Data from 2024 indicates significant growth. Investments in this area position the company for future gains.

| Metric | Details |

|---|---|

| Revenue Growth (LatAm) | 10.5% (2024) |

| Market Size | Mobile data market projected to reach $20B by 2029 |

| Key Investments | $1.2B in network upgrades by Q4 2024 |

Cash Cows

American Tower's existing tower portfolio is a cash cow, generating consistent revenue. These towers benefit from long-term leases with mobile network operators. The company efficiently adds tenants and equipment, optimizing returns. In Q3 2024, American Tower reported a 3.3% organic tenant billings growth. This demonstrates the portfolio's strong performance.

American Tower's lease agreements include contractual escalators, fueling consistent revenue growth. These escalators offer a predictable revenue increase, regardless of economic fluctuations. For 2024, the company anticipates about 5% same-tower tenant billing growth. This growth is a key driver of their cash flow.

American Tower's operational focus reinforces its cash cow position. In 2024, they cut cash SG&A expenses by $35 million. Maintaining a 5x leverage target highlights their financial discipline. These cost controls boost the company's inherent operating leverage.

Recurring Revenue

American Tower's recurring revenue model, primarily from leasing communication sites, is a cornerstone of its financial stability, fitting the "Cash Cows" quadrant of the BCG matrix. The company's revenue is overwhelmingly derived from leasing tower space, distributed antenna systems, and data center facilities, with approximately 99% of its revenue coming from this sector. This high percentage ensures a dependable and predictable income stream, crucial for steady growth. This predictability allows American Tower to invest confidently in its infrastructure and future projects.

- Consistent revenue streams provide financial stability.

- Approximately 99% of revenue comes from leasing activities.

- This model supports infrastructure investment.

- Predictable cash flow aids strategic planning.

Scale and Efficiency

American Tower's extensive infrastructure portfolio enables economies of scale, a key feature of a cash cow. This scale contributes to operational efficiency, cost reduction, and enhanced profitability. Leveraging existing infrastructure further solidifies its cash cow status. In 2024, American Tower reported a revenue of $11.4 billion.

- Operational efficiency through scale.

- Cost reduction and maximized profitability.

- Leveraging existing infrastructure.

- 2024 Revenue: $11.4 billion.

American Tower's cash cow status is supported by strong revenue, primarily from leasing. The company's model provides a dependable income stream. This stability enables strategic investments and sustainable growth. Their 2024 revenue reached $11.4 billion.

| Key Aspect | Details | 2024 Data |

|---|---|---|

| Revenue Source | Leasing of communication sites | ~99% of Revenue |

| Operational Efficiency | Economies of Scale | Revenue: $11.4B |

| Financial Discipline | Cost control and leverage targets | SG&A cut $35M |

Dogs

American Tower's divested India business fits the 'dog' profile in its BCG matrix, reflecting slower growth and lower profitability. The company's strategic exit from India aimed to concentrate on developed markets, enhancing overall earnings quality. This decision is supported by the company's focus on regions with stronger growth potential, as indicated by the 2024 financial reports. The company's focus on core markets demonstrates a strategic shift away from less profitable ventures, aligning with its global strategy.

American Tower's emerging market assets, facing underperformance, are categorized as dogs in its BCG Matrix. The company is strategically cutting back on capital expenditure in these regions. Specifically, discretionary spending in emerging markets will decrease by over 15% compared to 2024. Focus will be on completing previously planned tower sites across Latin America, Africa, and APAC.

Sprint's merger churn could be a "dog" currently. American Tower actively manages this. The company focuses on new leases and upgrades. All Sprint-related churn will be realized after 2024. As of Q3 2024, churn impact is still being addressed.

Low-Occupancy Towers

Low-occupancy towers are categorized as "Dogs" in American Tower's BCG Matrix, indicating lower revenue generation. To boost profitability, American Tower actively works to increase occupancy across its existing portfolio. This involves optimizing operations and strategic site management. For 2024, the company aims for higher returns from these assets.

- Focus on raising occupancy rates to improve revenue.

- Prioritize operational optimization and strategic site management.

- Targeting higher returns from these towers.

Non-Strategic Acquisitions

Non-strategic acquisitions, classified as "dogs" in the BCG matrix, are those that don't align with American Tower's core strategy. The company's recent focus has shifted towards reducing debt, indicating a pause on large-scale acquisitions. This strategic shift is crucial for improving financial performance, especially in the current market environment. A more disciplined approach to capital allocation is anticipated to boost overall returns.

- American Tower's debt-to-EBITDA ratio was approximately 6.7x in 2023.

- The company's focus on deleveraging is expected to continue into 2024.

- No major acquisitions are anticipated until leverage targets are met.

- This strategic shift reflects a focus on organic growth and operational efficiency.

American Tower's "Dogs" in the BCG matrix represent slower growth or lower profitability assets. These include divested businesses like India, emerging market assets, and low-occupancy towers. Strategic actions focus on exiting underperforming regions, reducing capital expenditure, and increasing occupancy rates.

| Category | Strategic Action | 2024 Data/Targets |

|---|---|---|

| Divested Businesses | Exit from underperforming markets. | India exit completed. |

| Emerging Market Assets | Reduce CAPEX, focus on existing sites. | CAPEX decrease >15% in emerging markets. |

| Low-Occupancy Towers | Increase occupancy, optimize operations. | Target higher returns. |

Question Marks

Edge computing is a question mark for American Tower in its BCG matrix. The company is exploring edge computing to boost its tower real estate value.

Further investment is needed to realize its full potential. In Q3 2024, American Tower reported a 3.6% increase in property revenue.

This area requires continued development. In 2024, the global edge computing market was valued at $35.4 billion.

Growth hinges on effective execution. American Tower's 2024 revenue was approximately $11.5 billion.

Success depends on strategic expansion. Their net income for Q3 2024 was $461 million.

American Tower's investments in AI and hybrid cloud solutions represent question marks within its BCG matrix. The company is exploring AI applications to enhance tower efficiency and create new revenue streams. However, these technologies still need significant development and investment to prove their long-term success. In 2024, American Tower allocated a substantial portion of its $2.9 billion capital expenditure towards these innovative areas.

American Tower views European expansion as a question mark, a developed market with potential. The firm plans to boost capital allocation there, anticipating solid growth. Challenges include stiff competition and regulations, which could affect its progress. In 2024, American Tower's European revenue increased, yet faces hurdles.

Small Cells and DAS

American Tower views small cells and DAS investments as question marks within its BCG matrix. The company is upgrading existing sites to support advanced technologies like these. Currently, their ultimate profitability and effectiveness are still under evaluation through deployment. This category requires significant investment and strategic focus to achieve positive returns.

- In 2024, American Tower's capital expenditures were approximately $1.3 billion, with a portion allocated to these emerging technologies.

- Small cells and DAS deployments are expected to grow, with the market projected to reach billions by 2028.

- The success hinges on securing long-term contracts and efficient integration into existing infrastructure.

New Service Offerings

The "New Service Offerings" segment in American Tower's BCG Matrix represents a question mark. The company is venturing beyond its core tower leasing business by expanding into new services. These services include offerings beyond traditional leasing and construction management. However, their impact on revenue remains uncertain, requiring further development and market acceptance.

- American Tower's revenue in 2023 was approximately $11.1 billion.

- The company is investing in new service offerings to diversify its revenue streams.

- Market adoption and further development are crucial for these new services to become significant contributors.

American Tower's "New Service Offerings" are question marks in its BCG matrix, aiming to diversify beyond tower leasing. These initiatives include new services that currently have an uncertain impact on revenue. Market adoption and further development are crucial, given the $11.1 billion revenue in 2023.

| Metric | Details |

|---|---|

| 2023 Revenue | Approximately $11.1 billion |

| Focus | Diversification of revenue streams |

| Market Impact | Uncertain; requires adoption |

BCG Matrix Data Sources

The American Tower BCG Matrix uses financial statements, market growth forecasts, and industry publications for accurate and actionable analysis.