Amgen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amgen Bundle

What is included in the product

Comprehensive Amgen product analysis using BCG, highlighting investment, holding, and divestment strategies.

Printable summary optimized for A4 and mobile PDFs, ensuring clear communication across all formats.

What You’re Viewing Is Included

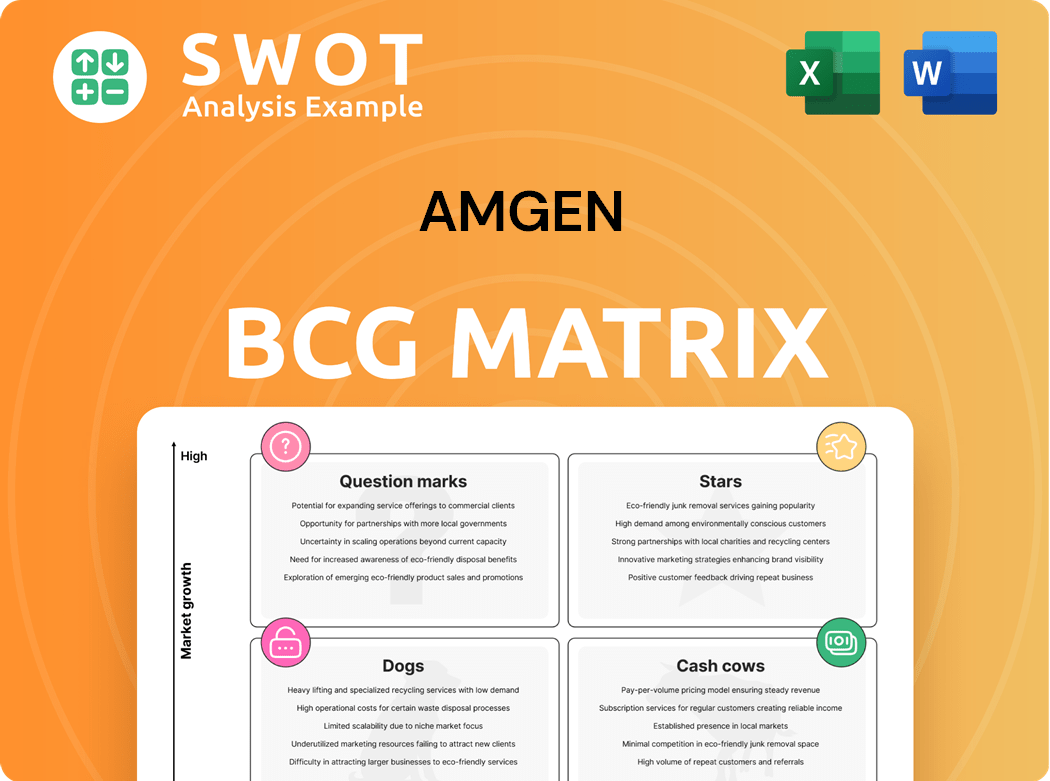

Amgen BCG Matrix

The Amgen BCG Matrix preview showcases the complete document you'll receive. Your purchased version delivers the same insightful, ready-to-use strategic analysis, ideal for understanding Amgen's portfolio.

BCG Matrix Template

Amgen's portfolio is dynamic, and understanding its strategic positioning is key. This peek reveals potential "Stars" like blockbuster drugs & "Cash Cows" driving profits. Explore "Question Marks," the future of growth, & "Dogs" needing careful attention.

This is just a glimpse into their strategic landscape. Dive deeper into Amgen's BCG Matrix and gain a clear view of its products—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Repatha, a PCSK9 inhibitor, is a star within Amgen's portfolio, showcasing robust growth. Sales reached $2.2 billion in 2024. This growth is fueled by wider adoption in cardiovascular disease management. Reduced barriers and increased prescriptions will likely boost 2025 performance.

Tezspire, a key asset in Amgen's portfolio, is rapidly gaining traction, with sales approaching $1 billion in 2024. This growth is fueled by its unique position as the only biologic approved for all severe asthma types. Amgen's strategic focus includes exploring new indications for Tezspire, promising expanded market reach.

Evenity, a key player in Amgen's portfolio, showed strong performance. Sales of the bone health drug surged, hitting approximately $1.6 billion in 2024. This growth stems from increased use among prescribers and targeted efforts on high-risk osteoporosis patients. Continued expansion and patient focus will likely fuel future success.

Blincyto (blinatumomab)

Blincyto, a key oncology drug for Amgen, has demonstrated robust sales growth, particularly in treating B-cell acute lymphoblastic leukemia (B-ALL). Its effectiveness in reducing mortality risk compared to chemotherapy solidifies its market position. Amgen's ongoing research into new applications for Blincyto further boosts its potential. The drug is a significant contributor to Amgen's portfolio.

- Blincyto's 2024 sales are expected to continue growing, driven by its proven efficacy.

- FDA approvals for new indications are expected to drive growth.

- Blincyto's market share in B-ALL treatment remains strong.

- Amgen's strategic focus on oncology supports Blincyto's development.

Tepezza (teprotumumab-trbw)

Tepezza, a key asset for Amgen, came with the Horizon Therapeutics acquisition. This rare disease treatment generated $1.9 billion in sales in 2024. As the sole FDA-approved therapy for thyroid eye disease (TED), it meets a significant medical need. Amgen aims to boost Tepezza's availability in the U.S. and globally, expecting continued growth.

- 2024 Sales: $1.9 billion

- Indication: Thyroid Eye Disease (TED)

- FDA Approval: First and only approved treatment

- Strategic Goal: Expand global access

Amgen's Stars, including Repatha, Tezspire, Evenity, Blincyto, and Tepezza, drive revenue growth. These drugs, with combined 2024 sales exceeding $7.6 billion, lead in their markets. Strategic focus on these assets enhances market presence.

| Drug | 2024 Sales (approx.) | Key Highlights |

|---|---|---|

| Repatha | $2.2B | PCSK9 inhibitor, growth in CVD |

| Tezspire | $1B | All severe asthma, biologic |

| Evenity | $1.6B | Bone health, focus on osteoporosis |

| Blincyto | $XX | Oncology, B-ALL treatment |

| Tepezza | $1.9B | Thyroid eye disease (TED) |

Cash Cows

Prolia is a significant cash cow for Amgen, achieving $4.37 billion in worldwide sales in 2024. This drug is a dependable source of income due to its established use in treating osteoporosis and related bone conditions. The main threat to Prolia is the potential for biosimilar rivals starting in late 2025, which could reduce its market share.

Xgeva, another key product for Amgen, is a strong revenue generator. In 2024, Xgeva's global sales reached $2.23 billion. It's vital for preventing fractures in cancer patients, showing its clinical importance. However, biosimilar competition is anticipated, which could affect its sales in the near future.

Enbrel, used for rheumatoid arthritis, is still crucial for Amgen. Despite patents until 2028, competition is rising. Sales in 2023 were around $3.5 billion, down from previous years. Amgen uses pricing strategies to handle the decrease.

Otezla (apremilast)

Otezla, an oral medication for inflammatory conditions, is a key revenue driver for Amgen. It's a preferred choice for many patients. Despite competition, its oral form gives it an edge. Amgen focuses on marketing and support to maintain its market position.

- Otezla's 2024 sales were approximately $2.2 billion.

- It competes with other treatments, like biologics.

- Amgen invests in patient support programs.

Amjevita/Amgevita (adalimumab biosimilar)

Amjevita, a biosimilar to Humira, is a key component of Amgen's biosimilars portfolio. This drug generates consistent revenue by offering a cost-effective option compared to the original biologic. Amgen's proficiency in biosimilar development and manufacturing strengthens its position in the market.

- Launched in the U.S. in January 2023, Amjevita has become a significant revenue contributor.

- Amgen's biosimilars sales reached $1.9 billion in 2023.

- Amjevita's market share is growing, indicating its success as a Humira alternative.

- Biosimilars are expected to be a $60 billion market by 2025.

Amgen's cash cows generate steady revenue, crucial for financial stability. Prolia ($4.37B in 2024 sales) and Xgeva ($2.23B) are key examples, with Enbrel also contributing ($3.5B in 2023). Otezla, with $2.2B sales in 2024, also plays a pivotal role.

| Product | 2024 Sales (USD B) | Notes |

|---|---|---|

| Prolia | 4.37 | Osteoporosis treatment, facing biosimilar threats. |

| Xgeva | 2.23 | Fracture prevention in cancer, facing competition. |

| Enbrel | 3.5 (2023) | Rheumatoid arthritis, facing rising competition. |

| Otezla | 2.2 | Oral treatment for inflammation, competitive market. |

Dogs

Epogen, a treatment for anemia, finds itself in the "Cash Cow" quadrant of Amgen's BCG matrix. Sales are under pressure from biosimilars and reimbursement issues. In 2023, Epogen's sales were around $500 million, reflecting a decline. Amgen is shifting focus to newer, higher-growth products, managing Epogen for profit.

Aranesp, used to treat anemia, faces declining sales. This mirrors trends seen with Epogen, influenced by biosimilars. Amgen's strategy involves prioritizing innovative therapies. In 2023, Aranesp sales decreased, impacting overall revenue. The company is focusing on drugs with better growth.

Neupogen, used to treat neutropenia, faces sales declines due to biosimilars. Competition has shrunk its market share significantly. In 2024, Neupogen's revenue was notably impacted. Amgen now focuses on newer oncology products for growth. For example, Amgen's 2024 revenue decreased by 1% to $29.6 billion.

Neulasta (pegfilgrastim)

Neulasta, a drug for neutropenia, faces decline due to biosimilars. Competition and pricing pressures have reduced its market volume. In 2024, Neulasta sales decreased significantly. Amgen shifts focus towards biosimilars and innovative oncology treatments.

- Neulasta sales are under pressure.

- Biosimilar competition impacts pricing.

- Amgen's focus is on new therapies.

- Sales decreased in 2024.

Nplate (romiplostim)

Nplate, a product within Amgen's portfolio, is categorized as a "Dog" in its BCG matrix. Sales for Nplate saw a 13% year-over-year decrease in Q4 2024, indicating a challenging market position. Despite a 4% growth excluding a 2023 U.S. government order, the product faces hurdles. Amgen might need to implement strategic initiatives to boost sales.

- Q4 2024 sales decreased by 13% year-over-year.

- Excluding a Q4 2023 government order, sales grew by 4%.

- The product faces significant market challenges.

- Amgen needs to focus on market share.

Nplate is classified as a "Dog" in Amgen's BCG matrix, with sales challenges. Q4 2024 sales dropped 13% year-over-year, showing a tough market. Excluding a 2023 government order, growth was 4%. Strategic steps may be needed.

| Product | BCG Status | Q4 2024 Sales Change |

|---|---|---|

| Nplate | Dog | -13% YoY |

Question Marks

MariTide, Amgen's obesity treatment, is a "Star" in their BCG matrix. The once-monthly dosing is a key advantage, potentially attracting patients. Phase 2 trials showed impressive weight loss, supporting its strong market position. Amgen's 2024 revenue is projected around $30 billion, partly from such promising drugs.

Olpasiran, Amgen's siRNA, targets lipoprotein(a) synthesis. As a potential best-in-class therapy, it tackles a major cardiovascular risk. The ongoing Ocean(a)-Outcomes Phase 3 trial is crucial. In 2024, the cardiovascular market is valued at billions.

Rocatinlimab is in Phase 3 trials for atopic dermatitis; data from the IGNITE study showed promise. This could be a key product in Amgen's inflammation portfolio, potentially becoming a Star. Amgen's 2023 revenue was around $28 billion, with inflammation drugs contributing significantly. If successful, Rocatinlimab could boost sales.

Bemarituzumab

Bemarituzumab, under development by Amgen, is in late-stage trials focusing on gastric cancer treatment. As a first-in-class FGFR2b-targeting monoclonal antibody, it aims to address an unmet medical need. The FORTITUDE-101 trial is assessing bemarituzumab combined with chemotherapy for first-line gastric cancer patients.

- FORTITUDE-101 trial data are expected in 2024/2025.

- The gastric cancer market is substantial, with significant unmet needs.

- FGFR2b targeting has shown promise in early trials.

Biosimilars Pipeline (Keytruda, Opdivo, Ocrevus)

Amgen's biosimilar pipeline is a significant component of its BCG Matrix, particularly focusing on high-growth areas. The company is developing biosimilars for blockbuster drugs like Keytruda, Opdivo, and Ocrevus. These biosimilars present substantial market opportunities due to their potential for cost savings compared to the original drugs.

- Amgen's biosimilar portfolio includes versions of Keytruda, Opdivo, and Ocrevus.

- Biosimilars offer more affordable alternatives, attracting market share.

- Amgen's expertise supports growth in the biosimilar segment.

- Market share for biosimilars is expected to grow by 2024.

Bemarituzumab, in late-stage trials for gastric cancer, is classified as a "Question Mark." Its success hinges on trial data expected in 2024/2025. Targeting the FGFR2b receptor is a novel approach, which could lead to significant market penetration. The gastric cancer market is valued at billions.

| Drug | Phase | Market |

|---|---|---|

| Bemarituzumab | Phase 3 | Gastric Cancer |

| Trial Data | Expected 2024/2025 | Large, Unmet Needs |

| FGFR2b Target | First-in-class | Potential |

BCG Matrix Data Sources

The Amgen BCG Matrix leverages financial statements, market analysis, and competitive reports. These are from industry databases and expert evaluations.