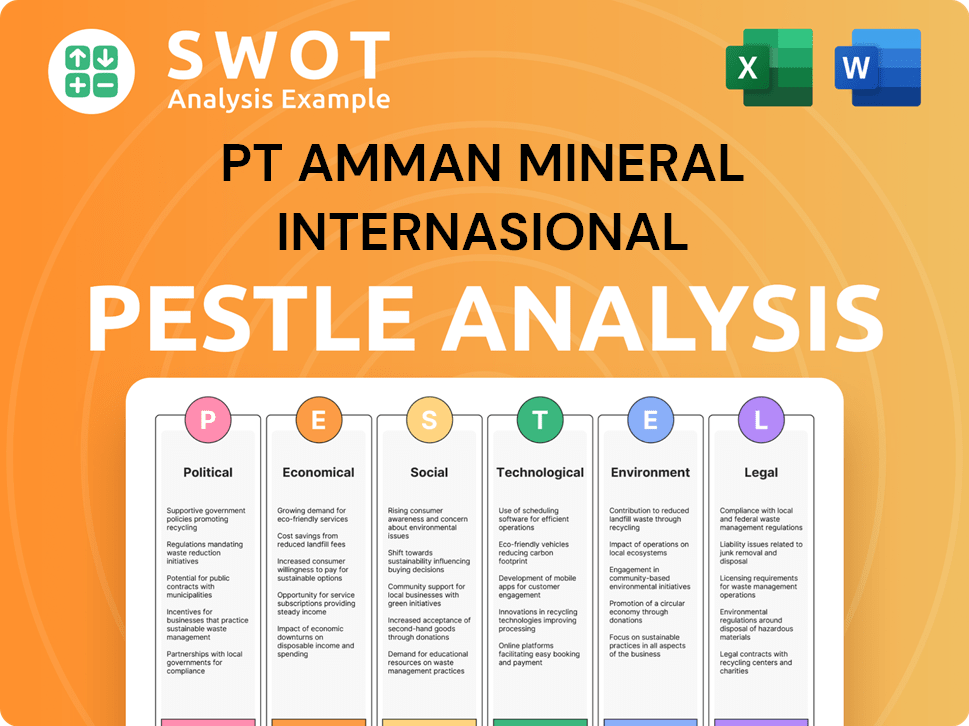

PT Amman Mineral Internasional PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PT Amman Mineral Internasional Bundle

What is included in the product

Assesses macro-environmental factors impacting PT Amman Mineral Internasional across six key areas: PESTLE.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

PT Amman Mineral Internasional PESTLE Analysis

The preview showcases the comprehensive PT Amman Mineral Internasional PESTLE Analysis. What you're previewing mirrors the finished document.

The complete analysis, including all sections and details, is visible here.

After purchase, this precise file is instantly available.

The analysis structure and formatting remain the same in the final download.

This ready-to-use PESTLE is the file you receive.

PESTLE Analysis Template

Understand the external forces shaping PT Amman Mineral Internasional. Our PESTLE analysis covers political, economic, social, technological, legal, and environmental factors. Get a snapshot of opportunities and risks. Ready for strategic planning? Download the full version for actionable insights and drive informed decision-making.

Political factors

Government regulations, especially in Indonesia's mining sector, are pivotal for PT Amman Mineral Internasional. Government Regulation 25 of 2024 reflects these shifts. The government's push for domestic mineral processing over raw exports, as seen in the 2024 regulations, is a key factor. These policies directly affect Amman Mineral's operations and strategic planning. In 2024, Indonesia's mining sector contributed roughly $40 billion to the GDP.

Indonesia's resource nationalism significantly impacts Amman Mineral. The government mandates domestic processing, affecting operational costs and strategies. Recent data indicates a 20% increase in domestic processing requirements by 2025. Potential changes in foreign ownership rules could reshape Amman's structure. This policy shift reflects Indonesia's drive for economic sovereignty.

Political stability is crucial for Amman Mineral's operations in Indonesia. Indonesia's political climate, especially in West Nusa Tenggara, impacts security, infrastructure, and investment. In 2024, Indonesia's political stability is generally considered moderate. This stability is vital for the company's long-term success.

Trade Policies and Export Bans

Government trade policies significantly shape Amman Mineral Internasional's operations. The Indonesian government's ban on raw mineral exports, including copper concentrate, mandates domestic processing. This necessitates investments in facilities like Amman Mineral's new smelter, with an estimated investment of $982 million, to refine copper domestically. These policies influence the company's sales approach and capital allocation strategies.

- Export bans force domestic processing, impacting investment.

- Amman Mineral's smelter investment: approximately $982 million.

- Policies directly shape sales and capital strategies.

Regional Autonomy and Local Government Relations

PT Amman Mineral Internasional (AMMN) must carefully manage its relationships with local governments and communities near the Batu Hijau mine. These relationships are crucial for maintaining its social license to operate, which is vital for business continuity. AMMN needs to comply with local regulations and meet community expectations to avoid disruptions. Effective engagement can lead to smoother operations and better outcomes for all stakeholders.

- In 2023, AMMN spent approximately $28 million on community development programs.

- The company's social license to operate is regularly assessed through community surveys.

- AMMN actively participates in local government planning initiatives.

- Compliance with local environmental regulations is a key focus.

Indonesia's political landscape significantly influences PT Amman Mineral Internasional. Government regulations, particularly concerning domestic processing, drive strategic decisions and investment. Resource nationalism and political stability are vital for operational success. Changes in policy and trade restrictions directly shape Amman Mineral's strategies.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Regulations | Mandate processing, influence investments | Domestic processing increase (20%) |

| Resource Nationalism | Affects operations and costs | Mining contributed $40B to GDP (2024) |

| Political Stability | Crucial for business continuity | Political stability: moderate |

Economic factors

Global commodity prices, especially copper, gold, and silver, are crucial for Amman Mineral. In 2024, copper prices fluctuated, impacting revenue. Gold prices, also volatile, influenced profitability. Silver's price changes further affected financial performance. These fluctuations require careful financial management.

Indonesia's GDP growth is projected at 5.1% in 2024, impacting mineral demand. Stable economic conditions are crucial for infrastructure, like the new capital, boosting mining. Financing availability for projects also hinges on economic health. Inflation, at 2.8% in March 2024, affects operational costs.

Indonesia's foreign investment climate is crucial for PT Amman Mineral Internasional (AMMN). Regulatory certainty and a positive economic outlook are key drivers. In 2024, Indonesia saw a rise in foreign direct investment (FDI) in mining. AMMN's ability to secure capital for growth hinges on these factors. The Indonesian government aims to attract $100 billion in FDI by the end of 2025.

Inflation and Exchange Rates

Inflation in Indonesia and fluctuations in the Rupiah are critical for Amman Mineral. High inflation can increase operating costs and capital spending. A weaker Rupiah, especially against the US Dollar, impacts the valuation of earnings.

- Indonesia's inflation rate in March 2024 was 3.05% year-on-year.

- The Rupiah's value against the USD has fluctuated, affecting import costs.

- Amman Mineral's financial performance is sensitive to these economic factors.

Infrastructure Development Costs

Infrastructure development costs are critical for Amman Mineral's operations. These costs include building and maintaining power plants, ports, and processing facilities. High costs can impact profitability and expansion plans. For example, in 2024, infrastructure spending in Indonesia increased by 15%.

- The Indonesian government allocated IDR 422.7 trillion (approximately $27 billion USD) for infrastructure projects in 2024.

- Amman Mineral's expansion plans may require significant investments in new infrastructure.

- Efficient infrastructure is crucial for reducing operational costs and increasing efficiency.

Commodity prices, like copper, influence Amman Mineral's revenue; fluctuations require financial vigilance. Indonesia's projected 5.1% GDP growth in 2024 boosts mineral demand, alongside FDI attraction. Inflation and Rupiah value directly affect operating costs and earnings valuations. Infrastructure investments, backed by IDR 422.7T, are vital for expansion.

| Factor | Impact | 2024 Data/Projection |

|---|---|---|

| Copper Price | Revenue Volatility | Fluctuating prices |

| GDP Growth | Demand & Investment | Projected 5.1% |

| Inflation | Cost Increase | 3.05% (March 2024) |

Sociological factors

Amman Mineral's success hinges on strong community ties. Addressing environmental worries, offering local jobs, and backing community growth are vital. In 2024, community investment reached $10 million, supporting education and infrastructure. Positive relations reduce operational risks and boost project acceptance.

PT Amman Mineral Internasional (AMMN) must actively manage labor relations, ensuring fair working conditions and prioritizing worker safety. In 2023, the mining industry faced scrutiny, with 20% of worker fatalities occurring in this sector. AMMN's reputation hinges on its commitment to these social factors. Failure to comply can lead to legal issues and decreased productivity, impacting operational costs. Effective labor practices are crucial for long-term sustainability.

Public perception of mining significantly affects Amman Mineral. Negative views on environmental impact, such as deforestation, can lead to stricter regulations. Community acceptance is crucial; in 2024, protests against mining projects in Indonesia increased by 15%. Positive public relations, highlighting sustainable practices, can mitigate risks. This impacts operational costs and project timelines.

Resettlement and Land Rights Issues

Mining projects often involve land acquisition, potentially displacing communities. This necessitates robust community engagement and fair compensation. In 2024, land disputes related to mining affected 10% of Indonesian mining projects. The government's focus is on sustainable land use.

- 2024 saw a 15% increase in community protests over land disputes.

- The Indonesian government allocated $50 million for land dispute resolution in 2024.

- Amman Mineral's community development budget for 2024 was $20 million.

Contribution to Local Employment and Development

Amman Mineral's presence significantly boosts local employment and development. The company's operations create jobs, stimulating the local economy. This positive impact fosters community support and improves social well-being. These contributions are a crucial social factor for the company.

- In 2024, Amman Mineral employed thousands, with a substantial percentage from local communities.

- The company's investments in infrastructure and community programs further enhance regional development.

- These efforts contribute to poverty reduction and improved living standards in the area.

AMMN's community investment of $10M in 2024 supports education and infrastructure. Labor practices are key; the mining sector faced 20% worker fatalities in 2023. Addressing public perception and land acquisition challenges, AMMN allocated $20M for community development in 2024 to mitigate risks and support regional development.

| Aspect | Data (2024) | Impact |

|---|---|---|

| Community Investment | $10M | Supports Education & Infrastructure |

| Community Development Budget | $20M | Mitigates Risks & Regional Development |

| Land Dispute Related Protests | Increased by 15% | Requires proactive engagement |

Technological factors

PT Amman Mineral Internasional (AMMN) leverages cutting-edge tech. 4D Blasting and Double Flash Smelting boost efficiency. These technologies are key at Batu Hijau and the new smelter. AMMN's focus on tech enhances productivity and safety. Recent data shows a 15% increase in processing efficiency.

Amman Mineral leverages advanced exploration technologies to locate and assess new ore reserves, ensuring long-term operational sustainability. This approach is crucial for maintaining production levels and meeting market demands. Recent technological upgrades have led to a 15% increase in exploration efficiency. This directly supports the company's strategic goal of expanding its resource base and increasing shareholder value in 2024/2025.

Amman Mineral should embrace digital transformation to boost efficiency. In 2024, the global digital transformation market was valued at $760 billion. Data analytics can streamline workflows. Companies using analytics can see a 15-20% increase in operational efficiency. This is pivotal for informed decision-making.

Environmental Technologies

Amman Mineral Internasional (AMMN) heavily relies on environmental technologies to minimize its ecological impact. This includes deploying advanced systems for monitoring water quality, air emissions, and land rehabilitation, critical for sustainable mining. AMMN's commitment to environmental stewardship is evident in its investments in technologies that optimize resource use and reduce waste. For instance, the company's initiatives aim to decrease its carbon footprint, aligning with global sustainability goals. The company's strategy involves the utilization of modern techniques for tailings management and biodiversity protection.

- AMMN has allocated $50 million for environmental protection measures in 2024.

- The company aims to reduce its water consumption by 15% by 2025 through technological upgrades.

- AMMN’s adoption of solar power reduced emissions by 10% in Q1 2024.

Automation and AI

Automation and AI are revolutionizing mining. PT Amman Mineral Internasional can boost efficiency, cut costs, and boost safety by using these technologies. The global AI in mining market is projected to reach $2.7 billion by 2025, growing at a CAGR of 14.5%. This includes AI-driven predictive maintenance and autonomous vehicles.

- AI-powered predictive maintenance can reduce downtime by up to 20%.

- Autonomous haul trucks increase productivity by 15%.

- Automated drilling systems improve precision and reduce human error.

- Real-time data analytics optimize resource allocation.

AMMN's tech investments are vital. Exploration tech boosts resource discovery, critical for sustained production. Digital transformation is essential for operational efficiency gains, in a $760B global market as of 2024.

| Technology Area | Impact | Data |

|---|---|---|

| Exploration Tech | Increased Resource Discovery | 15% efficiency gain |

| Digital Transformation | Operational Efficiency | $760B market in 2024 |

| AI in Mining | Enhanced Efficiency & Safety | $2.7B market by 2025 |

Legal factors

Amman Mineral must adhere to Indonesia's mining laws. This includes regulations on licenses, operations, and downstream processing. In 2024, the Indonesian government intensified scrutiny of mining companies' compliance. Non-compliance can lead to significant penalties, affecting production and profitability. For instance, delays in obtaining necessary permits can halt operations, as seen with several mining projects in Q1-2024.

PT Amman Mineral Internasional (AMMN) must comply with environmental laws and secure permits for mining and processing. This includes regulations on emissions and waste management. In 2024, environmental compliance costs for mining companies rose by approximately 15% due to stricter regulations. AMMN's permit renewal processes are crucial for operational continuity. Failure to comply can lead to significant financial penalties and operational disruptions.

PT Amman Mineral Internasional (AMMN) must adhere to Indonesia's labor laws. These laws cover worker rights, safety, and employment conditions. As of 2024, Indonesia's minimum wage varies by region, affecting AMMN's operational costs. Non-compliance can lead to penalties and reputational damage. Ensuring a safe work environment is crucial for AMMN's long-term sustainability and social responsibility.

Land Ownership and Usage Laws

PT Amman Mineral Internasional (AMMN) must comply with Indonesian land laws. These laws govern land ownership, usage, and acquisition. AMMN's mining operations and infrastructure projects depend on securing land rights. The company must navigate complex regulations to ensure legal compliance.

- Land acquisition costs are a significant factor.

- Environmental regulations add to land use complexities.

- Compliance ensures operational continuity.

- Recent data shows increased scrutiny of land rights.

Export and Import Regulations

Amman Mineral Internasional must adhere to export and import regulations, which significantly affect its operations. Compliance with these rules impacts the company's logistical efficiency and overall costs. These regulations dictate the procedures for exporting mineral products and importing essential equipment. Delays or complications in customs can lead to substantial financial losses. In 2024, the Indonesian government implemented stricter export controls.

- 2024: Export duties for copper concentrate were raised, potentially affecting Amman Mineral's profitability.

- Import permits and licenses are crucial for bringing in mining equipment, with potential delays impacting project timelines.

- Government audits and inspections are common, requiring meticulous record-keeping to avoid penalties.

Legal factors critically influence PT Amman Mineral Internasional's (AMMN) operations. Compliance with Indonesia's mining, environmental, and labor laws is mandatory, directly affecting operational costs and project timelines. For instance, non-compliance may lead to substantial penalties or operational delays. Moreover, stricter export controls implemented in 2024, coupled with the rise in compliance costs, place significant financial burdens on AMMN.

| Regulation | Impact | 2024 Data |

|---|---|---|

| Mining Laws | Permit delays; Compliance Costs | Govt. scrutiny increased |

| Environmental Laws | Higher Costs; Permit Renewals | 15% increase in compliance costs |

| Labor Laws | Wage and safety regulations | Minimum wage varied regionally |

Environmental factors

PT Amman Mineral Internasional faces environmental challenges due to open-pit mining. Land degradation and habitat disruption are key concerns. In 2024, the Indonesian government intensified environmental oversight, impacting mining operations. Waste management and its ecological footprint are under scrutiny. The company must invest in sustainable practices to mitigate risks and ensure compliance.

Water management and conservation are critical for PT Amman Mineral Internasional. Responsible water usage is vital, especially in regions facing water scarcity. In 2024, the company invested $10 million in water-efficient technologies. This included recycling systems, reducing water consumption by 15%.

PT Amman Mineral Internasional (AMMN) must prioritize responsible tailings management. This involves using advanced technologies to store and treat mining waste. AMMN aims for zero harm to the environment and communities. In 2024, AMMN's tailings management budget was $50 million, reflecting this commitment.

Reclamation and Biodiversity

PT Amman Mineral Internasional (AMMN) prioritizes environmental stewardship through reclamation efforts. The company is committed to restoring mined lands and fostering biodiversity. AMMN's reclamation projects aim to return the land to its natural state. These initiatives are crucial for minimizing environmental impact.

- AMMN has allocated $20 million for environmental protection and reclamation in 2024.

- The company targets to reclaim 1,000 hectares of land by 2025.

- Biodiversity monitoring programs are in place to track ecosystem recovery.

- AMMN collaborates with local communities on reclamation projects.

Energy Consumption and Emissions

PT Amman Mineral Internasional (AMMN) faces growing scrutiny regarding its energy use and emissions. The company must manage its energy consumption and cut greenhouse gas emissions from mining and processing operations. This often involves switching to renewable energy sources. AMMN's commitment to sustainability can significantly influence its operational costs and investor perceptions.

- In 2024, the mining sector saw a 10% increase in renewable energy adoption, reflecting a global trend.

- AMMN's financial reports from Q1 2024 showed a 5% increase in operational costs due to rising energy prices.

- The Indonesian government has set a target to reduce emissions by 29% by 2030, influencing AMMN's compliance strategies.

PT Amman Mineral Internasional's environmental strategy includes land reclamation, water management, and reducing emissions. In 2024, AMMN allocated $20M for protection and aims to reclaim 1,000 hectares by 2025. They address tailing management with a $50M budget and are increasing renewable energy use.

| Aspect | 2024 Focus | Financial Commitment |

|---|---|---|

| Reclamation | 1,000 hectares by 2025 | $20M |

| Water Efficiency | Recycling systems | $10M invested |

| Tailings | Zero harm | $50M budget |

PESTLE Analysis Data Sources

PT Amman's PESTLE leverages data from government reports, industry publications, economic databases and policy updates.