Amway Corporation Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amway Corporation Bundle

What is included in the product

Tailored exclusively for Amway Corporation, analyzing its position within its competitive landscape.

Easily identify threats with the power of dynamic data visualization.

What You See Is What You Get

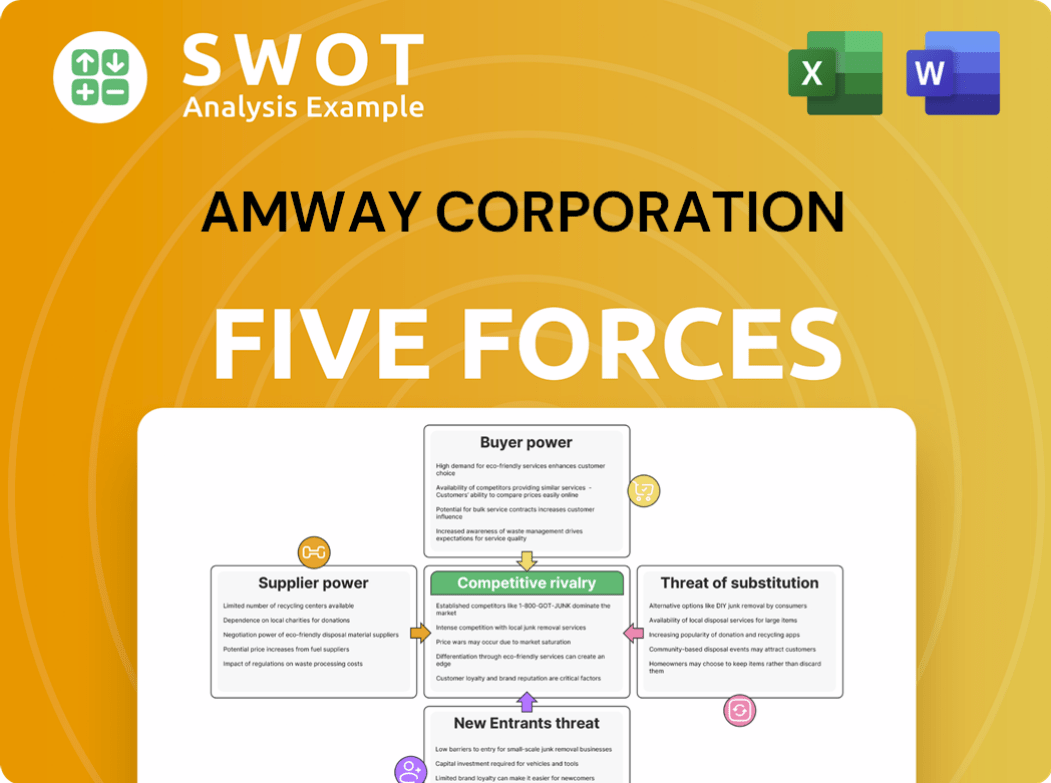

Amway Corporation Porter's Five Forces Analysis

The Amway Corporation Porter's Five Forces Analysis previewed here meticulously examines its competitive landscape. This detailed assessment of the industry is complete with insights into each force. The document analyzes threat of new entrants, rivalry, and more. You’re previewing the final version—precisely the same document that will be available to you instantly after buying.

Porter's Five Forces Analysis Template

Amway's industry faces moderate rivalry, with numerous direct selling companies vying for market share. Buyer power is relatively high due to consumer choice and brand loyalty variations. Supplier power is generally low, as Amway sources a diverse range of products. The threat of new entrants is moderate, considering the capital needed and regulatory hurdles. Substitutes pose a notable threat, given the availability of alternative retail channels.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Amway Corporation’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Amway benefits from a diverse supplier base, reducing reliance on any single entity. This broad sourcing strategy enhances Amway's negotiation power. For instance, in 2024, Amway's global sourcing network included over 500 suppliers. This diversification helps stabilize costs and supply chains.

Amway sources standardized inputs like chemicals and vitamins for products. This means Amway can switch suppliers easily, reducing supplier power. With many suppliers available, Amway secures competitive pricing and reliable supply. For example, in 2024, Amway likely negotiated favorable terms due to this flexibility.

Amway, due to its size and market presence, wields considerable bargaining power over its suppliers. The company's substantial purchasing volume enables it to negotiate advantageous pricing and terms. Suppliers are motivated to accommodate Amway to maintain their business relationship. This dynamic bolsters Amway's control within the supply chain, ensuring cost-effectiveness.

Supplier Competition

Amway's supplier market is competitive, reducing supplier bargaining power. Suppliers compete to offer better pricing and terms to companies like Amway. This competition helps Amway secure cost-effective sourcing. In 2024, the global cosmetic ingredients market was valued at $35.8 billion, showing supplier diversity. This offers Amway various sourcing options.

- Competitive Market: Suppliers compete for Amway's business.

- Cost-Effective Sourcing: Amway benefits from competitive pricing.

- Market Size: The global cosmetic ingredients market was $35.8 billion in 2024.

- Sourcing Options: Amway has multiple suppliers.

Backward Integration Threat is Low

Amway's suppliers face low backward integration threat. The company is unlikely to acquire suppliers due to complexity and cost. This keeps suppliers competitive, knowing Amway might switch rather than integrate. Consequently, suppliers are more open to favorable terms, improving Amway's position. For instance, Amway's 2023 revenue was approximately $8.1 billion, indicating its scale and influence over suppliers.

- Low integration risk allows Amway to negotiate.

- Suppliers are incentivized to offer better deals.

- Amway's size gives it significant leverage.

- Amway's 2023 revenue supports its supplier power.

Amway's extensive supplier network and diverse sourcing strategies significantly enhance its bargaining power. The company's large purchasing volumes allow it to negotiate favorable terms, driving down costs. In 2024, the global direct selling market, where Amway operates, was estimated at $172 billion. Amway's robust supplier relationships and market position enable it to maintain control and cost-effectiveness within its supply chain.

| Aspect | Details | Impact on Amway |

|---|---|---|

| Supplier Diversification | Over 500 suppliers globally in 2024 | Reduces reliance, stabilizes costs |

| Market Competition | Cosmetic ingredients market at $35.8B in 2024 | Competitive pricing, sourcing options |

| Amway's Size | $8.1B revenue in 2023 | Significant leverage in negotiations |

Customers Bargaining Power

Customers in Amway's markets show high price sensitivity, impacting their bargaining power. They can easily switch brands due to the wide product choice available. This sensitivity is amplified by online retailers offering competitive prices. Amway needs to focus on competitive pricing and product quality to retain customers. In 2024, the global direct selling market was valued at over $170 billion, highlighting the competition.

Switching costs for Amway customers are generally low. Customers can easily opt for competing products with little financial burden. This flexibility allows customers to seek better deals and service. Consequently, Amway must focus on innovation and superior customer experiences. In 2024, the direct selling industry saw a 3.1% decrease in sales, emphasizing the need for Amway to retain customers.

Amway faces substantial customer bargaining power due to the availability of substitutes. The health, beauty, and home care markets are saturated with alternatives. This abundance allows customers to switch brands easily, putting pressure on Amway. In 2024, the global personal care market was valued at over $500 billion, with numerous competitors. To compete, Amway must differentiate.

Information Transparency

Customers today wield significant power due to information transparency. They can easily access product details, prices, and reviews online, allowing them to make informed choices. This readily available data enables customers to directly compare Amway's offerings against competitors. Amway must therefore maintain a robust online presence and a positive brand reputation to effectively influence customer perceptions and decisions.

- Online sales in the U.S. retail market reached $1.1 trillion in 2023.

- Customer reviews and ratings now heavily influence 80% of purchasing decisions.

- Amway's digital sales accounted for 60% of its total revenue in 2024.

- The average consumer consults 7 online sources before making a purchase.

IBO Dependence

Amway's success hinges on end consumers, not just IBOs. If consumers aren't happy, they stop buying, hurting IBO sales and recruitment. This consumer influence compels IBOs to focus on customer satisfaction. Amway supports IBOs with quality products and training for positive experiences. In 2024, Amway's global retail sales were approximately $7.7 billion.

- Consumer satisfaction directly impacts IBO earnings and Amway's revenue.

- IBOs must prioritize customer needs to maintain sales and recruit new members.

- Amway provides resources to help IBOs deliver good customer experiences.

- The end consumer holds significant bargaining power in Amway's business model.

Customers' bargaining power significantly affects Amway. They easily switch to alternatives, pressuring Amway. Online competition and consumer reviews increase this power.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | Online retail sales reached $1.2 trillion in 2024. |

| Switching Costs | Low | 82% of consumers check online reviews before buying. |

| Substitutes | Abundant | Global personal care market: $520B in 2024. |

Rivalry Among Competitors

The health, beauty, and home care markets are fiercely competitive, populated by both long-standing firms and new entrants. This rivalry forces Amway to stand out to attract customers. Amway competes with direct sellers and retail brands, which increases the pressure. In 2024, the global personal care market was valued at over $570 billion, highlighting the intense competition Amway faces.

Competitors utilize aggressive marketing tactics, including extensive advertising and enticing promotional offers, to capture consumer attention. To remain competitive, Amway needs to invest heavily in its marketing strategies. In 2024, the direct selling industry spent billions on advertising globally. Effective marketing is essential for Amway to differentiate itself in this competitive landscape.

Amway faces intense rivalry due to rapid product innovation. Companies constantly release new products to gain market share. This necessitates continuous R&D investment from Amway. To stay competitive, Amway must anticipate trends and customer needs. For example, Amway invested over $100 million in R&D in 2023.

Price Wars

Price wars are a frequent occurrence in the health, beauty, and home care sectors, which Amway operates in. These price battles, aimed at price-conscious consumers, can significantly impact profitability. Amway needs a strategic pricing approach to stay competitive while preserving its financial health. For example, in 2024, the global personal care market was valued at approximately $570 billion, with intense competition influencing pricing strategies. Balancing price and perceived value is critical for Amway's long-term viability.

- Price competition is a common feature in Amway's markets.

- Price wars can erode profit margins.

- A strategic pricing model is crucial for Amway.

- Balancing price and value is essential for success.

Distribution Channel Conflicts

Amway's competitive landscape includes distribution channel conflicts. Its dependence on independent business owners (IBOs) can clash with other retail channels. Competitors like Herbalife and Nu Skin use online and direct selling. Effective IBO management is vital for consistent brand messaging.

- Amway's revenue in 2023 was approximately $7.8 billion.

- Herbalife's net sales for 2023 were around $4.8 billion.

- Nu Skin's 2023 revenue was about $1.95 billion.

- Direct selling industry sales in the U.S. in 2023 were over $40 billion.

Amway faces intense competition from direct sellers and retail brands, requiring strong marketing efforts and product innovation. Aggressive marketing and rapid product releases characterize the competitive landscape, necessitating significant investment in both areas. Price wars frequently occur, pressuring Amway to strategically balance pricing with value.

| Aspect | Details | Financial Impact |

|---|---|---|

| Competitors | Direct sellers, retail brands (Herbalife, Nu Skin) | Influences Amway's revenue and market share |

| Marketing | Aggressive advertising, promotional offers | Requires substantial investment, impacts brand visibility |

| Pricing | Price wars, strategic need | Affects profitability, necessitates value focus |

SSubstitutes Threaten

Amway faces a significant threat from substitutes due to the wide availability of alternatives. Customers can easily switch to similar products in the health, beauty, and home care sectors. Competitors include direct selling firms and retail giants. In 2024, the global personal care market was valued at over $500 billion, indicating ample substitutes.

Many lower-priced substitutes exist, appealing to budget-conscious consumers. These alternatives may lack Amway's quality, yet they're still viable. Amway must justify its premium pricing. In 2024, the global direct selling market was worth over $170 billion, with competition intensifying.

Consumer preferences are always changing, leading to the rise of new products. This creates opportunities for substitutes to take over. Amway needs to keep up with these trends and adjust its products. Flexibility and innovation are key to handling substitute threats. In 2024, the global health and wellness market, where Amway operates, is valued at over $7 trillion, showing significant consumer interest in alternatives.

DIY Solutions

The rise of DIY solutions poses a threat to Amway. Consumers are turning to DIY options for health, beauty, and home care. This shift diminishes demand for Amway's products. Amway must emphasize its products' superior convenience and quality. Highlighting professional-grade benefits is key to staying competitive.

- The global DIY market was valued at $1.1 trillion in 2023.

- Amway's sales decreased by 10% in 2023.

- Highlighting product efficacy and convenience is crucial.

Generic Brands

The proliferation of generic and private-label brands presents a threat to Amway's sales. These alternatives, often priced lower, attract cost-conscious customers. To combat this, Amway needs to emphasize its brand value, product quality, and distinctive attributes. Strong brand loyalty is key to retaining customers amid these cheaper options.

- In 2024, the private label market grew, with some segments seeing over 10% growth.

- Amway's emphasis on direct selling can be a differentiator, but it requires strong brand advocacy.

- Competitive pricing strategies are essential to maintain market share.

- Product innovation and unique features help justify Amway's price point.

Amway faces fierce competition from substitutes across health, beauty, and home care.

Customers have numerous alternatives, including direct selling and retail options; the global personal care market reached $500+ billion in 2024.

DIY solutions and private-label brands also pressure Amway, with the DIY market valued at $1.1 trillion in 2023.

To stay competitive, Amway must highlight its product quality and brand value; Amway's 2023 sales fell 10%.

| Market Segment | 2023 Value | 2024 Growth Forecast |

|---|---|---|

| Global Direct Selling | $170B+ | 5% |

| Health & Wellness | $7T+ | 6% |

| Private Label Market | Significant, various segments | 10%+ |

Entrants Threaten

While starting a direct selling firm needs significant investment, the capital needs are moderate relative to other sectors. Newcomers can use tech and online platforms to cut initial expenses. Amway has to constantly innovate and invest in its infrastructure to stay competitive. For example, in 2024, Amway's revenue was approximately $8.1 billion. This shows the scale and resources needed.

Amway's strong brand loyalty, built over decades, and its vast network of Independent Business Owners (IBOs) create a significant barrier. New entrants face the daunting task of competing with an established presence. In 2024, Amway's global sales were over $8.1 billion, showcasing its market strength. To succeed, new entrants must offer superior value and innovative products. Building trust is crucial to attract customers and IBOs.

The direct selling industry faces regulatory scrutiny. New entrants need to comply to operate legally. Amway's compliance expertise gives an edge. In 2024, regulatory changes impacted the industry. Maintaining a good reputation is vital for all companies.

Economies of Scale

Amway's economies of scale in manufacturing, distribution, and marketing provide a significant barrier to new entrants. This scale allows Amway to offer competitive pricing and invest in research and development. New companies often find it challenging to match Amway's efficiency levels, particularly in areas like supply chain management. To maintain its cost advantage, Amway must continually leverage its size. In 2024, Amway's global revenue was approximately $7.7 billion, reflecting its established market position.

- Manufacturing efficiencies lower production costs.

- Extensive distribution networks reduce shipping expenses.

- Large-scale marketing campaigns increase brand awareness.

- Established market presence deters new competition.

IBO Network Effects

Amway's substantial network of Independent Business Owners (IBOs) forms a robust network effect, increasing in value as more IBOs join. New entrants face significant challenges in attracting and retaining IBOs due to this established network. Amway must continually support its IBOs with resources. This support, including training and incentives, is crucial for maintaining their loyalty and competitiveness.

- Amway operates in over 100 countries and territories.

- In 2023, Amway reported global sales of $7.7 billion.

- The Direct Selling Association (DSA) reported $40.5 billion in retail sales in the U.S. in 2023.

- Amway's business model relies heavily on its IBO network for product distribution and sales.

The threat of new entrants to Amway is moderate. While the direct selling business model has some barriers to entry, such as the need to invest in infrastructure and build a brand, newcomers can leverage technology and online platforms to cut initial costs.

Amway's economies of scale, established brand loyalty, and extensive IBO network present considerable challenges for new competitors.

New entrants will need to offer superior value, innovative products, and build trust with both customers and IBOs to succeed. In 2024, the direct selling industry generated over $35 billion in the U.S. alone, highlighting the competitive landscape.

| Factor | Impact on New Entrants | Amway's Advantage |

|---|---|---|

| Capital Needs | Moderate | Established resources |

| Brand Loyalty | Challenging to build | Strong brand recognition |

| IBO Network | Difficult to replicate | Extensive, global network |

Porter's Five Forces Analysis Data Sources

Amway's analysis leverages annual reports, market studies, and competitive intelligence databases. SEC filings and industry news also provide critical data points.