Australian Pharmaceutical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Australian Pharmaceutical Bundle

What is included in the product

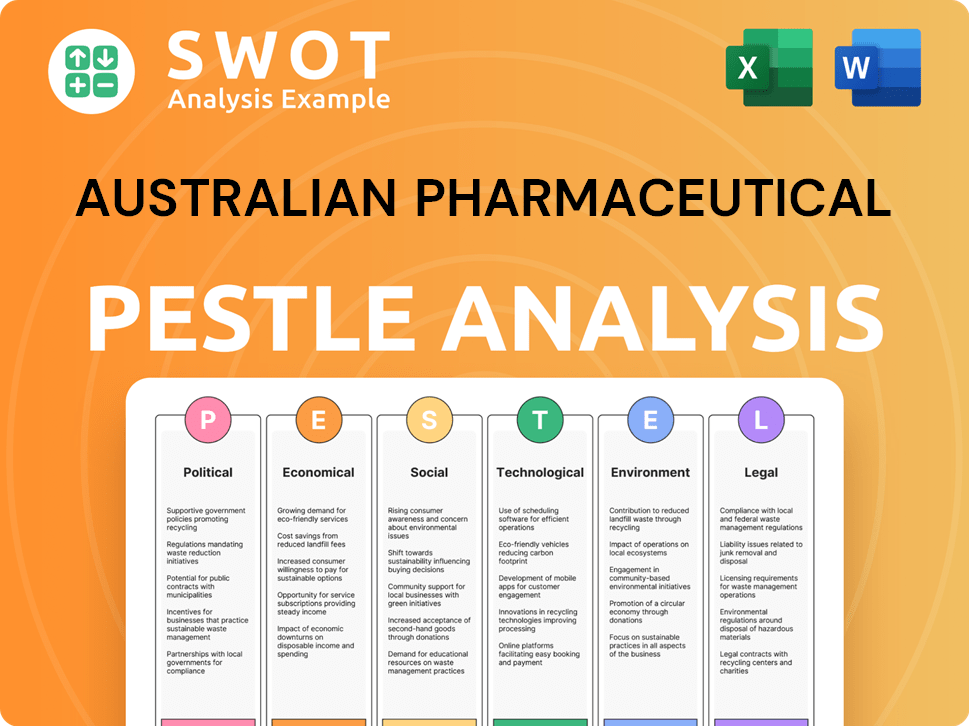

Analyzes the Australian pharmaceutical landscape using Political, Economic, Social, Technological, Environmental, and Legal factors.

Helps quickly identify critical factors to create focused strategies, fostering agile decision-making.

Preview Before You Purchase

Australian Pharmaceutical PESTLE Analysis

What you’re previewing here is the Australian Pharmaceutical PESTLE Analysis—a comprehensive, ready-to-use document.

Explore the insightful breakdown of political, economic, social, technological, legal, and environmental factors.

The exact content, formatting, and structure displayed in this preview are what you'll get immediately after purchase.

No revisions needed, the finished report is instantly available.

Get the complete PESTLE Analysis, ready to download!

PESTLE Analysis Template

Navigate the complex Australian pharmaceutical market. Our PESTLE analysis breaks down key external factors impacting businesses like yours. Understand political landscapes, economic shifts, social trends, and more. This essential guide helps forecast risks and uncover growth opportunities. Access expert-level insights, and empower your strategic decision-making. Get the full PESTLE analysis now!

Political factors

Government healthcare funding and policies are critical in the Australian pharmaceutical market. The Pharmaceutical Benefits Scheme (PBS) heavily subsidizes medicine costs. The 2024-25 Federal Budget allocated funds for Medicare and PBS cost reductions. This directly impacts the affordability and accessibility of pharmaceuticals. In 2024, the PBS saved Australians $1.8 billion.

Ongoing reforms to the Pharmaceutical Benefits Scheme (PBS), including price reductions and adjustments to listing criteria, significantly impact pharmaceutical companies' revenue and profitability. These changes aim to manage healthcare costs, potentially creating pricing pressures. The Health Technology Assessment (HTA) Review evaluates the system for assessing new medicines for PBS listing. In 2024-2025, these reforms are expected to continue, influencing market dynamics. The Australian government's PBS spending in 2023-2024 was approximately $15.7 billion.

The Therapeutic Goods Administration (TGA) oversees therapeutic goods in Australia, ensuring safety and effectiveness. Regulatory shifts in approval, advertising, or manufacturing impact API's operations. The TGA's framework is crucial, with over 15,000 medicines registered. In 2024, the TGA approved approximately 1,000 new medicines.

Government Initiatives in Healthcare and Manufacturing

Government initiatives significantly impact the Australian pharmaceutical sector. The Modern Manufacturing Strategy supports local pharmaceutical production, fostering growth. Medical research sees investment through the Medical Research Future Fund (MRFF). In 2024-2025, the MRFF is projected to invest billions in health and medical research. These initiatives create opportunities for local pharmaceutical companies.

- Modern Manufacturing Strategy aims to boost local production.

- MRFF drives research investments, supporting innovation.

- Government support enhances industry capabilities.

- Billions are invested in health and medical research.

Geopolitical Factors and Supply Chain Resilience

Geopolitical instability significantly influences pharmaceutical supply chains, potentially disrupting the availability and increasing the costs of essential raw materials and finished products. Australia is actively working to fortify its medical supply chains, a critical step toward ensuring national health security. This includes initiatives aimed at diversifying sourcing and bolstering local manufacturing capabilities. For example, in 2024, the Australian government invested $150 million to strengthen domestic pharmaceutical manufacturing. This focus reflects a broader global trend, with many nations prioritizing supply chain resilience.

- Global supply chain disruptions have increased the cost of pharmaceutical raw materials by up to 20% in 2024.

- The Australian government aims to increase domestic pharmaceutical manufacturing to 50% of national demand by 2030.

Australia's political landscape shapes its pharmaceutical sector. Government health funding and policies, such as the PBS, impact medicine costs and access. Ongoing reforms like price adjustments influence revenue. Regulatory bodies like the TGA also affect operations.

| Factor | Impact | Data |

|---|---|---|

| PBS Reforms | Price pressures & revenue impact | 2023-24 PBS spending: ~$15.7B |

| TGA Approvals | Drug registration & market entry | ~1,000 new medicines approved in 2024 |

| Supply Chains | Cost and availability of raw materials | Raw material cost increase up to 20% (2024) |

Economic factors

Healthcare spending is a significant economic factor in Australia. In 2024, the total health expenditure is projected to be around $240 billion. The Pharmaceutical Benefits Scheme (PBS) substantially affects medication affordability. Changes to co-payments can shift consumer spending on medicines. Australians highly value accessible, affordable healthcare.

The Australian pharmaceutical market is experiencing steady growth, fueled by an aging population and rising chronic disease prevalence. The market was valued at $30.5 billion in 2024. Forecasts indicate continued expansion, projecting the market to reach $37.5 billion by 2028. This growth creates a favorable economic environment for API and related businesses.

The Australian pharmaceutical wholesale market saw revenue growth, adapting business models. Retail pharmacy is expanding, driven by health awareness and OTC demand. The market's value is around $25 billion as of 2024, reflecting strong growth. These trends affect API's operations, requiring strategic adjustments.

Competition and Pricing Pressures

The Australian pharmaceutical market faces intense competition, with pricing pressures stemming from the Pharmaceutical Benefits Scheme (PBS) and generic drugs. These factors directly impact profitability. In 2024, the PBS spending reached $14.9 billion. Companies are adapting, for instance, by expanding non-PBS revenue.

- PBS expenditure in 2024 was $14.9 billion.

- Generic medicines make up a significant portion of prescriptions.

- Non-PBS revenue is a growing focus for pharmaceutical companies.

Investment in Research and Development

Investment in Research and Development (R&D) is vital for the Australian pharmaceutical industry, driving innovation and growth. Government programs, such as the R&D Tax Incentive, support this, alongside substantial company investments in new therapies. Economic conditions and incentives, like tax credits, significantly influence R&D spending. For example, in 2024, pharmaceutical R&D spending in Australia reached $6 billion.

- Government R&D Tax Incentive: 43.5% refundable tax offset for eligible small businesses.

- Total pharmaceutical R&D spending in 2024: $6 billion.

- Expected growth in pharmaceutical R&D by 2025: 6%.

Australia's pharmaceutical sector is strongly influenced by economic elements, particularly government healthcare spending and PBS dynamics. The total health expenditure for 2024 is about $240 billion. The pharmaceutical market reached $30.5 billion in 2024.

| Factor | Details |

|---|---|

| Market Growth | $30.5B market in 2024, to $37.5B by 2028 |

| R&D Spending | $6B in 2024, expected 6% growth by 2025 |

| PBS Expenditure | $14.9B in 2024, impacting pricing |

Sociological factors

Australia's aging population fuels the pharmaceutical market. The demand for medications treating age-related and chronic diseases is rising. This demographic shift impacts pharmaceutical needs. By 2024, 17% of Australians were aged 65+, increasing demand. Healthcare spending is expected to grow, with pharmaceuticals being a key area.

The prevalence of chronic diseases is rising in Australia, driving up demand for pharmaceuticals and healthcare. Conditions like diabetes and heart disease are increasingly common, requiring ongoing medication. In 2024, over 11 million Australians had at least one chronic condition. This boosts the pharmaceutical market, with long-term treatments becoming vital.

Consumer attitudes are shifting towards health and wellness, boosting demand for preventive healthcare and self-medication. This trend is evident in the Australian market, with a 6.2% increase in health supplement sales in 2024. Growing health awareness further fuels market expansion. Australians are increasingly proactive about their health, driving the pharmaceutical sector. This shift is projected to continue, with an estimated 5% annual growth in the wellness market through 2025.

Demand for Accessible Healthcare and Services

The Australian population's demand for accessible healthcare is growing. Telehealth and e-pharmacies are becoming more common, impacting how people get their medications. This shift is boosting digital health solutions in the pharmaceutical market. For instance, in 2024, telehealth consultations increased by 15% compared to the previous year.

- Telehealth adoption is rising, with a 20% increase in usage among Australians aged 65+ in 2024.

- The e-pharmacy market is expanding, showing a 10% annual growth rate, as of late 2024.

- Digital health solutions are gaining traction, with investments in these technologies reaching $500 million in 2024.

Workforce Skills and Availability

Australia's pharmaceutical sector relies on a skilled workforce. The availability of trained professionals in healthcare and life sciences is crucial for innovation and operational success. Ensuring adequate training and support for healthcare workers, including pharmacists, remains a key focus. In 2024, the healthcare and social assistance sector employed around 1.9 million people.

- The Australian Government invests in skills and training initiatives to support the healthcare workforce.

- Demand for skilled workers in biotechnology and pharmaceuticals is growing.

- The sector faces challenges in attracting and retaining talent.

- Universities and vocational institutions offer specialized programs to meet industry needs.

Sociological factors significantly impact the Australian pharmaceutical sector. An aging population drives demand for medicines, with 17% over 65 in 2024. Rising chronic diseases and changing health attitudes boost pharmaceutical needs. Increased telehealth and e-pharmacy adoption reshapes healthcare access. A skilled workforce is crucial.

| Factor | Impact | Data (2024) |

|---|---|---|

| Aging Population | Increased Demand | 17% aged 65+ |

| Chronic Diseases | Demand for Medication | 11M+ with conditions |

| Health Awareness | Growth in Wellness | 6.2% supplement sales increase |

Technological factors

Biopharmaceutical innovation and manufacturing advancements are reshaping the pharmaceutical sector. Automation and data analytics improve efficiency and reduce costs. The Australian pharmaceutical market was valued at $30.6 billion in 2024, with a projected increase to $33.3 billion by 2025. These technologies enhance product quality, supporting market growth.

Digital health, incorporating telehealth and e-prescribing, is rapidly expanding. In 2024, telehealth consultations in Australia increased by 30%, reflecting growing consumer adoption. The online pharmacy market is also growing, with a projected value of $2.5 billion by 2025. These technologies enhance accessibility and convenience.

Artificial Intelligence (AI) and advanced data analytics are transforming the Australian pharmaceutical sector. These technologies enhance operational efficiency and speed up drug discovery, while also improving strategic decisions. For example, the global AI in drug discovery market is projected to reach $4.1 billion by 2025.

E-commerce and Digital Capabilities

E-commerce and digital prowess are critical for Australian pharmaceutical companies. They need to adapt to shifting consumer buying habits and compete with online platforms. API has been investing in its digital presence, which is a key strategy. The Australian e-pharmacy market is expanding, with sales projected to reach $1.2 billion by 2025. This expansion highlights the need for robust online capabilities.

- Australian e-pharmacy sales are expected to hit $1.2 billion by 2025.

- API is actively boosting its digital presence.

Supply Chain Technology and Transparency

Technological advancements are transforming the Australian pharmaceutical supply chain, enhancing transparency and efficiency. These innovations help companies manage disruptions and ensure product reliability. According to a 2024 report, 75% of Australian pharmaceutical companies are investing in supply chain technology. This includes track-and-trace systems and blockchain for enhanced data visibility.

- Implementation of track-and-trace systems: Improves product traceability.

- Blockchain technology: Enhances data security and transparency.

- AI and automation: Optimizes logistics and reduces costs.

- Real-time monitoring: Ensures product integrity.

Technological innovation boosts the Australian pharmaceutical industry. Automation and data analytics enhance efficiency. The e-pharmacy market will reach $1.2B by 2025. Digital capabilities and supply chain tech are key.

| Technology | Impact | 2025 Projection |

|---|---|---|

| E-pharmacy | Expanding market | $1.2 Billion |

| Telehealth | Increased consultations | 30% increase (2024) |

| AI in drug discovery | Enhances operational efficiency | $4.1 Billion (Global) |

Legal factors

The Therapeutic Goods Administration (TGA) is the main regulatory body overseeing pharmaceuticals in Australia. API manufacturers must follow the Therapeutic Goods Act and related rules. This includes registration, manufacturing, labeling, and advertising requirements. In 2024, the TGA approved approximately 1,000 new therapeutic goods. The TGA's budget for 2024-2025 is around $180 million.

The Pharmaceutical Benefits Scheme (PBS) is crucial in Australia's pharmaceutical landscape. The National Health Act is the primary legislation governing the PBS, dictating medicine listing and subsidies. These laws heavily influence pricing and reimbursement structures for pharmaceutical products. In 2024-2025, the PBS budget is approximately $15 billion, impacting pharmaceutical companies' revenue.

Advertising and promotion of pharmaceuticals in Australia are strictly regulated. The Therapeutic Goods Act and Medicines Australia Code of Conduct set the standards. These laws dictate what can be communicated to doctors and the public. Breaching these rules can lead to significant penalties. In 2024, the TGA issued 120+ warnings related to non-compliant advertising.

Competition and Consumer Law

Australian pharmaceutical companies must comply with competition and consumer laws, including the Competition and Consumer Act and the Australian Consumer Law. These laws are crucial in preventing anti-competitive practices and safeguarding consumer rights. The Australian Competition & Consumer Commission (ACCC) actively enforces these regulations, ensuring fair market practices. In 2024, the ACCC secured penalties exceeding $50 million for breaches of competition and consumer laws across various sectors.

- The ACCC's focus includes scrutinizing mergers and acquisitions within the pharmaceutical industry to prevent monopolies.

- Consumer Law protects patients from misleading advertising and ensures product safety.

- Compliance involves rigorous internal processes and legal counsel to avoid penalties.

- Breaches can lead to significant fines, reputational damage, and legal actions.

Changes in Aged Care Legislation

The Australian aged care sector is undergoing significant legislative changes. The new Aged Care Act, set to take effect from July 2025, will reshape how pharmaceutical services are provided to the elderly. This legislation introduces a rights-based framework, potentially increasing demand for specialized pharmaceutical care. These changes are occurring against the backdrop of an aging population.

- The Australian population aged 65 and over is projected to reach 22% by 2062-63.

- The new act aims to improve the quality and safety of aged care services.

- Increased scrutiny on pharmaceutical services within aged care facilities is expected.

Legal factors significantly shape Australia's pharmaceutical industry. Key regulations include the Therapeutic Goods Act, influencing product approval and market access. The Pharmaceutical Benefits Scheme (PBS), governed by the National Health Act, impacts drug pricing and reimbursement.

Advertising rules are strict, with the Therapeutic Goods Act and Medicines Australia Code of Conduct setting standards, including over 120 advertising warnings issued in 2024 by the TGA. Competition and consumer laws, enforced by the ACCC, prevent anti-competitive practices; in 2024, penalties exceeded $50 million. Upcoming Aged Care Act reforms will impact aged care pharmaceutical services, starting from July 2025.

| Aspect | Regulation/Law | Impact |

|---|---|---|

| Product Approval | Therapeutic Goods Act | Market entry, compliance |

| Pricing/Reimbursement | National Health Act (PBS) | Revenue, subsidies |

| Advertising | TGA/Medicines Australia | Marketing restrictions |

| Competition | Competition/Consumer Act | Anti-competitive practices |

| Aged Care | Aged Care Act (July 2025) | Service delivery, standards |

Environmental factors

Environmental impact of pharmaceuticals is gaining attention globally. Australia currently lags in mandating environmental risk assessments for medicines pre-approval. The Australian government is under pressure to adopt these practices. This could affect pharmaceutical companies' costs and regulatory hurdles. The market is expected to reach $1.2 billion by 2025.

Proper disposal of pharmaceutical waste is vital to reduce environmental pollution in Australia. The "Return Unwanted Medicines" project facilitates safe disposal of household medications. In 2023, the program collected over 1,700 tonnes of unwanted medicines nationally. Pharmaceutical companies are increasingly developing waste management plans. The Australian government is also implementing stricter regulations.

Environmental sustainability is a key focus for Australian pharmaceutical firms. They are actively working to lower carbon emissions and waste. The industry is increasingly adopting sustainable practices in manufacturing and supply chains. For example, companies are investing in green technologies and renewable energy sources. The global sustainable pharmaceutical market is projected to reach USD 135.6 billion by 2032.

Impact of Climate Change on Health and Supply Chains

Climate change presents significant environmental factors for the Australian pharmaceutical industry, potentially impacting health. Increased instances of heatwaves and extreme weather could elevate the need for specific medications. Disruptions in supply chains, due to environmental events, can also affect medicine availability. The cost of weather-related supply chain disruptions is projected to reach $19.5 billion annually by 2030.

- The World Health Organization estimates climate change will cause approximately 250,000 additional deaths per year between 2030 and 2050.

- In 2023, Australia experienced several extreme weather events, leading to disruptions in pharmaceutical supply chains.

- The Australian Government has invested $1.5 billion in climate resilience initiatives.

Regulatory Focus on Environmental Impact

Australia's regulatory environment is gradually tightening its grip on the environmental impact of pharmaceuticals. While not as stringent as in Europe, the trend is clear: increased scrutiny. Pharmaceutical companies should anticipate more detailed environmental assessments. This could include lifecycle analyses and waste management protocols.

- The Australian government has committed to reducing greenhouse gas emissions by 43% below 2005 levels by 2030.

- The Therapeutic Goods Administration (TGA) is increasingly considering environmental factors in its approval processes.

- Expect more stringent requirements for the disposal of unused medications to prevent environmental contamination.

Environmental factors significantly influence Australia's pharmaceutical sector, including regulatory pressures for environmental risk assessments. Stricter disposal regulations and waste management practices are emerging, mirroring a global push. The market is predicted to hit $1.2B by 2025, showing growing importance.

| Aspect | Impact | Data Point |

|---|---|---|

| Climate Change | Supply chain disruptions, increased health needs | $19.5B annual cost by 2030 from weather disruptions |

| Sustainability | Focus on emissions, waste reduction | Sustainable Pharma market projected at $135.6B by 2032 |

| Regulations | Tighter environmental assessments | 43% emission cut by 2030 (below 2005 levels) |

PESTLE Analysis Data Sources

The analysis uses Australian government data, industry reports, and economic indicators. It incorporates information from global pharmaceutical and healthcare publications.