Appen PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Appen Bundle

What is included in the product

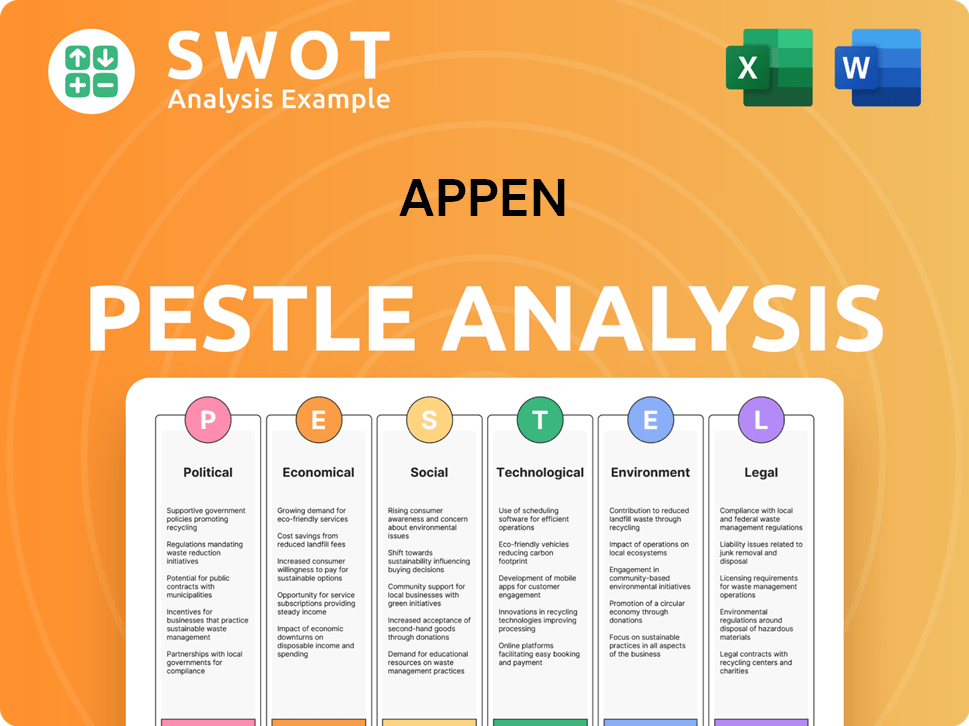

Analyzes the macro-environmental factors affecting Appen across Political, Economic, Social, Technological, Environmental, and Legal aspects.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations.

Preview the Actual Deliverable

Appen PESTLE Analysis

What you're previewing here is the actual file—fully formatted and professionally structured for Appen.

PESTLE Analysis Template

Navigate the complexities facing Appen with our insightful PESTLE Analysis. We delve into the political, economic, social, technological, legal, and environmental factors affecting the company. Uncover hidden opportunities and potential risks impacting Appen’s market position. This comprehensive analysis equips you with crucial insights for strategic planning and decision-making. Enhance your understanding of the external landscape. Download the full version now for instant access to actionable intelligence!

Political factors

Government AI policies and regulations are crucial for Appen. Data privacy laws like GDPR and CCPA, along with ethical AI guidelines, affect its operations. Government investments in AI research also influence demand. For instance, the global AI market is projected to reach $2 trillion by 2030, indicating potential growth for companies like Appen that provide AI training data and services.

Geopolitical tensions and trade policies significantly impact Appen's global footprint. China's economic policies and U.S.-China trade relations are critical for Appen. In 2024, shifts in these areas could influence Appen's market access and operational costs. Political stability in regions where Appen operates is also essential for business continuity.

Government agencies are increasing AI adoption, creating opportunities for data providers like Appen. In 2024, U.S. federal AI spending reached $2.5 billion. Procurement policies on AI data annotation services can impact Appen's revenue. The Biden administration's AI strategy emphasizes responsible AI use. Appen may benefit from government contracts.

Political Stability in Operating Regions

Appen's operational success hinges on political stability in its key markets and worker sourcing regions. Political instability, such as coups or significant policy shifts, can severely disrupt business continuity. Changes in government can lead to modified labor laws, impacting operational costs and workforce availability. For example, in 2024, countries like India and the Philippines, where Appen sources workers, experienced regulatory adjustments.

- India's labor law reforms in 2024 increased compliance burdens.

- Political unrest in Myanmar impacted some of Appen's regional operations.

- The Philippines saw changes in data privacy regulations affecting data processing.

International Cooperation and Standards for AI

International collaboration on AI standards, like those promoted by organizations such as the OECD, directly impacts Appen. Unified global standards could streamline Appen's operations and data compliance across different markets. However, differing regulations, as seen between the EU's AI Act and varied approaches in the US, could complicate data processing and client service delivery. These regulations affect the data types Appen can collect and the compliance burden it faces.

- OECD's AI Principles: Aim to promote responsible AI development, influencing global standards.

- EU AI Act: Sets stringent rules, potentially impacting Appen's data handling.

- US Approach: Focuses on voluntary guidelines, creating potential regulatory divergence.

- Data Privacy Laws: GDPR and similar laws shape data collection and usage globally.

Political factors greatly influence Appen's operations, including government AI policies and data privacy regulations. Global AI market projections, like the $2 trillion by 2030 forecast, signal significant opportunities.

Geopolitical tensions, especially U.S.-China relations, impact market access and operational costs. Political stability in key regions is also crucial for business continuity.

Increased government AI adoption and spending, with the U.S. allocating $2.5 billion in 2024, create opportunities via contracts and procurement policies. Appen's sourcing locations experienced compliance changes in 2024.

| Political Factor | Impact on Appen | 2024-2025 Data/Example |

|---|---|---|

| AI Regulations | Data compliance and market access | EU AI Act vs. US voluntary guidelines. |

| Geopolitical Tensions | Operational costs, market access | U.S.-China trade policies' effect. |

| Government Spending | Revenue, procurement | US federal AI spending: $2.5B in 2024. |

Economic factors

Global economic health significantly affects AI investment and Appen's data service demand. In 2024, global GDP growth is projected at 3.2%, influencing tech spending. Inflation and investment trends in AI-driven sectors directly impact Appen's financial performance. For instance, AI market revenue is expected to reach $1.8 trillion by 2030.

Appen, operating globally, faces currency exchange rate risks. Fluctuations affect reported revenue and operational costs across regions. In 2024, the AUD/USD rate varied, impacting financial results. For example, a weaker AUD could boost reported revenue, but increase expenses in USD-denominated markets. Understanding these movements is crucial for financial planning.

Appen's global workforce is sensitive to labor market dynamics. In 2024, average hourly earnings in the US rose to $34.75, impacting Appen's operational costs. The availability of skilled annotators, particularly in tech hubs like India, is crucial. Employment trends and wage inflation directly influence Appen's scalability and profitability.

Inflationary Pressures

Inflationary pressures pose a significant challenge for Appen, potentially increasing operating costs. These costs include labor, which can see wage increases, and technology infrastructure, which may become more expensive. Maintaining profitability necessitates effective management of these inflationary pressures. According to the U.S. Bureau of Labor Statistics, the Consumer Price Index (CPI) rose 3.5% in March 2024.

- Rising labor costs will affect Appen's expenses.

- Technology infrastructure expenses may also surge.

- Profitability hinges on inflation management.

- March 2024 CPI rose 3.5%.

Investment in AI and Technology Sectors

Investment in AI and technology sectors is crucial for Appen. Increased investment boosts demand for its data services. The global AI market is projected to reach $2 trillion by 2030. This growth fuels Appen's opportunities. Key areas include machine learning, natural language processing, and computer vision.

- Global AI market expected to reach $2 trillion by 2030.

- Increased investment in AI research and development.

- Demand for training data is directly correlated to investment.

- Appen provides data for machine learning and NLP.

Economic indicators shape Appen's performance. Global GDP growth of 3.2% in 2024 influences tech spending and AI investment. AI market revenue could hit $1.8T by 2030, boosting demand for Appen's services. Inflation impacts labor costs and operational expenses, requiring careful financial management.

| Economic Factor | Impact on Appen | Data (2024) |

|---|---|---|

| GDP Growth | Influences tech spending, data service demand | Global GDP growth projected at 3.2% |

| Inflation | Raises labor costs, impacts expenses | CPI rose 3.5% (March) |

| AI Market Growth | Increases demand for data services | AI market expected to hit $1.8T by 2030 |

Sociological factors

Appen relies on its global crowd for annotation. Access to education and digital literacy are critical. Freelance work willingness and domain expertise availability are key. In 2024, the gig economy saw significant growth. Statista projects a global gig economy revenue of $455 billion by the end of 2024.

Societal concerns about AI ethics, like algorithmic bias and data privacy, are rising. This impacts public perception and demand for ethical data. Appen's dedication to ethical AI is vital. The global AI market is projected to reach $1.81 trillion by 2030, highlighting the importance of ethical considerations.

Appen's strength lies in its capacity to offer diverse datasets across languages and dialects. The growing demand for AI to grasp linguistic and cultural subtleties presents opportunities. In 2024, the global AI market was valued at $200 billion, with significant growth anticipated. Appen's expertise in this area is crucial.

Changing Work Preferences and the Gig Economy

The gig economy's growth and evolving work preferences significantly influence Appen's crowd workforce dynamics. Attracting and retaining skilled workers hinges on competitive opportunities and a supportive environment. With the gig economy booming, Appen faces competition for talent. Appen needs to adapt to these shifts to remain competitive.

- The global gig economy is projected to reach $455 billion by the end of 2023.

- Around 57 million people in the U.S. participated in the gig economy in 2023.

- Appen's revenue for the first half of 2023 was $156.8 million.

Public Trust and Acceptance of AI Technologies

Public trust and acceptance are crucial for AI adoption, impacting industries. Negative views on AI's societal effects can hinder development and decrease demand for services like data annotation. A 2024 survey revealed that only 38% of the public fully trust AI systems. This lack of trust may slow down AI integration. For Appen, this means potential fluctuations in demand for their data annotation services.

- Trust in AI is low, with only 38% of the public fully trusting AI systems in 2024.

- Negative perceptions can slow down AI development.

- Reduced demand for data annotation services is a risk.

Societal attitudes towards AI ethics, like data privacy, significantly affect data demand.

A 2024 study showed only 38% of people fully trust AI, potentially slowing integration.

Appen's need for ethical practices is driven by public opinion.

| Sociological Factor | Impact on Appen | Data/Statistic (2024-2025) |

|---|---|---|

| AI Trust | Affects demand for data annotation | 38% public trust in AI (2024) |

| Ethical Concerns | Shapes need for ethical data | AI market at $200B (2024) growing to $1.81T by 2030 |

| Gig Economy | Influences workforce dynamics | Gig economy revenue: $455B by end of 2024 |

Technological factors

Rapid advancements in AI and machine learning, especially in generative AI and LLMs, significantly boost demand for Appen's services. The increasing complexity of AI models drives a need for high-quality, specialized training data. The global AI market, valued at $196.63 billion in 2023, is projected to reach $1.81 trillion by 2030. This growth highlights the importance of Appen's offerings. Appen's revenue in 2023 was $276.4 million.

Technological advancements in data annotation tools are crucial for Appen. Automation and AI-assisted tools boost efficiency and cut costs. In 2024, the AI market is valued at $200 billion, showing growth potential. Appen can leverage these tools for better quality and scalability, vital for its services. This can lead to a 15-20% improvement in project turnaround times.

The demand for specialized datasets is rising with AI's increasing specialization. Appen excels in gathering and annotating data for unique industries. In 2024, the AI market is projected to reach $300 billion, highlighting this trend. This positions Appen favorably for growth.

Evolution of Data Collection Methods

The rise of new data collection methods significantly impacts Appen. Synthetic data, advanced sensors, and AI-driven tools are emerging. These innovations could supplement or challenge Appen's established data sourcing. Appen must evolve its strategies. In 2024, the synthetic data market was valued at $1.7 billion and is projected to reach $3.5 billion by 2029.

- Synthetic data use is growing in AI training, potentially reducing reliance on human-labeled data.

- Advanced sensors offer new data streams, like those from IoT devices and wearables.

- Appen could integrate these technologies or risk facing competitive pressures.

Technological Infrastructure and Connectivity

Appen's operations heavily depend on dependable tech and internet for its global crowd. The quality of tech infrastructure varies by region, influencing service efficiency and reach. Appen's success is tied to these factors. Limited tech access in some areas poses challenges. This impacts project timelines and costs.

- Appen's revenue in 2023 was $274.6 million, reflecting the importance of efficient operations.

- Approximately 70% of Appen's costs are related to its workforce, highlighting tech's impact on labor.

AI and machine learning advancements fuel Appen's growth, supported by high-quality data needs. Automation in annotation tools improves efficiency and scalability, which boosts market position. The rising demand for specialized datasets and the rise of new data collection methods reshape strategies, including synthetic data adoption. Despite varied tech access, Appen focuses on efficient global operations.

| Technological Factor | Impact | Data/Statistics |

|---|---|---|

| AI & Machine Learning | Increases demand for training data | AI market projected to hit $1.81T by 2030 |

| Annotation Tools | Enhance efficiency | Possible 15-20% project time improvement |

| Data Collection | New sourcing methods | Synthetic data market: $3.5B by 2029 |

Legal factors

Data privacy regulations like GDPR and CCPA heavily influence Appen's operations. Appen must adhere to these rules, affecting data handling. Failure to comply can result in substantial fines. The GDPR fines can reach up to €20 million or 4% of annual global turnover; CCPA penalties are $2,500–$7,500 per violation.

Appen faces legal hurdles from labor laws impacting worker classification. Regulations vary, potentially affecting costs and operational models. For instance, California's AB5 law had significant impacts. Recent data shows legal battles continue, with potential financial repercussions. Adjustments to workforce practices are often needed to comply with evolving labor standards. Appen must stay updated to avoid penalties.

Appen must navigate complex legal landscapes regarding intellectual property, especially data ownership. Copyright laws dictate how Appen can use and license datasets, impacting its revenue streams. Recent legal precedents, like those in the EU's GDPR, influence data handling. Appen's contracts and compliance strategies must align with global IP regulations to protect its assets and ensure its operations remain compliant. In 2024, data privacy lawsuits increased by 20%.

Contract Law and Client Agreements

Appen's operations are significantly shaped by contract law, as client relationships are formalized through agreements. Any shifts in contract law can directly impact Appen's legal obligations and operational strategies. Disputes related to service level agreements (SLAs) or data quality, which are common in their industry, can lead to costly legal battles. For instance, in 2024, there were approximately 1,200 cases involving contract disputes in the tech sector. Moreover, a breach of contract can lead to financial penalties, with average settlements reaching $500,000.

- Contract law changes can alter Appen's legal obligations.

- Disputes over SLAs and data quality can lead to legal action.

- Breach of contract can result in financial penalties.

- Tech sector contract disputes are frequent.

Compliance with Industry-Specific Regulations

Appen must adhere to regulations specific to its clients' industries. For instance, healthcare projects require HIPAA compliance, while financial projects need adherence to GDPR or CCPA. This involves stringent data privacy and security measures. Failure to comply can result in significant fines and reputational damage.

- HIPAA violations can lead to fines up to $68,483 per violation.

- GDPR fines can reach up to 4% of annual global turnover.

- CCPA violations can incur fines of up to $7,500 per record.

Appen's legal standing is greatly influenced by compliance requirements, especially around data privacy. Recent stats show GDPR fines can be up to €20M. Additionally, labor laws and IP rights impact its operational and financial strategies.

| Legal Factor | Impact | 2024-2025 Data Points |

|---|---|---|

| Data Privacy | Compliance requirements & Fines | GDPR fines up to €20M, 20% rise in data privacy lawsuits |

| Labor Laws | Workforce classification and cost | Ongoing legal battles, AB5's impact, labor standard adjustments |

| Intellectual Property | Data ownership, IP regulations | Contracts and compliance with global IP regulations |

Environmental factors

The surge in AI training boosts data center demand, escalating environmental impact. Appen, though not a direct data center operator, is linked to this ecosystem. Data centers globally consumed 1.5% of electricity in 2023, a figure projected to rise. Pressure mounts for eco-friendly tech supply chains; in 2024, sustainable practices are a key focus.

Climate change poses a growing threat to Appen. The rise in extreme weather events, as demonstrated by the 2024 California floods and the 2023 Australian bushfires, could disrupt operations. These events can impact connectivity and workforce availability, which could negatively impact Appen's service delivery and financial results.

Sustainability and ESG reporting are becoming increasingly important for businesses like Appen. Investors and clients now expect companies to showcase their environmental commitments. In 2024, ESG-focused funds saw significant inflows, reflecting this trend. Appen might need to enhance its reporting to meet these demands.

Resource Consumption (Energy and Water)

Appen, as a technology-driven company, indirectly impacts resource consumption. Its operations, which rely on data centers and employee usage, require energy and water. While not as significant as manufacturing, optimizing these resources is still crucial.

- Data centers globally account for about 2% of total electricity usage.

- Water usage by data centers is a growing concern, with significant regional variations.

- Appen's distributed workforce can affect energy and water use through home office setups.

Waste Management and Electronic Waste

The tech industry, including companies like Appen, significantly contributes to electronic waste (e-waste). Appen's reliance on technology for its software and services means its operations generate e-waste. Effective waste management is crucial, with global e-waste expected to hit 82.6 million metric tons by 2025.

- Global e-waste generation is projected to reach 82.6 million metric tons by 2025.

- The US generated 6.92 million tons of e-waste in 2019.

- Recycling rates for e-waste remain low, around 20%.

Environmental factors significantly affect Appen. Data centers, vital for AI training, contribute to rising global electricity consumption, projected at 2% by 2024. Extreme weather, highlighted by recent floods, threatens operations. Sustainability is increasingly crucial, with e-waste reaching 82.6 million metric tons by 2025.

| Factor | Impact on Appen | Data Point (2024/2025) |

|---|---|---|

| Data Center Energy Use | Indirect impact, increased costs | Data centers consume ~2% global electricity |

| Extreme Weather | Operational disruptions, financial risk | 2024: floods, wildfires threaten connectivity |

| E-waste | Impact from tech use, waste management need | E-waste to reach 82.6 million tons by 2025 |

PESTLE Analysis Data Sources

Appen's PESTLE Analysis utilizes diverse data from government reports, economic indicators, market research, and industry publications for a comprehensive view.