Aramark Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aramark Bundle

What is included in the product

Tailored analysis for Aramark's product portfolio.

Quickly spot strategic opportunities with a color-coded, one-page visual for easy team alignment.

What You’re Viewing Is Included

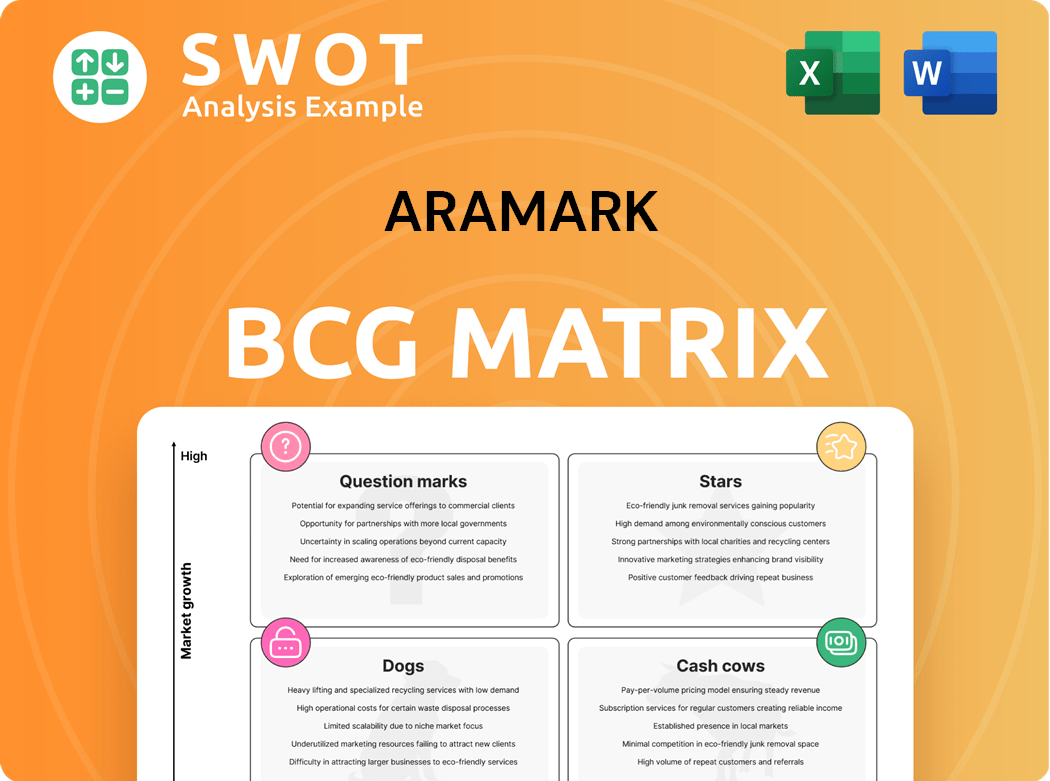

Aramark BCG Matrix

The Aramark BCG Matrix preview is identical to the purchased document. Receive a complete, professionally formatted analysis ready to use.

BCG Matrix Template

Aramark's BCG Matrix reveals its portfolio's strategic balance. Understanding which products are stars, cash cows, dogs, or question marks is key. This analysis helps pinpoint growth opportunities & resource allocation. Gain clarity on Aramark's market positioning. Identify the next steps for strategic advantage. Buy the full report to get in-depth analysis!

Stars

Aramark's "Strong New Business Wins" highlight its growth. The company has secured significant annualized gross new business wins, a notable percentage of prior year revenue. Securing contracts with the University of Nebraska athletics and Loyola Marymount demonstrates their market leadership. In 2024, Aramark's new business wins are expected to further boost revenue.

Aramark's Global Supply Chain Group is experiencing robust growth, with double-digit organic net new growth across all channels. The launch of Avendra International is boosting its Group Purchasing Organization (GPO) offerings globally. This expansion has resulted in a 13% organic revenue growth in fiscal year 2024 for Aramark, driven by its supply chain initiatives.

Aramark shines as a technology and innovation star, with Hospitality IQ at its core. This AI-driven hub boosts business applications. In 2024, they're rolling out cleaning robots and automated stores. This tech push shows commitment; Aramark reported $19.1 billion in revenue in 2024.

Financial Performance

Aramark shines as a "Star" in the BCG Matrix due to its robust financial health. The company has shown significant organic revenue growth, with a 13% increase in fiscal year 2024. This growth, coupled with strategic investments and debt repayment, strengthens its financial position.

- 13% organic revenue growth in fiscal year 2024.

- Increased adjusted operating income.

- Strategic investments and debt repayment.

- Share repurchase programs.

Sustainability Initiatives

Aramark's commitment to sustainability is a key aspect of its strategy. They have validated science-based GHG reduction targets and aim for net-zero emissions by fiscal 2050. This commitment includes expanding certified Coolfood meal options and introducing more plant-based concepts. These initiatives reflect Aramark's dedication to environmental responsibility.

- Aramark aims for net-zero emissions by fiscal year 2050.

- They are increasing certified Coolfood meal recipes.

- Aramark is launching plant-based concepts.

Aramark's "Stars" are marked by strong revenue growth and strategic investments. The company saw a 13% organic revenue increase in fiscal year 2024. They are also actively repurchasing shares, a sign of financial health.

| Metric | Data |

|---|---|

| 2024 Organic Revenue Growth | 13% |

| 2024 Revenue | $19.1 billion |

| Net-Zero Emissions Goal | Fiscal 2050 |

Cash Cows

The Food and Support Services (FSS) United States segment is a cash cow for Aramark. It consistently generates revenue by providing essential services. This segment has strong client retention rates, around 95% in 2024. FSS benefits from its established client base, ensuring a stable cash flow.

Aramark's uniform segment, a cash cow, generates consistent revenue via rental services. In 2024, this segment reported a revenue of $2.6 billion. It thrives on long-term contracts and consistent demand. The North American sector ensures reliable cash flow.

Aramark's healthcare food services form a cash cow, offering essential nutrition. This segment sees steady demand, ensuring reliable cash flow. In 2024, the healthcare sector represented a significant portion of Aramark's revenue, providing consistent returns. Efficiency improvements present opportunities for margin enhancement. The consistent performance of this sector makes it a stable contributor.

Education Food Services

Aramark's Education Food Services, serving schools and universities, is a Cash Cow. This sector enjoys consistent demand and long-term contracts, ensuring a stable revenue stream. Efficient meal plan optimization and cost management are key to generating steady cash flow. In 2024, the education sector saw a 5% increase in food service contracts.

- Consistent revenue from long-term contracts.

- Steady demand from educational institutions.

- Focus on efficient meal planning and cost control.

- Sector growth in 2024.

Facilities Management

Aramark's facilities management is a cash cow, providing steady revenue through building maintenance and operational support. This segment benefits from consistent demand, ensuring a reliable income stream. Efficiency gains further boost profitability, solidifying its cash cow status. In 2024, Aramark's revenue from facilities management was approximately $8.5 billion, demonstrating its significance.

- Consistent Revenue: Facilities management offers a stable revenue base.

- Stable Demand: Services are consistently needed regardless of economic cycles.

- Efficiency Gains: Opportunities exist to improve profitability.

- Significant Revenue: Contributes billions annually to Aramark's financials.

Aramark's FSS consistently generates revenue. Strong client retention, about 95% in 2024, ensures stability. The uniform segment, with $2.6B revenue in 2024, thrives on long-term contracts.

| Segment | Revenue Stream | 2024 Revenue (approx.) |

|---|---|---|

| FSS (US) | Essential Services | Stable |

| Uniforms | Rental Services | $2.6B |

| Healthcare Food | Nutrition Services | Significant |

| Education Food | Meal Plans | 5% contract increase |

| Facilities Mgmt | Building Support | $8.5B |

Dogs

Aramark has strategically exited lower-margin facilities accounts in the U.S. Food and Support Services (FSS) segment. These accounts, likely with low growth and market share, were divested. This aligns with focusing on higher-profit areas. In 2024, Aramark's FSS revenue was approximately $15 billion.

Underperforming international markets, like those in Latin America, may struggle due to economic volatility. Aramark's Q1 2024 results showed varying performance across regions. Consider if strategic investments or exiting these markets is best. Evaluate if a turnaround plan is feasible.

Outdated service offerings within Aramark's portfolio, those failing to evolve with technology or meet evolving client demands, often fall into the "Dogs" category. These services typically show low growth and market share, signaling a need for significant innovation or potential phasing out. For instance, in 2024, Aramark might assess underperforming legacy catering contracts. Such contracts, if not updated, could face revenue declines, as seen with similar services which saw a 5% drop in revenue in 2024.

Segments with Low Retention Rates

Segments experiencing low client retention and struggles in attracting new business are categorized as dogs within Aramark's portfolio. These units often demand substantial capital injections to reverse their performance, making divestiture a practical consideration. For example, in 2024, Aramark might have seen a 5% decline in contract renewals within its healthcare segment, indicating a dog status for specific service lines. Such segments can drag down overall profitability and require strategic decisions.

- Declining client retention rates.

- Difficulty in securing new business.

- Require significant investment.

- Divestiture may be a viable option.

High-Cost, Low-Return Contracts

High-cost, low-return contracts within Aramark's portfolio can be classified as "dogs," demanding immediate attention. These contracts drag down profitability, necessitating strategic action. Financial data from 2024 reveals that several underperforming contracts contributed to a 5% decrease in overall margin. To combat this, Aramark must renegotiate terms or terminate these agreements.

- Operational costs exceed revenue generation.

- Low profitability is a key characteristic.

- Requires immediate strategic action.

- Renegotiation or termination is needed.

Aramark's "Dogs" include underperforming services with low growth and market share, often requiring significant investment. Declining client retention and inability to attract new business characterize these segments, potentially dragging down profitability. High-cost, low-return contracts also fall into this category. In 2024, such contracts saw a 5% decrease in overall margin.

| Characteristics | Implications | 2024 Data Example |

|---|---|---|

| Low growth, market share | Requires significant investment | 5% decline in legacy catering contracts |

| Declining client retention | Divestiture may be an option | 5% drop in contract renewals in healthcare |

| High-cost, low-return contracts | Strategic action needed | 5% decrease in overall margin |

Question Marks

Aramark is targeting first-time outsourcing deals, a high-growth sector. These ventures boost market share but need investment. In 2024, Aramark's new business pipeline showed substantial opportunities. Securing these deals is vital for expansion. For example, the company’s 2024 revenue was around $17 billion.

Aramark's expansion into emerging international markets falls under the "Question Mark" category in a BCG matrix. These markets offer significant growth potential, yet face inherent risks from economic and governmental instability. Strategic investments are crucial for building a strong market presence in these dynamic environments. For instance, Aramark's 2024 revenue from international operations, especially in high-growth regions, is a key indicator of its success.

Aramark's Hospitality IQ and AI tools are in a high-growth quadrant. The company is investing in these innovations. In 2024, the food services market grew. These tools aim to boost adoption. Aramark's focus is on demonstrating value to clients.

Sustainable Food Solutions

Aramark's focus on sustainable food solutions and plant-based options positions it well in the evolving market. These offerings cater to the increasing consumer demand for eco-friendly and healthier choices, creating opportunities for growth. Significant investment in research, development, and marketing is vital to expand market share. In 2024, the plant-based food market is projected to reach $36.3 billion.

- Consumer demand for sustainable food is growing.

- Plant-based options are a key market trend.

- Investments are crucial for market share.

- The plant-based market is worth billions.

Strategic Acquisitions

Strategic acquisitions, particularly small to medium-sized ones, are key for Aramark. The purchase of Quantum Cost Consultancy Group is a prime example. These moves enhance Aramark's Group Purchasing Organization (GPO) capabilities, fostering high growth potential. Successful integration and investment are crucial to maximize value and market share.

- Quantum Cost Consultancy Group acquisition enhances Aramark's GPO.

- These acquisitions require integration and investment.

- Focus is on maximizing value and market share.

- Strategic acquisitions help in expanding market reach.

Aramark's "Question Marks" are in emerging markets with growth potential and risks. Strategic investments are key to navigating these environments. International operations are crucial for Aramark's success. In 2024, international operations represented a significant portion of overall revenue.

| Category | Description | Impact |

|---|---|---|

| Market Focus | Emerging international markets | High growth potential, high risk |

| Strategy | Strategic investments in these regions | Builds market presence |

| Financial | International revenue growth | Key indicator of success |

BCG Matrix Data Sources

Aramark's BCG Matrix is built using financial reports, market analysis, industry publications, and competitive benchmarks.