Aramco Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aramco Bundle

What is included in the product

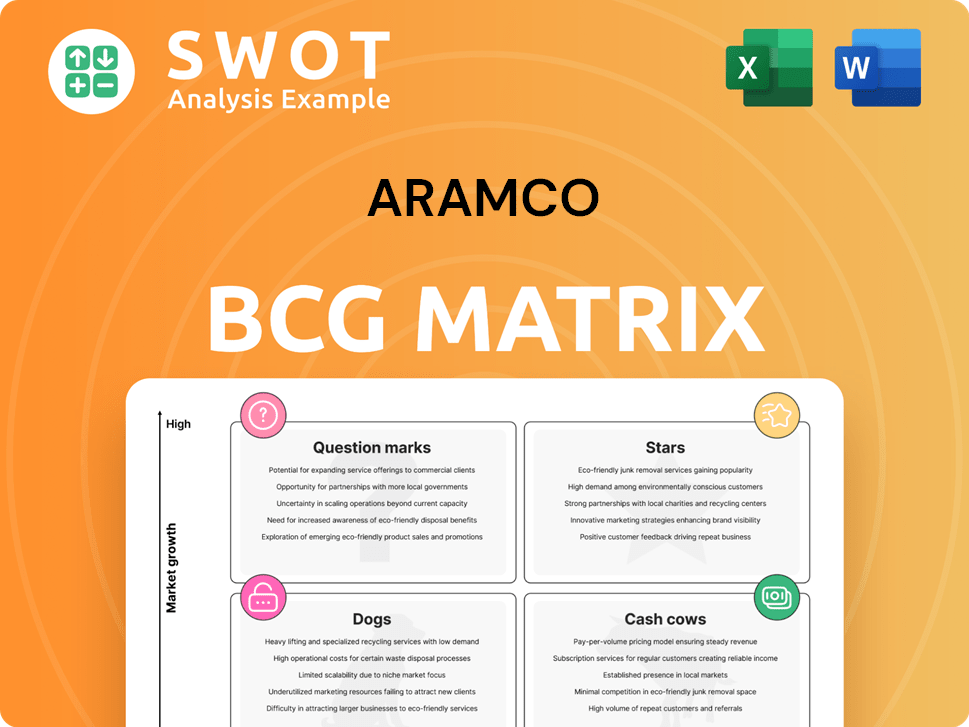

Aramco's BCG Matrix analysis reveals strategic investment, holding, and divestment options based on market share and growth.

Export-ready design for quick drag-and-drop into PowerPoint, saving time and boosting presentation prep.

What You See Is What You Get

Aramco BCG Matrix

This is the complete Aramco BCG Matrix you'll receive after purchase. See all the data, analyses and charts—unaltered and ready for your strategy sessions. The downloadable version mirrors this view, providing immediate access for your strategic insights.

BCG Matrix Template

Aramco's BCG Matrix categorizes its diverse portfolio, offering a snapshot of each business segment's growth and market share. This preliminary view hints at the potential of its "Stars," the stability of its "Cash Cows," the challenges of its "Dogs," and the promise (or peril) of its "Question Marks." Unlock a comprehensive understanding of Aramco's strategic landscape. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Aramco's upstream oil and gas production is a star due to its massive reserves and production efficiency. In 2024, Aramco's crude oil production averaged around 9 million barrels per day. They invest heavily in maintaining maximum sustainable capacity. This focus ensures high performance, delivering value to stakeholders.

Aramco's downstream petrochemical integration is a star in its BCG matrix, signifying growth. Over 50% of its crude oil goes to downstream operations. Aramco expands its liquid-to-chemical business. This targets the rising global petrochemical demand. Aramco's 2024 capital expenditure is projected to be around $50 billion, reflecting its focus on expanding its downstream operations.

Aramco is strategically expanding in the LNG market. Increased ownership in MidOcean Energy to 49% supports further investments. They secured 7.5 million tonnes per annum of LNG from projects like Sempra's Port Arthur. These moves diversify Aramco's portfolio.

Digital Transformation Initiatives

Aramco's digital transformation initiatives are a "Stars" component of its BCG Matrix. The company actively integrates AI across its operations, boosting efficiency and value. Investments include AI supercomputers and partnerships for AI solutions like drilling optimization and predictive maintenance. Aramco collaborates with Groq for a leading inferencing data center in Saudi Arabia.

- Aramco aims to increase the use of AI in its operations to improve efficiency and decision-making.

- Partnerships with tech companies are key to developing and deploying AI solutions.

- Investing in AI supercomputers is crucial for processing large datasets and running complex AI models.

Carbon Capture and Storage (CCS) Projects

Aramco's Carbon Capture and Storage (CCS) initiatives highlight its strategy to reduce emissions. The Jubail CCS hub, a key project, aims to store up to 9.0 mmtpa of CO2. This initiative aligns with Aramco's net-zero goals for 2050. They also have a Direct Air Capture test unit.

- Jubail CCS hub planned CO2 storage: up to 9.0 mmtpa.

- Aramco's net-zero target: Scope 1 and 2 emissions by 2050.

- CCS technology focus: mitigating greenhouse gas emissions.

Aramco's digital transformation is a star, using AI to boost efficiency. Investments include AI supercomputers and partnerships. The goal is to improve decision-making and streamline operations. In 2024, Aramco is expanding its digital footprint significantly.

| Initiative | Details | 2024 Focus |

|---|---|---|

| AI Integration | AI solutions for drilling and maintenance | Partnerships with Groq for AI solutions. |

| Digital Efficiency | AI-driven decision-making | Focus on AI to enhance processes. |

| Strategic Investments | AI supercomputers | Increased AI usage. |

Cash Cows

Aramco's core crude oil production is a robust cash cow. In 2024, it produced roughly 9 million barrels daily. Its low production costs, about $3 per barrel, ensure strong profitability. Global oil demand, hitting nearly 100 million barrels per day in 2024, supports Aramco's continued revenue.

Aramco's refining operations are a cash cow, converting crude into valuable products. These operations contribute significantly to cash flow, feeding domestic and global markets. Aramco’s refining directed over 50% of its crude oil production in 2024. The company's emphasis on operational excellence improves efficiency.

Aramco's petrochemical production is a cash cow, fueled by strong global demand. Integrated complexes boost production of high-value petrochemicals, enhancing profitability. Aramco plans to increase throughput to 4 million barrels daily. In 2024, Aramco's chemicals segment saw robust earnings. This segment is key to its financial strength.

Global Partnerships

Aramco's international collaborations are a key source of consistent revenue. These partnerships boost Aramco's global presence and open doors to new markets. A significant example is the intended venture with Sinopec. This giant petrochemical facility is planned to have a capacity of 1.8 million tonnes annually.

- Global partnerships provide stable revenue streams.

- They facilitate market expansion for Aramco.

- The Sinopec joint venture is a major project.

- It will have a substantial production capacity.

Dividend Payouts

Aramco's robust dividend payouts solidify its status as a cash cow, benefiting shareholders and the Saudi government. The company's strong profitability enables it to offer attractive dividend yields. Aramco's consistent distributions create a reliable income stream for investors. For 2025, Aramco anticipates declaring a total dividend of $85.4 billion.

- Consistent Dividends: Aramco's history of regular dividend payments.

- Attractive Yields: High dividend yields attract investors.

- Income Source: Dividends provide a stable income stream.

- 2025 Forecast: Expected total dividends of $85.4 billion.

Aramco's cash cows include core crude production, refining, and petrochemicals. In 2024, crude oil production averaged 9 million barrels daily, and refining directed over 50% of its crude. Petrochemical throughput is planned at 4 million barrels daily, boosting profitability.

| Cash Cow | 2024 Data | Key Feature |

|---|---|---|

| Crude Oil Production | 9M bpd | Low production cost |

| Refining Operations | 50%+ Crude Usage | Domestic and Global Supply |

| Petrochemicals | Robust Earnings | High Value Products |

Dogs

Mature oil fields represent a "dog" in Aramco's BCG matrix, facing declining production and higher costs. These fields, like Ghawar, require substantial investments in enhanced oil recovery. Despite contributing to overall output, their profitability lags behind newer, more efficient fields. For example, Ghawar's output has decreased by 20% since 2005, showing the challenges.

Non-core assets within Aramco's portfolio, like those not aligning with its core oil and gas focus, are categorized as dogs. These assets often yield low returns, potentially hindering capital allocation to more profitable ventures. In 2024, Aramco has been actively evaluating and divesting non-core holdings to streamline operations. This strategic shift aims to boost efficiency and shareholder value. Units identified as dogs become prime candidates for divestiture, as seen with recent asset sales.

Inefficient technologies at Aramco, such as older refining processes, can be classified as "Dogs" in the BCG matrix. These may lead to higher operational costs and reduced profitability. Investing in upgrades is crucial; Aramco plans to spend billions on efficiency projects. The integration of AI aims to boost efficiency and reduce emissions. In 2024, Aramco's focus is on tech upgrades, aiming for operational excellence.

Low-Margin Products

In Aramco's BCG Matrix, low-margin products with limited growth potential are considered dogs. These products don't significantly boost Aramco's revenue and may face discontinuation or restructuring. Aramco's focus remains on sustainable energy, aiming for maximum crude oil capacity and expanding gas capabilities. In 2024, Aramco's net income decreased to $121.3 billion, reflecting market dynamics.

- Focus on sustainable energy.

- Potential for discontinuation or restructuring.

- Aramco's net income in 2024 was $121.3 billion.

Underperforming Retail Operations

Aramco's retail segment might struggle in competitive markets. Strategic moves are needed to boost profits. In 2024, they invested in refining and petrochemicals globally. They also expanded retail in certain areas.

- Market competition can squeeze retail margins.

- Investments in refining aim to support retail.

- Geographic expansion is a key focus.

- Divestiture might be considered if needed.

Dogs in Aramco's portfolio include mature oil fields like Ghawar, facing production declines and needing investment. Non-core assets and inefficient technologies also fall into this category, potentially yielding low returns. Low-margin products with limited growth are considered dogs. In 2024, Aramco's net income was $121.3 billion.

| Category | Description | 2024 Impact |

|---|---|---|

| Mature Oil Fields | Declining production, high costs | Ghawar output down 20% since 2005 |

| Non-Core Assets | Low returns, not core focus | Divestiture to streamline operations |

| Inefficient Technologies | High operational costs | Billions in efficiency projects |

Question Marks

Aramco's renewable energy investments, including solar and wind projects, fit the question mark category in the BCG matrix. These ventures, despite high growth potential, currently hold a low market share. Aramco is strategically using Saudi Arabia's abundant solar and wind resources. In 2024, Aramco aims to increase its renewable energy capacity. The company is investing billions in renewable energy projects.

Aramco's blue hydrogen initiatives, like the potential acquisition of a 50% stake in Blue Hydrogen Industrial Gases Company, are currently question marks. These projects, which focus on capturing carbon dioxide from natural gas, face technological and economic hurdles. The financial returns are uncertain despite the significant cash investments required. In 2024, the global blue hydrogen market was valued at approximately $2.7 billion.

Aramco's foray into energy transition minerals, like lithium, is a question mark. These ventures have high growth potential but currently low market share. For instance, Saudi Arabia's lithium reserves are still being evaluated. This aligns with Aramco's diversification efforts. The global lithium market was valued at $24.7 billion in 2024.

New Chemical Technologies

Aramco's foray into new chemical technologies, especially crude oil to chemicals, places them in the question mark quadrant. These ventures face technological uncertainties and market adoption challenges, despite operating in growing markets. Aramco aims to significantly expand its liquids-to-chemicals business.

- Aramco plans to boost throughput in integrated refining and petrochemical complexes to 4 million barrels daily.

- The company is actively investing in converting crude oil into valuable chemicals.

- These new technologies carry risks related to innovation and market reception.

- The market share for these new chemical products is currently low.

International Retail Expansion

Aramco's international retail expansion, particularly its entry into markets like the Philippines, aligns with a "Question Mark" classification within the BCG matrix. This is due to the high-growth potential of these markets, but Aramco currently has a low market share. Aramco's planned 25% stake acquisition in Unioil in the Philippines reflects this strategy. The success of this venture depends on effective branding and navigating competitive landscapes.

- Aramco aims to expand its retail presence in growing, yet competitive markets.

- The Philippines entry involves acquiring a 25% stake in Unioil.

- Success hinges on building brand recognition.

- The strategy reflects a "Question Mark" classification.

Aramco's strategic moves into new chemical technologies, especially crude oil to chemicals, are classified as question marks in the BCG matrix. These initiatives are marked by technological risks. The market share for these new chemical products is currently low.

| Aspect | Details | 2024 Data |

|---|---|---|

| Crude Oil to Chemicals | Technological uncertainties | Market expected to reach $600B by 2030 |

| Market Share | Low current market share | Aramco aims for significant expansion. |

| Strategic Focus | Expanding liquids-to-chemicals | Refining and petrochemical complexes throughput target: 4 million barrels per day |

BCG Matrix Data Sources

The Aramco BCG Matrix is created with financial statements, market analyses, and expert industry forecasts. Data sources guarantee strategic insights.