Arcus Biosciences Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcus Biosciences Bundle

What is included in the product

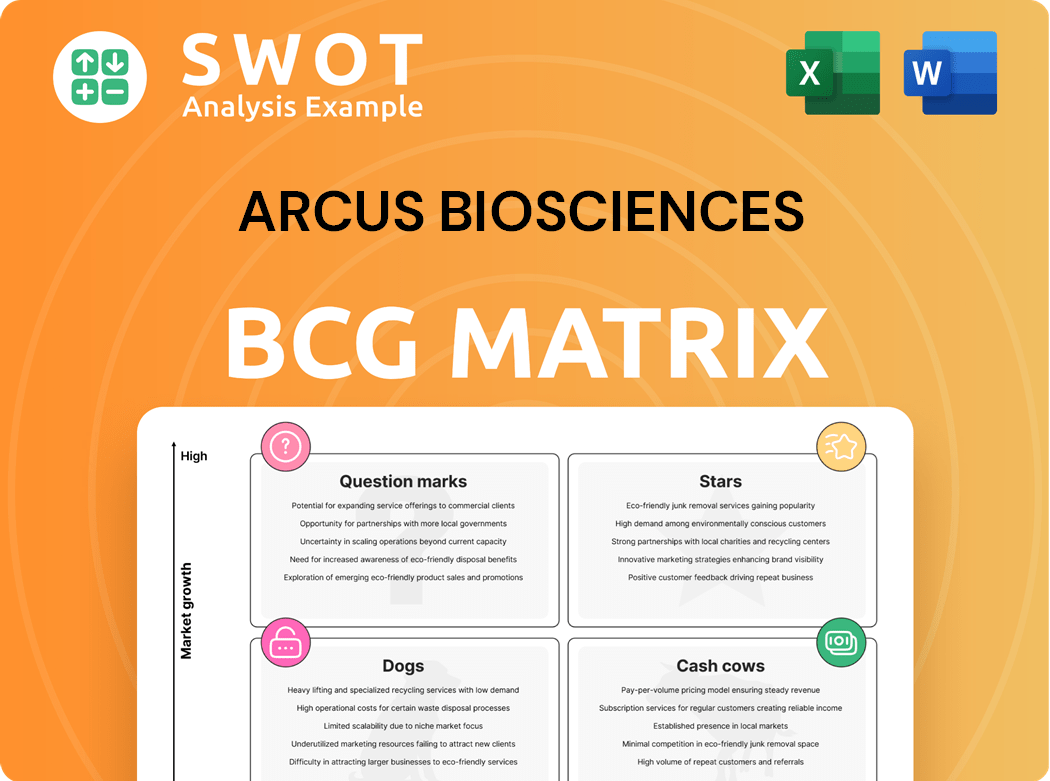

Arcus Biosciences' BCG Matrix analysis showcases product portfolio dynamics.

A printable summary optimizes the BCG Matrix for A4 & mobile PDFs, easing strategy presentations.

Delivered as Shown

Arcus Biosciences BCG Matrix

This preview offers the complete Arcus Biosciences BCG Matrix you'll receive after buying. It's a fully functional, editable document, ready for your strategic business applications and immediate download. No hidden content or changes—this is the final product.

BCG Matrix Template

Arcus Biosciences's BCG Matrix provides a snapshot of its diverse portfolio. See how each asset fits within the Stars, Cash Cows, Dogs, and Question Marks quadrants. This simplified view hints at the company's strategic focus. Discover how Arcus is managing its products, resource allocation and opportunities. The full version offers a detailed quadrant breakdown & actionable strategic insights for smarter decision making.

Stars

Casdatifan, a HIF-2α inhibitor, is a promising treatment for clear cell renal cell carcinoma (ccRCC). It has shown improved progression-free survival, and overall response rates compared to other HIF-2α inhibitors. Arcus is starting the Phase 3 PEAK-1 study in H1 2025 to test casdatifan with cabozantinib. This targets IO-experienced ccRCC patients.

Domvanalimab, Arcus's anti-TIGIT antibody, combined with zimberelimab (anti-PD-1) is a star. This combination shows promise in lung and upper GI cancers. Phase 2 EDGE-Gastric study data showed encouraging results. The Phase 3 STAR-221 and STAR-121 studies are underway. The global lung cancer therapeutics market was valued at $34.9 billion in 2023.

The Gilead Sciences collaboration is a key strength for Arcus Biosciences. Gilead's $320 million equity investment in January 2024 provides significant financial backing. This collaboration supports co-development across TIGIT and adenosine targets, boosting Arcus in immuno-oncology. The partnership validates Arcus's pipeline and resources.

Financial Position

Arcus Biosciences demonstrates a robust financial standing, crucial for its "Stars" within the BCG Matrix. As of December 31, 2024, Arcus reported $992 million in cash, equivalents, and marketable securities. This financial health is supported by recent fundraising efforts, such as a $150 million offering, securing resources for pivotal program milestones.

- Cash Position: $992M as of December 31, 2024.

- Recent Financing: $150M offering.

- Strategic Focus: Funding through key program readouts.

- Goal: Maximize asset potential.

Strategic Collaborations

Arcus Biosciences strategically forges collaborations to amplify its pipeline's potential. A prime example is the clinical trial partnership with AstraZeneca, focusing on casdatifan combined with volrustomig. This approach broadens Arcus's therapeutic reach and enables exploration of innovative combinations, reinforcing its market position. In 2024, these partnerships have been instrumental in advancing multiple clinical programs.

- AstraZeneca collaboration is focused on cancer treatments.

- These collaborations enhance Arcus's competitive edge.

- Partnerships advanced clinical programs in 2024.

- Arcus aims to maximize its pipeline's potential.

Domvanalimab with zimberelimab are "Stars" due to promising results in lung and upper GI cancers. Phase 3 studies are underway, indicating growth potential. The global lung cancer therapeutics market, valued at $34.9B in 2023, offers significant opportunity.

| Star Product | Indication | Clinical Status |

|---|---|---|

| Domvanalimab+Zimberelimab | Lung Cancer | Phase 3 STAR-221, STAR-121 |

| Upper GI Cancers | Phase 2 EDGE-Gastric | |

| Casdatifan | ccRCC | Phase 3 PEAK-1 (H1 2025) |

Cash Cows

Arcus Biosciences secures revenue via license and development agreements, notably with Gilead. In Q4 2024, Arcus reported $28 million from these collaborations. This revenue stream supports R&D, enhancing financial stability. These funds are vital for advancing Arcus's drug pipeline.

Arcus Biosciences benefits from option continuation payments from Gilead, a key aspect of its 'Cash Cows' in the BCG Matrix. In July 2024, Arcus received a $100 million payment from Gilead. These payments offer crucial non-dilutive funding, supporting Arcus's pipeline advancement. This collaboration validates Arcus's programs and provides financial stability.

Arcus Biosciences benefits from reimbursements for shared expenses from collaborations, notably with Gilead. In Q4 2024, Arcus received $41 million from these reimbursements. These funds help reduce operational expenses. This strategy enhances R&D efficiency and strengthens Arcus's financial health.

Taiho Pharmaceutical Partnership

In July 2024, Taiho Pharmaceutical took up its option for quemliclustat in Japan and other Asian areas. This means Taiho can now start the Phase 3 PRISM-1 study for pancreatic cancer in Japan. Arcus Biosciences will benefit from opt-in and milestone payments due to this deal. This partnership validates quemliclustat's potential.

- Taiho's move allows the PRISM-1 study to proceed.

- Arcus will gain financially from the agreement.

- The deal highlights quemliclustat's promise.

Early Stage Royalties

Early Stage Royalties for Arcus Biosciences represent a future cash cow, although they are not a current major revenue source. Programs like casdatifan and domvanalimab are advancing through clinical trials, which could lead to significant revenue. These potential royalties are a key long-term financial opportunity. As of 2024, Arcus has a market capitalization of approximately $3.5 billion.

- Casdatifan and domvanalimab are in late-stage trials as of 2024.

- Arcus Biosciences's revenue for 2023 was around $100 million.

- Royalties would be a future revenue stream.

- The company's R&D expenses are significant.

Arcus Biosciences leverages collaborations, especially with Gilead, as 'Cash Cows'. License agreements generated $28M in Q4 2024. In July 2024, Arcus received a $100M payment from Gilead, boosting financial stability and supporting research. Collaborations and Taiho's quemliclustat option represent ongoing revenue streams, while royalties from advanced trials offer future potential.

| Financial Aspect | Details | Q4 2024 Data |

|---|---|---|

| Collaboration Revenue | From licensing and development agreements | $28 million |

| Gilead Payment (July 2024) | Option continuation payment | $100 million |

| Expense Reimbursements | Shared costs with collaborators | $41 million (Q4 2024) |

Dogs

Zimberelimab, as a standalone PD-1 inhibitor, faces tough competition, potentially labeling it a 'Dog' in Arcus's BCG Matrix. Its independent market value is limited, even though it's used in combination therapies. The drug's success hinges on strategic partnerships to boost its presence and effectiveness. In 2024, the PD-1 inhibitor market was highly competitive, with established players dominating.

Some of Arcus Biosciences' older programs face uncertainty. These programs, lacking late-stage development or clear advantages, need assessment. In 2024, Arcus allocated resources, but strategic review is vital. This includes possibly divesting to boost focus on high-potential assets. Effective portfolio management is essential.

Dogs in Arcus Biosciences' BCG Matrix include early-stage assets. These are heavily reliant on combination therapies. If combinations fail, standalone value diminishes. This could drain resources. Risk mitigation is key.

Limited Monotherapy Efficacy

If Arcus Biosciences' programs consistently show limited efficacy as monotherapies, they would be considered Dogs in the BCG matrix. Monotherapy is crucial for drug value. Weak monotherapy data may hinder market success, leading to prioritization of combination therapies. In 2024, the pharmaceutical industry saw a shift towards combination therapies, with approximately 60% of new drug approvals being for combination products.

- Poor monotherapy performance often leads to lower valuations.

- Combination therapies can offer more robust efficacy.

- Limited monotherapy success may lead to R&D redirection.

- Market trends favor combination drug strategies.

Marginal Market Share Products

Products with consistently low market share and limited growth potential are "Dogs" in the BCG matrix. These products often fail to justify further investment, potentially leading to divestiture or out-licensing strategies. Effective management requires constant monitoring of market performance and strategic decision-making. For instance, in 2024, a pet food company might identify a specific dog treat line with minimal sales growth and market share as a "Dog."

- Low market share and growth.

- Poor return on investment.

- May require divestiture.

- Requires strategic review.

Dogs in Arcus's BCG Matrix represent low-growth, low-share products.

These may include standalone drugs or early-stage assets with limited market potential and high reliance on combination therapies.

In 2024, due to strategic review, the company might divest such underperforming assets, with similar actions seen across the biotech sector as market dynamics shift.

| Characteristic | Impact | Arcus Example |

|---|---|---|

| Low Market Share | Limited Revenue | Standalone PD-1 Inhibitors |

| Low Growth | Reduced Investment | Early-Stage Assets |

| High Combination Dependency | Increased Risk | Programs without clear monotherapy advantage |

Question Marks

AB801, an AXL inhibitor, is in a Phase 1/1b study, with Arcus planning expansion cohorts in NSCLC by the second half of 2025. This molecule's potential in non-small cell lung cancer (NSCLC) is under evaluation. The market for NSCLC treatments was valued at approximately $25 billion in 2024, showing strong growth. Further data is needed to assess its market success.

Etrumadenant, an A2a/A2b receptor antagonist, is in Arcus Biosciences' pipeline. It's assessed with zimberelimab, FOLFOX, and bevacizumab in third-line metastatic colorectal cancer (mCRC). Arcus will meet the FDA in H1 2025 for ARC-9 trial next steps. Its fate hinges on FDA discussions and further clinical data. The mCRC market was valued at $3.1 billion in 2024.

Quemliclustat, a CD73 inhibitor, is a key component of Arcus Biosciences' pipeline. It's currently assessed in Phase 3 PRISM-1 for pancreatic cancer. Taiho Pharmaceutical is managing the Japanese arm of the study. The drug's future depends on PRISM-1 results. Pancreatic cancer has a 5-year survival rate of only 12% (2024 data), making success crucial.

New Expansion Cohorts in ARC-20

Arcus Biosciences plans to launch three new expansion cohorts in the ARC-20 study during Q1 2025, focusing on casdatifan combined with zimberelimab, as well as monotherapy evaluations in 1L ccRCC. These cohorts aim to explore new treatment options for renal cell carcinoma (ccRCC). The success hinges on the clinical data generated from these trials. The market for ccRCC treatments is substantial, with global sales projected to reach $7.8 billion by 2029.

- ARC-20 expansion cohorts commence in Q1 2025.

- Focus on 1L ccRCC and IO-experienced/TKI-naive ccRCC.

- Casdatifan and zimberelimab are key components.

- Success depends on upcoming clinical data.

Early-Stage Combination Therapies

Arcus Biosciences' early-stage combination therapies represent a high-risk, high-reward area. These innovative treatments, while promising, face uncertain market potential, especially in the competitive oncology space. Substantial financial investments are needed to advance these therapies through clinical trials, with no guarantee of success. The company's success hinges on demonstrating both clinical efficacy and safety in the initial trials.

- Early-stage therapies require significant capital, potentially millions of dollars per trial.

- Failure rates in early clinical trials can be high, with estimates suggesting only a fraction of drugs make it to market.

- Market potential is uncertain, dependent on factors like competitor drugs and unmet medical needs.

- Success is defined by positive clinical data, which drives further investment.

AB801, etrumadenant, quemliclustat, and ARC-20 are Question Marks. These therapies require large investments with uncertain returns. Success is tied to clinical trial results. The oncology market is competitive, with billions in sales (e.g., NSCLC at $25B in 2024).

| Therapy | Status | Market (2024) |

|---|---|---|

| AB801 | Phase 1/1b | NSCLC: $25B |

| Etrumadenant | Phase Ongoing | mCRC: $3.1B |

| Quemliclustat | Phase 3 | Pancreatic Cancer |

| ARC-20 | Expansion Q1 2025 | ccRCC: $7.8B (by 2029) |

BCG Matrix Data Sources

Arcus Biosciences' BCG Matrix uses SEC filings, market analyses, and expert forecasts. This matrix leverages credible sources for reliable strategy.