Cementos Argos PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cementos Argos Bundle

What is included in the product

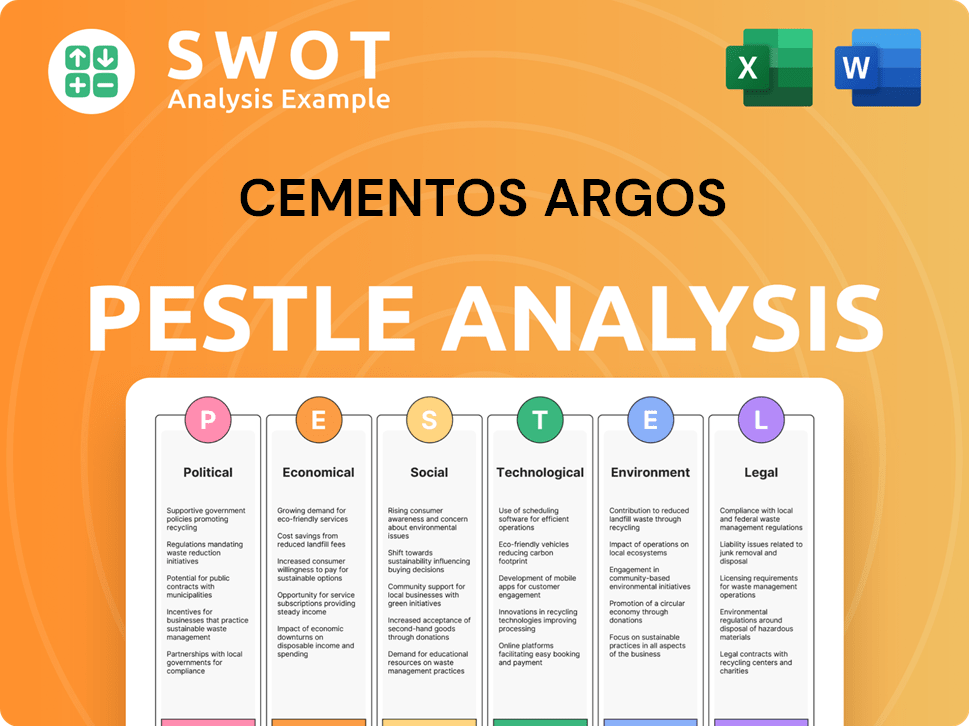

This analysis details macro-environmental factors affecting Cementos Argos: Political, Economic, Social, Technological, Environmental, and Legal.

Provides a concise version for PowerPoints and planning, keeping essential insights readily accessible.

Preview the Actual Deliverable

Cementos Argos PESTLE Analysis

The preview of the Cementos Argos PESTLE Analysis you see is the complete, finished document. This includes all the analysis and structure.

You will receive this precise file upon successful purchase.

The content and layout displayed is exactly what you will download instantly. This is a complete analysis.

No hidden extras or surprises – it’s all here!

Get immediate access after payment and dive in!

PESTLE Analysis Template

Unlock crucial insights into Cementos Argos's strategic environment with our PESTLE Analysis. Examine the impact of political instability, economic fluctuations, and shifting social attitudes on the company. We've dissected regulatory pressures, technological advancements, and environmental considerations affecting Argos. This detailed analysis allows for better decision-making, and strategic planning. Get the full PESTLE Analysis now and gain a competitive advantage!

Political factors

Cementos Argos faces political risks due to its multinational presence. Infrastructure spending shifts impact cement demand; for instance, U.S. infrastructure spending is projected to reach $1.2 trillion by 2025. Trade policies, like tariffs, affect material costs and market access. Construction regulations, such as those related to sustainability, also influence operations.

Political stability is key for Cementos Argos, given its international presence. Countries with political instability can halt construction projects, impacting revenue. For example, political risks in Colombia could affect 2024-2025 project timelines. Political changes can also shake investor confidence, potentially lowering stock value.

Cementos Argos's international strategy is highly impacted by trade agreements. For example, NAFTA (now USMCA) has influenced its North American operations. In 2024, the company navigated various tariffs, impacting its import/export costs. Reduced tariffs can boost profitability by lowering expenses. Conversely, new trade barriers may limit market access.

Government investment in infrastructure

Government infrastructure spending significantly impacts Cementos Argos. Public projects like roads and buildings directly boost cement demand. Argos's success hinges on infrastructure investment levels in its core markets. In 2024, infrastructure spending in Colombia, a key market, saw a 10% increase. This trend is expected to continue into 2025.

- Infrastructure projects drive cement and concrete demand.

- Cementos Argos' performance correlates with public investment.

- Colombia's 2024 infrastructure spending rose by 10%.

- Continued investment is anticipated in 2025.

Corporate governance and ethical standards

In the current political climate, Cementos Argos's dedication to strong corporate governance and ethical standards is critical. Transparency and anti-corruption measures are essential for maintaining a positive reputation. Responsible business conduct directly influences relationships with governments and operational licenses. Cementos Argos's adherence to ethical standards can lead to greater investor confidence and market stability.

- In 2024, companies with strong ESG (Environmental, Social, and Governance) ratings, like Cementos Argos, often experience a 10-15% higher valuation compared to their peers.

- The World Bank estimates that corruption adds up to 10% to the cost of doing business in many countries.

- Cementos Argos's ESG initiatives are supported by a $250 million green bond issuance in 2023.

Political factors significantly affect Cementos Argos. Infrastructure spending, influenced by government policies, directly impacts demand. Trade regulations, like tariffs, can raise costs and influence market access, as seen with USMCA's effects. Adherence to ESG standards boosts reputation, impacting valuation positively.

| Factor | Impact | 2024-2025 Data |

|---|---|---|

| Infrastructure Spending | Drives cement demand | US infra spending ~$1.2T by 2025, Colombia up 10% in 2024. |

| Trade Policies | Affect costs & access | Tariffs impacting import costs. |

| ESG Compliance | Boosts valuation | ESG firms 10-15% higher valuation vs peers. |

Economic factors

Economic growth is crucial for Cementos Argos. Strong economies boost construction, increasing demand for cement and concrete. In 2024, Colombia's construction sector grew by 4.5%, supporting Argos's sales. The company's performance correlates with the GDP growth of its operating countries.

Inflation significantly affects Cementos Argos. Rising prices of raw materials, energy, and transportation increase operational costs. In 2024, global inflation averaged around 3.2%. Cementos Argos must manage these costs to protect profits. They may adjust pricing to offset inflation.

Cementos Argos, operating globally, faces currency exchange rate risks. Changes impact raw material costs, especially for imports. International revenue values also fluctuate. For example, a strong Colombian peso could reduce the value of foreign earnings when converted. In 2024, currency volatility remained a key concern for multinational firms.

Interest rates and access to financing

Interest rates are a key economic factor, impacting Cementos Argos's financial health. Higher rates increase borrowing costs for the company and its clients, potentially reducing construction projects. In 2024, the Colombian central bank maintained a high interest rate environment. This impacts the company's financing costs and the affordability of construction projects.

- Colombia's benchmark interest rate was around 13% in early 2024.

- Increased borrowing costs can delay or decrease construction projects.

- Access to financing is crucial for Cementos Argos’s operations and customers.

Market competition and pricing

Market competition significantly affects Cementos Argos' pricing and profitability. In regions with high competition, like parts of the U.S., price wars can squeeze margins. Conversely, areas with less competition, such as some Colombian markets, offer better pricing opportunities. The company's ability to navigate these competitive landscapes is vital. For instance, in 2024, the U.S. cement market saw fluctuating prices due to supply chain issues and regional competition.

- 2024: US cement prices fluctuated due to supply chain issues.

- Competition varies by region, impacting pricing power.

Economic conditions greatly influence Cementos Argos' performance. Growth in construction, fueled by GDP, directly affects demand and sales. Inflation, at about 3.2% in 2024, drives up costs, necessitating effective price management.

Currency exchange rate fluctuations pose risks, impacting raw material costs and international revenue. Interest rates, notably Colombia's 13% benchmark in early 2024, increase borrowing expenses, possibly slowing construction projects.

Market competition shapes pricing and profitability; pricing is impacted by supply chains and the presence of competitive areas. Navigating these diverse economic conditions is key for Cementos Argos’ financial results.

| Economic Factor | Impact on Argos | 2024 Data/Trends |

|---|---|---|

| GDP Growth | Higher construction demand | Colombia construction +4.5% |

| Inflation | Increased costs | Global avg. 3.2% |

| Interest Rates | Higher borrowing costs | Colombia 13% (early 2024) |

Sociological factors

Population growth and urbanization in the Americas are key drivers for Cementos Argos. The demand for new housing and infrastructure escalates cement needs. For example, in 2024, construction spending in Colombia, a key market, grew by 8%. This trend fuels long-term cement demand. Urbanization, creating more buildings, further supports this growth.

Cementos Argos actively engages in social responsibility, crucial for its reputation. Community engagement helps build goodwill and prevent issues. In 2024, Argos invested $17.5 million in social projects. This includes education and infrastructure, demonstrating commitment to local communities. This approach enhances its social license to operate.

Labor relations and workforce demographics are vital. Cementos Argos must manage these factors across diverse regions. In 2024, the construction sector saw shifts in labor demands. Fair practices and union relations enhance stability and productivity. Addressing workforce diversity is key for operational success.

Safety and health standards

Societal expectations for workplace safety and health are rising, influencing Cementos Argos. The company must maintain high safety standards to protect its workforce and contractors, avoiding liabilities and reputational harm. In 2024, the construction industry saw a 10% increase in safety regulations. Strong safety records can boost investor confidence and operational efficiency. Cementos Argos should invest in robust safety protocols to align with societal values.

- In 2024, the construction industry saw a 10% increase in safety regulations.

- Strong safety records can boost investor confidence and operational efficiency.

Public perception and brand image

Public perception significantly impacts Cementos Argos. In 2024, the cement industry faced scrutiny regarding its environmental footprint. Cementos Argos can improve customer preference by promoting sustainable practices. Highlighting its contributions to community development is crucial for enhancing its brand image and garnering stakeholder support.

- Cementos Argos's 2024 sustainability report showed a 15% reduction in carbon emissions.

- Consumer surveys revealed that 70% of customers prefer brands with strong CSR initiatives.

- Cementos Argos invested $50 million in renewable energy projects in 2024.

- Stakeholder engagement increased by 20% after the company launched its community outreach programs.

Cementos Argos faces sociological factors like urbanization and social responsibility pressures, driving demand for cement and influencing its brand image. The company invests in communities, spending $17.5 million in 2024 on social projects, boosting goodwill. Rising safety standards, with a 10% increase in construction industry regulations in 2024, demand strong safety protocols.

| Factor | Impact | 2024 Data |

|---|---|---|

| Community Engagement | Enhances brand image, social license. | $17.5M invested in social projects |

| Safety Regulations | Affects operational efficiency, reputation. | 10% increase in construction safety regulations |

| Public Perception | Influences customer preference, stakeholder support. | 70% of customers prefer brands with CSR |

Technological factors

Technological advancements in cement production, such as enhanced grinding and clinker cooling, can boost efficiency. This leads to lower energy use and cuts emissions. Cementos Argos's move to invest in these technologies can enhance its competitiveness. In 2024, the global cement market is valued at $330 billion.

The construction industry is seeing a rise in sustainable materials. Cementos Argos can capitalize on this by using green cement and low-carbon concrete. This helps meet customer needs and supports environmental goals. In 2024, the global green cement market was valued at $38.2 billion.

Digitalization boosts Cementos Argos' efficiency and cuts costs. Modern tech in logistics and inventory management offers a competitive edge. In 2024, they invested heavily in digital transformation, focusing on smart factories and AI-driven processes. This strategy aims to improve supply chain visibility and reduce operational expenses by 10% by 2025.

Automation and artificial intelligence

Automation and AI are transforming Cementos Argos's operations. These technologies enhance efficiency and product quality. However, this requires investments in training and adapting the workforce. For instance, the global AI in manufacturing market is projected to reach $17.2 billion by 2025.

- AI adoption can boost productivity by up to 20%.

- Training costs could increase by 5-10% in the short term.

- Quality control improved by 15%.

Research and development in construction techniques

Technological advancements are reshaping the construction industry, impacting cement and concrete product demand. Cementos Argos must monitor these trends to adapt its offerings. For instance, 3D printing in construction is growing, potentially changing concrete needs. Staying ahead of these innovations is crucial for Cementos Argos's market relevance.

- 3D printing in construction market size was valued at USD 3.8 billion in 2024.

- The market is projected to reach USD 63.6 billion by 2032.

- The CAGR is expected to be 41.7% from 2024 to 2032.

Cementos Argos benefits from tech in production and sustainable materials. Digitalization and automation boost efficiency, cutting costs, and improving quality. By 2025, AI in manufacturing is expected to reach $17.2 billion, influencing their operations. This requires smart investments.

| Technology Area | Impact | 2024 Data |

|---|---|---|

| Green Cement Market | Meeting sustainable demand | $38.2 billion |

| Digital Transformation | Improve Supply Chain | Heavy Investments |

| AI in Manufacturing | Enhance operations | $17.2B by 2025 |

Legal factors

Cementos Argos faces stringent environmental regulations across its operating regions, impacting cement production processes. Compliance necessitates investments in emission control, waste management, and water conservation. For instance, in 2024, the company allocated $50 million to upgrade environmental technologies. Non-compliance can lead to hefty fines and operational restrictions, as seen with a $10 million penalty in 2023.

Labor laws and employment regulations significantly affect Cementos Argos' operations across the Americas. Compliance involves navigating different rules on wages, working hours, and employee benefits. For instance, in Colombia, labor costs represent a substantial portion of operational expenses, impacting profitability. As of late 2024, labor disputes in the construction sector have led to increased scrutiny of employment practices. Effective HR strategies are essential to manage legal risks and maintain operational efficiency.

Antitrust and competition laws are crucial for Cementos Argos, preventing monopolies and fostering fair market play. These laws ensure that no single entity dominates the cement market, promoting healthy competition. Cementos Argos must adhere to these regulations to avoid anti-competitive practices. In 2024, the Colombian Superintendency of Industry and Commerce fined several cement companies for price-fixing. This highlights the importance of compliance.

Construction and building codes

Construction and building codes are crucial legal factors for Cementos Argos, dictating the materials used in construction. These codes vary by market, and Cementos Argos must ensure its products meet local standards to be approved. Compliance is essential for sales and market access. In 2024, the global construction market was valued at over $15 trillion, highlighting the importance of adherence to building codes.

- Building codes compliance ensures product safety and market access.

- Non-compliance can lead to project delays and financial penalties.

- Updated standards may require product modifications and investments.

- Stringent codes can create barriers to entry.

Corporate governance regulations

Corporate governance regulations significantly influence Cementos Argos's operations, encompassing reporting, board structure, and shareholder rights. Adherence to these regulations is crucial for legal compliance and investor trust. In 2024, the company must comply with updated Colombian corporate governance codes, impacting board composition and transparency. Failure to comply could lead to financial penalties and reputational damage, as seen with other firms.

- Updated Colombian corporate governance codes.

- Impact on board composition and transparency.

- Potential financial penalties for non-compliance.

Cementos Argos faces legal factors including building codes, requiring adherence for market access, as the global construction market surpassed $15 trillion in 2024. Antitrust laws, as observed in the 2024 fines from Colombia, are also significant for competitive compliance. Compliance with corporate governance regulations is vital to manage investor trust.

| Legal Factor | Impact on Argos | 2024/2025 Data |

|---|---|---|

| Building Codes | Ensures market access; compliance vital. | Global construction market: $15T in 2024. |

| Antitrust | Prevents anti-competitive practices. | Fines in Colombia, 2024 for price-fixing. |

| Corporate Governance | Maintains investor trust; impacts board structure. | Updated Colombian codes influence transparency. |

Environmental factors

The cement industry is a major source of carbon emissions. Climate change concerns drive stricter regulations, pushing Cementos Argos to cut its carbon footprint. In 2024, the cement industry accounted for roughly 8% of global CO2 emissions. Companies are investing in process changes and carbon capture. Cementos Argos aims to reduce emissions by 25% by 2030.

Cementos Argos faces resource depletion issues, as cement production heavily relies on limestone and clay. In 2024, the cement industry consumed approximately 4 billion tons of raw materials globally. Sustainable sourcing and the use of recycled aggregates are key. The company is investing in alternative materials to lessen its environmental impact.

Water is essential in cement and concrete production. Water scarcity can disrupt operations, especially in water-stressed areas. In 2024, Cementos Argos invested $2 million in water management. Efficient use and responsible management are vital for sustainability.

Biodiversity and land use

Cementos Argos' quarrying operations are a key environmental concern, potentially harming biodiversity and necessitating careful land management. The company must actively mitigate its ecological footprint, especially in sensitive habitats. This includes habitat restoration and biodiversity protection initiatives. In 2024, Cementos Argos invested $1.5 million in environmental protection, including biodiversity projects.

- Quarrying impact: raw material extraction affects ecosystems.

- Mitigation efforts: habitat restoration and protection.

- Investment: $1.5 million in 2024 for environmental projects.

- Focus: minimizing ecological damage in operations.

Waste management and circular economy

Waste management is crucial for Cementos Argos, focusing on reducing production waste and using waste as alternative resources. This aligns with circular economy principles, minimizing environmental impact. In 2024, the global cement industry generated approximately 2.2 billion tons of CO2 emissions. Implementing waste-to-energy solutions can significantly decrease these figures. Cementos Argos is investing in technologies to use waste as fuel, improving efficiency.

- Cement production is energy-intensive, with waste management being a priority.

- Circular economy reduces environmental impact.

- Waste-to-energy solutions help reduce emissions.

- The cement industry faces significant environmental challenges.

Cementos Argos' environmental factors are crucial in the PESTLE analysis, given their substantial carbon footprint and reliance on resources like limestone and water. Stricter regulations aimed at combating climate change force Cementos Argos to minimize its impact and meet reduction targets. In 2024, they invested millions in waste and water management alongside biodiversity initiatives.

| Environmental Aspect | Impact | Cementos Argos Action |

|---|---|---|

| Carbon Emissions | ~8% global emissions in 2024 | Aim to reduce by 25% by 2030. |

| Resource Depletion | 4B tons raw materials globally used | Sustainable sourcing and recycling. |

| Water Usage | Production reliant, scarcity risk. | $2M investment in water management (2024). |

PESTLE Analysis Data Sources

Cementos Argos' PESTLE Analysis uses IMF, World Bank, and governmental reports for macroeconomic insights.