Arlo Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arlo Technologies Bundle

What is included in the product

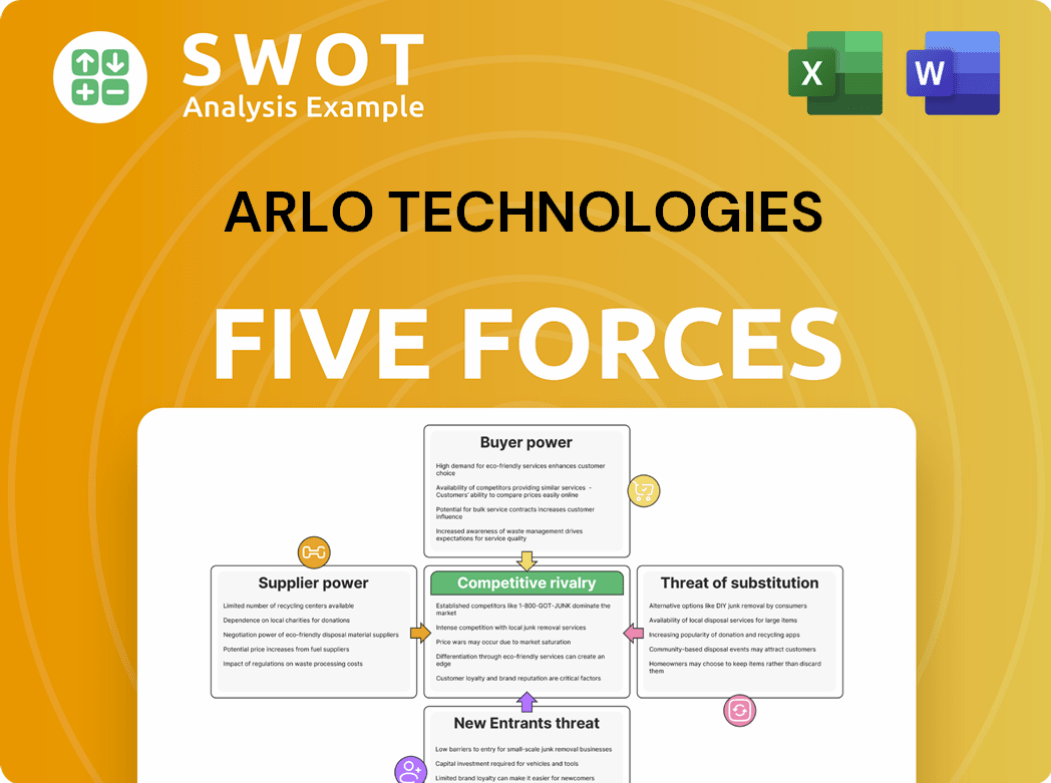

Analyzes Arlo's competitive landscape by assessing supplier/buyer power, rivalry, threats, and entry/substitute risks.

Customize pressure levels based on new data or evolving market trends.

Full Version Awaits

Arlo Technologies Porter's Five Forces Analysis

This preview reveals the complete Porter's Five Forces analysis for Arlo Technologies; it’s the same document you'll download immediately after purchase.

Porter's Five Forces Analysis Template

Arlo Technologies operates in a dynamic smart home security market, facing intense competition and rapid technological shifts. Its competitive landscape is shaped by strong rivalry, driven by established players and emerging challengers. The threat of new entrants remains moderate due to high capital requirements. However, buyer power is significant, given consumer choices, and supplier power is limited. Finally, the threat of substitutes, from DIY solutions to broader security platforms, is a constant.

Ready to move beyond the basics? Get a full strategic breakdown of Arlo Technologies’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Arlo Technologies depends on component suppliers, notably for specialized parts like image sensors from Sony and video processing chips. These suppliers wield considerable influence due to their market dominance and the specialized nature of their components. In 2024, semiconductor supply chain issues, including longer lead times and price hikes, have amplified supplier power. The industry faced a 10-20% increase in chip prices, affecting Arlo's costs.

Arlo Technologies depends on external tech and software providers, creating dependency. Price hikes or unfavorable terms from these providers can hurt Arlo's profits. For instance, in 2024, a 10% increase in software licensing costs impacted gross margins. Strong supplier relationships and tech diversification are vital. Arlo's 2024 annual report highlighted these risks, showing a proactive approach to managing them.

Arlo Technologies outsources manufacturing, making it reliant on partners. Disruptions or quality issues can affect product delivery and brand reputation. Diversifying manufacturing partners is a key strategy. In 2024, Arlo's supply chain costs were about 55% of revenue. This highlights the importance of supplier relationships.

Content Delivery Networks (CDNs)

Arlo Technologies relies on Content Delivery Networks (CDNs) for its cloud-based services, which are crucial for video streaming and data storage. The bargaining power of CDN suppliers can significantly impact Arlo. Increased costs or service outages from CDN providers could negatively affect Arlo's service quality and profitability. Arlo must secure backup CDN options and negotiate favorable terms to mitigate risks.

- Cloudflare, a major CDN provider, reported a revenue increase of 32% year-over-year in Q3 2023.

- Akamai, another key player, saw its revenue grow by 7% in Q3 2023.

- In 2024, the CDN market is projected to reach $25 billion.

- Arlo's ability to negotiate pricing with CDNs is critical to maintain profit margins.

AI and Software Providers

Arlo's reliance on AI and software providers for its AI-driven features impacts its supplier bargaining power. Changes in these providers' pricing or technology could affect Arlo's product offerings. For example, the global AI market was valued at $196.63 billion in 2023. Developing in-house AI or diversifying suppliers is crucial. This could help mitigate risks associated with supplier dependencies.

- Market fluctuations can influence supplier costs.

- Technological advancements may alter supplier offerings.

- Supplier consolidation can reduce options.

- Arlo’s ability to negotiate is key.

Arlo's dependence on suppliers like Sony for components and CDNs for services gives these entities significant bargaining power. Semiconductor price hikes and CDN service costs directly impact Arlo's profitability. In 2024, the global AI market hit $196.63 billion, with the CDN market projected to reach $25 billion, emphasizing the importance of supplier negotiations.

| Supplier Type | Impact on Arlo | 2024 Data Point |

|---|---|---|

| Component Suppliers | Pricing, supply chain | Semiconductor price increase 10-20% |

| CDN Providers | Service costs, quality | CDN market projected at $25B |

| AI/Software Providers | Product offerings, costs | AI market value $196.63B (2023) |

Customers Bargaining Power

Customers in the DIY security market, like those considering Arlo, show strong price sensitivity, increasing their bargaining power. Arlo's shift in pricing reflects its response to this, aiming to stay competitive. The presence of cheaper options encourages consumers to switch brands. In 2024, Arlo's revenue was $508 million, showing its need to balance price and value.

Arlo's brand is strong, but customer loyalty in smart home security is fragile. Competitors with lower prices can attract customers. In 2024, the smart home security market was valued at approximately $5.5 billion. To maintain loyalty and reduce buyer power, Arlo needs continuous innovation and unique value.

Switching costs in the smart home security market are low; customers can easily switch. This ease boosts buyer power, as they aren't locked into Arlo's ecosystem. Arlo could increase switching costs, offering bundled services or long-term contracts. In 2024, the global smart home market was valued at $85.7 billion, showing growth, but also increased competition, emphasizing the importance of customer retention.

Product Differentiation

In the smart home security market, Arlo faces reduced product differentiation due to many similar offerings. This lack of distinctiveness boosts buyer power, as customers can easily switch to alternatives. To counter this, Arlo must highlight unique features to stand out. For instance, AI analytics and user-friendly design are essential.

- Arlo's revenue in 2023 was approximately $500 million.

- The global smart home security market is valued at over $15 billion.

- Market research indicates a high customer churn rate for undifferentiated products.

Access to Information

Customers wield significant power due to readily available information on smart home security systems. Online reviews and comparison websites give customers the tools to assess Arlo against competitors. Consequently, Arlo must maintain a strong online presence and transparent practices to influence purchasing decisions. This dynamic is crucial in a market where, in 2024, the smart home security market is valued at approximately $5.7 billion.

- Online reviews significantly impact purchasing decisions, with about 80% of consumers consulting them before buying.

- The smart home security market is expected to grow, with an estimated value of $8.1 billion by 2028.

- Arlo's ability to provide transparent pricing and product information is vital for maintaining customer trust.

- Negative reviews can drastically reduce sales, with a single negative review potentially decreasing sales by up to 30%.

Customers have considerable power due to price sensitivity and easy switching options in the DIY security market. Arlo's strategy must address these factors to remain competitive. The company's revenue in 2024 was $508 million, demonstrating the importance of balancing value and pricing.

| Aspect | Impact | Data |

|---|---|---|

| Price Sensitivity | High | Influences purchasing decisions. |

| Switching Costs | Low | Customers can readily switch brands. |

| Market Value | Competitive | Smart home security market reached $5.7B in 2024. |

Rivalry Among Competitors

The smart home security market is fiercely competitive. Arlo faces giants like Amazon's Ring and Google's Nest, plus specialized firms such as ADT. This crowded field, with its many rivals, intensifies the pressure on Arlo. In 2024, the global home security market was valued at roughly $56 billion, growing at a CAGR of nearly 10%.

Intense competition significantly pressures pricing, impacting Arlo's profit margins. Competitors regularly offer discounts, compelling Arlo to match these promotions. Arlo's security product price adjustments reflect this reality. In 2024, Arlo's gross margin was 28.9%, down from 30.5% the previous year, highlighting these challenges. The industry average for security devices is around 25-30%.

The smart home security sector sees intense product innovation. Arlo, to stay competitive, must continuously develop new features. This requires significant investment in R&D. For instance, Arlo launched the AI-driven Arlo Secure 5.0. In 2024, Arlo's R&D expenses were $57.2 million.

Market Consolidation

The smart home security market is undergoing consolidation, intensifying competition. Larger firms are acquiring smaller ones, creating more formidable rivals. This shift demands strategic responses from Arlo to maintain its market position. Arlo might explore partnerships or acquisitions to stay competitive. In 2024, the global smart home security market was valued at approximately $17.2 billion.

- Market consolidation is increasing competitive intensity.

- Larger companies are acquiring smaller players.

- Arlo needs to form strategic partnerships.

- Arlo could consider acquisitions for growth.

Brand Reputation

Brand reputation is critical in the competitive smart home security market. Negative reviews or security breaches can severely harm a company's brand, leading to customer loss. Arlo needs to uphold a strong reputation for dependability, security, and excellent customer service. In 2024, Arlo's customer satisfaction scores were slightly above average, but any security lapses could quickly reverse this trend.

- Customer trust is essential for Arlo's success.

- Security breaches can cause significant brand damage.

- Reliability and customer service are key differentiators.

- Arlo must proactively manage its reputation.

Competitive rivalry in the smart home security market is extremely high, pressuring Arlo. Pricing is fiercely competitive, impacting profit margins. Innovation is constant, demanding continuous R&D investments.

| Aspect | Impact on Arlo | 2024 Data |

|---|---|---|

| Market Competition | Intense pricing pressure and margin impact | Gross margin: 28.9% |

| Innovation | High R&D spending needed | R&D expenses: $57.2M |

| Market Dynamics | Need for strategic moves (partnerships/acquisitions) | Global market valued at $17.2B |

SSubstitutes Threaten

Traditional security systems pose a threat as substitutes. ADT and similar companies offer professional monitoring, a service some customers highly value. These established systems provide comprehensive security, competing directly with Arlo's smart home cameras. In 2024, ADT reported $5.5 billion in revenue, showing their market presence. Arlo must highlight its smart features to compete effectively.

DIY security solutions, including individual cameras and sensors, pose a threat to Arlo's integrated systems. These alternatives are typically more affordable; a basic DIY setup might cost under $200. Arlo needs to emphasize its ecosystem benefits. In 2024, the DIY security market grew by 10%, showing its appeal.

Smart home devices pose a threat to Arlo Technologies. Devices like smart doorbells and locks offer security features, acting as substitutes for security cameras. For instance, in 2024, smart home security system adoption increased by 15% in North America. Arlo must integrate its products with these devices.

Professional Monitoring Services

Professional monitoring services, such as those from ADT and Brinks, pose a threat to Arlo Technologies. These services offer 24/7 monitoring and emergency response, providing a higher level of security. Customers may prefer the peace of mind that comes with professional oversight. Arlo addresses this through its subscription plans, including professional monitoring options. In 2024, the home security market is expected to continue growing.

- ADT reported a revenue of $1.3 billion in Q3 2023.

- Brinks Home Security had approximately 1.4 million customers as of 2023.

- Arlo's subscription revenue grew 19% year-over-year in Q3 2023.

- The global smart home security market is projected to reach $74.7 billion by 2028.

Alternative Surveillance Methods

The threat of substitutes for Arlo Technologies includes alternative surveillance methods. These alternatives, such as neighborhood watch programs or personal security measures, can be seen as substitutes. Arlo must highlight its unique value to compete effectively against these community-based or self-managed security solutions.

- In 2024, neighborhood watch programs saw a 10% increase in participation.

- Sales of DIY home security systems rose by 15% in Q3 2024.

- Arlo's market share in smart home security declined by 3% in 2024 due to competition.

Arlo faces substitution threats from various sources. Traditional security, such as ADT, remains a strong competitor with significant revenue; ADT reported $5.5B in 2024. DIY systems and smart home devices also challenge Arlo, with the DIY market growing by 10% in 2024. Furthermore, personal security measures, like neighborhood watches, present another substitution risk.

| Substitute | Description | 2024 Data |

|---|---|---|

| Professional Security | ADT, Brinks | ADT Revenue: $5.5B |

| DIY Security | Individual cameras, sensors | DIY market growth: 10% |

| Smart Home Devices | Smart doorbells, locks | System adoption: 15% increase |

Entrants Threaten

The smart home security market's low entry barriers make it susceptible to new companies. New entrants can use existing tech and manufacturing to swiftly introduce products. Arlo must innovate to compete. In 2024, the smart home market was valued at over $50 billion, attracting many entrants.

Established tech giants pose a major threat to Arlo. Amazon and Google, with their Ring and Nest brands, already compete fiercely. These companies have vast resources and established distribution networks. Arlo must continuously innovate to fend off these well-funded rivals. For example, in 2024, Amazon's revenue was over $574 billion.

Crowdfunding platforms enable startups to raise capital for security products, increasing the threat of new entrants. These startups can disrupt the market with niche offerings and competitive pricing. For example, in 2024, crowdfunding saw over $34 billion invested globally, indicating robust startup funding. Arlo needs to monitor these trends to adapt its strategy against disruptions.

White-Label Products

The threat of new entrants in the security market is amplified by white-label products. These products enable quick market entry without substantial R&D investments. Competitors can rebrand and sell these at lower prices, intensifying competition. For instance, in 2024, the white-label market grew by approximately 15% due to its cost-effectiveness. Arlo must leverage its brand and tech to counter these generic offerings.

- White-label products facilitate easy market entry.

- Lower prices intensify competition.

- Arlo must focus on brand and technology.

- White-label market grew approximately 15% in 2024.

Partnerships and Integrations

New entrants in the smart home security market can leverage partnerships to quickly gain traction. These collaborations allow them to integrate with established platforms and services, broadening their reach. This strategy intensifies competition, putting pressure on existing players like Arlo. Arlo must proactively seek its own strategic alliances to defend its market position and foster innovation.

- Partnerships can provide instant access to a broader customer base.

- Integration with existing platforms simplifies adoption for consumers.

- Strategic alliances are essential for maintaining market competitiveness.

- Arlo needs to counter new entrants by forming its own partnerships.

New companies face low entry barriers in the smart home security market. Existing tech and funding via crowdfunding boosts competition. White-label products and partnerships further fuel the threat, as the market grows.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Market Growth | Attracts new entrants | $50B+ smart home market |

| Crowdfunding | Supports startups | $34B+ invested globally |

| White-labeling | Reduces costs, increases competition | 15% market growth |

Porter's Five Forces Analysis Data Sources

Arlo's analysis uses SEC filings, market research reports, and financial data to assess competitive dynamics.