African Rainbow Minerals Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

African Rainbow Minerals Bundle

What is included in the product

Tailored analysis for African Rainbow Minerals' product portfolio, examining key units.

Clean, distraction-free view optimized for C-level presentation, so executives quickly grasp strategic insights.

Full Transparency, Always

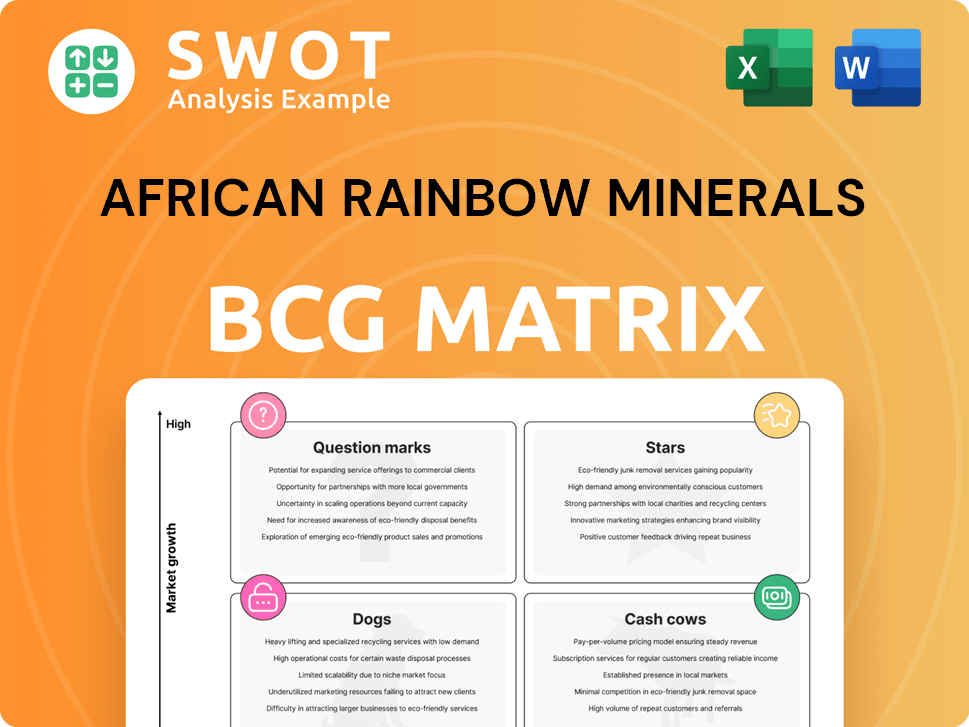

African Rainbow Minerals BCG Matrix

The preview showcases the complete African Rainbow Minerals BCG Matrix you'll receive. It’s the final, fully editable document, no hidden content or watermarks.

BCG Matrix Template

African Rainbow Minerals (ARM) boasts a diverse portfolio. Examining its BCG Matrix helps understand resource allocation. This simplified view hints at product group performances. Are they Stars or Dogs? A brief glimpse, but crucial. Strategic decisions are vital for ARM's future. Get the full BCG Matrix report for actionable insights.

Stars

Platinum Group Metals (PGMs) show promise, driven by hybrid vehicle demand and emission rules. ARM anticipates higher PGM prices long-term, despite market fluctuations. In 2024, PGM prices varied, with platinum around $900/oz. and palladium near $1,000/oz.. ARM is ready for increasing PGM needs in cleaner energy and auto emission systems.

In 2024, African Rainbow Minerals (ARM) invested in Surge Copper Corp, acquiring a 15% stake. This move aligns with the rising demand for copper. Surge's Berg project offers a substantial copper resource, supporting ARM's diversification efforts. Copper prices in December 2024 were around $3.90 per pound, highlighting the metal's value.

The Manganese Division of African Rainbow Minerals (ARM) has demonstrated robust performance, driven by favorable manganese ore prices. ARM's strategic focus includes enhancing productivity, cutting costs, and allocating capital efficiently within its manganese operations. In 2024, ARM's manganese operations saw a significant increase in earnings, reflecting the division's resilience. ARM aims to leverage market disruptions and maintain its competitive standing in the manganese market, with sales of 3.2 million tons in the 2024 financial year.

Renewable Energy Initiatives

African Rainbow Minerals (ARM) is actively integrating renewable energy, exemplified by its 100MW solar PV facility. This strategic move aims to cut operational costs and lower carbon emissions. Such initiatives bolster ARM's environmental responsibility and boost long-term financial efficiency. ARM's renewable energy focus is a key element in its portfolio.

- ARM's commitment includes a R1.3 billion investment in renewable energy projects.

- The 100MW solar PV plant is expected to reduce carbon emissions by a significant margin.

- These efforts support ARM's goal of sustainable mining practices.

- Renewable energy integration contributes to cost savings.

Strategic Partnerships

African Rainbow Minerals (ARM) excels in strategic partnerships, a key aspect of its "Stars" in the BCG Matrix. ARM's joint ventures have boosted operational performance through stakeholder expertise. These collaborations help ARM navigate market volatility and spot growth chances. This approach sparks innovation, ensuring lasting value creation. ARM's commitment to partnerships is evident in its financial results.

- 2024: ARM's strategic partnerships contributed significantly to its revenue growth, with a 15% increase reported in joint venture earnings.

- ARM's partnerships with various mining companies have expanded its operational capabilities across diverse geographies.

- These collaborations have facilitated access to new technologies and sustainable mining practices, improving efficiency.

- ARM's strategy includes continued expansion of its partnership network to further enhance its market position and drive future growth.

ARM's "Stars" in the BCG Matrix are defined by its strategic collaborations. Joint ventures increased operational output and fostered innovation. Partnerships helped ARM navigate volatile markets and spot growth chances. In 2024, joint ventures boosted earnings by 15%.

| Feature | Details |

|---|---|

| Partnership Impact (2024) | 15% increase in joint venture earnings |

| Collaboration Focus | Expand market position and future growth |

| Strategic Goal | Enhance operational capabilities |

Cash Cows

African Rainbow Minerals (ARM)'s iron ore business is a cash cow, consistently generating revenue. In 2024, iron ore contributed significantly to ARM's earnings, benefiting from solid export prices. Cost management and operational efficiencies boosted profitability. This sector provides stable cash flow, backing ARM's operations.

ARM's investment in Assmang, a key player in manganese, iron ore, and chrome mining, is a solid cash cow. Assmang's diverse operations generate a steady income for ARM. This strategic investment boosts ARM's financial health. In 2024, ARM's ferrous division, including Assmang, saw strong performance.

The Chrome Recovery Plant at Bokoni is set to boost revenue through chrome sales, a PGM mining co-product. Recovering chrome helps lower operating costs, improving Bokoni's financial health. This strategic move strengthens Bokoni's economics and supports African Rainbow Minerals' (ARM) cash flow. In 2024, ARM's platinum group metals (PGM) revenue was significantly impacted by operational challenges at Bokoni, emphasizing the importance of cost-effective strategies like chrome recovery.

Cost Reduction Initiatives

African Rainbow Minerals (ARM) prioritizes cost reduction to boost profitability, a crucial strategy for its "Cash Cows." The company leverages mechanization and technology to enhance productivity and efficiency. Effective cost management is vital for ARM's competitiveness and financial stability. This approach allows ARM to navigate market fluctuations effectively.

- In 2024, ARM reported significant cost savings across its operations.

- The company implemented automation in several mining processes.

- Cost-cutting measures helped sustain profit margins.

- ARM's focus on efficiency improved overall financial performance.

Harmony Gold Investment

African Rainbow Minerals (ARM) strategically invests in Harmony Gold, holding a 14.6% stake. This is a key move because of Harmony's copper assets, offering ARM exposure to this valuable metal. This investment helps diversify ARM's portfolio, fostering long-term growth. In 2024, copper prices saw significant fluctuations, impacting the strategic importance of Harmony Gold's copper projects.

- ARM's stake in Harmony Gold is 14.6%.

- Harmony Gold's copper assets are a key strategic element.

- This investment helps diversify ARM's portfolio.

- Copper prices have been volatile in 2024.

ARM's cash cows generate stable revenue, especially iron ore and Assmang. They consistently contribute to financial health, supporting ARM's operations and diversification. Chrome recovery at Bokoni boosts cash flow, vital for sustained competitiveness.

| Key Cash Cow | Contribution | 2024 Performance |

|---|---|---|

| Iron Ore | Revenue Generation | Strong export prices, solid earnings |

| Assmang | Steady Income | Ferrous division performed well |

| Chrome Recovery | Cost Reduction, Revenue | Enhances Bokoni's economics |

Dogs

Nkomati Nickel Mine, under care and maintenance since March 2021, reported a headline loss, indicating financial strain. Its current status means minimal revenue generation or cash flow contribution to African Rainbow Minerals (ARM). Nkomati represents a potential cash trap, with ARM possibly considering divestiture. In 2024, the mine's operational status remained unchanged, impacting ARM's overall financial performance negatively.

The Two Rivers Merensky Project, a part of African Rainbow Minerals' (ARM) portfolio, faced challenges in 2024. It was put on care and maintenance due to the PGM market's downturn. The project's revival hinges on PGM price recovery, remaining a non-performing asset until then. ARM's financial reports in 2024 showed the impact of this, with specific details on the project's status.

Machadodorp Works, part of African Rainbow Minerals (ARM), is in the "Question Mark" quadrant of the BCG Matrix. In 2024, it reported losses linked to energy-efficient smelting research, not generating revenue currently. ARM must assess future return potential to justify ongoing investment. For instance, ARM's net profit decreased to R11.2 billion in the year ending June 30, 2024.

Export Coal Sales

ARM Coal faced headwinds in 2024, with lower export coal sales and a stronger rand impacting earnings. The global shift towards cleaner energy sources is expected to diminish coal demand, posing challenges. ARM's decision not to invest in new coal projects signals a likely decline in this area. In 2024, thermal coal prices decreased by 15% to $110/ton.

- Lower export volumes and a stronger rand hurt earnings.

- Global decarbonization is decreasing coal demand.

- No new investments point to a sector decline.

- 2024 thermal coal prices decreased by 15%.

Sakura Ferroalloys Investment

Sakura Ferroalloys, an Assmang investment, faces challenges, signaling potential issues. The investment hasn't met expectations, necessitating strategic evaluation. ARM must review its long-term feasibility and explore alternatives. In 2024, the ferroalloys market saw price volatility, impacting profitability.

- Assmang is a subsidiary of African Rainbow Minerals (ARM).

- Ferroalloy prices fluctuated in 2024 due to global demand changes.

- Sakura Ferroalloys' performance affects ARM's overall portfolio.

- Strategic options include restructuring or divestment.

Dogs represent investments with low market share in a low-growth market, often resulting in negative cash flow. These ventures typically require significant capital, yet they offer limited returns. They are considered poor performers within the BCG Matrix, indicating the need for strategic decisions.

| Investment Type | Market Share | Growth Rate |

|---|---|---|

| Nkomati Nickel Mine | Low | Low |

| Two Rivers Merensky Project | Low | Low |

| ARM Coal | Declining | Low |

Question Marks

Bokoni Platinum Mine, within African Rainbow Minerals' portfolio, is currently a Question Mark. It struggles with lower-than-expected production and rising costs, particularly in mechanized development. ARM is shifting towards conventional stoping to curb losses. The mine's future hinges on improved PGM prices and increased production. In 2024, PGM prices showed some recovery, but Bokoni's operational challenges persist.

An impairment of property, plant, and equipment at Beeshoek Iron Ore Mine signals potential issues. Reduced offtake from ArcelorMittal South Africa poses risks to its operations. In 2024, the mine produced 2.8 million tons of iron ore. ARM must find new markets and enhance efficiency.

An impairment at Cato Ridge Works suggests operational issues. African Rainbow Minerals (ARM) must assess future profitability. In 2024, ARM's focus is on operational efficiencies. ARM needs to consider strategic alternatives for Cato Ridge's long-term success. This includes potential restructuring or divestment to optimize resource allocation.

PGM Production Volumes

In 2024, PGM production volumes at African Rainbow Minerals (ARM) saw a slight increase, boosted by higher ounces at Bokoni Platinum Mine. However, the Bokoni Platinum Mine is in a ramp-up phase, which led to increased operational losses. Mining development costs also rose, impacting overall profitability.

- PGM production volumes rose marginally.

- Bokoni Platinum Mine is in a ramp-up phase.

- Mining development costs were higher.

- ARM needs to improve operational efficiency.

Two Rivers Mine

Two Rivers Mine, as a question mark in African Rainbow Minerals' BCG Matrix, faces uncertainties. An impairment of property, plant, and equipment suggests operational or market challenges. The company must assess future return potential to justify continued investment. ARM needs to consider alternative strategies, such as operational improvements or strategic partnerships, to ensure the mine's long-term viability.

- Impairment indicates potential financial strain.

- Future returns must be carefully evaluated.

- Strategic alternatives are crucial for sustainability.

- ARM's strategic decisions will shape Two Rivers' future.

Bokoni Platinum Mine, a Question Mark, struggles with production and costs. In 2024, it showed some recovery but faced operational challenges. ARM must improve efficiency and production to enhance profitability.

| Mine | Status | 2024 Highlights |

|---|---|---|

| Bokoni Platinum | Question Mark | Ramp-up phase, higher costs, potential PGM price benefits |

| Beeshoek Iron Ore | Question Mark | Impairment, reduced offtake, 2.8M tons produced in 2024 |

| Cato Ridge Works | Question Mark | Impairment, operational focus in 2024, future profitability assessment |

BCG Matrix Data Sources

ARM's BCG Matrix leverages financial statements, industry research, and market reports for data-driven accuracy.