Asics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asics Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Export-ready design for quick drag-and-drop into PowerPoint, allowing for fast and compelling presentations.

Delivered as Shown

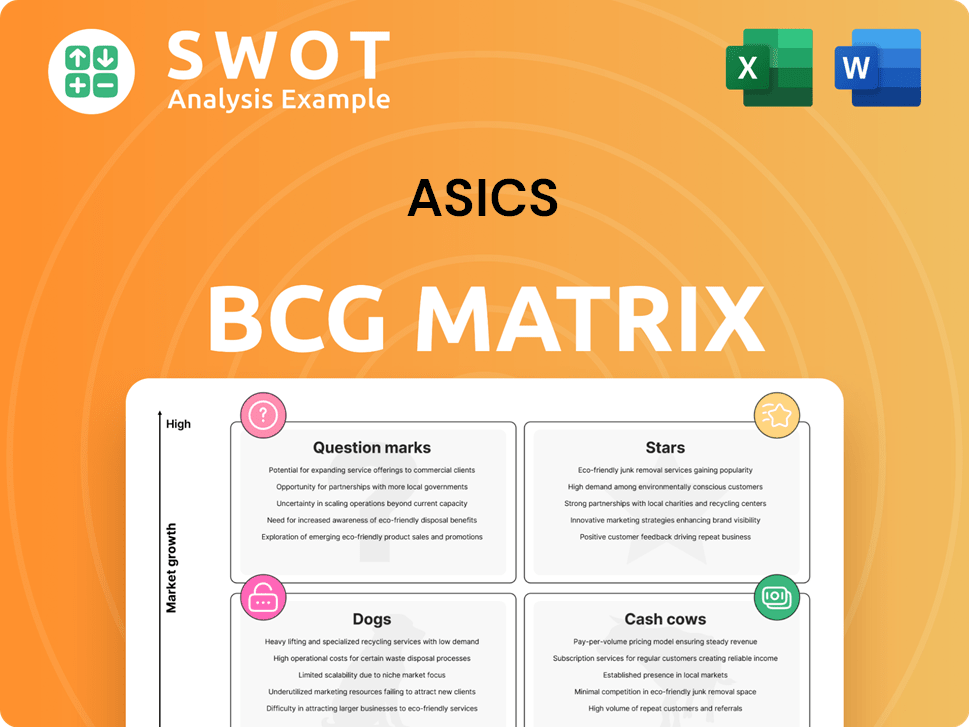

Asics BCG Matrix

The preview shows the complete Asics BCG Matrix report you'll receive. Upon purchase, you get the final, ready-to-use document. It's designed for strategic decision-making, with no hidden content. This professional-grade matrix is instantly downloadable.

BCG Matrix Template

The Asics BCG Matrix categorizes its products based on market growth and market share. This quick view helps identify Stars (high growth, high share), Cash Cows (low growth, high share), Dogs (low growth, low share), and Question Marks (high growth, low share). Understanding these positions is crucial for strategic decisions about investment and resource allocation. The matrix helps pinpoint which products drive revenue and which need attention.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Asics' performance running footwear is a star, leading in the market. The category's growth and profits remain high due to innovation. In 2024, Asics saw a 10% revenue increase in this segment. Research and development investments ensure its top status for runners.

The SportStyle category, encompassing lifestyle and street-style products, has shown impressive growth. Sales have nearly hit ¥100 billion, with over 50% year-over-year growth. Operating profits have more than doubled from 2023. This indicates strong market demand for Asics' lifestyle products.

Onitsuka Tiger, Asics' heritage line, experienced remarkable growth, with a 58.3% sales increase. This brand's appeal to Gen Z is evident, thanks to its classic 'Tiger Stripes' and retro style. Onitsuka Tiger's performance showcases its ability to align with current fashion trends. The brand's revenue in 2024 reached $400 million, up from $250 million in 2023.

North American Market

Asics' North American market is a star, demonstrating robust performance. Net sales surged by 17.8% in 2024, fueled by strong demand in Performance Running and SportStyle. This success is further highlighted by an impressive 682.5% increase in segment profit. This region is a key growth driver for the company.

- Strong Sales Growth: 17.8% increase in net sales in 2024.

- Profitability: 682.5% increase in segment profit.

- Key Categories: Performance Running and SportStyle driving growth.

European Market

Asics shines brightly in the European market, mirroring its global success. Revenue in Europe surged by 12.8% to ¥179.3 billion. Operating profit soared by 78.2%, boosting the operating margin to 13.4%. This growth stems from strong performance in both the performance and SportStyle categories.

- Revenue increased by 12.8% to ¥179.3 billion.

- Operating profit rose by 78.2%.

- Operating margin increased to 13.4%.

- Growth driven by performance and SportStyle.

Stars include the Performance Running and SportStyle categories. Both demonstrate high market growth and significant market share. These segments experienced substantial revenue increases in 2024, particularly in North America and Europe.

| Category | 2024 Revenue Growth | Key Market |

|---|---|---|

| Performance Running | 10% | Global |

| SportStyle | 50%+ YoY | Global |

| North America | 17.8% Net Sales | North America |

| Europe | 12.8% Revenue | Europe |

Cash Cows

The GEL-Kayano series is a cash cow for Asics, highly valued for its cushioning and support, first launched in 1993. This series consistently generates revenue due to its loyal customer base. The GEL-Kayano's strong brand recognition and market presence ensures steady income. In 2024, Asics reported strong sales, with the GEL-Kayano contributing significantly.

The GEL-Nimbus series, launched in 2000, remains a key cash cow for Asics. This line caters to neutral runners, known for its cushioned comfort. GEL-Nimbus consistently generates stable revenue. In 2024, Asics' running category grew by 15%, and the Nimbus series was a key contributor.

Core Performance Sports (CPS), featuring tennis and indoor athletics gear, experiences consistent growth. This segment thrives on Asics' innovation, drawing in athletes needing specialized equipment. CPS's steady sales bolster Asics' financial health; in 2024, this sector accounted for approximately 15% of total sales. This consistent performance makes CPS a reliable revenue source.

Japanese Market

The Japanese market stands out as a "Cash Cow" for Asics. In 2024, it saw a remarkable 34.2% revenue increase, driven by robust sales to visitors and strategic focus. This growth, coupled with high operating margins, showcases the effectiveness of Asics' domestic market strategies.

- Revenue Growth: 34.2% increase in 2024.

- Key Drivers: Strong sales to inbound visitors and focused strategies.

- Profitability: High operating margins.

- Strategic Success: Effective strategies in the home market.

Online Sales

Asics' online sales demonstrate a solid performance, increasing by 20.7% in the last year, positioning it as a reliable cash cow. This growth reflects the company's successful adaptation to e-commerce and its appeal to online consumers. The expansion of online sales has broadened Asics' market reach and improved accessibility. This also allows the company to maintain a steady revenue stream.

- Online sales growth of 20.7% in 2024.

- Successful e-commerce adaptation.

- Expanded market reach and accessibility.

- Consistent revenue stream.

Cash cows are profitable, low-growth businesses. They generate substantial cash, requiring minimal investment. Asics' Japan market is a cash cow, with 34.2% revenue growth in 2024.

| Category | Description | 2024 Data |

|---|---|---|

| Japan Market Revenue Growth | Increase due to sales and focus. | 34.2% |

| Online Sales Growth | Growth from e-commerce. | 20.7% |

| CPS Sales Contribution | Share in total sales. | ~15% |

Dogs

ASICS' apparel segment contributes less revenue than footwear. The apparel market is competitive, limiting ASICS' market share. In 2024, footwear dominated ASICS' sales, with apparel a smaller portion. Innovation in apparel could boost its standing, but footwear remains the priority.

In some less developed markets, ASICS faces challenges like strong local brand competition. These regions might not significantly contribute to revenue. ASICS's revenue growth was 15.1% in FY23, yet some areas still lag. Strategic investments and marketing are key for improvement.

Older ASICS models no longer actively marketed are "dogs." These models have low market share and minimal revenue. In 2024, ASICS saw a 5% decrease in sales from discontinued lines. ASICS should phase these out or repurpose the tech.

Niche Sport Categories with Low Market Share

ASICS, while diverse, faces challenges in niche sports. Some categories, like wrestling or specific outdoor activities, may have low market share and growth. These could be classified as "dogs" in a BCG matrix analysis. In 2024, ASICS's revenue was approximately ¥550 billion, but specific niche segment performances vary. Focusing on core strengths is crucial for sustainable growth.

- Wrestling and niche outdoor segments may have minimal revenue contribution.

- Market share and growth rates in these areas are likely low.

- ASICS might consider divesting or reducing investment in these "dog" categories.

- Prioritizing core strengths and high-growth areas is a more strategic approach.

Products with Limited Sustainability Features

In 2024, products without sustainability features are increasingly viewed as "dogs" in the ASICS portfolio. Consumer demand for eco-friendly options is rising; ASICS must adapt to maintain market share. According to a 2024 report, sustainable athletic footwear sales grew by 15%. Investing in sustainable materials and production is vital.

- Consumer preference shifts towards sustainable products.

- Products lacking sustainability face potential market decline.

- Investment in sustainable practices is critical.

- ASICS needs to align with eco-conscious values.

ASICS identifies "dogs" as products with low market share and minimal growth. Discontinued models and niche sports segments often fall into this category, reflecting poor performance. For example, in 2024, ASICS saw a 5% drop in sales from phased-out product lines, underscoring the need to eliminate these items.

Products lacking sustainability features are also classified as "dogs," as consumer preferences evolve. This means focusing on sustainable practices is essential to remain competitive. In 2024, sustainable athletic footwear experienced a 15% growth, signaling the need for ASICS to innovate.

| Category | Definition | Example |

|---|---|---|

| Dogs | Low market share, low growth | Discontinued models, niche sports segments |

| Performance | Sales decrease in phased-out products | 5% decline in 2024 |

| Sustainability Impact | Products lacking eco-friendly features | Shift in consumer preferences |

Question Marks

ASICS' expansion into emerging sports places them in the question mark quadrant of the BCG matrix. These new ventures, like pickleball, have high growth prospects but low market share initially. Success hinges on strong marketing and innovative product development. ASICS needs to invest strategically to boost market presence and potentially become a star. In 2024, the global pickleball market was valued at $4.3 billion, reflecting rapid growth.

ASICS faces sustainability challenges, marking it as a question mark within the BCG Matrix. While ASICS is making efforts, further initiatives are needed to fully capitalize on the growing demand for eco-friendly products. To succeed, ASICS must invest in research, development, and marketing, targeting a significant market share. In 2024, the global sustainable footwear market was valued at $24.5 billion, highlighting the opportunity.

ASICS' digital fitness and wearable tech initiatives fit the question mark category. The global wearables market was valued at $61.3 billion in 2023 and is projected to reach $153.5 billion by 2029. ASICS needs innovation to compete. Partnerships and acquisitions could enhance their position.

Customization and Personalization

Customization and personalization represent a burgeoning trend within the athletic footwear market, yet ASICS' initiatives in this domain remain nascent. The potential for substantial growth is significant, fueled by consumers' increasing demand for personalized experiences. To capitalize on this, ASICS must strategically invest in technological advancements and robust infrastructure. This will enable efficient and effective delivery of customized products, thereby enhancing customer satisfaction and brand loyalty.

- Market size for personalized athletic footwear is projected to reach $2.5 billion by 2028.

- ASICS' revenue in 2024 was approximately $3.7 billion.

- Investment in 3D printing and digital design tools is crucial for effective customization.

Expansion in Emerging Markets

ASICS' foray into emerging markets like India places it in the "Question Mark" quadrant of the BCG matrix. These regions offer considerable growth potential, yet ASICS must navigate challenges. These include strong competition and adapting to local consumer preferences. Success hinges on tailored product offerings and marketing.

- ASICS plans to open 30 new stores in India in 2025.

- Over 50% of these new stores will be in tier-2 and tier-3 cities.

- India's sportswear market is projected to reach $2.6 billion by 2027.

ASICS, in the "Question Mark" quadrant, is targeting customized athletic footwear. The market is projected to reach $2.5 billion by 2028. Successful execution relies on tech investment and infrastructure.

| Aspect | Details | Financials |

|---|---|---|

| Market Focus | Customized athletic footwear | $2.5B projected market by 2028 |

| Strategy | Invest in tech, robust infrastructure | ASICS 2024 Revenue: ~$3.7B |

| Goal | Enhance customer satisfaction, loyalty | 3D printing & design key investment areas |

BCG Matrix Data Sources

The Asics BCG Matrix utilizes diverse sources like financial filings, market reports, and sales data for reliable and actionable strategic positioning.