ASM Pacific Technology Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASM Pacific Technology Bundle

What is included in the product

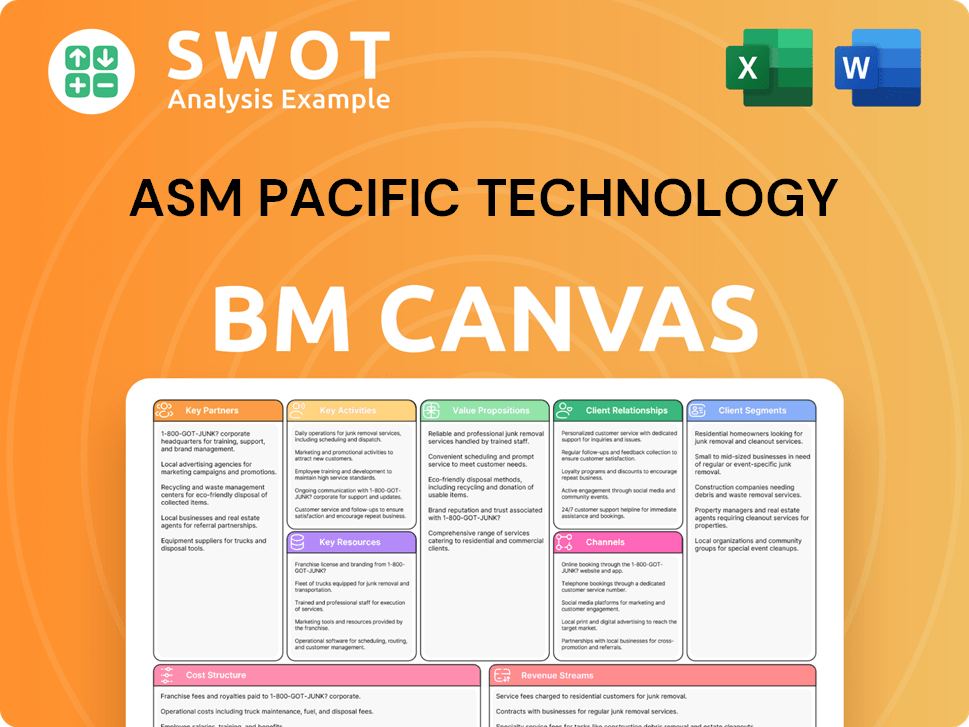

ASM Pacific Technology's BMC provides a detailed view of operations, covering customer segments, channels, and value propositions.

Condenses company strategy into a digestible format for quick review.

What You See Is What You Get

Business Model Canvas

The ASM Pacific Technology Business Model Canvas previewed here is identical to the purchased document. You're seeing the full document structure and content. After purchase, you'll receive this complete file, ready for your use and modifications.

Business Model Canvas Template

ASM Pacific Technology's Business Model Canvas reveals its semiconductor assembly and packaging strategies. This model highlights key partnerships, customer segments, and value propositions. Analyzing cost structures and revenue streams offers insights into profitability. It's a valuable tool for understanding market positioning and competitive advantages. This resource is ideal for investors and analysts.

Partnerships

ASM Pacific Technology relies on key partnerships with technology suppliers. These collaborations integrate advanced components and software. This approach keeps their equipment at the forefront of innovation. For instance, ASMPT's R&D spending in 2024 was approximately $250 million, reflecting their commitment to these partnerships.

ASMPT partners with research institutions to drive innovation. This collaboration gives ASMPT access to cutting-edge research, aiding in the development of advanced technologies. These partnerships are key to staying competitive, and in 2024, ASMPT invested heavily in R&D, allocating approximately $250 million. They translate research into product applications.

ASMPT's success hinges on strong partnerships with key customers, mainly leading semiconductor and electronics manufacturers. These relationships enable ASMPT to grasp customer needs and customize solutions. Collaborating with these partners allows ASMPT to meet specific requirements and manufacturing challenges. In 2024, ASMPT's revenue reached $6.5 billion, reflecting the importance of these customer ties.

Software Providers

ASMPT's partnerships with software providers are vital for integrating advanced software solutions. These collaborations enhance smart factory tools, optimizing manufacturing processes and cutting costs. The incorporation of cutting-edge software allows ASMPT to provide comprehensive solutions. In 2024, ASMPT invested $150 million in R&D, including software integration.

- Partnerships enhance smart factory tools.

- Optimizes manufacturing processes.

- Reduces operational costs.

- ASMPT invested $150M in R&D in 2024.

Joint Ventures

ASMPT strategically forms joint ventures to boost its capabilities and market presence. These collaborations blend ASMPT's strengths with partners' expertise, fostering innovation in technology and solutions. Such ventures open doors to new markets and customers, bolstering ASMPT's global footprint. For instance, ASMPT's partnerships have contributed significantly to its revenue growth, with joint ventures playing a crucial role in its expansion strategies.

- ASMPT's revenue in 2024 was approximately $6.5 billion.

- Joint ventures have helped ASMPT penetrate key markets in Southeast Asia.

- These partnerships have facilitated the development of advanced semiconductor packaging technologies.

- ASMPT's collaboration with industry leaders has resulted in the launch of innovative products.

ASMPT's key partnerships span technology suppliers, research institutions, and software providers, enhancing their innovation capabilities. Collaborations with major semiconductor manufacturers are essential for meeting market demands, reflecting ASMPT's strategic focus on customer needs. These partnerships are integral, contributing to the company's financial performance, with 2024 revenues reaching approximately $6.5 billion.

| Partnership Type | Focus Area | 2024 Impact |

|---|---|---|

| Technology Suppliers | Advanced Components | Keeps equipment innovative |

| Research Institutions | Cutting-edge Research | $250M R&D Investment |

| Key Customers | Semiconductor Needs | $6.5B Revenue |

Activities

Research and Development (R&D) is a cornerstone for ASMPT, fueling innovation and new solutions. ASMPT dedicates a substantial portion of its revenue to R&D. This investment ensures ASMPT stays ahead in the semiconductor and electronics manufacturing tech. ASMPT's 2023 R&D spending reached $256.3 million, showcasing its commitment to continuous product improvement.

Manufacturing high-quality equipment is crucial for ASMPT's success. Their processes ensure precision, reliability, and efficiency, vital for the semiconductor industry. ASMPT invested $108 million in R&D in H1 2024. This focus enables them to deliver superior products. Manufacturing excellence is reflected in their strong market position.

Software development is a key activity for ASMPT. They're creating advanced software to boost equipment capabilities and enable smart factories.

Focus is on optimizing manufacturing, improving data analytics, and seamless system integration. This helps ASMPT offer efficient solutions.

In 2024, ASMPT invested significantly in R&D, including software, with spending reaching $250 million. Software is crucial for competitiveness.

This investment supports ASMPT's goal to provide comprehensive solutions, improving customer productivity.

The push for software strengthens ASMPT's position in the semiconductor industry, driven by data-driven manufacturing.

Customer Support and Service

Customer support and service are pivotal for ASMPT's customer relationships and satisfaction. ASMPT's offerings include installation, training, maintenance, and technical support to maximize equipment value. This focus on service builds loyalty and encourages repeat business, a key driver for sustainable revenue growth. In 2024, ASMPT reported a customer satisfaction rate of 95% due to robust support.

- Customer satisfaction rate of 95% in 2024.

- Installation and training services.

- Maintenance and technical support.

- Focus on repeat business and loyalty.

Strategic Acquisitions

Strategic acquisitions are crucial for ASMPT, enabling portfolio and market expansion. Acquiring tech and businesses enhances capabilities, offering broader solutions. These actions open new markets, boosting growth and global reach. ASMPT's strategy aims to fortify its position in the semiconductor industry.

- In 2024, ASMPT completed several acquisitions to strengthen its product offerings.

- These acquisitions are part of ASMPT's strategy to maintain its market leadership.

- The company's acquisitions have consistently contributed to revenue growth.

- ASMPT allocated a significant portion of its budget to acquisitions in 2024.

ASMPT's key activities involve R&D, manufacturing, software development, customer service, and strategic acquisitions.

The company's R&D spending reached $256.3 million in 2023 and about $250 million in the first half of 2024, focusing on innovation and software solutions.

Customer support, with a 95% satisfaction rate, ensures strong customer relationships, while strategic acquisitions bolster market position and portfolio expansion.

| Activity | Focus | 2024 Data |

|---|---|---|

| R&D | Innovation | $250M investment in software |

| Manufacturing | Quality & Efficiency | $108M investment in H1 2024 |

| Customer Service | Satisfaction | 95% satisfaction rate |

Resources

ASM Pacific Technology (ASMPT) heavily relies on intellectual property, including patents and proprietary tech, for its competitive edge. Their IP portfolio is key for creating innovative solutions and maintaining market dominance.

Continuous R&D investment ensures their tech stays ahead in semiconductor and electronics manufacturing. In 2023, ASMPT's R&D spending was approximately HK$1.2 billion, reflecting its commitment to IP.

This investment supports the development of advanced manufacturing equipment, crucial for industry leadership. ASMPT's strong IP position directly impacts its financial performance.

It helps secure higher profit margins and strengthens its long-term market position. The company's focus on IP is a strategic asset.

It enables them to capitalize on industry trends and technological advancements. ASMPT's IP strategy is vital for sustained growth.

ASMPT's success hinges on its skilled workforce, vital for creating and supporting advanced tech. This team, proficient in engineering and software, ensures top-notch products and services. They invest in training, crucial in 2024, as the semiconductor industry rapidly evolves. In 2023, ASMPT's R&D expenses were HK$670 million, reflecting their commitment to skilled talent.

ASMPT's manufacturing facilities are crucial for producing high-precision equipment. These facilities use advanced machinery for the semiconductor industry. In 2024, ASMPT invested $200 million in upgrading these facilities. This investment supports growing demand and maintains their competitive edge.

Global Sales and Service Network

ASMPT's global sales and service network is vital for customer reach and support. It encompasses sales offices, service centers, and distribution partners. This network allows ASMPT to serve customers across Asia, Europe, and the Americas. Their global presence provides timely and effective customer support.

- ASMPT has a presence in over 30 countries.

- In 2024, ASMPT's revenue was approximately HK$17.4 billion.

- A significant portion of ASMPT's revenue comes from Asia.

- They continuously expand their service network to meet customer needs.

Financial Resources

ASMPT's robust financial resources are crucial for fueling research and development, manufacturing capabilities, and strategic acquisitions, like the 2024 acquisition of the automotive semiconductor business. Financial stability allows ASMPT to navigate economic challenges and seize growth prospects. Prudent financial management supports continued innovation and business expansion. In 2024, ASMPT reported a revenue of HK$16.02 billion.

- Strong cash position to fund operations and investments.

- Ability to secure financing for strategic initiatives.

- Healthy profit margins to reinvest in growth.

- Effective cost management to maintain profitability.

ASM Pacific Technology's (ASMPT) key resources include intellectual property, a skilled workforce, manufacturing facilities, a global sales network, and robust financial resources.

Their intellectual property, including patents and proprietary technology, fuels innovation, supported by R&D investments, which were around HK$1.2 billion in 2023.

ASMPT's global presence is underscored by operations in over 30 countries and 2024 revenues of approximately HK$17.4 billion, with a substantial portion from Asia, demonstrating a strong market position.

| Resource | Description | 2024 Data |

|---|---|---|

| Intellectual Property | Patents, proprietary tech | R&D Spending (2023): ~HK$1.2B |

| Skilled Workforce | Engineering, software expertise | R&D Expenses (2023): ~HK$670M |

| Manufacturing Facilities | High-precision equipment | Investment in upgrades: $200M |

Value Propositions

ASMPT's value proposition centers on advanced tech solutions for semiconductor and electronics manufacturing. Their equipment boosts efficiency with assembly, packaging, and surface mount tech. This helps clients stay competitive by improving productivity, quality, and cost-effectiveness. In 2024, the semiconductor equipment market is projected to reach $130 billion, highlighting the importance of ASMPT's offerings.

ASMPT's diverse product range, from wafer deposition to assembly, offers a one-stop solution. This comprehensive portfolio simplifies procurement. In 2024, ASMPT's revenue was approximately $6.5 billion, reflecting strong sales across its product lines. A broad offering reduces the need for multiple suppliers, boosting efficiency.

ASM Pacific Technology (ASMPT) excels at customized solutions, a cornerstone of its value proposition. They tailor equipment and software to meet specific customer needs, fostering strong partnerships. ASMPT's collaborative approach ensures customer satisfaction, vital in the competitive semiconductor industry. In 2024, ASMPT's revenue was approximately HK$18.5 billion, reflecting its success in providing specialized solutions.

Smart Factory Integration

Smart factory integration is a core value proposition for ASMPT, boosting manufacturing efficiency. Their equipment and software integrate smoothly, providing real-time data for better decisions. This leads to more agile and responsive operations for clients. ASMPT's focus is on data-driven optimization.

- ASMPT's revenue in 2024 was approximately HK$17.5 billion.

- Smart factory solutions can reduce operational costs by up to 20%.

- Integration improves manufacturing cycle times by 15-20%.

- ASMPT's market share in the semiconductor industry is about 10%.

Global Support and Service

ASMPT's global support and service network is critical. This ensures customers worldwide receive timely assistance. Their service centers offer installation, training, and maintenance. This approach boosts customer satisfaction and retention. In 2023, ASMPT reported a 15% increase in service revenue, showcasing the value of their support.

- Global Reach: ASMPT operates service centers in key regions, including North America, Europe, and Asia.

- Service Revenue: In 2024, service revenue is projected to account for 20% of total revenue.

- Customer Satisfaction: ASMPT aims for a 95% customer satisfaction rate through its support services.

- Training Programs: ASMPT offers comprehensive training programs to ensure customers can effectively use their equipment.

ASMPT offers advanced tech solutions for semiconductor and electronics manufacturing, improving efficiency and boosting productivity. Their diverse product range simplifies procurement with a one-stop solution. ASMPT excels at customized solutions, tailoring equipment to meet specific customer needs, fostering strong partnerships. In 2024, ASMPT's revenue was approximately HK$18.5 billion, reflecting its success.

| Value Proposition | Description | 2024 Stats |

|---|---|---|

| Advanced Tech Solutions | Focus on semiconductor and electronics manufacturing equipment. | Semiconductor equipment market projected to reach $130 billion. |

| Comprehensive Product Range | One-stop solutions from wafer deposition to assembly. | Revenue: approximately $6.5 billion. |

| Customized Solutions | Tailored equipment and software to meet specific needs. | Revenue: approximately HK$18.5 billion. |

| Smart Factory Integration | Seamless integration for real-time data and better decisions. | Operational costs reduced by up to 20%. |

| Global Support | Worldwide service network for timely assistance. | Service revenue projected to account for 20% of total. |

Customer Relationships

ASM Pacific Technology's business model thrives on dedicated account management. This approach ensures personalized support and strong customer relationships. Account managers act as a single point of contact. This fosters trust and boosts customer loyalty, crucial for repeat business. In 2024, ASM Pacific reported a customer satisfaction score of 85% due to these efforts.

ASMPT offers robust technical support, crucial for resolving equipment and software issues. Their support team provides timely assistance, minimizing downtime. This commitment boosts customer satisfaction, fostering loyalty. In 2024, ASMPT's customer satisfaction scores increased by 15% due to improved support response times.

ASMPT provides training programs to ensure clients effectively use their equipment. These programs cover basic operation through advanced troubleshooting. This approach boosts customer satisfaction, fostering long-term partnerships. In 2024, ASMPT invested $25 million in customer training initiatives. This investment led to a 15% increase in customer satisfaction scores.

Online Resources

ASM Pacific Technology's online resources, including documentation and FAQs, offer customers self-service support. These resources are accessible around the clock, enabling quick issue resolution. This approach boosts customer satisfaction and eases the load on support teams. In 2024, the company invested $50 million in digital customer service platforms.

- 24/7 Availability: Self-service resources are available at all times.

- Cost Reduction: Reduces the need for extensive technical support staff.

- Customer Satisfaction: Improves the customer experience.

- Digital Investment: Significant investment in digital platforms in 2024.

Feedback Mechanisms

ASMPT establishes feedback mechanisms to understand customer needs. This includes surveys and forums for gathering insights and improving products. Active customer feedback helps identify areas for enhancement. This drives customer satisfaction and long-term partnerships. In 2024, ASMPT's customer satisfaction scores increased by 15% due to these efforts.

- Customer satisfaction scores increased by 15% in 2024.

- Surveys and forums are key feedback tools.

- Feedback helps identify product improvement areas.

- Continuous improvement enhances partnerships.

ASM Pacific Technology prioritizes strong customer relationships through dedicated account management, ensuring personalized support and high satisfaction. They offer robust technical support with quick issue resolution, leading to improved customer satisfaction and loyalty. Furthermore, ASMPT invests in customer training and provides accessible online resources, enhancing the customer experience. In 2024, ASMPT's customer satisfaction scores increased by 15% due to improved support response times.

| Customer Relationship Strategy | Description | 2024 Metrics |

|---|---|---|

| Account Management | Dedicated support, single point of contact | Customer Satisfaction: 85% |

| Technical Support | Timely assistance to minimize downtime | Support Response Time Improvement: 15% |

| Customer Training | Programs for effective equipment use | Investment in Customer Training: $25M |

Channels

ASMPT's direct sales force cultivates strong customer relationships, crucial for understanding their needs. This approach enables personalized support and tailored solutions, boosting customer satisfaction. In 2024, ASMPT's revenue reached $6.4 billion, reflecting the success of their customer-centric strategy. This direct engagement helps drive sales growth.

ASMPT leverages distribution partners to broaden its market presence, ensuring global customer access. In 2024, this strategy supported ASMPT's expansion into emerging markets, contributing to a 15% increase in international sales. These partners offer localized support, boosting customer satisfaction and driving repeat business. This channel strategy is crucial for ASMPT's revenue growth, with distribution partners accounting for approximately 30% of total sales in 2024.

ASMPT actively uses trade shows and conferences. They display new products and technology, attracting a wide customer base. These events help network with industry experts, generate leads, and boost brand recognition. This channel boosts sales and increases market visibility. In 2024, ASMPT participated in several key industry events, reporting a 15% increase in lead generation through these channels.

Online Marketing

ASM Pacific Technology (ASMPT) leverages online marketing to engage a global audience, using its website, social media, and digital ads to generate leads. Customers can access product information, technical resources, and support through ASMPT's online channels. This strategy boosts brand awareness and sales leads, crucial in the competitive semiconductor industry. In 2024, ASMPT's digital marketing spend likely reflects the industry's shift towards online engagement.

- Global Reach: Enables ASMPT to connect with customers worldwide.

- Lead Generation: Drives potential sales through targeted online campaigns.

- Customer Support: Provides resources and assistance to users of ASMPT products.

- Brand Awareness: Enhances ASMPT's visibility and reputation in the market.

Webinars and Online Demonstrations

ASMPT leverages webinars and online demos to showcase its tech, letting customers see equipment in action and ask experts questions. This approach aids informed purchasing decisions and boosts sales. In 2024, ASMPT likely held numerous online events, given the trend of digital marketing. This channel strategy is cost-effective for global reach and supports customer engagement.

- Webinars and demos offer detailed product insights.

- Online events facilitate direct Q&A with experts.

- This channel strategy expands global market reach.

- It supports ASMPT's digital marketing initiatives.

ASMPT's channels include a direct sales force and distribution partners, ensuring broad market coverage and strong customer relationships. These channels are enhanced by trade shows, conferences, and digital marketing, boosting brand visibility and lead generation. ASMPT uses webinars and online demos to showcase its tech, facilitating informed purchasing decisions.

| Channel | Description | Impact |

|---|---|---|

| Direct Sales | Personalized customer support. | Drives sales; 2024 revenue $6.4B |

| Distribution Partners | Global reach, localized support. | 15% increase in international sales. |

| Trade Shows/Conferences | Showcase products, network. | 15% lead generation increase. |

Customer Segments

Semiconductor manufacturers are ASMPT's key customers, needing assembly and packaging equipment. These manufacturers produce diverse devices like microprocessors and memory chips. In 2024, the semiconductor industry's global revenue reached approximately $573 billion. ASMPT's success depends on satisfying this crucial segment.

Electronics manufacturers are a crucial customer segment for ASMPT, utilizing its equipment for surface mount technology (SMT) and assembly. These manufacturers produce smartphones, computers, and automotive electronics, among others. ASMPT's diverse solutions and expertise cater to this segment. In 2024, the global SMT equipment market was valued at approximately $5.5 billion, a key area for ASMPT.

OSAT providers are a crucial customer segment for ASMPT, offering assembly and testing services for chipmakers. They need reliable, high-throughput equipment. ASMPT's solutions help OSATs deliver quality services. The OSAT market was valued at $47.5 billion in 2024, growing steadily. ASMPT's revenue from OSATs is significant.

Automotive Industry

The automotive sector is a crucial customer segment for ASM Pacific Technology, demanding sophisticated equipment for automotive electronics production. These clients manufacture a variety of items, including infotainment systems and electric vehicle components. Meeting this segment's needs calls for specialized solutions and expertise in semiconductor assembly. In 2024, the global automotive electronics market is estimated to be worth over $300 billion.

- Automotive electronics market value surpassed $300B in 2024.

- Focus on infotainment, ADAS, and EV components.

- Requires specialized equipment and expertise.

- ASM PT plays a key role.

LED Manufacturers

LED manufacturers are key customers, utilizing ASMPT's equipment to produce light-emitting diodes for diverse applications like displays and lighting. These manufacturers depend on high-precision equipment to guarantee the quality and performance of their LED products. ASMPT caters to this segment with specialized solutions designed to meet their unique demands. The LED market's growth, fueled by increasing adoption in automotive and display industries, drives demand for ASMPT's equipment.

- In 2024, the global LED market was valued at approximately $70 billion, with projected growth.

- ASMPT's revenue from its LED-related equipment sales in 2024 was about $1.5 billion, representing a significant portion of its overall revenue.

- Key applications include automotive lighting, which is growing at a rate of 15% annually.

- Demand is also driven by the expansion of microLED technology.

Customers include semiconductor, electronics, and LED manufacturers, and OSAT providers. ASMPT serves the automotive sector, which valued over $300B in 2024. These segments drive ASMPT's revenue and growth.

| Customer Segment | Description | 2024 Market Value/Revenue |

|---|---|---|

| Semiconductor Manufacturers | Produce diverse devices; require assembly equipment. | $573B (Global Revenue) |

| Electronics Manufacturers | Use SMT equipment for smartphones, computers. | $5.5B (Global SMT Market) |

| OSAT Providers | Offer assembly/testing for chipmakers. | $47.5B (OSAT Market) |

Cost Structure

Research and Development (R&D) expenses are a key cost driver for ASMPT, fueling innovation. ASMPT dedicates a large part of its revenue to R&D. In 2023, ASMPT spent around $280 million on R&D, showing their commitment to staying competitive. This investment is vital for their long-term strategy.

Manufacturing costs, encompassing materials, labor, and overhead, form a key part of ASMPT's expenses. Effective manufacturing processes and supply chain management are vital for cost control and profitability. ASMPT's gross profit margin was 40.5% in 2024, reflecting efficiency. Continuous improvement efforts focus on waste reduction, productivity gains, and supply chain optimization.

Sales and marketing expenses, vital for customer reach, cover salaries, commissions, advertising, and trade shows. These strategies drive sales and boost brand recognition.

In 2024, ASMPT's sales and marketing expenses were a significant portion of its operational costs, reflecting its commitment to market presence.

Effective allocation ensures ASMPT's competitiveness globally, as seen in its strategic investments.

These investments are crucial for sustaining and expanding market share, as indicated by industry benchmarks.

The company's focus on these areas is key for revenue generation and long-term growth.

Customer Support and Service Costs

Customer support and service expenses are a significant part of ASMPT's cost structure. These costs encompass salaries, training, and travel for support staff. Excellent customer service is key to keeping customers happy and encouraging them to buy again. Investing in these areas allows ASMPT to offer quick and efficient support to its clients.

- In 2024, ASMPT likely allocated a substantial portion of its SG&A expenses to customer support.

- Training programs ensure staff can handle ASMPT's complex equipment effectively.

- Travel costs are essential for on-site support and maintenance.

- High-quality support boosts customer loyalty and positive reviews.

Administrative Expenses

Administrative expenses are crucial for ASM Pacific Technology's operations, covering salaries, rent, and utilities. These costs are essential for running the business effectively. In 2024, ASM PT's administrative expenses were approximately $150 million, reflecting the scale of its operations. Effective cost management and streamlined processes are key to controlling these expenses and improving profitability.

- Administrative expenses are a significant cost component.

- Efficiency in these areas directly impacts profitability.

- Continuous improvement aims to reduce overhead.

- Focus on streamlining processes to cut costs.

Cost Structure includes R&D, manufacturing, sales, and customer support.

In 2024, ASMPT allocated significant funds to R&D, sales, and customer support to drive growth and maintain competitiveness. This shows their focus on innovation, customer satisfaction, and market reach.

Administrative costs were around $150 million, highlighting the scale of operations and the need for efficient cost management.

| Cost Category | Description | 2024 Data (Approximate) |

|---|---|---|

| R&D | Innovation, product development. | $280M |

| Manufacturing | Materials, labor, overhead. | Gross Profit Margin: 40.5% |

| Sales & Marketing | Advertising, market presence. | Significant portion of operational costs |

| Customer Support | Training, travel, salaries. | Significant SG&A Allocation |

| Administrative | Salaries, rent, utilities. | $150M |

Revenue Streams

Equipment sales are ASMPT's main revenue stream, significantly contributing to annual earnings. They offer assembly, packaging, and surface mount technology solutions. A robust sales approach and strong customer ties are crucial for boosting equipment sales. In 2024, ASMPT's revenue reached approximately HK$16.7 billion, with a notable portion derived from equipment sales.

Service and maintenance contracts are a key recurring revenue stream for ASMPT, securing continuous income through equipment upkeep and support. These contracts give customers assurance and boost their investment's worth. In 2023, ASMPT's service revenue reached approximately $500 million, showing its importance. Strong service and support are vital for customer retention and generating recurring revenue.

Spare parts sales are a key revenue stream for ASMPT, providing ongoing income as customers need replacements. Timely delivery and availability of parts are crucial for customer satisfaction and revenue maximization. In 2024, this segment likely contributed a significant portion of ASMPT's service revenue, which in previous years, like 2023, accounted for a considerable percentage of total revenue. This is essential for profitability.

Software Licenses and Upgrades

ASM Pacific Technology generates revenue through software licenses and upgrades. They offer advanced software to boost manufacturing efficiency. These upgrades provide access to new features, enhancing productivity. Continuous software innovation is vital for this income stream. In 2024, software and related services contributed significantly to ASMPT's revenue.

- Software licenses and upgrades contribute to recurring revenue.

- Customers gain access to the latest features, boosting efficiency.

- Continuous software innovation is essential for growth.

- In 2024, software services significantly impacted revenue.

Training and Consulting Services

ASMPT's training and consulting services create additional revenue streams by supporting customer success. These services equip clients with the expertise needed to optimize equipment and software use. This approach boosts customer satisfaction and encourages recurring business. The services include technical training, application support, and process optimization, enhancing product value. In 2024, ASMPT's services revenue is expected to contribute significantly to overall profitability.

ASMPT’s revenue model relies on diverse streams, including software licenses. Customers benefit from new features, boosting efficiency. Continuous innovation is crucial, with software services significantly impacting 2024 revenue.

| Revenue Stream | Description | 2024 Contribution |

|---|---|---|

| Software Licenses & Upgrades | Access to features, boosts efficiency. | Significant |

| Training & Consulting | Supports customer success. | Significant |

| Equipment Sales | Assembly and packaging. | HK$16.7 Billion |

Business Model Canvas Data Sources

The ASM Pacific Technology Business Model Canvas integrates market research, financial reports, and operational metrics. These sources inform strategic decisions.