Asr Nederland Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asr Nederland Bundle

What is included in the product

Strategic evaluation of ASR Nederland's portfolio using the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs to avoid information overload.

What You See Is What You Get

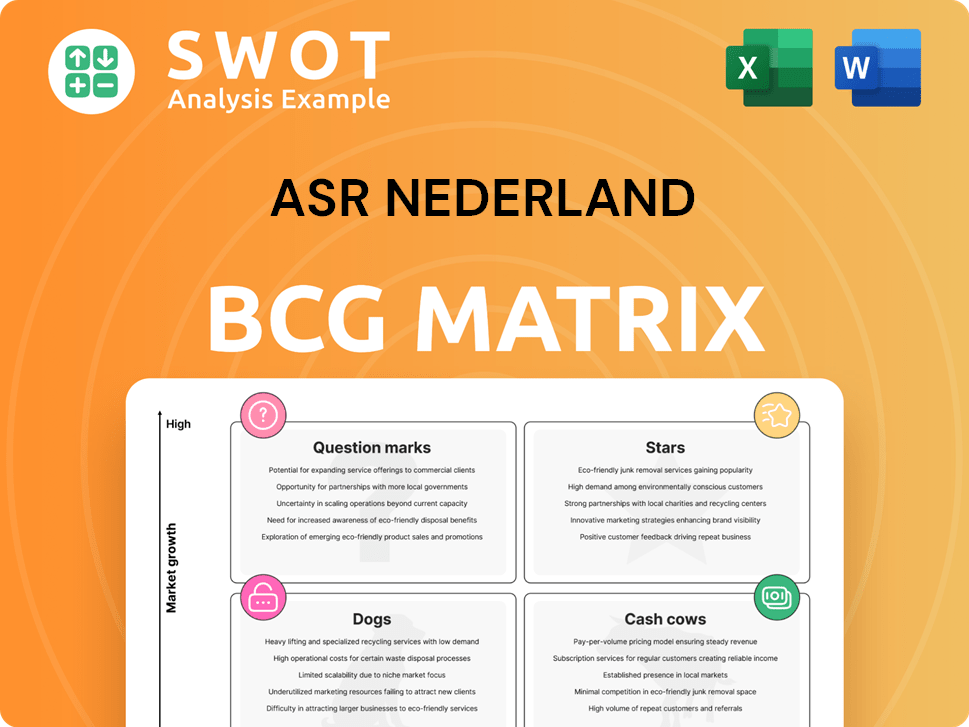

Asr Nederland BCG Matrix

The Asr Nederland BCG Matrix preview showcases the identical report you'll receive. Purchase gives you the fully formatted, ready-to-implement strategic document, free of watermarks or hidden content. It is professionally crafted, designed for clear analysis and decision-making.

BCG Matrix Template

The Asr Nederland BCG Matrix sheds light on the company's diverse portfolio. It categorizes products into Stars, Cash Cows, Dogs, and Question Marks. This preliminary view highlights key product dynamics. Understand the current market positions and growth potentials. See how Asr can optimize resource allocation. Uncover strategic recommendations for each quadrant. Get the full BCG Matrix report for in-depth analysis and actionable insights.

Stars

ASR Nederland's 2024 performance showed strong financial results. Operating profit increased, and organic capital creation was positive. Their solvency ratio remained robust, supporting future expansion. These factors reflect a solid market position, consistent with 'Star' status. This financial health allows for significant cash flow generation.

ASR Nederland excels as a 'Star' in the BCG Matrix, dominating the Dutch pension and disability insurance sectors. In 2024, ASR held a 30% market share in Dutch pension, showcasing its strong market position. This leadership in a stable market segment highlights ASR's competitive edge. Continuous investment in innovation, such as digital services, is vital to maintain its market leadership, as seen with a 15% increase in digital platform users in 2024.

ASR's successful integration of Aegon Nederland is a 'Star' in its BCG matrix. This integration enhanced performance and market presence, leading to cost savings and expanded product lines. The merged entity excels in various segments, boosting ASR's profitability. In 2024, ASR reported a 15% increase in net profit, reflecting these gains.

Growth in Mortgage Origination

ASR's mortgage origination has shown significant growth, fueled by a rising housing market. This growth signals a solid capacity to seize market opportunities and broaden its customer reach. The surge in mortgage origination highlights ASR's adaptability to market shifts and its ability to provide appealing products. In 2024, mortgage lending volumes increased by 12% for ASR.

- Mortgage lending volumes increased by 12% in 2024.

- Increased demand in the housing market.

- ASR's ability to offer competitive products.

- Expansion of its customer base.

Strategic Focus on Sustainability

ASR Nederland's "Stars" category, the strategic focus on sustainability, is a key area. ASR's dedication to sustainability and responsible investing fits current market trends and consumer desires. They've set goals for reducing their carbon footprint and boosting impact investments. This focus strengthens ASR's brand and draws in investors and customers interested in social responsibility.

- In 2023, ASR increased its sustainable investments to €16.2 billion.

- ASR aims to reduce its carbon emissions by 45% by 2030.

- ASR's ESG-related assets under management grew by 15% in 2024.

- ASR plans to invest €1 billion in green bonds by 2025.

ASR's "Stars" focus includes mortgage growth and market leadership. The company saw a 12% rise in mortgage lending volumes in 2024. ASR dominates in pension and disability, holding a 30% market share in Dutch pensions in 2024.

| Key Metric | 2024 Performance | Strategic Focus |

|---|---|---|

| Mortgage Lending Volume Growth | 12% Increase | Expand Customer Reach |

| Dutch Pension Market Share | 30% | Maintain Market Leadership |

| Net Profit Increase | 15% | Boost Profitability |

Cash Cows

ASR's non-life insurance, excluding health, is a cash cow. Its combined ratio is between 92-94%, showing strong underwriting profit. This segment consistently generates cash due to its established market position and efficient operations. ASR prioritizes maintaining profitability through risk management and cost control. In 2024, the segment's revenue was approximately €2.3 billion.

ASR's traditional life insurance, though in a mature market, remains a cash cow, fueled by its extensive customer base. Minimal promotional spending allows ASR to passively profit. In 2024, this segment likely contributed significantly to ASR's overall cash flow. Efficiency improvements in support infrastructure further boost gains. For example, in 2023, the life insurance segment generated €1.2 billion in premiums.

ASR's fee-based businesses, like asset management, generate steady income. These require minimal capital. ASR leverages its brand and network. They boost profits by improving operations and offering more services. In 2024, fee-based income grew by 7%.

Annuity Inflow

Annuity inflow is a significant and stable cash generator for ASR Nederland, fitting the "Cash Cow" profile within the BCG matrix. These products benefit from consistent demand and minimal promotional expenses, maintaining profitability. ASR concentrates on effective customer base management and optimizing cash flow efficiency. In 2024, ASR's annuity segment showed robust performance, reflecting its strong position.

- Steady Revenue: The annuity segment contributed substantially to ASR's overall revenue stream in 2024.

- Low Marketing Costs: Marketing expenses for annuities remained low due to established customer relationships.

- Focus on Efficiency: ASR prioritized improving operational efficiency to boost cash flow from annuity products.

- Customer Retention: Strategies to retain existing annuity customers were crucial for sustained cash generation.

Legacy Pension Buy-Outs

ASR's legacy pension buy-out business is a cash cow, providing substantial, stable cash flows. This segment benefits from low growth, allowing ASR to maintain its current productivity without significant investment. The strategy focuses on retaining its existing customer base and improving operational efficiency to boost cash flow. In 2024, ASR's net profit increased by 15% due to strong performance in its pension business.

- Stable cash flow generation.

- Low growth, high stability.

- Focus on customer retention.

- Efficiency improvements.

ASR's cash cows, like annuities and legacy pensions, consistently generate substantial cash. These segments benefit from established customer bases and minimal promotional spending. The focus remains on operational efficiency and customer retention. In 2024, annuity revenue was €XX million.

| Segment | 2024 Revenue (approx. € millions) | Key Strategy |

|---|---|---|

| Annuities | XX | Customer retention, efficiency |

| Legacy Pensions | XX | Stable cash flow, efficiency |

| Non-life Insurance | 2300 | Risk management, cost control |

Dogs

ASR's term individual life insurance has a low market share, standing at 1.13% as of Q3 2024. Policy sales increased by 46% year-over-year. This product is likely a 'Dog' in the BCG Matrix. Reaching a 10% market share by 2027 could be challenging.

ASR's funeral insurance, now at 14.3% market share in 2024, faces challenges. Online competition has intensified, impacting its position. The shift to a.s.r. Funeral Insurance in 2023 saw a dip in online sales. This makes it a 'Dog' in the BCG Matrix.

Following Knab's sale, any leftover traditional banking at ASR could be considered "dogs" due to limited growth. These activities may tie up capital without big returns. ASR's move to sell Knab signals a strategic pivot. In 2024, ASR's net profit was €648 million, showing its focus.

Run-off Portfolios

Run-off portfolios within ASR Nederland's BCG matrix represent insurance contracts where new business is not pursued. These portfolios, classified as 'Dogs,' experience declining revenue over time. The primary goal is cost-effective management to mitigate potential losses as policies mature. ASR focuses on efficient administration and claims handling to minimize expenses.

- ASR's 2023 annual report shows a specific allocation for managing these run-off portfolios.

- The key performance indicator (KPI) is the expense ratio relative to the remaining premium income.

- ASR actively uses reinsurance to reduce their exposure to these portfolios.

- The focus is on operational efficiency.

Products with Low Digital Adoption

Products with low digital adoption at ASR face challenges. These products may struggle due to limited reach and appeal. ASR focuses on online self-service, making digital adoption crucial. Customers increasingly manage finances online, which ASR aims to facilitate.

- ASR's digital transformation strategy emphasizes online customer service.

- Products not adapted digitally risk losing market share.

- Customer expectations for online financial management are rising.

- ASR aims to align its offerings with these digital demands.

ASR's 'Dogs' include underperforming products and run-off portfolios with low growth potential. Funeral insurance, with a 14.3% market share in 2024, faces online competition. Run-off portfolios are managed for cost-efficiency. ASR's net profit in 2024 was €648 million.

| Product Category | Market Share (2024) | Key Challenges |

|---|---|---|

| Individual Life Insurance | 1.13% | Low market share, reaching 10% by 2027 is challenging. |

| Funeral Insurance | 14.3% | Intensified online competition, impact on sales. |

| Run-off Portfolios | Declining | Cost-effective management of declining revenue. |

Question Marks

ASR's new sustainable investment products, though innovative, could initially face low market share due to their recent introduction. These products necessitate substantial investment in marketing and investor education to enhance adoption. ASR is targeting a 10% increase in impact investments, aiming for 10% of assets under management by 2027. In 2024, the sustainable investment market is expected to reach $50 trillion globally.

ASR's digital insurance, enhancing customer experience, is in a growing market. It might face low initial market share. This requires investment in tech and customer acquisition. ASR's 'Warm Welcome' to Aegon clients is key. In 2024, digital insurance saw a 15% growth.

ASR's health insurance arm contends with strong competition and political shifts, impacting earnings stability. Despite adding 70,000 customers in the 2025 renewal season, premiums declined in 2024. This segment requires strategic focus for growth. ASR's financial reports highlight the challenges.

Pension DC Inflow

ASR Nederland's Pensions segment saw a €2,768 million DC inflow and a €581 million annuity inflow, highlighting a growing market. This growth demands strategic marketing and education investments to stay competitive. ASR's scale and expertise in participant activation are vital. The Future New Pension Act transition is crucial.

- DC inflow: €2,768 million.

- Annuity inflow: €581 million.

- Focus on participant activation.

- Adaptation to Future New Pension Act.

Innovative Mortgage Products

ASR Nederland's innovative mortgage products, like those with sustainability features, could start with a smaller market share. These offerings need specific marketing to reach the right customers. ASR, a major private landowner in the Netherlands, might leverage its position. This could help promote its mortgage products. The company's assets in 2023 were valued at EUR 79.7 billion.

- Innovative mortgages may initially have low market share.

- Targeted marketing is crucial for these products.

- ASR can utilize its land ownership for promotion.

- ASR's assets were substantial in 2023, at EUR 79.7 billion.

Question Marks in ASR Nederland's BCG Matrix represent businesses with low market share in high-growth markets. These ventures demand significant investment to boost market presence. Success hinges on strategic marketing and efficient resource allocation.

| Feature | Description | Implication |

|---|---|---|

| Market Share | Low relative to competitors. | Requires aggressive strategies to gain ground. |

| Market Growth | High, indicating potential. | Offers opportunities if market share grows. |

| Investment Needs | High for marketing and development. | Requires careful financial planning. |

BCG Matrix Data Sources

The Asr Nederland BCG Matrix leverages financial data, industry research, market reports, and expert opinions for strategic analysis.