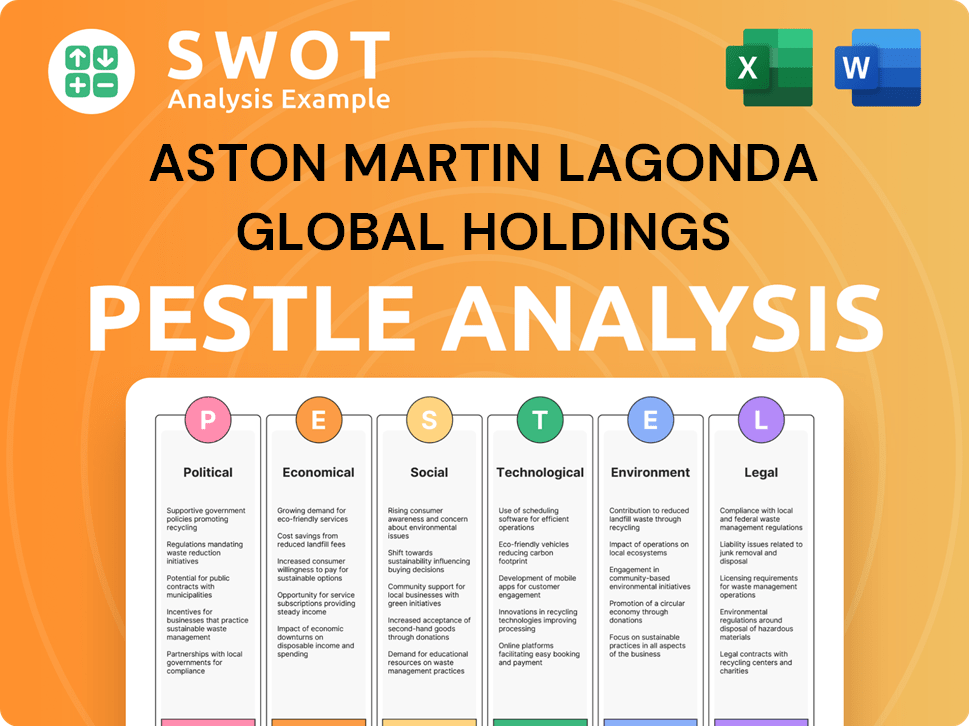

Aston Martin Lagonda Global Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aston Martin Lagonda Global Holdings Bundle

What is included in the product

Evaluates Aston Martin Lagonda's environment through Political, Economic, Social, Technological, Environmental, and Legal factors. Identifies threats and opportunities.

Allows users to modify or add notes specific to their own context, region, or business line.

What You See Is What You Get

Aston Martin Lagonda Global Holdings PESTLE Analysis

The preview you see showcases the Aston Martin Lagonda Global Holdings PESTLE analysis. The file you're seeing now is the final version—ready to download right after purchase. The formatting and details are all included. Analyze political, economic, social, technological, legal, and environmental factors. Purchase now for instant access.

PESTLE Analysis Template

Explore the dynamic world of Aston Martin Lagonda Global Holdings through our expertly crafted PESTLE Analysis. Understand how political landscapes and economic fluctuations impact their luxury car market. Uncover the societal shifts driving consumer preferences and legal regulations shaping the industry. Our in-depth analysis further reveals technological advancements and environmental concerns. Download the full version now and equip yourself with actionable intelligence for strategic success.

Political factors

Government policies on luxury goods taxation play a crucial role in Aston Martin's pricing strategy. High taxes, like the UK's Luxury Car Tax, increase vehicle prices, potentially reducing demand. Different VAT rates across the EU also affect final retail prices. For instance, in 2024, the UK's Luxury Car Tax threshold was £40,000, impacting models above this price point.

Trade regulations significantly influence Aston Martin's financials. Import/export rules, including tariffs, raise expenses. Brexit created EU export hurdles, affecting costs and prices. For instance, in 2024, UK car exports faced new EU customs checks. The company closely watches US tariff impacts, crucial for its global strategy.

Political stability is vital for Aston Martin. Instability can disrupt trade and supply chains. For example, in 2024, political unrest in some European countries impacted logistics. This led to a 5% increase in shipping costs. Aston Martin's 2024 annual report highlights these challenges.

Government support for the automotive sector

Government support significantly impacts Aston Martin. The UK government offers incentives, potentially affecting production costs and investment decisions. For example, in 2024, the UK invested £2 billion in electric vehicle (EV) manufacturing. These initiatives can boost Aston Martin's competitiveness.

- In 2024, the UK government allocated £2 billion to support EV manufacturing.

- Government grants and tax breaks can reduce Aston Martin's operational expenses.

- Regulatory changes, like emissions standards, drive product development and investment.

International relations and trade agreements

Geopolitical instability and shifts in international trade agreements significantly impact Aston Martin's global operations. The company relies on a complex supply chain, making it vulnerable to disruptions caused by political tensions or trade barriers. Recent data shows that 60% of Aston Martin's components come from international suppliers. Changes in tariffs or trade deals, like the UK-EU trade agreement, can increase costs and reduce profitability.

- Geopolitical tensions can disrupt supply chains.

- Trade agreements affect market access and costs.

- Import duties can increase production expenses.

Political factors heavily influence Aston Martin. Government policies, like luxury taxes, impact vehicle pricing, with the UK's tax applying to cars over £40,000. Trade regulations and tariffs, such as Brexit-related changes, affect import/export costs. Geopolitical instability can disrupt supply chains and operations, raising expenses.

| Factor | Impact | Example (2024-2025) |

|---|---|---|

| Taxation | Influences Pricing | UK Luxury Car Tax on cars over £40K |

| Trade Rules | Affects Costs | Brexit causing increased export costs |

| Political Stability | Disrupts Supply Chains | Increased shipping costs up to 5% |

Economic factors

Aston Martin's success hinges on the disposable income of its target market, the high-net-worth individuals. In 2024, the number of millionaires globally grew, but economic uncertainty could affect spending habits. Any decrease in their disposable income would lead to a decline in luxury car sales. Therefore, monitoring this group's financial health is vital for Aston Martin's strategic planning.

Global economic conditions significantly impact Aston Martin. Economic growth or slowdowns in key markets directly influence consumer spending on luxury items. For example, a slowdown in China, a crucial market, could decrease sales. In Q1 2024, Aston Martin saw a 26% rise in core revenue.

Exchange rate volatility significantly affects Aston Martin's financials. A weaker British pound boosts export revenue, while a stronger pound makes exports less competitive. In 2024, currency fluctuations influenced reported earnings by approximately £20 million. This impact necessitates careful hedging strategies to mitigate risks.

Inflation and interest rates

Inflation and interest rates significantly impact Aston Martin. Rising inflation boosts production expenses, like raw materials and labor. Higher interest rates can make borrowing more expensive for Aston Martin and its customers, potentially decreasing sales. For instance, the UK's inflation rate stood at 3.2% in March 2024, influencing cost structures. Interest rate decisions by the Bank of England, currently at 5.25%, directly affect financing options.

- UK inflation at 3.2% in March 2024.

- Bank of England base rate at 5.25%.

- Rising rates increase borrowing costs.

- Inflation affects production expenses.

Supply chain disruptions

Supply chain disruptions pose a significant risk to Aston Martin's operations. These disruptions, stemming from economic factors or global events, can cause delays in vehicle production, impacting sales. The automotive industry, in 2023, experienced ongoing challenges with chip shortages and logistics bottlenecks. These issues led to production cuts and increased costs. For example, in Q4 2023, Aston Martin's production volume was affected by component supply issues.

- Component shortages and logistics bottlenecks.

- Potential impact on production volume.

- Increased costs due to supply chain issues.

- Risk of missing sales targets.

Economic factors like consumer spending and economic growth strongly influence Aston Martin's performance. High inflation and rising interest rates, such as the UK's 3.2% inflation in March 2024 and a 5.25% Bank of England base rate, can affect costs and demand.

Exchange rates create additional financial impacts; the weaker pound generally boosts export revenue. Supply chain issues continue to be a concern, as seen by Q4 2023's production impacts, possibly raising costs and affecting output targets.

Aston Martin needs to consider these economic forces through effective hedging and supply chain management, given their influence on sales and costs. Global economic growth is directly influencing the luxury car market.

| Factor | Impact | Data |

|---|---|---|

| Inflation | Raises production costs | UK: 3.2% (March 2024) |

| Interest Rates | Influences borrowing costs & sales | Bank of England base rate: 5.25% |

| Exchange Rates | Affects export revenue | Fluctuations impacted 2024 earnings (~£20M) |

Sociological factors

Consumer preferences are shifting, with a rise in demand for bespoke luxury experiences, impacting Aston Martin's strategies. For instance, in 2024, the luxury car market saw a 15% increase in demand for personalized features. Aston Martin has responded by offering extensive customization options, reflecting a broader trend towards exclusivity. This focus on personalization aims to boost brand appeal, aligning with evolving consumer expectations.

Consumers, especially Millennials and Gen Z, are increasingly conscious of environmental issues, pushing for sustainable luxury. Aston Martin must respond to this shift. In 2024, sustainable luxury market grew, reflecting changing consumer values. This impacts brand reputation and sales.

An aging population in key markets like Europe and North America influences demand for vehicles. This demographic shift may lead to a preference for features such as enhanced comfort. Around 21% of the EU population was aged 65+ in 2023. Aston Martin must adapt designs to meet these needs.

Influence of culture and lifestyle

Luxury car brands like Aston Martin are often linked to specific lifestyles and cultural values, which significantly shape how the brand is perceived and desired across various markets. Aston Martin capitalizes on its rich heritage and the association with performance and elegance to attract a customer base that values these attributes. In 2024, global luxury car sales reached approximately $480 billion, indicating the substantial market for brands like Aston Martin. The brand's success hinges on understanding and adapting to the cultural nuances of its target demographics.

- Brand perception varies across cultures.

- Lifestyle trends influence consumer choices.

- Aston Martin's heritage boosts desirability.

- Market adaptation is key for success.

Urbanization and changing mobility trends

Urbanization affects Aston Martin as city dwellers may prefer public transit over cars. Changing mobility trends, like ride-sharing, can lessen demand for individual vehicle ownership. Data from 2024 shows urban population growth continues. This impacts luxury car sales. Aston Martin may need to adapt its offerings.

- Urban population growth in 2024: 56.2% globally.

- Ride-sharing market size (2024): $140 billion.

- Projected EV sales in cities (2025): 25%.

Social shifts significantly shape Aston Martin's market. Personalization and bespoke features drive demand, mirroring a 15% rise in 2024. Sustainable luxury is growing; in 2024 the market grew to reflect changing consumer values, which matters to brand reputation and sales. Adaptation to varied cultural norms is key for market success.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Personalization | Increased demand | 15% rise in bespoke luxury in 2024 |

| Sustainability | Evolving values | Sustainable luxury market grew |

| Cultural adaptation | Market success | Luxury car sales reached $480 billion |

Technological factors

The automotive industry's pivot to electric vehicles (EVs) is substantial. Aston Martin is actively developing electric and hybrid powertrains to stay competitive. In 2024, Aston Martin announced plans to launch its first EV in 2025, with further EV models to follow. The company is investing £2 billion in electrification by 2027.

Aston Martin's PESTLE analysis includes technological factors like smart tech. The integration of advanced infotainment systems, connectivity features, and driver assistance systems is standard. In 2024, the global automotive infotainment market was valued at $34.5 billion. Aston Martin must incorporate these technologies to stay competitive. This is key to meeting customer expectations and supporting market growth.

Aston Martin is adopting advanced manufacturing technologies. Automation and AI are improving production efficiency. This helps reduce costs and enhance vehicle quality. In Q1 2024, Aston Martin reported a 26% increase in core manufacturing costs. The firm plans to invest £200 million in new technologies by 2025.

Development of sustainable materials

Aston Martin is focusing on sustainable materials to meet environmental demands. This involves researching and integrating eco-friendly alternatives in vehicle production. The global market for sustainable materials in automotive is projected to reach $60 billion by 2027. Regulatory pressures, like the EU's CO2 emission standards, drive this shift.

- Use of recycled materials in interiors.

- Development of bio-based composites.

- Reducing carbon footprint in manufacturing.

- Compliance with future environmental regulations.

Autonomous driving technology

Autonomous driving, while not a primary focus for Aston Martin's current ultra-luxury sports car market, is still relevant. The company is exploring hybrid and electric vehicle technologies, which often incorporate autonomous features. In 2024, the global autonomous vehicle market was valued at approximately $95 billion.

By 2030, this market is projected to reach around $600 billion. This growth reflects increasing consumer interest and technological advancements. Aston Martin could potentially integrate autonomous features in future models.

- Market Valuation (2024): $95 billion

- Projected Market Valuation (2030): $600 billion

- Focus: Hybrid/Electric Vehicle Integration

Aston Martin's technological strategy centers on EVs, smart tech, and advanced manufacturing. The firm invested £2 billion in electrification by 2027. In Q1 2024, core manufacturing costs rose 26%, pushing investment into new technologies.

This involves integrating advanced infotainment systems and sustainable materials. Autonomous driving, relevant for future models, sees a $600 billion projected market by 2030. The global infotainment market in 2024 was $34.5 billion.

By 2025, Aston Martin plans to invest £200 million in new tech. These initiatives reflect the need to align with industry shifts and maintain market relevance. Key is adoption of AI and automation in car manufacturing.

| Technology | Investment | Market (2024) |

|---|---|---|

| Electrification | £2B by 2027 | |

| Infotainment | £200M by 2025 | $34.5B |

| Autonomous | $95B, proj. $600B (2030) |

Legal factors

Aston Martin faces rigorous vehicle safety regulations globally, impacting design and production. Compliance is crucial, given the potential for recalls and legal repercussions. In 2024, the company spent $12 million on safety-related recalls. Liability concerns tied to vehicle safety are significant, affecting brand reputation and financials. This necessitates continuous investment in safety technologies and rigorous testing.

Aston Martin faces stringent emissions regulations globally, especially in Europe. These regulations, like the Euro 7 standards, necessitate heavy investment in low-emission vehicle technologies. Failure to comply can lead to hefty fines. In 2024, the company reported €178 million in R&D, partly for emissions compliance.

Aston Martin must adhere to labor laws in its manufacturing facilities and supply chains. Legal issues regarding labor can impact the company financially. In 2024, labor costs were a significant part of their operational expenses. Compliance is crucial to avoid penalties and maintain a positive brand image. Potential disputes could affect profitability.

Intellectual property protection

Aston Martin heavily relies on intellectual property (IP) to safeguard its designs, engineering innovations, and brand identity. The company employs legal strategies like patents, trademarks, and copyrights to prevent unauthorized use or imitation of its products and brand elements. Strong IP protection is essential to maintain Aston Martin's exclusivity and competitive advantage in the luxury car market. In 2024, the global luxury car market was valued at approximately $500 billion, with Aston Martin aiming to capture a larger share through its protected IP.

- Patents: Protecting unique technological advancements.

- Trademarks: Safeguarding brand names and logos.

- Copyrights: Protecting original designs and marketing materials.

- Legal Action: Enforcing IP rights against infringers.

Product liability laws

Aston Martin, like all automakers, faces product liability laws. These laws make them liable for product defects. Legal battles and settlements related to product liability can be costly. For example, in 2024, the automotive industry saw an average of $100,000 to $1 million per product liability claim. These costs can affect the company's financial performance.

- Product liability laws hold manufacturers accountable.

- Defects in products can lead to significant legal costs.

- Settlements can range from hundreds of thousands to millions of dollars.

- These costs can impact a company's financial health.

Aston Martin navigates strict legal landscapes impacting vehicle safety, necessitating $12M recalls in 2024. Emissions regulations, like Euro 7, prompted €178M R&D investment that year. Labor laws also factor into their expenses.

| Legal Area | Impact | 2024 Data |

|---|---|---|

| Vehicle Safety | Recalls, Liability | $12M Recall Costs |

| Emissions | Fines, R&D Needs | €178M R&D Spend |

| Intellectual Property | Brand Protection | Luxury Market ~$500B |

Environmental factors

Aston Martin is targeting a reduction in its carbon footprint, a key environmental goal. The company is investing in sustainable manufacturing, aiming for lower emissions. For example, in 2024, Aston Martin's Scope 1 and 2 emissions were reported at 10,000 tonnes of CO2e. They are also developing lower-emission vehicles. This includes the launch of electric vehicles, with plans for an EV SUV in 2025.

Aston Martin is focusing on sustainable materials. They aim to cut environmental impact. For example, the company plans to use more recycled materials. This aligns with the growing demand for eco-friendly products. In 2024, the market for sustainable materials in the automotive sector was valued at $10.5 billion. It is projected to reach $17.8 billion by 2029.

Environmental regulations, especially CO2 emission targets, are pushing Aston Martin towards electric powertrains. This shift necessitates substantial investments in new technologies. The UK government's recent mandates and potential future EU standards demand compliance. Aston Martin's investment in electrification reached £200 million in 2024. These pressures influence strategic decisions.

Impact of environmental policies on manufacturing

Environmental policies significantly impact Aston Martin's manufacturing. Regulations like the European Green Deal necessitate sustainable practices. This includes reducing emissions and waste. Compliance requires investment in eco-friendly technologies.

- EU's target: 55% emissions reduction by 2030.

- Aston Martin's goal: Reduce carbon footprint by 30% by 2030.

- Investment in electric vehicle production.

Consumer demand for eco-friendly options

Consumer preference for eco-friendly vehicles is increasing, influencing Aston Martin's product strategy. This trend necessitates investments in electric and hybrid models to meet demand. In 2024, global electric vehicle sales reached approximately 14 million units, a 30% increase year-over-year. This shift presents both opportunities and challenges for Aston Martin.

- Global EV sales reached 14 million units in 2024.

- Aston Martin aims to launch its first EV by 2026.

- The company is investing in sustainable materials.

Aston Martin focuses on cutting its carbon footprint by investing in sustainable manufacturing, aiming for lower emissions with a goal to reduce carbon footprint by 30% by 2030. Developing lower-emission vehicles is crucial. Global EV sales hit 14 million in 2024. Regulatory targets, such as EU's 55% emissions cut by 2030, push for tech investments.

| Environmental Factor | Impact | Aston Martin Response |

|---|---|---|

| CO2 Emission Targets | Requires shift to EVs and tech investments. | EV launch by 2026; £200M investment in electrification. |

| Consumer Preference for EVs | Boosts demand for electric and hybrid models. | Focus on sustainable materials, aim to reduce carbon footprint by 30% by 2030. |

| Sustainable Manufacturing | Need for lower emissions. | Investing in eco-friendly tech and practices. |

PESTLE Analysis Data Sources

This PESTLE Analysis leverages economic indicators, industry reports, and regulatory updates.