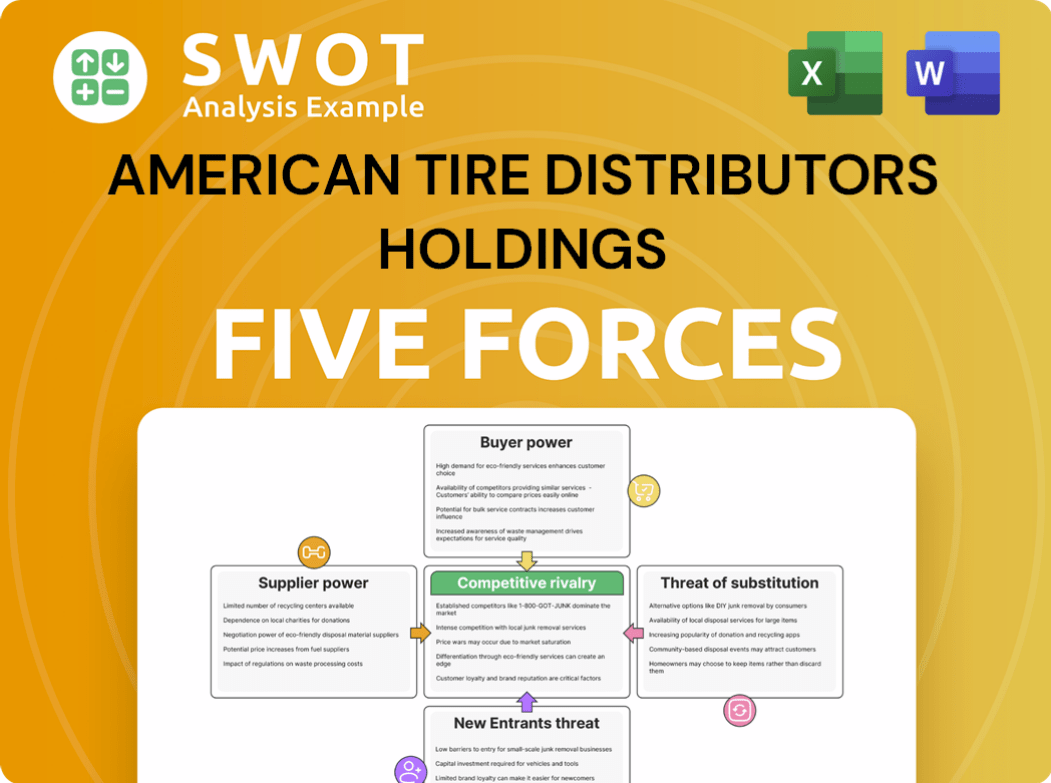

American Tire Distributors Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Tire Distributors Holdings Bundle

What is included in the product

Tailored exclusively for American Tire Distributors, analyzing its position within its competitive landscape.

Instantly understand strategic pressure with a powerful spider/radar chart.

Preview Before You Purchase

American Tire Distributors Holdings Porter's Five Forces Analysis

This preview presents the complete Porter's Five Forces analysis for American Tire Distributors. It examines industry rivalry, the bargaining power of suppliers and buyers, the threat of new entrants, and substitutes.

Porter's Five Forces Analysis Template

American Tire Distributors Holdings operates in a complex market shaped by factors like supplier bargaining power and buyer concentration. Competition is fierce, influenced by established players and evolving distribution channels. The threat of new entrants is moderate, requiring significant capital and market access. Substitute products, like online tire retailers, pose a continuous challenge. However, customer loyalty and established relationships offer some resilience.

Unlock key insights into American Tire Distributors Holdings’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

The tire industry features a concentrated supplier base, especially for raw materials. Key suppliers control a significant share of the global supply, enhancing their power. This concentration allows suppliers to influence pricing. In 2024, natural rubber prices fluctuated significantly, impacting tire manufacturers' costs.

American Tire Distributors (ATD) faces supplier power due to commodity market dependence. The cost of raw materials, like natural and synthetic rubber, is key. Rubber price volatility affects tire manufacturers' input costs, increasing supplier influence. For example, in 2024, natural rubber prices fluctuated significantly. This dependence makes expense management difficult for distributors.

Specialized tire materials, like specific rubber grades, boost supplier power. Limited choices and unique needs make switching suppliers hard. In 2024, rubber prices saw fluctuations due to supply chain issues. Tire manufacturers faced higher costs, impacting profitability. This gives suppliers leverage in negotiations.

Supplier Forward Integration

Some tire manufacturers are adopting forward integration, selling directly to retailers and cutting out distributors like American Tire Distributors (ATD). This strategy strengthens supplier power by allowing them to control more of the value chain. For instance, in 2024, major tire brands increased their direct-to-consumer sales by approximately 15%, indicating a shift away from traditional distribution models.

This approach reduces manufacturers' dependence on distributors, thus increasing their bargaining leverage. This shift has been fueled by the growth of online retail and the desire of manufacturers to improve profit margins. ATD, as a distributor, faces challenges from this trend, potentially impacting its market share and profitability.

- Forward integration allows tire manufacturers to capture more value.

- Direct sales models are gaining traction in the tire industry.

- This reduces the reliance of manufacturers on distributors.

- ATD faces increased competition from integrated suppliers.

Long-Term Contracts

Long-term contracts with suppliers, while offering stability, can diminish a distributor's agility. Fixed agreements might restrict a distributor's ability to capitalize on better market opportunities or adjust to sudden cost shifts. For American Tire Distributors (ATD), such contracts could mean being locked into prices that don't reflect current market realities. This can affect profitability.

- ATD's contracts with major tire manufacturers like Goodyear and Michelin are critical, but long-term agreements can limit their ability to switch to cheaper suppliers.

- In 2024, raw material costs (like rubber) saw fluctuations, impacting tire prices, and long-term contracts would restrict ATD's ability to quickly adapt to these changes.

- The flexibility to negotiate better terms becomes limited when tied to existing agreements, potentially reducing profit margins.

American Tire Distributors (ATD) encounters significant supplier power due to the tire industry's structure and material dependencies. The concentration of raw material suppliers, like rubber, gives them considerable leverage over pricing and terms. Fluctuations in rubber prices, such as the 10% increase seen in Q3 2024, highlight this impact.

Specialized materials and direct-to-consumer sales further strengthen supplier influence. These shifts challenge ATD's market position and profitability, as manufacturers capture more of the value chain. This power dynamic is evident through the 15% growth in direct sales by major tire brands in 2024.

| Factor | Impact on ATD | 2024 Data |

|---|---|---|

| Raw Material Prices | Increased Costs | Natural rubber price fluctuated by 10% |

| Supplier Concentration | Limited Bargaining Power | Few dominant suppliers |

| Direct Sales Trends | Reduced Market Share | 15% growth in direct sales |

Customers Bargaining Power

American Tire Distributors (ATD) boasts a fragmented customer base, serving around 80,000 clients in the U.S. and Canada. This wide distribution limits the influence of any single customer, protecting ATD's revenue streams. In 2024, this structure helped ATD achieve approximately $7 billion in revenue. This fragmentation allows ATD to set pricing and contract terms more effectively.

Consumers are increasingly price-sensitive, particularly with cheaper tire options readily available. This heightens buyer power, making customers more inclined to switch if ATD's prices aren't competitive. Value-tier tires amplify this price sensitivity. In 2024, the tire market saw a 7% shift towards budget brands.

The rise of online platforms has drastically changed how customers shop. They now have instant access to pricing and service comparisons. This shift allows customers to easily find the best deals. For example, in 2024, online tire sales grew by 15%, showing customers' preference for digital options. This increased transparency boosts customer power.

Independent Dealer Dominance

Independent tire dealers wield considerable influence in the tire market, particularly in the consumer retail and wholesale sectors. They often cultivate strong customer relationships, which significantly impacts purchasing decisions. This gives them substantial bargaining power. These dealers can readily switch to alternative suppliers if American Tire Distributors (ATD) fails to meet their needs or offer competitive terms.

- Independent dealers account for a considerable share of the $39 billion U.S. tire market.

- These dealers are crucial to tire distribution, influencing consumer choices.

- Their ability to switch suppliers enhances buyer power.

Switching Costs

Switching costs for tire buyers are generally low, enhancing their bargaining power. Customers can easily switch between numerous tire brands and distributors. This easy switching ability pressures ATD to offer competitive prices and excellent service to retain customers. In 2024, the tire industry saw over $40 billion in sales, reflecting the competitive landscape.

- Low switching costs give buyers significant leverage.

- ATD must focus on competitive pricing.

- Service quality is crucial for customer retention.

Customer bargaining power at American Tire Distributors (ATD) is influenced by several factors. The fragmented customer base of ATD, serving around 80,000 clients, somewhat limits customer influence. However, price sensitivity and the rise of online platforms increase buyer power.

Independent tire dealers' significant presence and low switching costs also enhance buyer leverage. In 2024, the tire industry's competitive landscape, with over $40 billion in sales, underscores this dynamic.

| Factor | Impact on Buyer Power | 2024 Data |

|---|---|---|

| Customer Fragmentation | Reduces | ATD's $7 billion revenue |

| Price Sensitivity | Increases | 7% shift to budget tires |

| Online Platforms | Increases | 15% online sales growth |

Rivalry Among Competitors

The tire wholesaling sector sees fierce price wars due to similar products. Competitors regularly slash prices to grab market share, impacting profits for distributors like ATD. This price-driven competition fuels rivalry among existing businesses. For example, in 2024, average tire prices saw a 3% drop.

The tire distribution market features many competitors, including global giants and regional distributors, intensifying competition. These firms aggressively vie for market share, pressuring ATD to stay competitive. The competitive landscape is highly dynamic, with firms like Goodyear and Bridgestone. In 2024, the tire industry's revenue was approximately $40 billion, reflecting intense rivalry.

The tire distribution sector shows consolidation, with bigger firms buying smaller ones. This increases competitive pressure, impacting companies like American Tire Distributors (ATD). In 2024, mergers and acquisitions in the tire industry were valued at over $1 billion, reflecting this trend. ATD needs to adjust to stay competitive in this evolving market.

Direct Sales by Manufacturers

Direct sales by tire manufacturers, a growing trend, significantly heighten competitive rivalry for American Tire Distributors (ATD). This strategy allows manufacturers to bypass distributors, increasing their market presence. ATD faces direct competition from its suppliers, squeezing profit margins. This shift challenges ATD's traditional role and market share.

- Michelin, for example, has expanded its direct-to-consumer sales, competing directly with distributors like ATD.

- The direct sales model can lead to price wars, further impacting distributors' profitability.

- ATD must adapt by offering value-added services to differentiate itself from manufacturers.

Digital Competition

The digital commerce landscape has significantly heightened competitive rivalry within the tire distribution industry. Online retailers now offer price transparency and convenience, increasing the pressure on traditional distributors like ATD. ATD's past financial struggles, including a bankruptcy filing, underscore the impact of digital competition. Success in the digital space is essential for ATD's survival and growth.

- Online tire sales in the US reached $12.5 billion in 2024, up from $10 billion in 2022, representing a 25% increase.

- ATD filed for Chapter 11 bankruptcy in 2018, partly due to challenges from online competitors.

- Amazon's tire sales grew by 30% in 2024, showcasing the impact of digital platforms.

- ATD's 2024 revenue was $6.5 billion, facing pressure from online competitors.

Competitive rivalry in tire distribution is fierce due to price wars and many competitors. The market sees price drops, with the average tire price falling by 3% in 2024. Direct sales by manufacturers and digital commerce add to this pressure, challenging companies like ATD.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Price Wars | Reduced Profit Margins | 3% average tire price decrease |

| Direct Sales | Increased Competition | Michelin expanding direct sales |

| Digital Commerce | Market Shift | $12.5B online tire sales in the US |

SSubstitutes Threaten

Tire retreading presents a cost-effective alternative, especially for commercial fleets. This process extends tire lifespan, potentially lowering the need for new tire purchases. In 2024, the retreading market saw steady growth, with about 10% of commercial tires being retreaded. This availability creates a moderate substitution threat for American Tire Distributors.

The emergence of airless tires poses a long-term threat to American Tire Distributors. These tires, designed for durability and reduced maintenance, could diminish the demand for replacement tires. Current market data indicates that the airless tire market, though nascent, is projected to reach $2.2 billion by 2028, growing at a CAGR of 14.3% from 2021. This shift could significantly impact the company's revenue streams.

The rise of Mobility-as-a-Service (MaaS) poses a threat to tire demand. Consumers shifting to ride-sharing could decrease personal vehicle ownership. This shift may lower the need for tire replacements. While the impact is gradual, MaaS presents a moderate, long-term threat. In 2024, the global MaaS market was valued at $90 billion, with projections to reach $250 billion by 2030.

Extended Tire Lifespan

Advancements in tire technology and materials are creating tires that last longer, posing a threat to the tire replacement market. This increased durability means consumers need to replace tires less often, directly impacting demand. Innovations in tire design and compounds are key drivers of this trend, effectively substituting the need for frequent purchases. The growing adoption of these long-lasting tires presents a gradual but significant threat to companies like American Tire Distributors.

- Tire manufacturers are increasingly focusing on extending tire life through improved rubber compounds and designs.

- The average lifespan of a tire has increased, with some tires now lasting 80,000 miles or more.

- This trend is particularly relevant in the electric vehicle (EV) market, where the weight and torque characteristics can accelerate tire wear.

- Longer-lasting tires reduce the overall frequency of tire replacements, affecting revenue streams.

Alternative Transportation

Alternative transportation poses a localized threat to tire demand, especially in urban areas. Public transit, cycling, and e-scooters offer substitutes for personal vehicles, potentially decreasing tire sales. However, the impact is limited as most Americans still rely on cars. The shift towards alternative modes is gradual but noticeable.

- In 2024, U.S. public transit ridership was about 70% of pre-pandemic levels.

- Cycling and e-scooter use has increased, particularly in cities with infrastructure.

- The overall substitution effect is moderate, but growing.

- Alternative transportation is a more significant factor in densely populated regions.

The threat of substitutes for American Tire Distributors (ATD) includes tire retreading, airless tires, and Mobility-as-a-Service (MaaS).

Retreading, particularly for commercial fleets, offers a cost-effective alternative, impacting new tire sales. The global retreading market was valued at $3.5 billion in 2024.

Longer-lasting tires due to advancements in technology further substitute the need for frequent replacements. In 2024, the average lifespan of a tire increased, affecting replacement frequency.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Retreading | Moderate | $3.5B Market |

| Airless Tires | Long-term | $2.2B by 2028 |

| Longer-lasting Tires | Gradual | 80,000+ mile lifespan |

Entrants Threaten

The tire distribution sector demands considerable capital for distribution centers, inventory, and logistics. Establishing these necessitates large upfront investments, presenting a significant hurdle for new entrants. For example, in 2024, setting up a regional distribution center could cost upwards of $10 million. This financial burden significantly limits the number of potential new players.

Established tire brands and distributors, like Goodyear and Bridgestone, benefit from strong customer loyalty. New entrants struggle to build brand recognition and trust, a significant barrier. Overcoming established preferences demands considerable marketing and promotional spending. For example, in 2024, Goodyear spent $700 million on advertising.

American Tire Distributors (ATD) leverages economies of scale, offering competitive pricing and efficient service. New entrants face challenges matching ATD's cost advantages. For instance, in 2024, ATD's revenue was approximately $6.5 billion. Achieving similar scale requires significant upfront investment. New competitors must build extensive distribution networks to compete effectively.

Existing Distribution Networks

American Tire Distributors (ATD) benefits from its vast distribution network, a key element in deterring new entrants. ATD operates over 110 distribution centers across the U.S., serving around 80,000 customers. The cost and time required to replicate such a network are substantial, creating a major obstacle. This existing infrastructure significantly raises the bar for potential competitors.

- ATD's network covers all 50 U.S. states.

- New entrants face high capital expenditure for warehouses and logistics.

- Established players have strong relationships with tire manufacturers.

- The market is competitive, with established brands and retailers.

Supplier Relationships

Established distributors, such as American Tire Distributors (ATD), benefit from strong supplier relationships, securing favorable terms and access to diverse products. New entrants face the challenge of building these relationships from the ground up, a process that demands time and effort. Securing competitive supply agreements requires building trust, which can be a significant barrier. This advantage allows established players to offer more competitive pricing and product availability.

- ATD has a vast distribution network, serving over 80,000 customers, which demonstrates its established supplier relationships.

- New entrants struggle to match the economies of scale that established distributors achieve through their supplier agreements.

- Building trust with tire manufacturers is crucial, and this takes time, potentially years, to establish.

- Established distributors can leverage their historical sales data and market insights to negotiate better terms with suppliers.

New entrants face considerable hurdles, including high capital investment for distribution centers and inventory, a significant deterrent. Building brand recognition and trust poses another challenge, requiring substantial marketing expenditure. ATD's vast distribution network and established supplier relationships further limit new competitors.

| Barrier | Description | Impact |

|---|---|---|

| Capital Needs | High costs for infrastructure, inventory, and logistics. | Limits the number of potential new players. |

| Brand Loyalty | Established brands have strong customer preferences. | Requires significant marketing to overcome. |

| Economies of Scale | ATD offers competitive pricing due to its size. | New entrants struggle to match cost advantages. |

Porter's Five Forces Analysis Data Sources

Our Porter's analysis uses data from annual reports, industry research, and market share reports. It also incorporates competitor analysis and financial news for competitive intelligence.